Blockchain’s Impact in Residential and Commercial Real Estate: Transactions & Industry Performance

This article is the second part of a series outlining the impacts of blockchain technology in the Residential & Commercial Real Estate Industry.

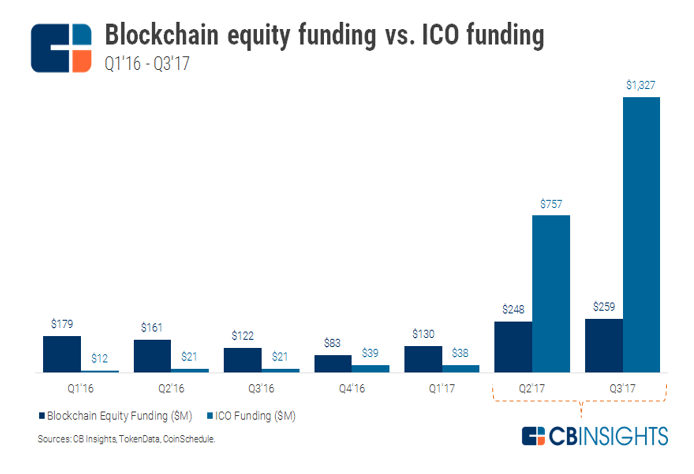

In 2017, ICOs raised a lot of eyebrows as the total funding raised by the new crowdfunding mechanism surpassed the total funding raised via traditional equity financing for the first time. While funding from venture capital and angel investors for blockchain startups remained more or less stagnant throughout year, ICOs grew by 75% since the second quarter of 2017. They have closed more than $2 billion in funding to date[1].

Exhibit 1: Blockchain Equity Funding vs. ICO Funding

Hence, to understand the impact and potential that blockchain could bring to the real estate investments, one must first fully comprehend the nature, purpose and functions of the ICO.

What is an ICO?

To put it in perspective, an ICO (Initial Coin Offering) can be seen as a fundraising mechanism that is similar to an IPO[2]. However, instead of selling shares, ICOs sell their underlying crypto tokens in exchange for bitcoin, ether, or other cryptocurrencies. It is to be noted that most ICOs do not accept fiat currency[3].

Also, it is important for investors to understand that crypto tokens (coins) offered in ICOs can be categorized into either Security tokens or Utility tokens.

Security Token

In a sense, a security token is similar to shares issued by a company. It represents an ownership share of a business and may incorporate voting rights. Considering the recent SEC announcement, any tokens that can’t pass the Howey Test should be considered as a security and falls under the regulations of the 1934 Security Exchange Act.

Utility Token

Utility tokens are the core differentiating factor between an ICO and a traditional startup investment. While utility tokens do not give investors any ownership or voting rights in the company, they serve another purpose.

For most legitimate blockchain ICOs that offers utility tokens, the token sale is not designed with the sole purpose of raising capital. It is undertaken to build and scale an ecosystem of users and stakeholders for the issuer’s products[3]. For example, if a startup’s business model is to provide blockchain enabled peer-to-peer (P2P) rental services its underlying tokens would be used to pay for rental transactions when the technology is matured and released. Thus, anyone who owns the company tokens can use them to make rental transactions on the company’s marketplace. In theory this use would determine the value of the tokens. Hence, the token is considered a core component in enabling a company’s business. This introduces a new way for startups to build their user base, ecosystem and sell part of their product to in turn benefit from it when the technology is released[3].

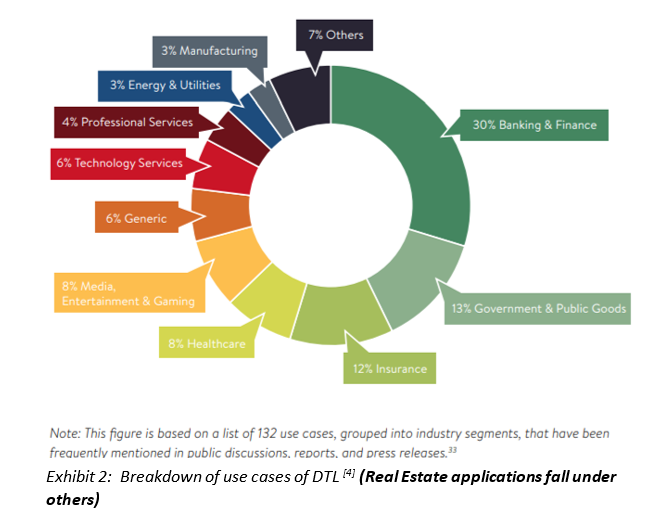

Thus, for most ICOs to make any sense the underlying businesses must have a legitimate use case for blockchain and distributed ledger technology (DLT) accompanied with a token offering. The following is a breakdown of DTL use cases from a study conducted by University of Cambridge in collaboration with EY.

Investment Trends & Outlook on Real Estate ICOs

Since the blockchain real estate industry is still very young, most ICOs in this field were launched by startups with little to no track record to date[5]. Albeit, following is a breakdown on notable real estate startup ICOs, business model and recent activities.

It is to be noted that the startups highlighted in this article went from founders funding straight to ICO, without any seed funding from VC or Angel investors that has been reported. However, it is possible that VC and Angel investors participated in the pre-sales of the startups’ tokens before the public ICO.

Propy.com (ICO funding: $16 Million)

- Propy claims to be the world’s first international real estate marketplace that enables a seamless purchase of international real estate online.

- In February 2018, Propy completed the first real estate deal to be recorded on a blockchain in the US.

- At the time of writing, Propy’s blockchain real estate transaction was the only disclosed transaction in the blockchain real estate field.

Real Estate Asset Ledger (ICO funding: $10.8 Million)

- REAL allows investors to invest in real estate using cryptocurrency. It is essentially a blockchain powered Real Estate Investment Trust.

- It offers investors the option to purchase fractionalized non-ownership economic rights from a varied property portfolio for as little as a dollar.

- Bernardo Hernandez, the former Director of Product Management at Google, was involved in Real’s ICO.

Atlant (ICO funding: $6.5 Million)

- Atlant is a blockchain enabled real estate platform that offers tokenized ownership and P2P rental for properties listed on its market place.

Caviar Capital (ICO funding: $4 Million)

- Caviar promises to provide a dual market exposure in a single token by combining investment in fast appreciating crypto asset and real estate backed short term loans.

- Caviar is involved in an ongoing lawsuit filed by the state of Massachusetts for violating securities and business laws through its ICO[6].

Industry Outlook

Overall, the blockchain enabled real estate industry is still very young and filled with speculation. Despite the growing trend of real estate ICOs, with hundreds of them scheduled and announced on ICO Bench – an ICO rating platform and agency, the highly complex laws around real estate still prove to be a hurdle for crypto real estate’s success. On top of the ambiguous ICO regulations, the main concerns lie upon disconnected U.S. real property recording system. These concerns are founded in the fact that each local government has a role in local real estate ownership and has latitude to create its own laws, recording requirements and fee structures[7].

Key External Drivers

Growth in the Commercial & Residential Real Estate Industry

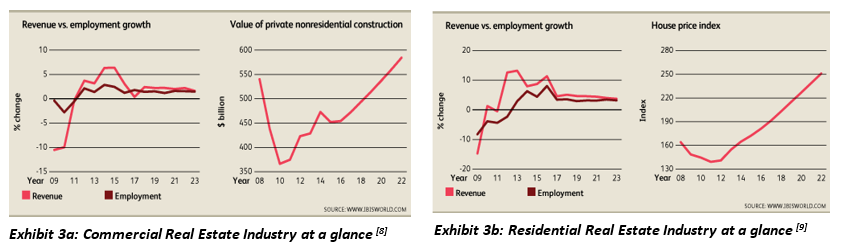

The performance of the Real Estate industry would directly impact the prospect of Blockchain Real Estate startups. As of 2017 the overall real estate industry has been on a steady recovery path and is expected to continue its rebound with the general economy post-2008 recession.

Over the five years to 2022, the industry revenue is forecasted to grow at an annualized rate of 2.2% to $1.1 trillion for commercial real estate and 4.5% to $197.9 billion in residential real estate. Overall, the real estate industry is expected to continue its steady recovery while some markets, such as San Francisco, have already grown to surpass their pre-2008 recession peak.

SEC Regulations on ICOs

Even though there are many successful ICOs in the real estate industry under the current ambiguous ICO regulations, they might still be subject to future government cracked downs if they violate US and other securities laws. In addition, the SEC is moving towards implementing tighter regulations on ICOs.

While regulations in the ICO and the blockchain field are considered as good measures to standardize the industry, tighter regulations might hamper the number of startups in the sector and slowdown the growth in the blockchain real estate industry.

However, with more attention directed to blockchain in real estate and increased ICO regulations looming, rapid growth for good actors in the industry is possible in the future.

“If done responsibly and legally, I do think these types of projects can advance the industry by offering previously inaccessible liquidity and investment opportunity to individuals.” – Joshua Nussbaum – Partner at Compound Venture Capital

Jing Ming (Jimmy) Soo contributed to this report.

[1]“Blockchain Investment Trends In Review.” CB Insights Research, 12 Dec. 2017, www.cbinsights.com/research/report/blockchain-trends-opportunities/

[2]“What Is an ICO?” NASDAQ.com, Bitcoin Magazine, 10 Aug. 2017, www.nasdaq.com/article/what-is-an-ico-cm830484.

[3]Massey, Rob et al. “Initial Coin Offering, A new paradigm.” Deloitte Development, 2017, pg. 1-12, PDF, file:///C:/Users/Jimmy%20Soo/Downloads/us-cons-new-paradigm.pdf

[4]Hileman, Garrick et al. “Global Blockchain Benchmarking Study.” Cambridge Center for Alternative Finance, 2017, pg. 31 – 38, PDF, https://www.jbs.cam.ac.uk/fileadmin/user_upload/research/centres/alternative-finance/downloads/2017-09-27-ccaf-globalbchain.pdf

[5]High, Too. “Real Estate ICOs: Boom Or Bust? – The Startup – Medium.” Medium, The Startup, 26 Nov. 2017, https://medium.com/swlh/real-estate-icos-boom-or-bust-1c3d0504074b

[6]De, Nikhilesh De. “Massachusetts Sues ICO Organizer for Alleged Securities Violations.” Coindesk, coindesk publishing, 19 Jan. 2018, https://www.coindesk.com/massachusetts-sues-ico-operator-for-alleged-securities-violations/

[7]Compton, Spencer, and Diane Schotenstein. “Blockchain Technology and Its Applicability to the Practice of Real Estate Law.” National Commercial Services Division of First American Title Insurance Company , 2017, pp. 1–8., www.firstam.com/assets/commercial/newsletters/asset-upload-file29732-120961.pdf.

[8]Commercial Real Estate in the US. (n.d.). IBISWorld Industry Report NN007. Retrieved March 15, 2018, from http://clients1.ibisworld.com.ezp3.lib.umn.edu/reports/us/industry/default.aspx?entid=2009

[9]Real Estate Sales & Brokerage in the US. (n.d.). IBISWorld Industry Report 53121. Retrieved March 15, 2018, from

http://clients1.ibisworld.com.ezp3.lib.umn.edu/reports/us/industry/default.aspx?entid=1354

- Covid-19 Impact on US Private Capital Raising Activity in 2020 - May 27, 2021

- Healthcare 2021: Trends, M&A & Valuations - May 19, 2021

- 2021 Outlook on Media & Telecom M&A Transactions - May 12, 2021