Self Storage Real Estate – Industry Performance

This article is part of a series covering the self-storage industry, a sub-sector of the commercial real estate investment banking market.

This article will present the overall performance of the self-storage industry. Included in the report is a discussion of the main external drivers that impact the industry, the current performance over the past five years, the industry outlook as well as the life cycle of the industry.

Key External Drivers

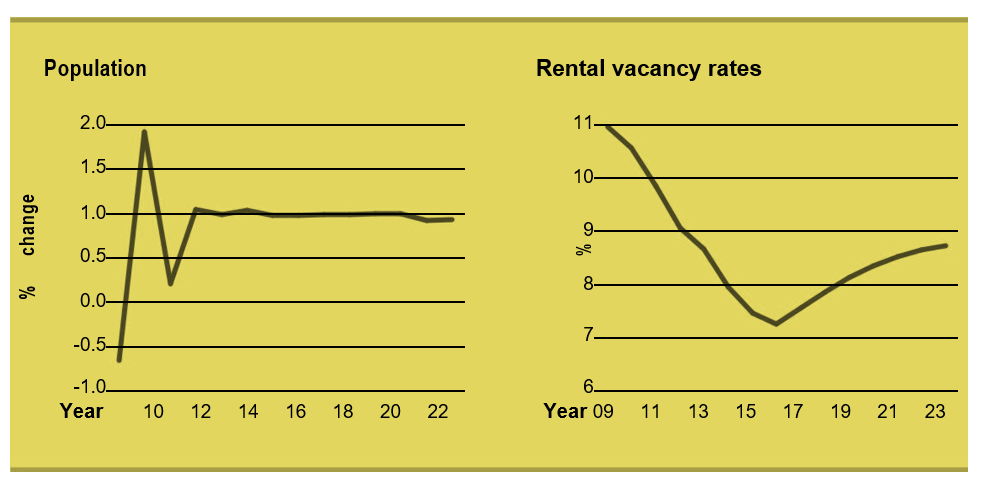

Population is a key driver that influences the growth of storage facilities. An increase in population directly impacts the development of apartments and smaller homes, resulting in a higher demand for self-storage. Self-storage companies capitalize on the growth of populations to increase revenue.[1]

Rental vacancy rates can determine the revenue of the self-storage industry. A decrease in rental vacancy rates has the potential to increase industry revenue since more households rent apartments and demand more storage space.1

Source: IBISWorld

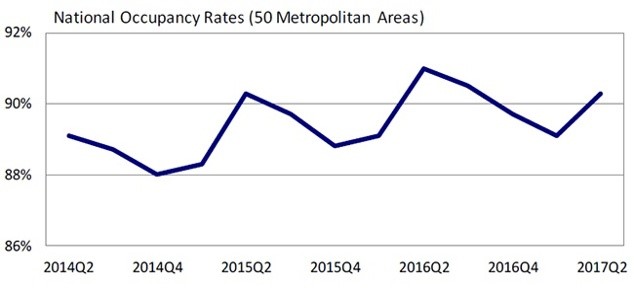

For example, in Q2 2017, self-storage facilities in the U.S gained a strong return as occupancy rates increased by 120 basis points.[2]

Source: Reis.com

House price index has an impact on the demand for housing. Fewer households purchase properties when housing becomes less affordable. This reduces the need for storage space and affects the revenue of self-storage companies.1

Per capita disposable income determines the demand for self-storage. Consumers purchase more possessions with an increase in disposable income and have limited space for storing their possessions in their primary residences. Self-storage facilities gain more revenue as consumers demand more space to store additional belongings.1

Current Performance

According to IBIS World, the self-storage industry increased at an annualized rate of 7% in the last five years with a 4.3% growth in 2017. Despite the slow growth in the economy, the self-storage industry experienced an increase in demand for storage space due to downsizing of apartments and homes to reduce spending. Both cyclical and countercyclical demand as well as changes in the national economy have affected the industry’s revenue. Overall, the industry has gained advantage from changes in the labor market, the housing market, decrease in rental vacancy rates as well as consumer spending.1

Industry Outlook

The industry is expected to thrive in the future due to the increase in household demand for storage space. The industry’s growth can be supported over the next five years by an increase in disposable income, a stable population growth, a rise in the housing market as well as an increase in relocations. By 2022, the industry’s revenue is expected to reach $43.5 billion and to grow at an annualized rate of 2.8%. Profit margins are likely to stay high due to population growth and high occupancy rates.1 Trends such as customer service, industry consolidation, complementary products and services, high tech facilities and increased competition support a positive industry outlook.[3]

Industry Life Cycle

According to IBIS World, the storage industry is in its mature phase within its life cycle. Consolidation activity, a feature of a mature phase in the industry, is a main strategy that industry players are using to increase their market share. M&A activity is a consolidation approach that is enhancing the industry’s growth. Another indication that the industry is in its mature phase is that it has maintained a downstream market and has properly defined its product.1

Summary

Overall, the self-storage industry has performed well despite fluctuations in macroeconomic indicators, slow economic growth and market volatility. Key external drivers such as per capita income, populations, rental vacancy rates and house price index have a significant impact on the industry’s performance. The increase in demand for self-storage is expected to increase the industry’s revenue over the next five-year period.

[1] Marisa Lifschutz, Storing up: Low rental vacancies have paved the way for high demand for storage units, IBISWorld, (Nov 2017).

[2] Victor Calanog, Q2 2017 Self Storage Trends, REIS, (Aug 22, 2017), https://www.reis.com/cre-news-and-resources/q2-2017-self-storage-market-trends.

3 Scott Meyers, The Future of Self Storage, (2017), https://www.reiclub.com/articles/Future-of-Self-Storage.

Jenn Abban contributed to this report.

- Covid-19 Impact on US Private Capital Raising Activity in 2020 - May 27, 2021

- Healthcare 2021: Trends, M&A & Valuations - May 19, 2021

- 2021 Outlook on Media & Telecom M&A Transactions - May 12, 2021