Self-Storage Real Estate — M&A and VC Trends, Valuations & Investments

This article is one in a series covering the self-storage industry, a sub-sector of commercial real estate investments. The purpose of this article is to present mergers and acquisition (M&A), venture capital (VC), leverage buyout and angel trends within the past five years. The report will cover domestic and international deals and present the global market share for self-storage transactions.

M&A Trends

Self-storage companies are using M&A activity as a growth strategy to increase market share. However, M&A deal activity has been relatively low since 2015.[1] The decline in deal size in 2015 and 2016 was due to a slight pullback in transaction volume as a result of previous year portfolio divestments.[2] Deal size steadily increased to $74.43 million by 2017, but did not significantly increase as expected by some investors. Several publicly traded self-storage real estate investment trusts (REITs) pulled back from 70% of acquisitions, whilst private equity firms and private investors picked-up some of the acquisition-slack for self-storage properties.[3]

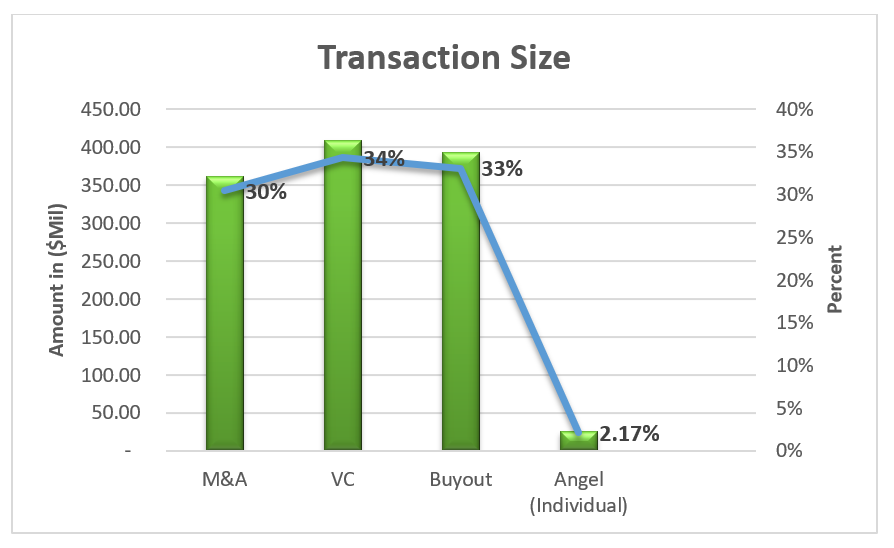

The $195 million M&A deal size in 2013 was attributable to self-storage companies utilizing M&A as a viable growth method to expand.[4] For example, All Aboard Mini Storage, sold a nineteen-building portfolio of self-storage buildings to Extra Space Storage Inc. of Salt Lake City. The transaction influenced the large M&A deal size in 2013. The deal was estimated at approximately $195.1 million.[5] A third (30%) of the transactions from 2013 through 2017 were M&A deals, 33% were buyout transactions, 34% were VC transactions and 2.17% of the transactions were angel transactions.. In aggregate, buyout transactions slightly outperformed M&A transactions by 4%.1

Source: Pitchbook

VC Trends

The emergence of VC firms has increased VC transactions for the self-storage industry. Deal activity rose steadily from 2015 to 2016, and sharply increased by 2017 indicating an overall increase in VC deals in 2017. The significant increase in deal size in 2015 was a result of a growing interest in self-storage start-up companies as well as contribution of funds to help start-up companies to grow.[6] There were three deals in both 2016 and 2017 and a single deal in 2015. VC transaction values increased exponentially in 2017 from $56.42 million to $345.5 million.1 In 2017, several on-demand storage companies raised funding from VC firms to disrupt traditional self-storage firms. VCs increased their funding in 2017 to help start-up on-demand storage companies increase storage access.[7] For example, Clutter, a warehouse in Los Angeles, with an estimated valuation of $240 million, raised funds from venture firms to expand its market share in several cities in the U.S.[8]

Source: Pitchbook

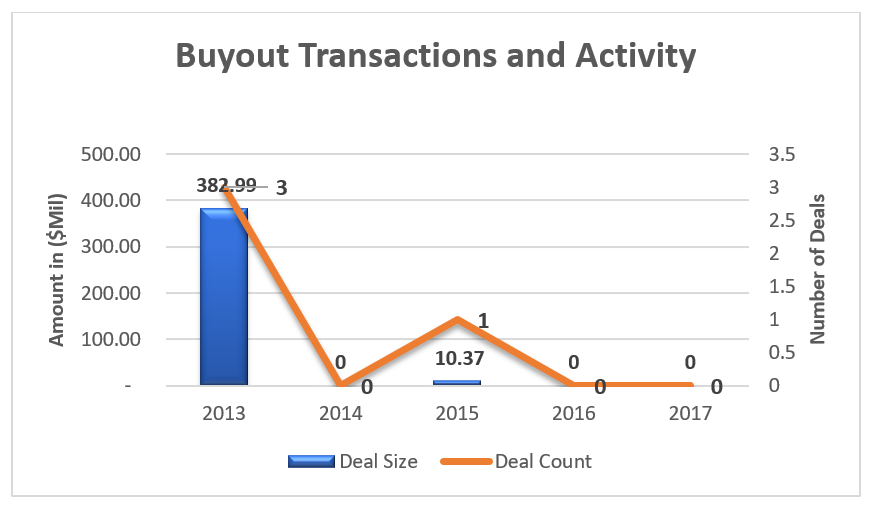

Buyout Trends

Acquisitions of self-storage firms through leveraged buyout transactions gained popularity four to five years ago. Deal activity for buyout transactions experienced a sharp decline from 2013 through 2017. The large deal size in 2013 was due to private equity investor interest in buying out self-storage companies to obtain long-term returns on portfolios. In 2015, private equity firms were aggressively bidding for small portfolios of mom-and-pop ownership storage properties as well as large portfolios with the support of REITs.[9] However, private equity firm acquisitions resulted in a low volume of transactions. By 2017, leveraged buyout for self-storage companies declined. There was a total transaction value of $382.99 million in 2013 compared to no transactions in 2017.1

Angel Trends

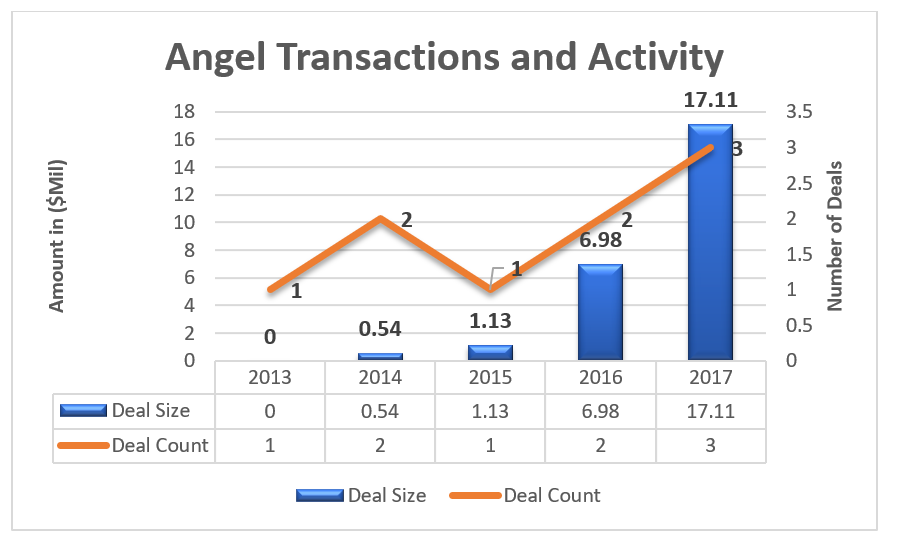

Angel activity experienced an upward trend from 2014 through 2015 and sharply increased in 2017. In 2017, angel transaction value peaked to $17 million from $54,000 in 2013. The sharp increase in 2017 was a result of an increase in angel investors to expand on-demand storage startup in new markets.[10] The transaction size in 2017 was almost three times that of the value in 2016. Transaction size was $17 million in 2017 compared to 7 million in 2016.1

Deal activity rose steadily from 2015 through 2017 with an aggregate of 100 percentage points increase from 2015 to 2016, and a 50 percentage points increase from 2016 to 2017. The increase in deal activity was due to an increased funding by angel investors to expand their startup companies.10 Although, deal volume decreased, down by -50% to one deal from two deals in 2014.1

Source: Pitchbook

Deal Size

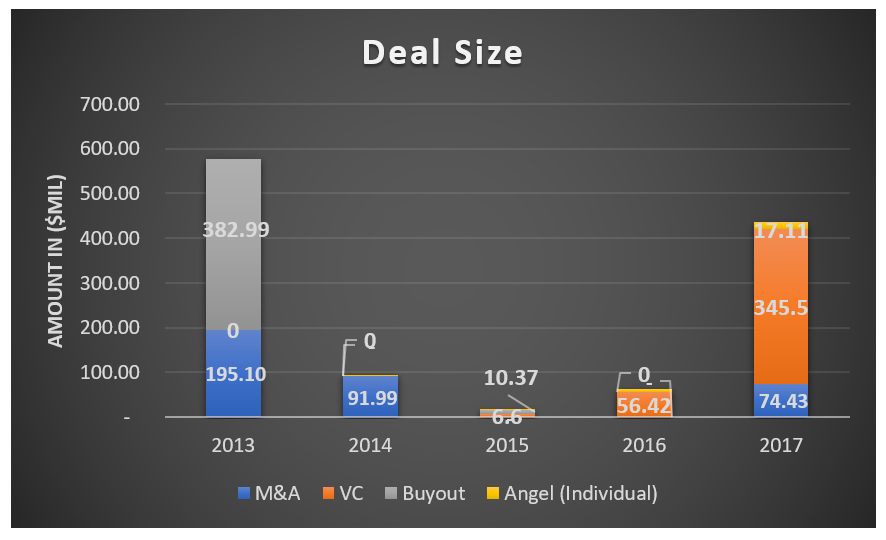

In 2017, the deal size of VC transactions was almost 5 times the value of M&A transactions, $345.5 million compared to $74.43 million, respectively. In 2013, buyout transactions outperformed M&A transactions. The value of buyout transactions was almost three times that of M&A transactions. The reason for the large buyout deal size was that large institutional investors backed private equity funds to buyout storage facilities. These transactions dominated the big portfolio deals in 2013.[11] In 2014, M&A transactions outperformed buyout and VC transactions due to an increase in M&A activity for self-storage properties.4 However, in 2016, VC transactions outperformed M&A transactions. The value of VC transactions was $56 million with no M&A transactions in 2016. The higher value for VC transactions was due to the increased funding for start-up storage companies to expand their market.7

Source: Pitchbook

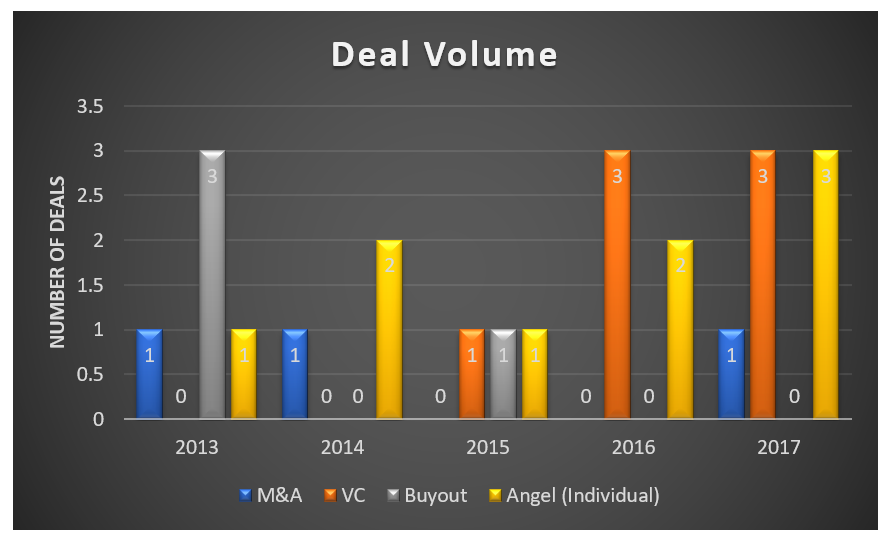

Deal Volume

Deal volume for angel investor and VC transactions was highest in 2017, a total of three deals each compared to one M&A deal in 2017. However, in 2016, VC deal volume surpassed angel transactions. The reason for the increase in deal volume for VC was the increased interest by VC firms to raise funding for start-up on-demand storage companies. Overall, VC transactions performed better than angel, M&A and buyout transactions, whereas, deal volume for VC and angel deals was larger than M&A and buyout deals in 2017.1

Source: Pitchbook

Notable deals

On March 22, 2017, StorageVault announced the 396.6 million acquisition of Sentinel Storage, a premier self-storage portfolio in Canada.[12] The deal is notable since it was the largest M&A transaction that occurred internationally in the self-storage industry in 2017. The acquisition of the portfolios will expand StorageVault’s businesses across Canada.

The acquisition of Quraz, the largest self-storage operator in Japan, by Evergreen Real Estate Partners LLC, was a notable deal that occurred in September 2013.[13] The acquisition was valued at $300 million.1

Q4 2017 M&A Announced Deals

On December 12, 2017, Harrison Street Real Estate Capital LLC (HSRE) a real estate private equity firm, announced its acquisition of Mallory Station Self Storage with a two-property portfolio for $38 million. Both facilities will be renamed US Storage Centers.[14]

On December 4, 2017, a press release reported the acquisition of American Storage Center in Snellville, GA by Compass Self Storage. In October, Compass acquired three self-storage properties including Franklin Park Self Storage in Sewickley, PA and Safe & Secure Self Storage in Ft. Worth, Texas.[15]

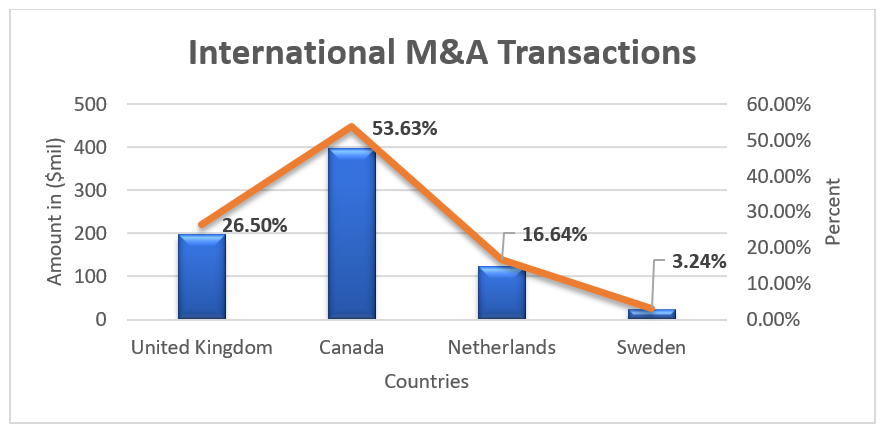

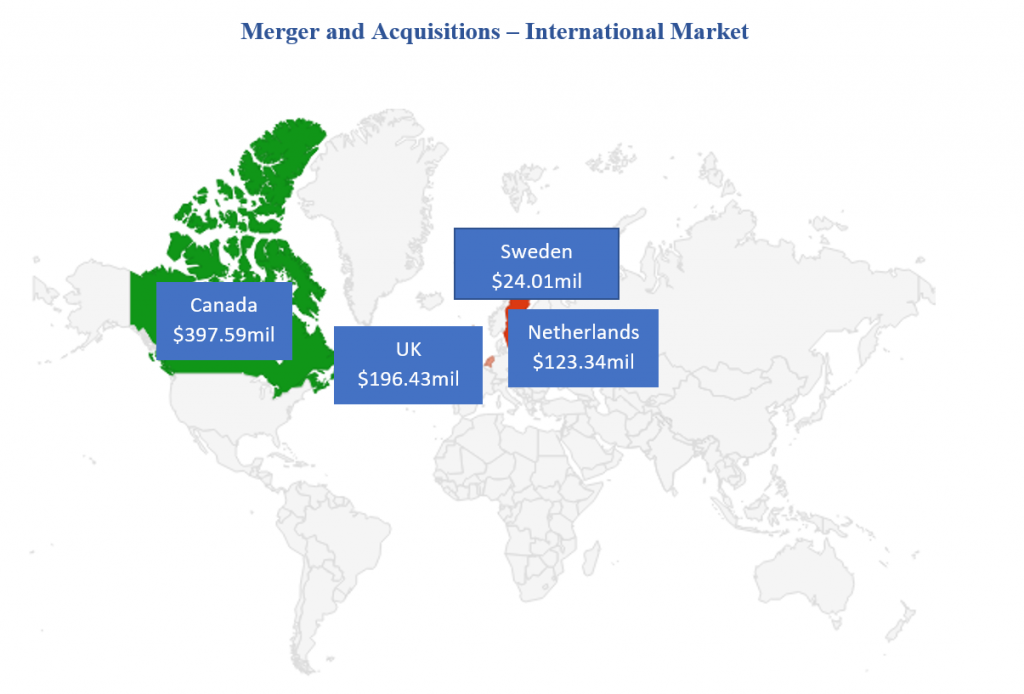

International Deals

Transaction values for international deals from 2013 through 2017 totaled $741.37 million. More than half (53.63%) of the M&A transactions occurred in Canada and were valued at $397.59 million. The large deal size in Canada was a result of a $396.6 million portfolio purchase of Sentinel Storage, Canada’s premier self-storage portfolios, by StorageVault, owner and operator of storage locations in Canada.13 Internationally, the UK had the second largest M&A transactions. The UK M&A transactions were valued at $196.43, 26.50% of total M&A transactions in foreign markets. The Netherlands had 16.64% of the M&A transactions in the amount of $123.34 million. Sweden had the lowest volume of M&A transactions in the amount of $24.01 million1

Source: Pitchbook

Source: Pitchbook

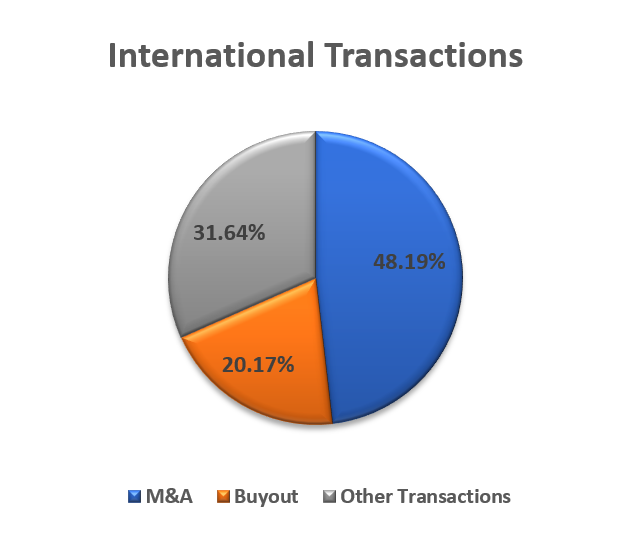

Almost half (48.19%) of the international transactions that occurred within the past five years are M&A deals. The reason for the large percentage increase in M&A transactions was due to large acquisitions in countries such as Canada and the Netherlands to expand self-storage businesses. A fifth (20.17%) of the international deals were buyout transactions.1

Source: Pitchbook

Valuation

The post valuation median has fluctuated within the past five years. In 2013, the post-valuation median value decreased, down by -44.02% to 82.64 and steadily declined to 32, down by -61.28%. However, in 2015, the post-valuation median value increased, up by 45.81% to 46.66. By 2017, the post-median value trended upward with a value of 64.91.1

Source: Pitchbook

Summary

Several self-storage companies have expanded their domestic and foreign market share to achieve greater economies of scale, increase operations in different geographical locations and increase storage access for customers. In the last five years, VC transactions have outperformed angel, buyout and M&A, with a total of $408.52 million compared to $393.36 million, $361.52 million and $25.76 million for buyout, M&A and angel transactions, respectively.1 In 2017, self-storage facilities experienced large deal sizes with VC transactions. More than half of M&A transactions in foreign markets have occurred in Canada. Overall, the self-storage industry has experienced significant growth through acquisitions, buyouts and other forms of investments.

Sources

[1] Pitchbook Data, Inc. Pitchbook Deal Analytics, (Dec 12, 2017).

[2] Beth Matson-Teig, As Appetite for Storage Acquisitions Grows, Will Sellers Show, (Feb 29, 2016), https://www.sparefoot.com/self-storage/news/3764-as-appetite-for-storage-acquisitions-grow-will-sellers-show/.

[3] Jay Fitzerald, Acquisitions Down 70 Percent Among Public Storage Operators, (Aug 21, 2017), https://www.sparefoot.com/self-storage/news/5757-self-storage-acquisitions-2017/

[4] Dan Misali, The Guide to Selling a Self-Storage Business, (April 16, 2016), https://www.vikingmergers.com/blog/2016/the-guide-to-selling-a-self-storage-business/.

[5] Mini-Storage Messenger, All Aboard Mini Storage Sells Self-Storage Portfolio For $195.1 Million To Extra Space Storage, (Sept 13, 2013), https://www.ministoragemessenger.com/mini-storage-messenger-blog/messenger-news/all-aboard-mini-storage-sells-self-storage-portfolio-for-195-1-million-to-extra-space-storage/

[6] Kevin Heintz, The Future of Venture Capital in Self-Storage, (May 20, 2015), http://blog.storitz.com/2015/05/the-future-of-venture-capital-in-self-storage/.

[7] Robert Joneja, Can Traditional Self Storage Compete with On-Demand Technology Disruptors? (Feb 7, 2017), http://blog.storitz.com/2017/02/can-traditional-self-storage-compete-with-on-demand-technology-distruptors/

[8] Kathleen Chaykowski, This L.A. Startup Is Digitally Transforming the Self-Storage Industry, (Aug 15, 2017), https://www.forbes.com/sites/kathleenchaykowski/2017/08/15/this-l-a-startup-is-digitally-transforming-the-self-storage-industry/#48f9e6dc7fc2

[9] Robert Carr, Private Equity Pours Money into Self-Storage Deals, (Mar 16, 2015), http://www.nreionline.com/self-storage/private-equity-pours-money-self-storage-deals

[10] Daniel Abril, Callbox Storage to Expand its On-Demand Services to Austin, (Sept 8, 2017), https://www.dmagazine.com/business-economy/2017/09/callbox-storage-to-expand-its-on-demand-services-to-austin/

[11] Alexander Harris, 7 self-storage operators to watch in 2014, (Dec 30, 2013), http://blog.selfstorage.com/self-storage-mom-and-pop/7-self-storage-operators-to-watch-in-2014-3493

[12]StorageVault Canada, Inc., StorageVault to Acquire Two Stores in Montreal Area and Confirms that Sentinel Storage is the Previously Announced $396.6 Million Portfolio Purchase (May 17, 2017), http://www.marketwired.com/press-release/storagevault-acquire-two-stores-montreal-area-confirms-that-sentinel-storage-is-previously-tsx-venture-svi-2216907.htm

[13] Inside Self-Storage, Evergreen Real Estate Partners Acquires Quraz, Japan’s Largest Self-Storage Operator, (Sept 25, 2013), http://www.insideselfstorage.com/news/2013/09/evergreen-real-estate-partners-acquires-quraz-japans-largest-self-storage-operator.aspx

[14] Inside Self-Storage, Harrison Street Acquires 2-Facility Mallory Station Self-Storage Portfolio in Nashville Market (2017), http://www.insideselfstorage.com/news/2017/12/harrison-street-acquires-2-facility-mallory-station-self-storage-portfolio-in-nashville-market.aspx.

[15] Inside Self-Storage, Amsdell Cos./Compass Acquires American Storage Center in Snellville, GA, (2017), http://www.insideselfstorage.com/news/2017/12/amsdell-cos-compass-acquires-american-storage-center-in-snellville-ga.aspx.

Jenn Abban contributed to this report

- Covid-19 Impact on US Private Capital Raising Activity in 2020 - May 27, 2021

- Healthcare 2021: Trends, M&A & Valuations - May 19, 2021

- 2021 Outlook on Media & Telecom M&A Transactions - May 12, 2021