Diagnostics: Investment Banking & M&A Industry Trends & Performance

Our diagnostics institutional investment guide covers the following topics

- What is the diagnostics industry? (Executive Summary)

- What are the M&A and VC transaction trends and business valuations?

- What is the historical and future expected performance for the diagnostics industry?

- What are the key performance indicators (KPIs) in the diagnostics space?

- What are the major subsectors, markets and demand determinants in diagnostics?

- Who are the major industry competitors and what is their market share?

- What are the industry operating conditions (capital intensity, technology required and diagnostics industry volatility)?

- What have been some industry players’ typical buy-side M&A investment strategies?

Diagnostics Investment Banking

Maximizing transaction value through expert advisory.

Our experienced healthcare, medical and diagnostics team provides world-class strategic investment banking advisory across the diagnostics ecosystem. With deep industry knowledge, expertise and execution experience in both diagnostics and surrounding technologies, our team provides an added layer to our client teams. In every client engagement, we provide partner-level support, shepherding transactions from start to finish.

With access to judgement, borne from transaction experience, we assist our clients in diagnostics, medical imaging, healthcare supply, monitoring, neurology, oncology and surgical tools.

The clients we serve create some of the world’s most cutting-edge and leading medical products on the market. Our senior bankers have long-standing relationships with some of the most active, key industry executives. With broad transaction experience, we help clients in providing a differentiated go-to-market strategy. Regardless of whether your business requires assistance on a corporate sale, recapitalization, acquisition or capital requisition project, our team has the expertise and tenacity to effectively deliver on our client objectives.

By partnering with some of the most innovative clients in the world, our diagnostics team boasts a high delivery rate of successful outcomes for our clients. Bolstering the standard of care and executing on a long-term strategic vision for your diagnostic or specialty healthcare business is what we are all about. Our team also includes numerous research analysts, covering both public and private diagnostics and medical device buyers and sellers around the globe. We pride ourselves on giving our clients the expertise and focused effort required to navigate difficult transactions. Get in touch with one of our investment bankers today to discuss how we can help with your capital transaction goals.

Diagnostics Industry Overview

An executive summary of diagnostics and in vitro diagnostics

The In-Vitro Diagnostics (IVD) industry refers to the production, use, and/or sale of medical devices such as reagents, systems, techniques, instruments, or a combination of these that are used in vitro for the examination and research of specimens such as blood, urine or tissue with the goal of detecting disease, infection, or other anomalies from assays in a controlled environment outside a living organism. IVD distinguishes itself from other equipment and tests by being in vitro or in an artificial environment such as a test tube, as opposed to inside a living organism.

Segmentation

Major Techniques

IVD testing is used for a variety of functions including glucose testing, blood testing, infectious disease testing, and pregnancy testing to name a few. Research for epidemics, viruses (HIV and Cancer), and diseases all use in vitro diagnostics. The IVD industry can be broken down into several verticals based on testing technique. Below is a graphic showing the major verticals of the IVD market by growth rate and market share in 2016.

- Point of Care: POC testing refers to medical diagnostic testing at or near the point of care, or at the time and place of patient care. Seen as more convenient and helpful in making quicker decisions, POC has grown quickly in the past years. Generating about $18B annually in revenue, POC represents about 30% of the IVD market.[i]

- Immunoassay: A biochemical test that measures the presence or concentration of a macromolecule or a small molecule in a solution through the use of an antibody (usually) or an antigen (sometimes). Representing about 22% of the IVD market, Immunoassay testing and equipment produces about $13B in revenue.[2]

- Molecular Diagnosis: Using techniques such as DNA (deoxyribonucleic acid) microarray analysis, mass spectrometry and nucleic acid amplification in order to make rapid diagnoses, Molecular Diagnostics is the fastest growing vertical of the IVD industry. Growing at a 3 year CAGR of 14%, Molecular Diagnostics generated $6B in market revenue in 2016.[3]

Other major techniques:

- Clinical Chemistry

- Homeostasis

- Hematology

- Flow Cytometry

Major Competitors

Overall the Global IVD market is dominated by 8-10 key players:

- Roche Diagnostics

- Abbott Diagnostics (including Alere)

- Siemens

- Sysmex

- Johnson & Johnson Medical Devices and Diagnostics

- BioMerieux

- Danaher

- Becton Dickinson

Smaller players tend to be highly specialized, whereas the largest players compete in multiple IVD verticals. Economies of scale are critical to effective competition due to the lack of product differentiation.[4]

Major Countries

The majority of the IVD market is concentrated in developed countries. The United States ($25B), Europe ($19B) and Japan ($ 5.5B) account for over 80% of global market sales.[5]

Growth Drivers & Outlook

With an estimated global market size of $61B as of 2016, the IVD industry is set to experience steady growth and continued consolidation.[6] Growing at a 5-year CAGR of 5%, some analysts expect IVD to top $80B by 2022.[7] The industry is expected to see growth in profits as industry consolidation and technological advancements lead to greater economies of scale. Growth drivers include an aging world population, increased technological innovation and involvement in healthcare by tech companies, rising living standards in developing nations, and industry consolidation.

Sources

[i] Chantal Morel, Overview of the diagnostics market Ensuring innovation in diagnostics for bacterial infection: Implications for policy [Internet]. (2016), https://www.ncbi.nlm.nih.gov/books/NBK447315/ (last visited Dec 18, 2017).

[2] Chantal Morel, Overview of the diagnostics market Ensuring innovation in diagnostics for bacterial infection: Implications for policy [Internet]. (2016), https://www.ncbi.nlm.nih.gov/books/NBK447315/ (last visited Dec 18, 2017).

[3] Chantal Morel, Overview of the diagnostics market Ensuring innovation in diagnostics for bacterial infection: Implications for policy [Internet]. (2016), https://www.ncbi.nlm.nih.gov/books/NBK447315/ (last visited Dec 18, 2017).

[4] Chantal Morel, Overview of the diagnostics market Ensuring innovation in diagnostics for bacterial infection: Implications for policy [Internet]. (2016), https://www.ncbi.nlm.nih.gov/books/NBK447315/ (last visited Dec 18, 2017).

[5] Chantal Morel, Overview of the diagnostics market Ensuring innovation in diagnostics for bacterial infection: Implications for policy [Internet]. (2016), https://www.ncbi.nlm.nih.gov/books/NBK447315/ (last visited Dec 18, 2017).

[6] Abha Thakur, IVD Market by Product Type (Reagents, Instruments and Software & Services), by Technique (Immunodiagnostics, Blood Testing, Molecular Diagnostics, Tissue Diagnostics, Clinical Chemistry, and Other IVD Techniques), by Application (Infectious Diseases, Cancer, Cardiac Diseases, Immune System Disorders, Nephrological Diseases, Gastrointestinal Diseases, and Other Indications), and by End Users (Standalone Laboratory, Hospitals, Academic and Medical Schools, Point of Care Testing, and Others) – Global Opportunity Analysis and Industry Forecast, 2017-2023 Allied Market Research, https://www.alliedmarketresearch.com/ivd-in-vitro-diagnostics-market (last visited Dec 18, 2017).

[7] Abha Thakur, IVD Market by Product Type (Reagents, Instruments and Software & Services), by Technique (Immunodiagnostics, Blood Testing, Molecular Diagnostics, Tissue Diagnostics, Clinical Chemistry, and Other IVD Techniques), by Application (Infectious Diseases, Cancer, Cardiac Diseases, Immune System Disorders, Nephrological Diseases, Gastrointestinal Diseases, and Other Indications), and by End Users (Standalone Laboratory, Hospitals, Academic and Medical Schools, Point of Care Testing, and Others) – Global Opportunity Analysis and Industry Forecast, 2017-2023 Allied Market Research, https://www.alliedmarketresearch.com/ivd-in-vitro-diagnostics-market (last visited Dec 18, 2017).

Diagnostics Transaction and Capital Trends

Diagnostics Mergers, Acquisition & Venture Capital Investments

The In Vitro Diagnostics (IVD) market experienced a record year of deal-making in 2016. With an estimated $61B in market revenue in 2016, growing at a 5-year CAGR of 5%, growth trends support another strong year of investment activity in 2017.[i] This article will discuss the transaction activity, buyer profile, notable transactions, and valuation methodologies in the IVD industry.

In-Vitro Diagnostics Investment Overview

The IVD market experienced heavy investment and a hot transaction market in 2016. With a few blockbuster M&A deals, 2016 surpassed the record breaking year of 2011 with the highest amount of capital invested in the industry’s recent history. In 2016, there was just over $13B in disclosed transactions, compared to 2011’s $11.76B. Despite varying amounts of invested capital over the past seven years, deal flow has seen consistent and strong growth. Growing at a CAGR of 10.6%, deal flow has grown from 174 total deals in 2011 to 319 in 2016. This growth has been largely driven by venture capital and private equity deals, while M&A activity has been relatively stable over the same period.

2017 is set to surpass all previous years in capital invested, already matching 2016’s total of $13B by 12/1, despite seeing flat or even negative YoY deal flow growth. The dip in deal flow is a consequence of a drop of late stage VC deals from 101 in 2016, to 58 in 2017. However, the total late stage VC funding in 2017 was $761M, which still surpassed 2016’s total of $546M.

The most interesting development in the transactions of 2017 is the growth of the average deal size. Both median and mean deal size reached new peaks in 2017, with the mean deal size growing from $62.2M in 2016 to $71.6M in 2017, and the median deal size hitting $3.63M in 2017, almost double that of $1.75M in 2016. This growth in average deal size indicates the companies are placing higher value on each individual deal. Higher business valuations can make it more attractive for new companies to enter the market, speeding growth and increasing M&A activity.

| Year[ii] | Deal Count | Total Capital Invested ($M) | Capital Invested Mean ($M) | Capital Invested Median ($M) |

| 2011 | 174 | 11,756 | 67.56 | 3 |

| 2012 | 215 | 7,970 | 48.3 | 2.5 |

| 2013 | 234 | 4,295 | 25.75 | 2 |

| 2014 | 265 | 11,658 | 63.36 | 1.8 |

| 2015 | 300 | 7,963 | 38.1 | 1.73 |

| 2016 | 319 | 13,318 | 62.23 | 1.75 |

| 2017 | 271 | 13,317 | 71.6 | 3.63 |

Major Investors

- Competitors –

The In Vitro Diagnostics market has seen a large amount of consolidation in the past ten years. As a result the market is dominated by eight to ten key players who compete in multiple verticals within the IVD market. Due to the lack of product differentiation, economies of scale are essential to generating a profit.[iii] Consequently, the largest investors in IVD companies are the major market participants looking to acquire or build strategic partnerships in order to gain access to a larger clientele.

- PE/VC firms –

IVD is among the fastest growing verticals within the massive medtech market with strong trends to support that growth. As a result, both venture capital and private equity investors continue to pour in capital in both small, specialized IVD shops, as well as more established companies – like the Carlyle Group’s $4B acquisition of Johnson & Johnson’s blood testing division.

Notable Deals

IVD has seen several blockbuster deals in the past 7 years. As industry consolidation continues, almost all of these transactions have been completed by a few of the market’s largest players like Danaher, Thermo Fisher, and Abbott as they seek to gain economies of scale. The majority of these deals have taken place between American companies. The major exceptions are China-based Mindray Medical, which was originally listed on the NYSE before being taken private by Excelsior Union, and Japanese Wako Pure. This demonstrates the rough split of deal activity between global regions where North America leads Europe and Asia. It is worth noting that this list excludes Abbott’s mega-acquisition of St. Jude Medical which included a price tag of $25B and closed in 2017. Despite the fact that Abbott competes directly in the IVD market, its acquisition of St. Jude Medical will allow it compete more in the cardiovascular and therapeutic device markets. As was discussed previously, it can be observed that the more recent deals have been, on average, larger in terms acquisition price. This demonstrates the market’s determination that IVD companies will provide high amounts of growth and value over the next 10 year period, boosting corporate valuations as time moves forward.

Valuations and Multiples

As the IVD market reaches the mature stage, its cashflows and revenue streams have become predictable. As a result, the methodologies used to value IVD companies fall into traditional categories.[iv]

- Asset-based valuation

- Income approach (capitalization of earnings)

- Income approach (DCF)

- Market approach (public comps)

The above chart gives the industry multiples based off PitchBook data on 14 of the industry’s main participants as of 9/30/2017 and excludes outliers.[v]

Valuation Drivers –

- Client reach – Due to the lack of product differentiation, building solid revenue growth is a matter of acquiring more books of sale. The greater a company’s client base, the higher valuation they can justify.

- Specialization in niche vertical – Large strategic buyers must compete in multiple industry verticals to generate profit. Acquiring smaller specialized competitors with a client base in that vertical is the generally the simplest way of doing that. Smaller companies that specialize and generate profits can justify higher valuations.

- Premiums paid by strategic buyers – As higher valuations are paid by strategic buyers, the potential ROI for investors grows. This boosts the value of comparable companies in the eyes of competitors of strategic buyers.

Industry Outlook

The IVD industry is the fastest growing sector within of medtech, and it has strong supporting growth trends that will sustain its growth for the next ten years.[vi] Because of this both VC and PE investing is expected to increase. As technology plays a larger role in IVD advancements, additional partnership and VC investments from outside the IVD industry will increase. Industry consolidation is expected to continue, and as a result M&A activity is expected to grow as companies pay higher premiums for acquisitions. While deal flow is expected to maintain modest growth, capital invested and average deal sizes are expected to increase moving forward.

Sources

[i] Abha Thakur, IVD Market by Product Type (Reagents, Instruments and Software & Services), by Technique (Immunodiagnostics, Blood Testing, Molecular Diagnostics, Tissue Diagnostics, Clinical Chemistry, and Other IVD Techniques), by Application (Infectious Diseases, Cancer, Cardiac Diseases, Immune System Disorders, Nephrological Diseases, Gastrointestinal Diseases, and Other Indications), and by End Users (Standalone Laboratory, Hospitals, Academic and Medical Schools, Point of Care Testing, and Others) – Global Opportunity Analysis and Industry Forecast, 2017-2023 Allied Market Research, https://www.alliedmarketresearch.com/ivd-in-vitro-diagnostics-market (last visited Dec 18, 2017).

[ii] PitchBook data found searching the following keywords: “in vitro diagnostics” or “ivd” or “point-of-care testing” or “blood testing device” or “point-of-care diagnostics” or “blood diagnostic” or “point-of-care diagnostic” or “vitro diagnostic” or “point-of-care device” or “diagnostics test” or “cancer diagnostic” or “clinical diagnostic” or “disease detection” or “disease diagnostics” or blood testing system” or “diagnostic reagents” or “research diagnostics” or “clinical diagnostics” or “molecular detection” or “clinical chemistry” or “molecular diagnostics” or immunoassay or flow cytometry or haemostasis or hematology or coagulation or histology or “research reagents” or “reagent systems”

[iii] Maria Shepherd, An Update on the In Vitro Diagnostics Sector Your online source for medical device product information – Medical Product Outsourcing (2017), https://www.mpo-mag.com/issues/2017-04-01/view_columns/an-update-on-the-in-vitro-diagnostics-sector (last visited Dec 22, 2017).

[iv] Valuation Guide: Medical Device Industry, Experts on Damages, Valuation & Accounting, http://www.fulcrum.com/medicaldevice_appraisal/ (last visited Dec 22, 2017).

[v] Includes Abbott, Alere, Becton Dickinson, Danaher, Roche, Siemens, Thermo Fisher, Sysmex, Illumina, Myriad Genetics, Qiagen, Luminex, BioMerieux, Diasorin

[vi] Zacks Equity Research, Global In Vitro Diagnostic Market Booms: Stocks in Focus Zacks Investment Research (2017), https://www.zacks.com/stock/news/283747/global-in-vitro-diagnostic-market-booms-stocks-in-focus (last visited Dec 22, 2017).

Diagnostics Industry Performance

Historical and future expected macro performance in diagnostics and in-vitro diagnostics

The In Vitro Diagnostics (IVD) market is the largest segment of the Medical Technology industry, comprising a 12.8% market share in 2016, and an estimated 13.3% share by 2022.[i] The market revenue in 2016 was $61B[ii] and grew at a 5% CAGR[iii] from 2011-2016, and that growth is expected to accelerate to 5.9%[iv] from 2016-2022.

Key Drivers

Growing Geriatric Population

The Global Health and Aging report presented by the World Health Organization (WHO) said, “The number of people aged 65 or older is projected to grow from an estimated 524 million in 2010 to nearly 1.5 billion in 2050, with most of the increase in developing countries.”[5] The Office of Disease Prevention and Health Promotion projected that by 2030, more than 60% of the “baby boomer” generation will be managing at least one chronic illness or condition.[6] As the world’ population ages, there will be greater pressure on the healthcare system for inexpensive and accurate diagnostics.

Increase in Healthcare Expenditures Per Capita

The latest estimates of global healthcare spending statistics show global healthcare expenditure per capita at all-time high levels of $1,058 in 2014.[vii] In fact, healthcare spending per capita has increased YoY every year since 1998, and that trend is expected to continue, driving consumption of IVD products.

Increase in Incidence of Chronic and Infectious Disease

Chronic and infectious diseases have seen rapid rates of growth in recent years, and that growth is expected to continue. The number of cancer cases is expected to rise from 17 million in 2020 to 27 million by 2030.[viii] The AHA recently reported that the number of Americans with diabetes is projected to increase from 30 million in 2016 to 46 million by 2030.[ix] HIV/AIDS, obesity, Alzheimer’s and dementia, among others, will experience accelerated incidence rates in the next 10 years. In addition, there is a substantial rise in the number of patients suffering from infectious diseases such as gastrointestinal, respiratory, and sexually transmitted diseases (STDs).[x] This will drive demand for cheaper and more accessible diagnostic tests.

Technological Advancements

In the past, functions performed by in-vitro diagnostics used to be exclusively performed in labs or clinics. As technology has developed, these functions have been made accessible in smaller, easier, cheaper and more portable versions, such as take-home pregnancy tests or blood glucose testing devices. This development has driven demand and use of IVD products.

Key Restraints

Regulation

As much of the technology that is driving the growth in the IVD market is new and part of the healthcare sphere, there is a high degree of regulation on the approval and marketing of IVD products, especially in North America and Europe. This may represent a restraint on the market as growth accelerates.

Lack of Infrastructure

Emerging nations and regions that are experiencing high growth rates in healthcare spending lack the facilities and infrastructure necessary to support this growth. Therefore, their continued growth will in large part be dependent on the continued investment in the necessary infrastructure.

Industry Lifecycle Stage

The IVD industry is currently entering the mature stage of its lifecycle. Industry growth rates are stabilizing around 5%, although some analysts argue those rates are closer to 4.5%. Industry competition is fierce, and massive consolidation has already taken place, with a relatively small amount of multi-national companies holding a lion’s share of the market. Profits are not based on product differentiation, but on economies of scale, and therefore companies must either hyper-specialize in a niche segment or acquire other companies to grow. However, there are both product and geographical segments experiencing high growth rates, such as molecular diagnostics and the Asia-Pacific region, respectively. From 2017-2022, expect the trend of consolidation to continue and growth rates to remain stable around 4.5-5.5% CAGR.

Sources

[i] Evaluate, Top global medical technology segments by market share in 2016 and 2022, Statista, https://www.statista.com/statistics/309273/top-sehments-in-medical-technology-by-market-share/ (last visited Jan. 8, 2018).

[ii] Abha Thakur, IVD Market by Product Type (Reagents, Instruments and Software & Services), by Technique (Immunodiagnostics, Blood Testing, Molecular Diagnostics, Tissue Diagnostics, Clinical Chemistry, and Other IVD Techniques), by Application (Infectious Diseases, Cancer, Cardiac Diseases, Immune System Disorders, Nephrological Diseases, Gastrointestinal Diseases, and Other Indications), and by End Users (Standalone Laboratory, Hospitals, Academic and Medical Schools, Point of Care Testing, and Others) – Global Opportunity Analysis and Industry Forecast, 2017-2023 Allied Market Research, https://www.alliedmarketresearch.com/ivd-in-vitro-diagnostics-market (last visited Dec 18, 2017).

[iii] Chantal Morel, Overview of the diagnostics market Ensuring innovation in diagnostics for bacterial infection: Implications for policy [Internet]. (2016), https://www.ncbi.nlm.nih.gov/books/NBK447315/ (last visited Dec 18, 2017).

[iv] Zacks Equity Research, Global In Vitro Diagnostic Market Booms: Stocks in Focus Zacks Investment Research (2018), https://www.zacks.com/stock/news/283747/global-in-vitro-diagnostic-market-booms-stocks-in-focus (last visited Jan 8, 2018).

[5] The Aging Population: The Increasing Effects on Health Care, Pharmacy Times (2016), http://www.pharmacytimes.com/publications/issue/2016/january2016/the-aging-population-the-increasing-effects-on-health-care (last visited Jan 8, 2018).

[6] The Aging Population: The Increasing Effects on Health Care, Pharmacy Times (2016), http://www.pharmacytimes.com/publications/issue/2016/january2016/the-aging-population-the-increasing-effects-on-health-care (last visited Jan 8, 2018).

[vii] Health expenditure per capita (current US$), Health expenditure per capita (current US$) | Data, https://data.worldbank.org/indicator/SH.XPD.PCAP?end=2014&start=1995&view=chart (last visited Jan 8, 2018).

[viii] The Aging Population: The Increasing Effects on Health Care, Pharmacy Times (2016), http://www.pharmacytimes.com/publications/issue/2016/january2016/the-aging-population-the-increasing-effects-on-health-care (last visited Jan 8, 2018).

[ix] The Aging Population: The Increasing Effects on Health Care, Pharmacy Times (2016), http://www.pharmacytimes.com/publications/issue/2016/january2016/the-aging-population-the-increasing-effects-on-health-care (last visited Jan 8, 2018).

[x] Abha Thakur, IVD Market by Product Type (Reagents, Instruments and Software & Services), by Technique (Immunodiagnostics, Blood Testing, Molecular Diagnostics, Tissue Diagnostics, Clinical Chemistry, and Other IVD Techniques), by Application (Infectious Diseases, Cancer, Cardiac Diseases, Immune System Disorders, Nephrological Diseases, Gastrointestinal Diseases, and Other Indications), and by End Users (Standalone Laboratory, Hospitals, Academic and Medical Schools, Point of Care Testing, and Others) – Global Opportunity Analysis and Industry Forecast, 2017-2023 Allied Market Research, https://www.alliedmarketresearch.com/ivd-in-vitro-diagnostics-market (last visited Dec 18, 2017).[/vc_column_text][vc_separator type=”transparent” up=”60″ down=”0″][/vc_column][/vc_row][vc_row css_animation=”” row_type=”row” use_row_as_full_screen_section=”no” type=”full_width” angled_section=”no” text_align=”left” background_image=”24406″ background_image_as_pattern=”without_pattern”][vc_column][vc_separator type=”transparent” up=”10″ down=”30″][vc_separator type=”transparent” up=”10″ down=”30″][vc_separator type=”transparent” up=”10″ down=”30″][vc_column_text]

Diagnostics Key Performance

Key Performance Indicators (KPIs) in diagnostics and in-vitro diagnostics

The In Vitro Diagnostics (IVD) industry had an estimated $61B in market revenue in 2016 and grew at a 5-year CAGR of 5% from 2012-2017.[i] This article focuses on the key vocabulary and major statistics of the IVD industry.[ii]

Industry Jargon & Key Terms

- Reagent: A substance or compound added to a system to cause a chemical reaction or added to test if a reaction occurs.

- Assays: An investigative (analytic) procedure in laboratory medicine, pharmacology, environmental biology and molecular biology for qualitatively assessing or quantitatively measuring the presence, amount, or functional activity of a target entity (the analyte).

- Point of Care Testing (POCT): POCT testing refers to medical diagnostic testing at or near the point of care, or at the time and place of patient care. Seen as more convenient and helpful in making quicker decisions, POC has grown quickly in the past years. Generating about $18B annually in revenue, POC represents about 30% of the IVD market.[iii]

- Molecular Diagnostics: Using techniques such as DNA (deoxyribonucleic acid) microarray analysis, mass spectrometry and nucleic acid amplification in order to make rapid diagnoses, Molecular Diagnostics is the fastest growing vertical of the IVD industry. Growing at a 3-year CAGR of 14%, Molecular Diagnostics generated $6B in market revenue in 2016.[iv]

- Immunoassays: A biochemical test that measures the presence or concentration of a macromolecule or a small molecule in a solution through the use of an antibody (usually) or an antigen (sometimes). Representing about 22% of the IVD market, Immunoassay testing and equipment produces about $13B in revenue.[v]

- Flow Cytometry: A laser-based, biophysical technology employed in cell counting, cell sorting, biomarker detection and protein engineering, by suspending cells in a stream of fluid and passing them through an electronic detection apparatus. A flow cytometer allows simultaneous multiparametric analysis of the physical and chemical characteristics of up to thousands of particles per second.

- Haematology: The study and analysis of blood to diagnose and treat illnesses

- Haemostasis: A branch of the Haematology field that focuses on the body’s normal physiological response for the prevention and stopping of bleeding/haemorrhage.

- Clinical Chemistry: An applied form of biochemistry that analyzes bodily fluids for diagnostic and/or therapeutic purposes.

- 510(k) Pre-Market Notifications (PMN): A 510(K) is a “premarket submission made to the FDA to demonstrate that the device to be marketed is at least as safe and effective, that is, substantially equivalent, to a legally marketed device that is not subject to premarket approval.”[vi]

- Premarket Approval Pathway (PMA): Premarket approval (PMA) is the FDA “process of scientific and regulatory review to evaluate the safety and effectiveness of Class III medical devices. Class III devices are those that support or sustain human life, are of substantial importance in preventing impairment of human health, or which present a potential, unreasonable risk of illness or injury. A PMA application must be submitted if the device cannot be cleared through the 510(k) premarket notification procedures. The PMA process is much more demanding than the 510(k) premarket notification process and is the most stringent type of device marketing application required by FDA.”[vii]

- Quality System Regulation (QSR): Requires manufacturers to follow design, testing, control, documentation and other quality assurance procedures during the manufacturing process.[viii]

- Geriatric: Relating to an older or aging person, particularly in reference to their health care.

Key Transaction Data

Key Valuation Multiples

Key Efficiency Ratios

Key Liquidity & Leverage Ratios

Key Profitability Ratios

[i] Abha Thakur, IVD Market by Product Type (Reagents, Instruments and Software & Services), by Technique (Immunodiagnostics, Blood Testing, Molecular Diagnostics, Tissue Diagnostics, Clinical Chemistry, and Other IVD Techniques), by Application (Infectious Diseases, Cancer, Cardiac Diseases, Immune System Disorders, Nephrological Diseases, Gastrointestinal Diseases, and Other Indications), and by End Users (Standalone Laboratory, Hospitals, Academic and Medical Schools, Point of Care Testing, and Others) – Global Opportunity Analysis and Industry Forecast, 2017-2023 Allied Market Research, https://www.alliedmarketresearch.com/ivd-in-vitro-diagnostics-market (last visited Dec 18, 2017).

[ii] In Vitro Diagnostics (IVD) Market Outlook To 2024: In-Depth Market View, Key Product & Service Categories (Reagents & Kits, CT, Instruments, Softwares, Services), Application (Diabetes, Infectious Diseases, Oncology, Cardiology, Nephrology, HIV/Ads, Autoimmune Diseases, Drug Testing/Pharmacogenomics), Regional Segmentation, Top Players & Company Share, Competitive Dynamics, Growth Drivers & Restraints, M&A Insights, Segment Forecast And Key Conclusion, Ameri Research Inc. (2017), https://www.ameriresearch.com/product/vitro-diagnostics-ivd-market-outlook-2024-depth-market-view-key-product-service-categories-reagents-kits-ct-instruments-softwares-services-application-diabetes-infectious-dis/ (last visited Jan 12, 2018).

[iii] Chantal Morel, Overview of the diagnostics market Ensuring innovation in diagnostics for bacterial infection: Implications for policy [Internet]. (2016), https://www.ncbi.nlm.nih.gov/books/NBK447315/ (last visited Dec 18, 2017).

[iv] Chantal Morel, Overview of the diagnostics market Ensuring innovation in diagnostics for bacterial infection: Implications for policy [Internet]. (2016), https://www.ncbi.nlm.nih.gov/books/NBK447315/ (last visited Dec 18, 2017).

[v] Chantal Morel, Overview of the diagnostics market Ensuring innovation in diagnostics for bacterial infection: Implications for policy [Internet]. (2016), https://www.ncbi.nlm.nih.gov/books/NBK447315/ (last visited Dec 18, 2017).

[vi] 510(k) Premarket Notification, accessdata.fda.gov, https://www.accessdata.fda.gov/scripts/cdrh/cfdocs/cfPMN/pmn.cfm (last visited Feb 8, 2018).

[vii] Center for Devices and Radiological Health, Premarket Approval (PMA) U S Food and Drug Administration Home Page, https://www.fda.gov/medicaldevices/deviceregulationandguidance/howtomarketyourdevice/premarketsubmissions/premarketapprovalpma/ (last visited Feb 8, 2018).

[viii] Jack Curran, IBISWorld Industry Report 33911a Medical Instrument & Supply Manufacturing in the US, IBIS World US 30–35 (2017), http://clients1.ibisworld.com/reports/us/industry/operatingconditions.aspx?entid=881 (last visited Jan 29, 2018).

[ix] PitchBook data found searching the following keywords: “in vitro diagnostics” or “ivd” or “point-of-care testing” or “blood testing device” or “point-of-care diagnostics” or “blood diagnostic” or “point-of-care diagnostic” or “vitro diagnostic” or “point-of-care device” or “diagnostics test” or “cancer diagnostic” or “clinical diagnostic” or “disease detection” or “disease diagnostics” or “blood testing system” or “diagnostic reagents” or “research diagnostics” or “clinical diagnostics” or “molecular detection” or “clinical chemistry” or “molecular diagnostics” or immunoassay or flow cytometry or haemostasis or hematology or coagulation or histology or “research reagents” or “reagent systems”

[x] PitchBook data based on a proxy market composed of the following data: Abbott, Alere, Becton Dickinson, Danaher, Roche, Siemens, Thermo Fisher, Sysmex, Illumina, Myriad Genetics, Qiagen, Luminex, BioMerieux, Diasorin

[xi]PitchBook data based on a proxy market composed of the following data: Abbott, Alere, Becton Dickinson, Danaher, Roche, Siemens, Thermo Fisher, Sysmex, Illumina, Myriad Genetics, Qiagen, Luminex, BioMerieux, Diasorin

[xii]PitchBook data based on a proxy market composed of the following data: Abbott, Alere, Becton Dickinson, Danaher, Roche, Siemens, Thermo Fisher, Sysmex, Illumina, Myriad Genetics, Qiagen, Luminex, BioMerieux, Diasorin

[xiii]PitchBook data based on a proxy market composed of the following data: Abbott, Alere, Becton Dickinson, Danaher, Roche, Siemens, Thermo Fisher, Sysmex, Illumina, Myriad Genetics, Qiagen, Luminex, BioMerieux, Diasorin[/vc_column_text][vc_separator type=”transparent” up=”60″ down=”0″][/vc_column][/vc_row][vc_row css_animation=”” row_type=”row” use_row_as_full_screen_section=”no” type=”full_width” angled_section=”no” text_align=”left” background_image=”24406″ background_image_as_pattern=”without_pattern”][vc_column][vc_separator type=”transparent” up=”10″ down=”30″][vc_separator type=”transparent” up=”10″ down=”30″][vc_separator type=”transparent” up=”10″ down=”30″][vc_column_text]

Major Markets & Demand Determinants

Major subsectors, products and demand determinants in diagnostics and in-vitro diagnostics

The In Vitro Diagnostics (IVD) market is the largest segment of the Medical Technology industry. In vitro diagnostic products use specimens from patients to detect diseases. They have grown in popularity and application in recent years because they are considered less invasive and less expensive than traditional diagnostic tests. This article will discuss major products, market demand drivers, regions, and end-users.

Major Products

The IVD product market is segmented into instruments, reagents, services, and data management software. Instruments make up the largest segment because of their advanced technology and high price point. However, the fastest growing product segment is the reagents category, which is expected to grow at a CAGR of 6.4%.[1]

IVD testing has a variety of common applications including glucose testing, blood testing, infectious disease testing, and pregnancy testing to name a few. Research for epidemics, viruses (AIDS/HIV and Cancer), diabetes, and many other diseases all use in vitro diagnostics as well.

Demand Determinants

Three major factors have been driving global demand for IVD products.

- Aging Population: The Global Health and Aging report presented by the World Health Organization (WHO) said, “The number of people aged 65 or older is projected to grow from an estimated 524 million in 2010 to nearly 1.5 billion in 2050.”[2] The Office of Disease Prevention and Health Promotion projected that by 2030, more than 60% of the “baby boomer” generation will be managing at least one chronic illness or condition.[3] As the world’ population ages, there will be greater pressure on the healthcare system for inexpensive and accurate diagnostics.

- Growth in Chronic and Infectious Disease: Chronic and infectious diseases have seen rapid rates of growth in recent years, and that growth is expected to continue. The number of cancer cases is expected to rise from 17 million in 2020 to 27 million by 2030.[4] The AHA recently reported that the number of Americans with diabetes is projected to increase from 30 million in 2016 to 46 million by 2030.[5] HIV/AIDS, obesity, Alzheimer’s and dementia, among others, will experience accelerated incidence rates in the next 10 years. In addition, there is a substantial rise in the number of patients suffering from infectious diseases such as gastrointestinal, respiratory, and sexually transmitted diseases (STDs).[6] This will drive demand for cheaper and more accessible diagnostic tests.

- Technological Advancements: In the past, functions performed by in-vitro diagnostics used to be exclusively performed in labs or clinics. As technology has developed, these functions have been made accessible in smaller, easier, cheaper and more portable versions, such as take-home pregnancy tests or blood glucose testing devices. This development has driven demand and use of IVD products.

Major Markets

Region

North America dominates the IVD market with nearly 42% market revenue at $31.1B mostly due to the huge healthcare market and expenditure in the USA, advanced technology, established government and private health infrastructure and agencies.[7] Europe, Middle East, and Africa (EMEA) accounted for 35% of the 2017 market. The Asia-Pacific market is expected to be the fastest growing region in the world with an anticipated CAGR of 13.5% to $34.8B in 2022.[8]

End User

The end-user of IVD devices include laboratories, academics, hospitals, and patient self-testing. There has been a marked evolution of the end user in the IVD market from hospitals and laboratories to patient self-testing as technology has created simpler, portable, and cheaper IVD products that can be used at home and by non-medical professionals. Despite this, the largest end user group continues to be private and hospital laboratories that use complex, high priced diagnostic tests not available to commercial clinics.[9]

Sources

[1] In Vitro Diagnostics (IVD) Market Outlook To 2024: In-Depth Market View, Key Product & Service Categories (Reagents & Kits, CT, Instruments, Softwares, Services), Application (Diabetes, Infectious Diseases, Oncology, Cardiology, Nephrology, HIV/Ads, Autoimmune Diseases, Drug Testing/Pharmacogenomics), Regional Segmentation, Top Players & Company Share, Competitive Dynamics, Growth Drivers & Restraints, M&A Insights, Segment Forecast And Key Conclusion, Ameri Research Inc. (2017), https://www.ameriresearch.com/product/vitro-diagnostics-ivd-market-outlook-2024-depth-market-view-key-product-service-categories-reagents-kits-ct-instruments-softwares-services-application-diabetes-infectious-dis/ (last visited Jan 12, 2018).

[2] The Aging Population: The Increasing Effects on Health Care, Pharmacy Times (2016), http://www.pharmacytimes.com/publications/issue/2016/january2016/the-aging-population-the-increasing-effects-on-health-care (last visited Jan 8, 2018).

[3] The Aging Population: The Increasing Effects on Health Care, Pharmacy Times (2016), http://www.pharmacytimes.com/publications/issue/2016/january2016/the-aging-population-the-increasing-effects-on-health-care (last visited Jan 8, 2018).

[4] The Aging Population: The Increasing Effects on Health Care, Pharmacy Times (2016), http://www.pharmacytimes.com/publications/issue/2016/january2016/the-aging-population-the-increasing-effects-on-health-care (last visited Jan 8, 2018).

[5] The Aging Population: The Increasing Effects on Health Care, Pharmacy Times (2016), http://www.pharmacytimes.com/publications/issue/2016/january2016/the-aging-population-the-increasing-effects-on-health-care (last visited Jan 8, 2018).

[6] Abha Thakur, IVD Market by Product Type (Reagents, Instruments and Software & Services), by Technique (Immunodiagnostics, Blood Testing, Molecular Diagnostics, Tissue Diagnostics, Clinical Chemistry, and Other IVD Techniques), by Application (Infectious Diseases, Cancer, Cardiac Diseases, Immune System Disorders, Nephrological Diseases, Gastrointestinal Diseases, and Other Indications), and by End Users (Standalone Laboratory, Hospitals, Academic and Medical Schools, Point of Care Testing, and Others) – Global Opportunity Analysis and Industry Forecast, 2017-2023 Allied Market Research, https://www.alliedmarketresearch.com/ivd-in-vitro-diagnostics-market (last visited Dec 18, 2017).

[7] Reportlinker, The global in vitro diagnostics (IVD) market should reach $102.4 billion by 2022 from $74.1 billion in 2017 at a compound annual growth rate (CAGR) of 6.7%, from 2017 to 2022 PR Newswire: news distribution, targeting and monitoring (2017), https://www.prnewswire.com/news-releases/the-global-in-vitro-diagnostics-ivd-market-should-reach-1024-billion-by-2022-from-741-billion-in-2017-at-a-compound-annual-growth-rate-cagr-of-67-from-2017-to-2022-300575320.html (last visited Jan 13, 2018).

[8] Reportlinker, The global in vitro diagnostics (IVD) market should reach $102.4 billion by 2022 from $74.1 billion in 2017 at a compound annual growth rate (CAGR) of 6.7%, from 2017 to 2022 PR Newswire: news distribution, targeting and monitoring (2017), https://www.prnewswire.com/news-releases/the-global-in-vitro-diagnostics-ivd-market-should-reach-1024-billion-by-2022-from-741-billion-in-2017-at-a-compound-annual-growth-rate-cagr-of-67-from-2017-to-2022-300575320.html (last visited Jan 13, 2018).

[9] Abha Thakur, IVD Market by Product Type (Reagents, Instruments and Software & Services), by Technique (Immunodiagnostics, Blood Testing, Molecular Diagnostics, Tissue Diagnostics, Clinical Chemistry, and Other IVD Techniques), by Application (Infectious Diseases, Cancer, Cardiac Diseases, Immune System Disorders, Nephrological Diseases, Gastrointestinal Diseases, and Other Indications), and by End Users (Standalone Laboratory, Hospitals, Academic and Medical Schools, Point of Care Testing, and Others) – Global Opportunity Analysis and Industry Forecast, 2017-2023 Allied Market Research, https://www.alliedmarketresearch.com/ivd-in-vitro-diagnostics-market (last visited Dec 18, 2017).

Diagnostics Industry Competitors

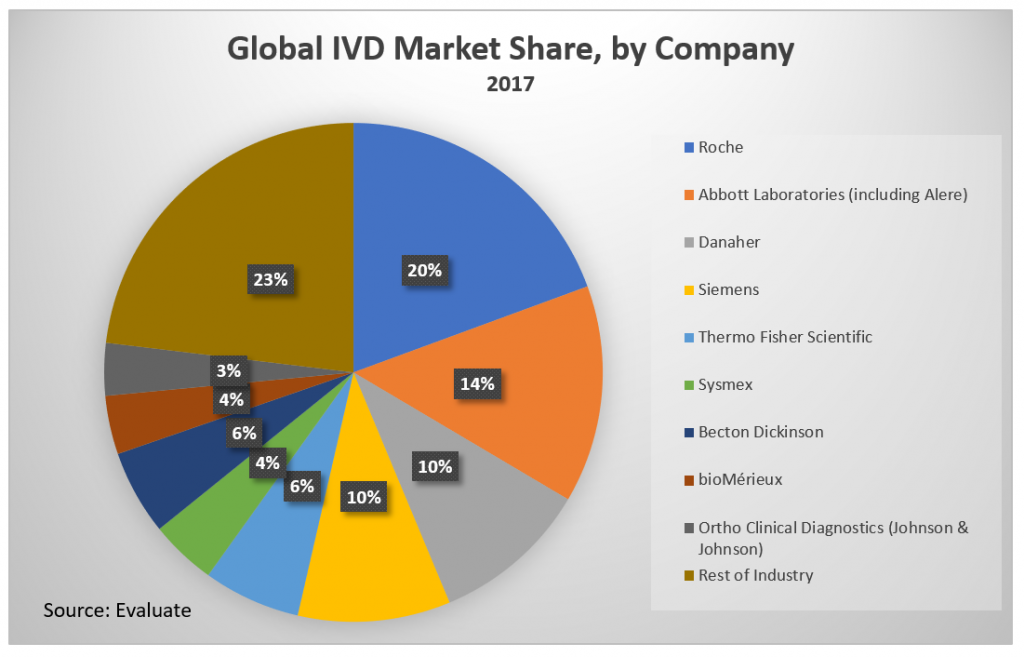

Major industry players and their share of the overall diagnostics market

Due to the recent trend of consolidation and a hot M&A market, the In Vitro Diagnostics (IVD) market is the now dominated by 8-10 major companies. They contributed to a 2016 market revenue of $61B[i] that grew at a 5% CAGR[ii] from 2011-2016. That growth is expected to accelerate to 5.9%[iii] from 2016-2022 in part due to the continued globalization of the IVD industry. The market is highly competitive. Because of the lack of product differentiation among IVD producers, economies of scale are critical to competitive profit margins. The most efficient way to gain new books of sale and to create a footing in a new market is through acquisitions. Because of its advanced lifecycle stage, the IVD market has high barriers to entry. The IVD market is currently experiencing an upward trend in globalization as emerging markets are expected to gain significant market share in the next 5 years.

Market Share Concentration

The global IVD market is dominated by 8-10 key players:

- Roche Diagnostics

- Abbott Diagnostics (including Alere)

- Siemens

- Sysmex

- Ortho-Clinical Diagnostics (Johnson & Johnson diagnostic division)

- BioMerieux

- Danaher

- Thermo Fisher

- Becton Dickinson

The IVD market is highly concentrated, with 9 companies generating 77% of the market revenue in 2016.[iv] The four-firm concentration ratio of the same year was 54%.[v] This number increased from 49% after Abbott’s 2017 acquisition of major competitor Alere.[vi] The market is expected to become less concentrated over the next 5 years but is still projected to have a four-firm concentration ratio of 50% in 2022.[vii] These top companies compete globally in multiple verticals within and without of the in-vitro diagnostic field. Companies that can’t compete with volume must compete with specialization.

Key Success Factors

As the IVD market enters the mature stage of its lifecycle industry consolidation increases, product differentiation becomes less effective, and specialization or diversification become more important. Smaller players tend to be highly specialized, whereas the largest players compete in multiple IVD verticals. Economies of scale are critical to effective competition due to the lack of product differentiation.[viii] As a result, an intelligent and well executed acquisition strategy is necessary for growth.

- Smart acquisitions

- High degree of specialization

- Diversified revenue streams/Compete in multiple verticals

- Global supply chains

Barriers to Entry

The IVD market has high barriers to entry. The IVD market is highly developed and competition is intense. Market participants must be robust enough to compete in multiple verticals across multiple regions or specialized enough to gain a competitive advantage. Additionally, the IVD market is relatively new and its technology is advancing rapidly. As a result, there are heavy regulations on new and existing products and techniques.

- Heavy regulation

- Intense competition

- High degree of specialization

Globalization

The IVD market is highly globalized. The North American and European markets are very developed due to the established healthcare systems in developed countries, while the Asia-Pacific market is the fastest growing segment and has already gained a substantial amount of global market share. While Japan has a mature IVD market, the global IVD powers are vying for space in the rest of the Asia-Pacific market, in particular China, as there is huge market potential and an expected 13.5% CAGR from 2016-2022.[ix]

Sources

[i] Abha Thakur, IVD Market by Product Type (Reagents, Instruments and Software & Services), by Technique (Immunodiagnostics, Blood Testing, Molecular Diagnostics, Tissue Diagnostics, Clinical Chemistry, and Other IVD Techniques), by Application (Infectious Diseases, Cancer, Cardiac Diseases, Immune System Disorders, Nephrological Diseases, Gastrointestinal Diseases, and Other Indications), and by End Users (Standalone Laboratory, Hospitals, Academic and Medical Schools, Point of Care Testing, and Others) – Global Opportunity Analysis and Industry Forecast, 2017-2023 Allied Market Research, https://www.alliedmarketresearch.com/ivd-in-vitro-diagnostics-market (last visited Dec 18, 2017).

[ii] Chantal Morel, Overview of the diagnostics market Ensuring innovation in diagnostics for bacterial infection: Implications for policy [Internet]. (2016), https://www.ncbi.nlm.nih.gov/books/NBK447315/ (last visited Dec 18, 2017).

[iii] Zacks Equity Research, Global In Vitro Diagnostic Market Booms: Stocks in Focus Zacks Investment Research (2018), https://www.zacks.com/stock/news/283747/global-in-vitro-diagnostic-market-booms-stocks-in-focus (last visited Jan 8, 2018).

[iv] Evaluate, Global top 10 companies based on in vitro diagnostics market share in 2016 and 2022, Statista, https://www-statista-com.erl.lib.byu.edu/statistics/331722/top-global-medtech-companies-by-in-vitro-diagnostics-market-share/ (last visited Jan. 23, 2018).

[v] Evaluate, Global top 10 companies based on in vitro diagnostics market share in 2016 and 2022, Statista, https://www-statista-com.erl.lib.byu.edu/statistics/331722/top-global-medtech-companies-by-in-vitro-diagnostics-market-share/ (last visited Jan. 23, 2018).

[vi] Staff Reporter, Abbott Completes Alere Acquisition GenomeWeb (2017), https://www.genomeweb.com/business-news/abbott-completes-alere-acquisition (last visited Jan 21, 2018).

[vii] Evaluate, Global top 10 companies based on in vitro diagnostics market share in 2016 and 2022, Statista, https://www-statista-com.erl.lib.byu.edu/statistics/331722/top-global-medtech-companies-by-in-vitro-diagnostics-market-share/ (last visited Jan. 23, 2018).

[viii] Chantal Morel, Overview of the diagnostics market Ensuring innovation in diagnostics for bacterial infection: Implications for policy [Internet]. (2016), https://www.ncbi.nlm.nih.gov/books/NBK447315/ (last visited Dec 18, 2017).

[ix] Reportlinker, The global in vitro diagnostics (IVD) market should reach $102.4 billion by 2022 from $74.1 billion in 2017 at a compound annual growth rate (CAGR) of 6.7%, from 2017 to 2022 PR Newswire: news distribution, targeting and monitoring (2017), https://www.prnewswire.com/news-releases/the-global-in-vitro-diagnostics-ivd-market-should-reach-1024-billion-by-2022-from-741-billion-in-2017-at-a-compound-annual-growth-rate-cagr-of-67-from-2017-to-2022-300575320.html (last visited Jan 13, 2018).

Diagnostics Industry Operating Conditions

Capital Intensity, Technology Systems & Revenue Volatility in Diagnostics

The In Vitro Diagnostics (IVD) market is expected to experience accelerated growth of 5.9%[i] from 2016-2022 and continue to be the largest segment of the global MedTech industry.[ii] The operating conditions of the IVD market are characterized by low capital intensity, high levels of technological advancements, low levels of revenue volatility, heavy regulation, and medium industry assistance from governments and political associations.

Capital Intensity

The level of capital intensity is low in the IVD market. Capital Intensity is measured by the ratio of capital to labor in a given industry. IVD products are developed through rigorous testing and require significant capital investment to bring to market. Although the market is developing and using increasingly specialized equipment, the labor costs are relatively higher and increasing for multiple reasons. In 2017, for every dollar spent on labor, the industry invested an estimated $0.08 in capital.[iii]

The labor force required for the IVD market is highly trained, well-educated, and in high demand. Laboratory and clinic testing requires high levels of skill and experience and therefore training, and education must be specialized. In addition, a large staff is necessary to conduct tests, develop distribution networks and market products. Workers include scientists, technicians, radiologists, and medical and genetic specialists.[iv]

Technology & Systems

Due to rapid advancement in testing equipment and diversified techniques, there is a high level of technology change in the IVD industry. Heavy investment in R&D is required to maintain relevance in a rapidly changing industry.[v] As consumer preferences have shifted to be more personalized and convenience focused, the IVD market has responded with a large shift towards point of care testing products. This allows users to perform tests at home and at a much lower cost. Additionally, the equipment needed to manufacture and test new diagnostics is becoming increasingly complex and specialized.

New technology is also allowing for new, more complex diagnostic techniques to be explored as more efficient methods to diagnose diseases. This, in turn, spurs greater technological innovation. Molecular and genetic diagnostics are becoming more commonplace and effective. These advances in technology also include increased automation, which is leading to lower demand for specialized testing personnel.

Revenue Volatility

The level of revenue volatility in the in-vitro diagnostics market is low. This low level of volatility is driven by the high demand and high frequency of use of IVD tests and products. In-vitro diagnostics are becoming the standard for diagnosing a wide array of illnesses and diseases and are projected to continue to grow in use. They are considered high priority products that have a relatively low price elasticity of demand. Additionally, the government support for healthcare in the majority of developed nations leads to reduced prices for consumers and steady demand for producers. This level of volatility is expected to remain level for the next five years as revenue growth will match external pressures against growth.

Regulation & Policy

The in-vitro diagnostics market has high levels of regulation. With the rate of technological change in the IVD industry, governments are increasingly weary of the effect on consumers. New products face rigorous and complicated approval processes before distribution can begin. In May 2017, the EU introduced a new regulation covering IVD products. New instruments are given a unique identifier, divided into classes and ranked by risk level. For higher risk instruments, manufacturers will be required to make public summaries of safety and risk.[vi] The FDA has a similar classification system for the US market that decides how rigorous the approval process must be based on the risk level of the product.[vii] Products must gain a 510(k) or pre-market approval (PMA) depending on the nature of the product.[viii] After the product has entered the market the FDA requires it to regularly pass QSR, or quality system regulation, or MDR, which requires the company to inform the FDA if a product may have caused or contributed to a serious injury or death. Companies are subject to random inspection of products and manufacturing facilities to ensure compliance. Failure to comply with the appropriate regulation can lead to a number of consequences including fines, injunctions, civil or criminal prosecution, and rejection of future product proposals.[ix]

Additionally, the effect of the changing landscape of healthcare reform in the US on the global IVD market is still unclear. In order to fund the 2010 Affordable Care Act and the subsequent healthcare reform, a 2.3% excise tax was levied on the sale of medical devices. However, the tax was suspended until December 31, 2017.[x] And with the recent repeal of the individual mandate, the ripple effect of healthcare reform continues to be uncertain.

Industry Assistance

The level of industry assistance is medium in the IVD market. Government sponsored healthcare programs play a large role in the IVD market. Although the in-vitro diagnostics industry receives little direct assistance from government, the increasing level of government funded healthcare programs make up a significant amount of revenue in the IVD market. In the US, Medicare and Medicaid made up 20.3% of the revenue in the diagnostics market in 2016.[xi] This level of government assistance for consumers is even higher in European markets where the state-sponsored healthcare systems are more robust. This level of assistance is expected to remain level in the coming years as fluctuations in healthcare and welfare spending continue to be the center of heated debate in the USA.

IVD market participants also receives a healthy amount of assistance from industry associations and activist groups. These include the Association of Medical Diagnostics Manufacturers (AMDM), the Medical Device Manufacturers Association (MDMA) and the Advanced Medical Technology Association (AdvaMed). The AMDM connects industry players and regulatory agencies, whereas the MDMA represents the interest of medical device manufacturers by protecting the industry from excessive or unreasonable regulation. It was the MDMA that directed the political efforts to repeal the 2.3% excise tax on medical device sales put into place by the Patient Protection and Affordable Care Act in 2010 which resulted in the suspension of the tax until December 31, 2017.[xii] AdvaMed is the largest medical technology association in the world, representing medical device manufacturers globally, including makers of medical equipment, medical software and medical supplies. It works to promote communication between legislators, regulators, and medical societies. It also seeks to ensure rapid product approvals by regulators, reasonable reimbursement and coverage policies and fair access to global markets.[xiii][xiv]

Sources

[i] Zack’s Equity Research, Global In Vitro Diagnostic Market Booms: Stocks in Focus Zack’s Investment Research (2018), https://www.zacks.com/stock/news/283747/global-in-vitro-diagnostic-market-booms-stocks-in-focus (last visited Jan 8, 2018).

[ii] Evaluate, Top global medical technology segments by market share in 2016 and 2022, Statista, https://www.statista.com/statistics/309273/top-sehments-in-medical-technology-by-market-share/ (last visited Jan. 8, 2018).

[iii] Jack Curran, IBISWorld Industry Report 62151 Diagnostic & Medical Laboratories in the US, IBIS World US 32–38 (2017), http://clients1.ibisworld.com/reports/us/industry/operatingconditions.aspx?entid=1575 (last visited Feb 1, 2018).

[iv] Jack Curran, IBISWorld Industry Report 62151 Diagnostic & Medical Laboratories in the US, IBIS World US 32–38 (2017), http://clients1.ibisworld.com/reports/us/industry/operatingconditions.aspx?entid=1575 (last visited Feb 1, 2018).

[v] Jack Curran, IBISWorld Industry Report 33911a Medical Instrument & Supply Manufacturing in the US, IBIS World US 30–35 (2017), http://clients1.ibisworld.com/reports/us/industry/operatingconditions.aspx?entid=881 (last visited Jan 29, 2018).

[vi] In Vitro Diagnostic Device Regulation (IVDR), LR UK, http://www.lrqa.co.uk/standards-and-schemes/ivd/ivd-new-regulation/ (last visited Jan 31, 2018).

[vii] Center for Devices and Radiological Health, IVD Regulatory Assistance – Overview of IVD Regulation U S Food and Drug Administration Home Page, https://www.fda.gov/MedicalDevices/DeviceRegulationandGuidance/IVDRegulatoryAssistance/ucm123682.htm (last visited Jan 31, 2018).

[viii] Jack Curran, IBISWorld Industry Report 33911a Medical Instrument & Supply Manufacturing in the US, IBIS World US 30–35 (2017), http://clients1.ibisworld.com/reports/us/industry/operatingconditions.aspx?entid=881 (last visited Jan 29, 2018).

[ix] Jack Curran, IBISWorld Industry Report 33911a Medical Instrument & Supply Manufacturing in the US, IBIS World US 30–35 (2017), http://clients1.ibisworld.com/reports/us/industry/operatingconditions.aspx?entid=881 (last visited Jan 29, 2018).

[x] Jack Curran, IBISWorld Industry Report 33911a Medical Instrument & Supply Manufacturing in the US, IBIS World US 30–35 (2017), http://clients1.ibisworld.com/reports/us/industry/operatingconditions.aspx?entid=881 (last visited Jan 29, 2018).

[xi] Jack Curran, IBISWorld Industry Report 62151 Diagnostic & Medical Laboratories in the US, IBIS World US 32–38 (2017), http://clients1.ibisworld.com/reports/us/industry/operatingconditions.aspx?entid=1575 (last visited Feb 1, 2018).

[xii] Jack Curran, IBISWorld Industry Report 33911a Medical Instrument & Supply Manufacturing in the US, IBIS World US 30–35 (2017), http://clients1.ibisworld.com/reports/us/industry/operatingconditions.aspx?entid=881 (last visited Jan 29, 2018).

[xiii] Main Issues, Main Issues | AdvaMed, https://www.advamed.org/issues (last visited Jan 31, 2018).

[xiv] Jack Curran, IBISWorld Industry Report 33911a Medical Instrument & Supply Manufacturing in the US, IBIS World US 30–35 (2017), http://clients1.ibisworld.com/reports/us/industry/operatingconditions.aspx?entid=881 (last visited Jan 29, 2018).

Buy-Side M&A Investment Trends & Strategies

Historical strategies for institutional buy-side investment in diagnostics and in-vitro diagnostics

The In-Vitro Diagnostics (IVD) market experienced heavy investment and a hot transaction market in 2016. With a few blockbuster M&A deals, 2016 surpassed the record-breaking year of 2011 with the highest amount of capital invested in the industry’s history. In 2016, there was just over $13B in disclosed transactions, compared to 2011’s $11.76B.[i] Despite varying amounts of invested capital over the past seven years, deal flow has seen consistent and growth has been strong. Growing at a CAGR of 10.6%, deal flow has grown from 174 total deals in 2011 to 319 in 2016.[ii]

Why is the IVD industry an attractive buy-side opportunity?

The IVD market is attractive because of its stability, size, and growth.

Large, Stable Industry

With a 2017 revenue of close to $64B, and projected 5-year growth of 5.9%, the IVD market is a global industry that has seen stable, consistent growth over the past 10 years.[iii] It has been the largest segment of the Medical Technology market for over 5 years and is projected to gain more market share through 2022.[iv] It has relatively mature markets in North America, Europe, Australia, and Japan, with emerging markets in China and India. Steady growth along with a significant market revenue signals a relatively low-risk market with a high potential for upside.

High Growth Segments & Locations

In-vitro diagnostics offers an attractive buy-side institutional investment case because of its high growth segments. Despite its maturing market, there are new segments and emerging markets with high growth rates. Growing at a 3-year CAGR of 14%, Molecular Diagnostics generated $6B in market revenue in 2016.[v] Point-of-care Testing (POCT) and Immunoassays, two of the largest segments in the IVD universe, saw relatively high growth rates of 7% and 6.5%.[vi] The Asia-Pacific region is expected to grow at a 5-year CAGR of 13.5% from 2017-2022, mostly driven by the rise of the Chinese market.[vii]

Robust, Growing Demand for In-Vitro Diagnostics

The demand for IVD products and services has continued to grow for over 20 years. This demand has driven the IVD segment to its position as leader in MedTech market.[viii] The factors that contribute to this strong demand are all projected to consistently grow over the next 10 year period.

- Advances in IVD Technology

IVD products and services have become increasingly easier to use and therefore manufacture. As a result, the end customer of these diagnostics has evolved from labs and hospitals exclusively to individuals using point-of-care IVD products at home. Tapping into this fresh new consumer pool, IVD market revenue has grown exponentially. Additionally, the advances in technology have led to expanded capabilities of in-vitro diagnostics and an increased adoption by labs, hospitals, clinics, and retail pharmacies. This is one of the most attractive aspects of the IVD market from an investor’s perspective.

- Increased Incidences of Diseases

Not only has there been an observable increase in the capabilities of IVD products, but a marked increase in the need for them as well. Chronic and infectious diseases have seen rapid rates of growth in recent years which are expected to continue. The number of cancer cases is expected to rise from 17 million in 2020 to 27 million by 2030.[ix] The AHA recently reported that the number of Americans with diabetes is projected to increase from 30 million in 2016 to 46 million by 2030.[x] HIV/AIDS, obesity, Alzheimer’s and dementia, among others, will experience accelerated incidence rates in the next 10 years. Due to these trends, IVD products and techniques are becoming the standard for diagnosing illnesses. This positions the IVD market as a necessity good, making it significantly more price inelastic and a much more attractive investment proposition.

- State-Sponsored Insulation

As use of IVD products has become the standard in hospitals, labs, and pharmacies, a greater portion of government funding is used for research and in healthcare benefits that are used to purchase these products. In the US, Medicare and Medicaid made up 20.3% of the revenue in the diagnostics market in 2016.[xi] These numbers are even greater in European markets where state funded healthcare is far more comprehensive. The result is a stable stream of demand for IVD products, techniques, and services.

Horizontal vs. Vertical M&A

Horizontal

The In Vitro Diagnostics market has seen a large amount of consolidation in the past ten years. Due to the lack of product differentiation, economies of scale are essential to generating a profit.[xii] Consequently, the largest investors in IVD companies are the major market participants looking to acquire or build strategic partnerships in order to gain access to a larger clientele. Horizontal mergers & acquisitions have been completed by some of the market’s largest players like Danaher buying Beckman Coulter and Cepheid, Thermo Fisher acquiring Patheon and Immunodiagnostics, and Abbott picking up Alere and St. Jude.

Vertical

IVD manufacturers are also expanding vertically in an attempt to create more efficient supply chains. The IVD production process can be broken down into creation, testing, validation, manufacture and marketing phases. Many companies that specialize in certain phases have acquired other firms in order to complete the process. In 2016, LabCorp acquired Sequenom and Oxford Immunitec bought Imugen – both acquisitions had the strategic objective of taking advantage of the technology testing capabilities of the acquired party.[xiii]

Outlook

The IVD industry is the fastest growing section of MedTech, and it has strong supporting growth trends that will sustain its growth for the next ten years.[xiv] High M&A activity is expected to continue as industry consolidation moves forward and companies look for paths to increased efficiency and profitability. As technology plays a larger role in IVD advancements, additional partnership and VC investments from technology companies will grow. While capital invested and average deal sizes are expected to increase moving forward, deal flow is projected to maintain modest growth.

Sources

[i] PitchBook data found searching the following keywords: “in vitro diagnostics” or “ivd” or “point-of-care testing” or “blood testing device” or “point-of-care diagnostics” or “blood diagnostic” or “point-of-care diagnostic” or “vitro diagnostic” or “point-of-care device” or “diagnostics test” or “cancer diagnostic” or “clinical diagnostic” or “disease detection” or “disease diagnostics” or blood testing system” or “diagnostic reagents” or “research diagnostics” or “clinical diagnostics” or “molecular detection” or “clinical chemistry” or “molecular diagnostics” or immunoassay or flow cytometry or haemostasis or hematology or coagulation or histology or “research reagents” or “reagent systems”

[ii] PitchBook data found searching the following keywords: “in vitro diagnostics” or “ivd” or “point-of-care testing” or “blood testing device” or “point-of-care diagnostics” or “blood diagnostic” or “point-of-care diagnostic” or “vitro diagnostic” or “point-of-care device” or “diagnostics test” or “cancer diagnostic” or “clinical diagnostic” or “disease detection” or “disease diagnostics” or blood testing system” or “diagnostic reagents” or “research diagnostics” or “clinical diagnostics” or “molecular detection” or “clinical chemistry” or “molecular diagnostics” or immunoassay or flow cytometry or haemostasis or hematology or coagulation or histology or “research reagents” or “reagent systems”

[iii] Zacks Equity Research, Global In Vitro Diagnostic Market Booms: Stocks in Focus Zacks Investment Research (2018), https://www.zacks.com/stock/news/283747/global-in-vitro-diagnostic-market-booms-stocks-in-focus (last visited Jan 8, 2018).

[iv] Evaluate, Top global medical technology segments by market share in 2016 and 2022, Statista, https://www.statista.com/statistics/309273/top-sehments-in-medical-technology-by-market-share/ (last visited Jan. 8, 2018).

[v] Chantal Morel, Overview of the diagnostics market Ensuring innovation in diagnostics for bacterial infection: Implications for policy [Internet]. (2016), https://www.ncbi.nlm.nih.gov/books/NBK447315/ (last visited Dec 18, 2017).

[vi] Chantal Morel, Overview of the diagnostics market Ensuring innovation in diagnostics for bacterial infection: Implications for policy [Internet]. (2016), https://www.ncbi.nlm.nih.gov/books/NBK447315/ (last visited Dec 18, 2017).

[vii] Reportlinker, The global in vitro diagnostics (IVD) market should reach $102.4 billion by 2022 from $74.1 billion in 2017 at a compound annual growth rate (CAGR) of 6.7%, from 2017 to 2022 PR Newswire: news distribution, targeting and monitoring (2017), https://www.prnewswire.com/news-releases/the-global-in-vitro-diagnostics-ivd-market-should-reach-1024-billion-by-2022-from-741-billion-in-2017-at-a-compound-annual-growth-rate-cagr-of-67-from-2017-to-2022-300575320.html (last visited Feb 6, 2018).

[viii] Evaluate, Top global medical technology segments by market share in 2016 and 2022, Statista, https://www.statista.com/statistics/309273/top-sehments-in-medical-technology-by-market-share/ (last visited Jan. 8, 2018).

[ix] The Aging Population: The Increasing Effects on Health Care, Pharmacy Times (2016), http://www.pharmacytimes.com/publications/issue/2016/january2016/the-aging-population-the-increasing-effects-on-health-care (last visited Jan 8, 2018).

[x] The Aging Population: The Increasing Effects on Health Care, Pharmacy Times (2016), http://www.pharmacytimes.com/publications/issue/2016/january2016/the-aging-population-the-increasing-effects-on-health-care (last visited Jan 8, 2018).

[xi] Jack Curran, IBISWorld Industry Report 62151 Diagnostic & Medical Laboratories in the US, IBIS World US 32–38 (2017), http://clients1.ibisworld.com/reports/us/industry/operatingconditions.aspx?entid=1575 (last visited Feb 1, 2018).

[xii] Maria Shepherd, An Update on the In Vitro Diagnostics Sector Your online source for medical device product information – Medical Product Outsourcing (2017), https://www.mpo-mag.com/issues/2017-04-01/view_columns/an-update-on-the-in-vitro-diagnostics-sector (last visited Dec 22, 2017).

[xiii] Jude, Top-5 Diagnostics Trends Identified by Kalorama Will Impact In Vitro Diagnostics Manufacturers, Medical Laboratories in 2017 Dark Daily (2017), https://www.darkdaily.com/top-5-diagnostics-trends-identified-by-kalorama-will-impact-in-vitro-diagnostics-manufacturers-medical-laboratories-in-2017 (last visited Feb 6, 2018).

[xiv] Zacks Equity Research, Global In Vitro Diagnostic Market Booms: Stocks in Focus Zacks Investment Research (2017), https://www.zacks.com/stock/news/283747/global-in-vitro-diagnostic-market-booms-stocks-in-focus (last visited Dec 22, 2017).

William Montgomery contributed to this report.

- Covid-19 Impact on US Private Capital Raising Activity in 2020 - May 27, 2021

- Healthcare 2021: Trends, M&A & Valuations - May 19, 2021

- 2021 Outlook on Media & Telecom M&A Transactions - May 12, 2021