Virtual Data Room–Industry Performance

This article is one in a multi-part series covering the trends, opportunities and major players in the virtual data room (VDR) industry.

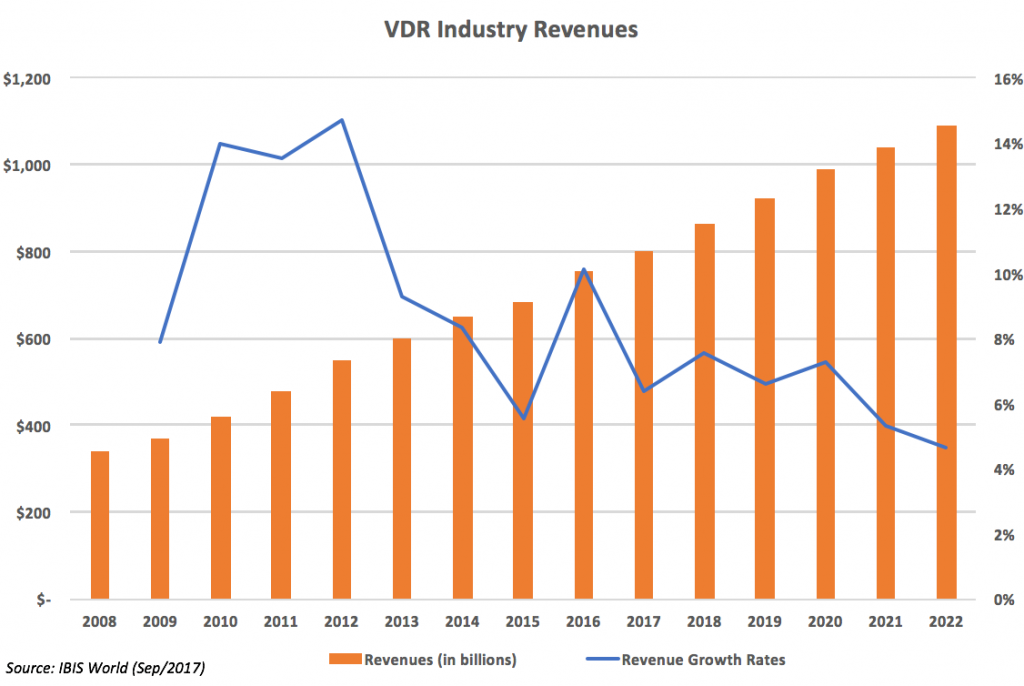

Over the last year, the Virtual Data Room (VDR) industry continued to grow rapidly, in line with its historical trend of faster-paced revenue growth than the overall economy. According to IBIS World, total industry revenues are estimated to have reached $803.5 million in 2017, which represents a 6.4% increase when compared to previous year’s total revenues and a 7.9% annualized growth rate over the past five years.[1] Such growth was a result of both the increase in the adoption of technology by businesses, and the strong performance observed in the main markets that demand virtual data rooms, such as initial public offerings, real estate, and mergers and acquisitions. Furthermore, the VDR industry is projected to continue on its rapid growth over the next five years (2018-2022), albeit at a slightly lower annualized rate of 6.3%.[2]

Key External Drivers

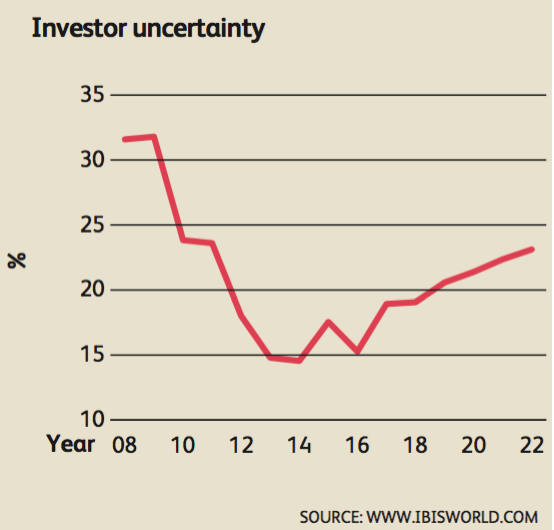

Investor Uncertainty

The level of investor uncertainty is a key determinant in the decision businesses make between seeking external funding or looking for potential acquirers. In times when investor uncertainty is low, businesses seek investors interested in a purchase, which contributes towards increasing the demand for virtual data rooms. Investor uncertainty rose during 2017, and is expected to remain at a reasonably similar level in 2018.

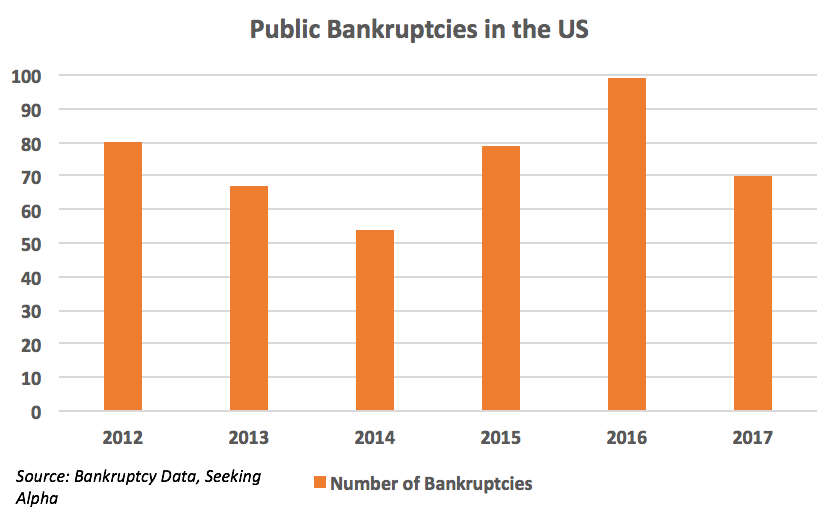

Business Bankruptcies

Liquidations and acquisitions are not only two very common consequences of business bankruptcies, but also transactions that require the use of virtual data rooms during their due diligence process. Thus, an increase in business bankruptcies leads to an increase in the demand for virtual data rooms. The total number of business bankruptcies decreased by 29.3% in 2017, and is expected to remain at this level in 2018.[3]

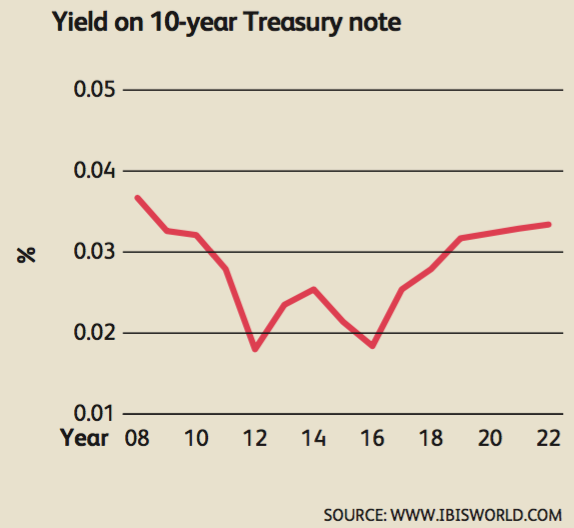

Yield on 10-year Treasury Note

Businesses care about the yield on 10-year Treasury bonds because it is the benchmark for interest rates in the economy, and therefore affects the cost of borrowing for both firms and investors. Lower yields lead to cheaper credit and to investors seeking higher returns by investing in riskier assets, which work towards increasing both investment and M&A activities, and therefore the demand for virtual data rooms. Yields on 10-year Treasury bonds are expected to rise in the foreseeable future as a consequence of higher expected inflation in the economy.

Percentage of Services Conducted Online

The increase in the percentage of services conducted online, as well as that in the amount of data firms generate and store electronically, has increased the adoption of virtual data rooms by businesses. These two factors are expected to continue to increase over the next few years, further driving demand for the industry services.

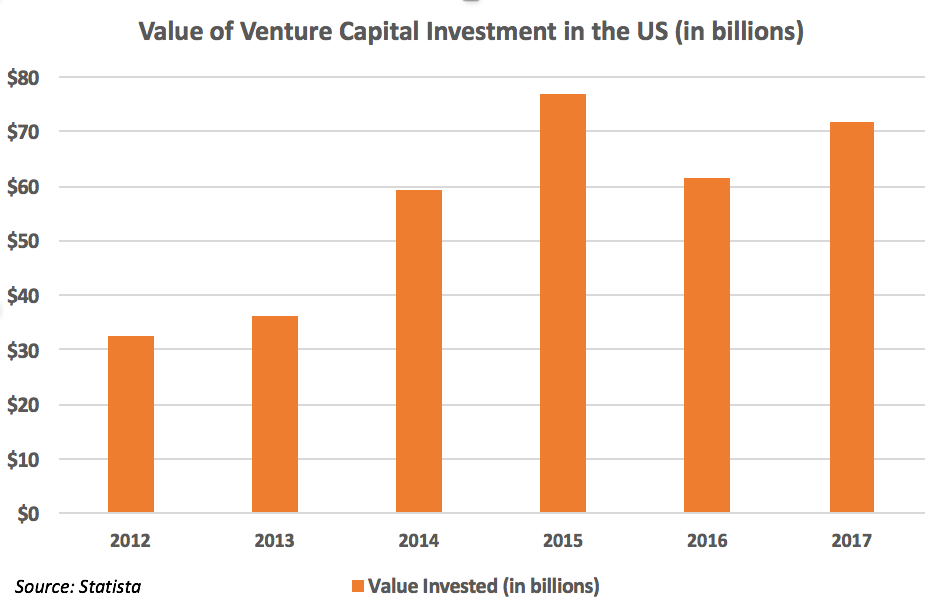

Demand from Venture Capital

The use of virtual data rooms allows venture capital firms to conduct the processes related to offering document preparation and due diligence in a much more efficient and cost-effective manner than with physical data rooms. As a result, those firms are among the main consumers of the industry products and services. As of September 2017, demand from venture capital firms represents 39.8% of total revenues for the Virtual Data Rooms industry.[4] The increase in the number of venture capital deals in 2017 led to higher demand for virtual data rooms.

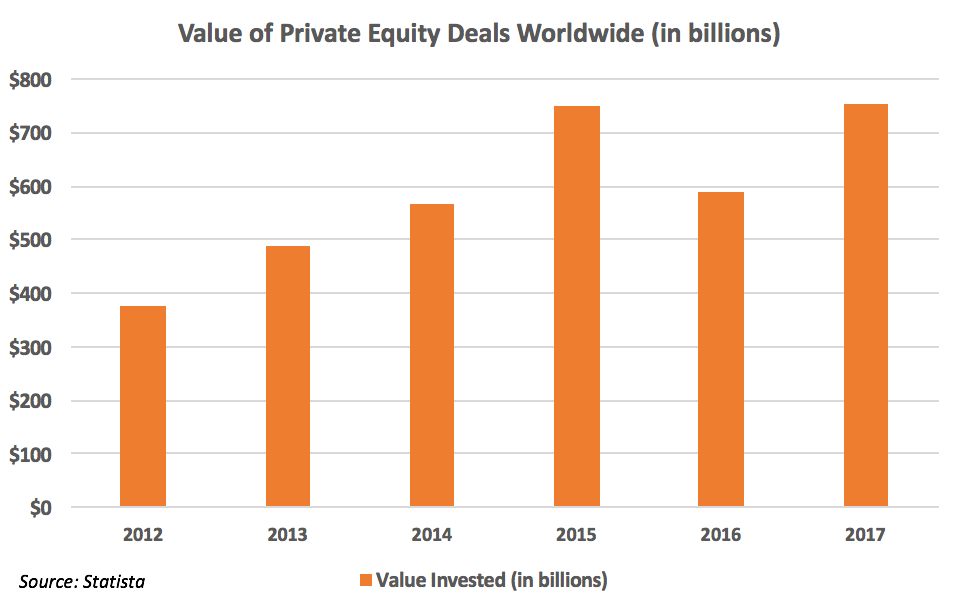

Demand from Private Equity

Virtual data rooms provide the private equity industry with the same benefits enjoyed by venture capital firms, which has also led private equity firms to become major consumers of the VDR industry products and services. According to IBIS World, there was an increase in the demand for virtual data rooms from private equity firms in 2017.

Current Performance

The emergence of virtual data rooms was a natural consequence of the increasing adoption of technology by businesses, which nowadays generate and store vast amounts of data at an astonishing pace. While some firms prefer to maintain their own data hosting servers, many choose to hire with third-party data hosting and document-sharing software providers due to security concerns[5]. On top of that, firms have increased their usage of virtual data rooms due to the benefits these services provide over their physical alternative, such as time and money savings, and the possibility to involve a larger number of bidders in deals. Finally, the high level of investment activity in the past view years, due to the availability of relatively cheaper financing costs, was another important factor that led to the high growth observed in the VDRs industry during the period.

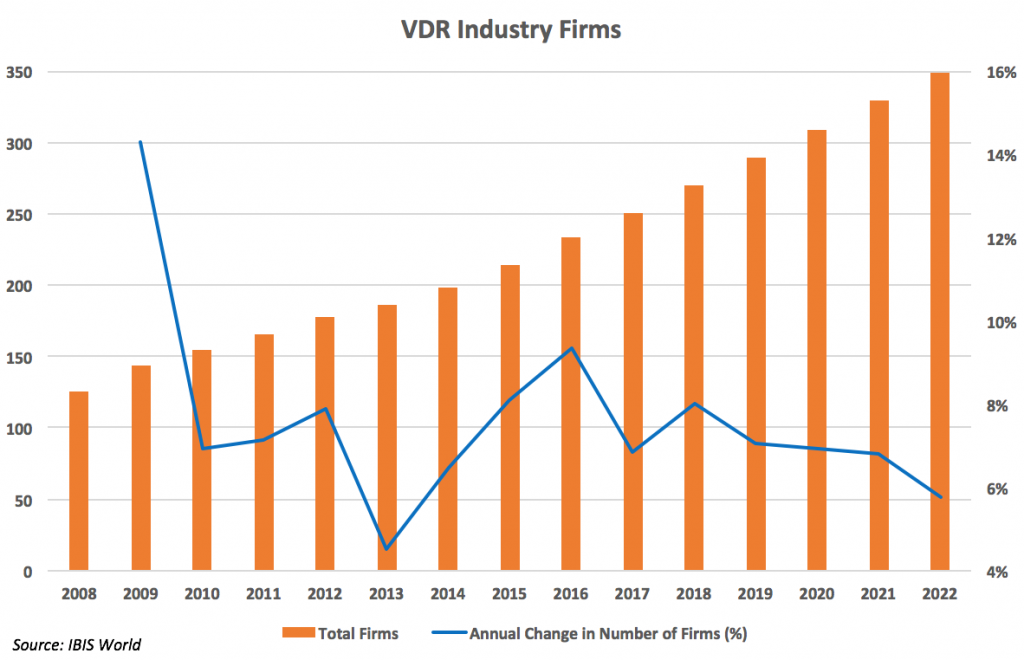

This consistent industry growth has attracted a number of firms to enter the market. IBIS World estimates that the total number of players in the industry has increased from 178 to 250 between 2012 and 2017, representing a 7.0% annualized growth rate.[6] Building a network of customers is vital for becoming a successful player in the industry. Such task is made harder by the fact that customers tend to select the first player they encounter as their VDR provider. Firms who had previous relationships with some of the main users of virtual data rooms, such as Merrill Corporation and Donnelley Financial Solutions, were able to quickly market and create demand for their VDRs solutions.[7] Others, such as IntraLinks and many incumbents, had to either resort to aggressive marketing efforts or serving a niche market, or both.

Industry Outlook

The consistent growth in the VDRs industry is projected to continue over the five-year period leading to 2022, once businesses are expected to rely less on physical data rooms, as they seek to benefit from both the money and time savings offered by virtual data rooms. That is not to say that the transition to virtual data rooms comes without threats. A possible security breach resulting in the release of sensitive information represents the greatest threat to the VDRs industry, one that could increase as it becomes a more well-known industry. Moreover, industry revenues are more volatile than those of other software-as-a-service (SaaS) markets, once they are not earned from annual subscriptions, which is the norm for most SaaS providers[8]. Rather, revenues are usually generated from one-time transactions. Nevertheless, IBIS World projects revenues to increase at an annualized rate of 6.3% and reach $1.1 billion by the end of the period[9].

Industry Life Cycle

The Virtual Data Rooms industry is currently in the growth stage of its life cycle. Its key characteristics are the growing acceptance by customers of the products and services offered by industry players, the entry of many new firms into the market, the strong growth of industry revenues, and the fast growth of industry value added, which exceeds the overall economy. The growing demand for virtual data rooms, both in key and new niche markets, as well as the current industry profit margins, estimated at 11.2% of revenues[10], will continue to attract new firms and increase the level of employment in the industry over the next five-year horizon. While the number of players in the VDR industry is projected to grow at an annualized rate of 6.9% and reach 349 by 2022, employment is forecasted to grow at an annualized rate of 6.97% to 3,853 people by the same year.[11]

Sources

George Putnam, 2017 Bankruptcy Review And 2018 Distressed Debt Forecast Seeking Alpha (2017), https://seekingalpha.com/article/4134315-2017-bankruptcy-review-2018-distressed-debt-forecast (last visited Feb 20, 2018).

Iris Peter, IBISWorld Industry Report OD4593: Virtual Data Rooms in the US. IBISWorld (September 2017).

Value of private equity deals globally 2012-2017 | Statistic, Statista, https://www.statista.com/statistics/520839/value-of-global-private-equity-deals/ (last visited Feb 20, 2018).

Value of venture capital investment in the U.S. 1995-2017 | Statistic, Statista, https://www.statista.com/statistics/277501/venture-capital-amount-invested-in-the-united-states-since-1995/ (last visited Feb 20, 2018).

[1] IBISWorld Industry Report OD4593: Virtual Data Rooms in the US (September 2017)

[2] IBISWorld Industry Report OD4593: Virtual Data Rooms in the US (September 2017)

[3] https://seekingalpha.com/article/4134315-2017-bankruptcy-review-2018-distressed-debt-forecast

[4] IBISWorld Industry Report OD4593: Virtual Data Rooms in the US (September 2017)

[5] IBISWorld Industry Report OD4593: Virtual Data Rooms in the US (September 2017)

[6] IBISWorld Industry Report OD4593: Virtual Data Rooms in the US (September 2017)

[7] IBISWorld Industry Report OD4593: Virtual Data Rooms in the US (September 2017)

[8] IBISWorld Industry Report OD4593: Virtual Data Rooms in the US (September 2017)

[9] IBISWorld Industry Report OD4593: Virtual Data Rooms in the US (September 2017)

[10] IBISWorld Industry Report OD4593: Virtual Data Rooms in the US (September 2017)

[11] IBISWorld Industry Report OD4593: Virtual Data Rooms in the US (September 2017)

Marcelo Scott contributed to this report.

- Covid-19 Impact on US Private Capital Raising Activity in 2020 - May 27, 2021

- Healthcare 2021: Trends, M&A & Valuations - May 19, 2021

- 2021 Outlook on Media & Telecom M&A Transactions - May 12, 2021