Senior Debt: General Structure and Overview

Senior debt is the most common form of debt lending in the credit market and holds the most significant share of the market. Investors incorporate senior debt financing to raise capital for potential mergers and acquisitions as well as leveraged buyout (LBO) transactions. The article will present an overview of senior debt that includes its key characteristics as well as the benefits and drawbacks. The implications associated with structuring senior debt will also be discussed.

Overview and Characteristics

Senior debt, also known as bank debt financing, is the most senior tranche in a company’s capital structure. Senior bank debt loans are rated as non-investment grade similar to high-yield ratings.[1] As the first layer in the capital structure of a company, senior debt is paid off first during a company’s liquidation since it has a priority claim on the company’s cash flow. Generally, senior debt is amortized over a five to ten-year period and has the lowest rate of return compared to other debt in a capital structure. [2]

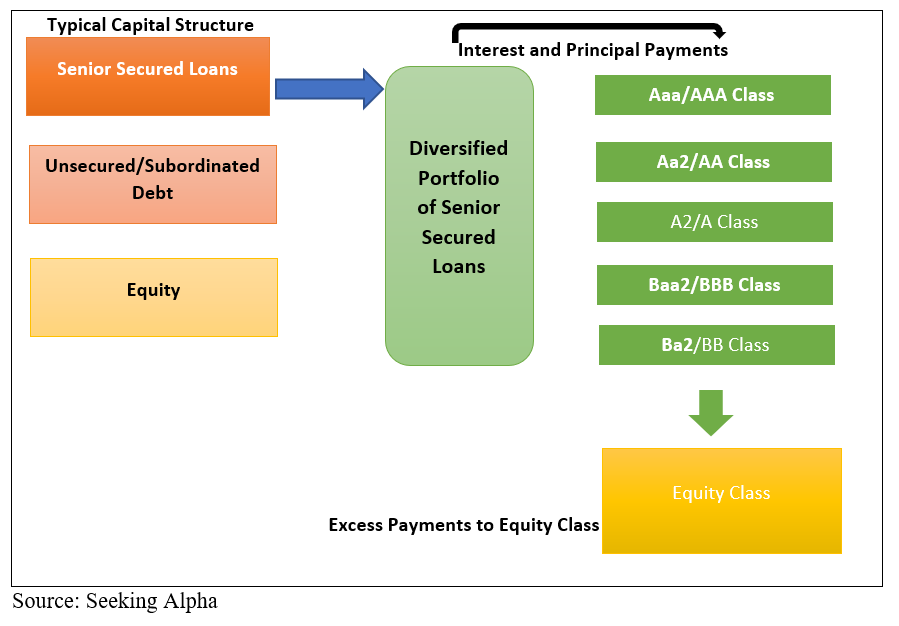

Senior debt loans are granted in tranches such as A, B, C and D tranches. The A tranche is paid off with amortization, while the remaining tranches are paid off with no amortization. A tranches are typically sold to commercial banks, and loans in the B, C and D tranches are usually sold to mutual funds and hedge funds.[3] Senior debt loans have covenant agreements that include a maximum allowable debt/cash flow ratio and minimum coverage of interest priced at LIBOR rate plus 200 to 400 basis points (bps).1 Interest and principal payments are paid by seniority based on the different classes of loans.[4]

General Features:

- Based on collateral and/or company cash flows

- Most loans are fully secured Provided by banks, private placement or debt/unitranche funds

- Senior debt is typically amortized or include options of a bullet repayment[5]

Benefits

Senior debt financing has been beneficial to both investors and senior lenders.

- Senior lenders benefit from the security interest in the company’s collateral. During a liquidation or bankruptcy, senior lenders are paid off prior to paying all other creditors since they have payment seniority over all other debt claims. Assets that are pledged as collateral can be claimed by lenders and can be foreclosed to recover funds. Senior lenders also benefit from senior debt since they can influence negotiations when the senior debt borrower is unable to service its debts.[6]

- The relatively low interest on senior debt instruments makes it attractive to borrowers. Investor borrowers can benefit from the typical floating rate coupons during an interest rate rising environment. The senior loans have the potential to mitigate inflation risk and enhance a portfolio’s risk-adjusted performance.[7] For example, the floating rate coupon can act as a hedge against price sensitivity and income as the coupon is adjusted to the LIBOR and the agreed upon spread.1 Due to the relatively low volatility associated with senior debt financing compared to high yield bonds, investors incorporate senior debt in the company’s capital structure to secure the financial status of the company.

- Senior loans can be used to optimize the capital cost of debt for a company. As companies collateralize their assets against safer assets, they can achieve better interest rates on the debt.

- Senior loans allow companies to reduce credit risk inherent in its seniority of claims.

- Companies that structure more senior loans have the potential to protect shareholder returns.

Disadvantages

- Incorporating senior debt in funding can cause companies that default in payments to lose important corporate assets since company assets are pledged as collateral for the loan.

- Senior debt is a liability on a company’s financial statement position and increases the company’s business expenses and may increase the financial burden on the company.[8]

Risks and Implications

One of the implications of structuring senior debt is that the investors must be willing to forgo further acquisitions for the company. Senior debt loans can be restricted by covenants to prevent further acquisition or additional borrowing.[9] This implies that companies must agree to senior restrictions placed on capital expenditure, dividends and acquisitions. Another implication is that companies that incorporate senior debt in their debt structure must consider the requirement to maintain certain defined financial ratios. Company managers and creditors must monitor the financial ratios of companies to ensure that the company can repay the interest and principal of the senior loan.

Conclusion

Senior debt instruments have been a source of debt financing for many investors. Senior debt loans are characterized by different tranches of loans as well as amortization periods for interest and principal payments. Both senior lenders and investors benefit from senior loans. Senior lenders have access to a company’s assets in the event of a bankruptcy or liquidation, while investors benefit from paying low interest payments to lenders. Senior debt financing can increase the financial burden of a company and place the company under pressure to perform. Investors must consider the restrictive covenant agreements associated with structuring senior debt prior to incorporating this form of debt in the company’s capital structure.

Sources

[1] Ziegler Capital Management, Senior Secured Bank Loans, (2017), http://www.zcmfunds.com/FRF-Documents/Floating_Rate_Fund-Whitepaper.pdf.

[2] http://www.streetofwalls.com/finance-training-courses/investment-banking-technical-training/leveraged-buyout-analysis/

[3] Joseph V. Rizzi, The Capital Structure of PE-Funded Companies (and How New Debt

Instruments and Investors Are Expanding Their Debt Capacity) 28 Journal of Applied Corporate Finance 60-68 (2017).

[4] Seeking Alpha, What Are Collateralized Loan Obligations? (CLO/CLOs)(OXLC/ECC)

(Dec 26, 2017), https://seekingalpha.com/article/4133857-collateralized-loan-obligations-clo-clos-oxlc-ecc

[5] CapitalMind, Financing the Future, (2017).

[6] RAJAY BAGARIA, HIGH YIELD DEBT: AN INSIDER’S GUIDE TO THE MARKETPLACE, (2016).

[7] MARIYA STEFANOVA, PRIVATE EQUITY ACCOUNTING, INVESTOR REPORTING, AND BEYOND: ADVANCED GUIDE FOR PRIVATE EQUITY MANAGERS, INSTITUTIONAL INVESTORS, INVESTMENT PROFESSIONALS, AND STUDENTS, (2015).

[8] Steve Fong Chun Cheong, Equity Financing and Debt Financing, http://www.hkiaat.org/e-newsletter/Apr-15/technical_article/PBEII.pdf.

[9] Joe Begley, Restrictive Covenants Included in Public Debt Agreements: An Empirical Investigation, https://www.researchgate.net/profile/Joy_Begley/publication/247404491_Restrictive_Covenants_Included_in_Public_Debt_Agreements_An_Empirical_Investigation/links/0c9605399edcf96d61000000/Restrictive-Covenants-Included-in-Public-Debt-Agreements-An-Empirical-Investigation.pdf

- Covid-19 Impact on US Private Capital Raising Activity in 2020 - May 27, 2021

- Healthcare 2021: Trends, M&A & Valuations - May 19, 2021

- 2021 Outlook on Media & Telecom M&A Transactions - May 12, 2021