Virtual Data Rooms — Industry Overview

Virtual data rooms (VDRs) are secure extranets that serve as online repositories of data. They are used by businesses to share confidential and sensitive information with other parties in processes such as mergers and acquisitions, initial public offerings, bankruptcies, and due diligence. Since their introduction in the last decade, VDRs have largely replaced physical data rooms during due diligence processes, as the amount of data generated and stored by firms has continued to grow exponentially. Apart from allowing companies to share information online in a safe, transparent, and efficient manner, the emergence of virtual data rooms has also enabled firms to cut down costs related with physical data rooms rentals, transportation, and accommodations.[1]

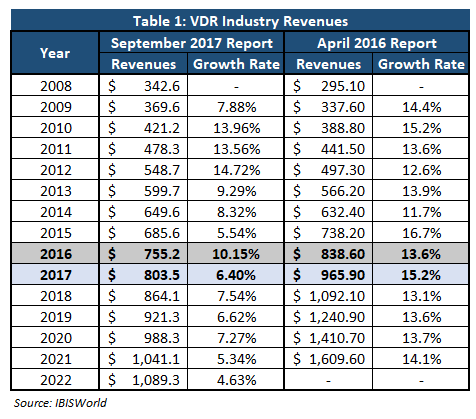

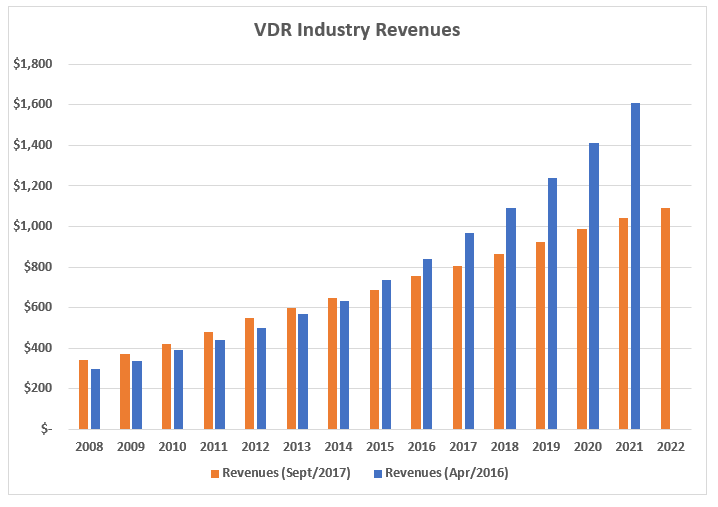

According to IBIS, revenues in the virtual data rooms industry increased from $599.7 million to $803.5 million between 2012 and 2017, representing an annualized growth rate of 7.94% over the last five years.[2] This consistent growth was a result of the increasing adoption of technology by firms, as well as strong results in important markets such as initial public offering, real estate, licensing, and especially mergers and acquisitions, which reached a record $4.3 trillion in deals globally in 2015.[3] In the next few years, the industry is expected to sustain a similar, but slightly lower, annual growth rate of 6.3, eventually reaching an estimated $1.09 billion in revenues by 2022.[4]

As of 2017, a total of 250 firms operate in the industry, but estimates by IBIS suggest that this number should increase to 349 by the end of 2022, growing at an annual rate of 6.9%.[5] Despite the large number of existing companies, the VDR industry is highly concentrated, with 60.3% of total revenues being captured by the four largest firms (IntraLinks Holding Inc., Merrill Corporation, Donnelley Financial Solutions Inc., and Firmex Inc.). This high level of market concentration is expected to continue over the next few years, since smaller firms are able to survive in the industry by serving niche markets, which as a consequence puts a limit on the number of customers they are capable to acquire.[6] Some of the most relevant transactions in the industry during the last few years include the acquisition of IntraLinks by Synchronoss in January 2017 for $821 million, the spin-off of Donnelley Financial Solutions Inc. by R.R. Donnelley & Sons in October 2016, and the recent acquisition of IntraLinks by the private equity firm Siris Capital Group for $1 billion in October 2017.[7]

Current trends in the industry include the use of VDRs by customers in earlier stages of the transaction lifecycle and technological developments of new features aimed at increasing the efficiency and accuracy of the due diligence process, such as dynamic indexing, file format flexibility, restricted use, and search and Q&A functions.[8] The two main risks faced by firms in the industry relate to cybersecurity and a slowdown in the mergers and acquisitions and initial public offering markets. While the former could result in significant monetary and reputational losses, the latter could severely affect industry demand, once those two segments accounted for 50.7% of total revenues in 2017.

Similar Industries

The following are similar industries to virtual data rooms:

- Data Processing & Hosting Services

- Law Firms

- IT Consulting

- Internet Publishing and Broadcasting

With the exception of internet publishing and broadcasting, the industries listed above are all part of the VDR industry’s supply chain. While law practices are some of the main users of virtual data rooms, in particular for mergers and acquisitions, data processing & hosting sites and IT consultants are two of the key sellers for the industry, either through the hosting of data stored in VDRs or the provision of support for the VDR solutions.

Sources

Crunchbase, https://www.crunchbase.com/ (last visited Jan 28, 2018).

Iris Peter, IBISWorld Industry Report OD4593: Virtual Data Rooms in the US. IBISWorld (September 2017).

Kathryn Gaw, How Multimillion-Dollar Virtual Data Rooms Market Has Grown in 2017 | iDeals Blog Deal Making Wire (2017), https://www.idealsvdr.com/blog/multimillion-dollar-virtual-data-rooms-market-grown-2017-2/ (last visited Jan 28, 2018).

M&A: Setting Up A Virtual Data Room, Cleverism (2016), https://www.cleverism.com/ma-setting-virtual-data-room/ (last visited Jan 25, 2018).

Maureen Farrell, 2015 Becomes the Biggest M&A Year Ever, The Wall Street Journal (2015), https://www.wsj.com/articles/2015-becomes-the-biggest-m-a-year-ever-1449187101 (last visited Jan 27, 2018).

[1] https://www.cleverism.com/ma-setting-virtual-data-room/

[2] IBISWorld Industry Report OD4593: Virtual Data Rooms in the US (September 2017)

[3] https://www.wsj.com/articles/2015-becomes-the-biggest-m-a-year-ever-1449187101

[4] IBISWorld Industry Report OD4593: Virtual Data Rooms in the US (September 2017)

[5] IBISWorld Industry Report OD4593: Virtual Data Rooms in the US (September 2017)

[6] https://www.idealsvdr.com/blog/multimillion-dollar-virtual-data-rooms-market-grown-2017-2/

[7] https://www.crunchbase.com

[8] https://www.cleverism.com/ma-setting-virtual-data-room/

For a more extensive overview of our research on M&A transactions in the virtual data room industry, click here.

Marcelo Scott contributed to this report.

- Covid-19 Impact on US Private Capital Raising Activity in 2020 - May 27, 2021

- Healthcare 2021: Trends, M&A & Valuations - May 19, 2021

- 2021 Outlook on Media & Telecom M&A Transactions - May 12, 2021