Self-Storage Investing–Industry Operating Conditions

This article is one in a series covering opportunities in real estate investment banking and M&A, specifically targeting the self-storage industry, a sub-sector of the commercial real estate market. The article will present a discussion of the operating condition in the industry, including capital intensity, technology and systems, revenue volatility, regulation and policy and industry assistance.

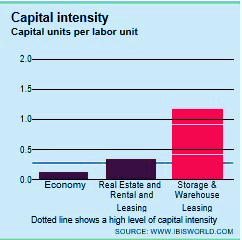

Capital Intensity

According to IBISWorld, the capital intensity level of the self-storage industry is high. Although, wages in the industry are considered high, capital expenditure exceeds the cost of wages. For example, self-storage operators spend $1.18 on capital expenditure for every dollar spent on wages. The purchase of storage unit properties, buildings and equipment increase the cost of capital for self-storage firms. Within the last five years, industry operators have built more storage space due to the increased demand for space and increase in occupancy rates. Consumer demand for monitoring equipment in storage units has also increased capital spending for self-storage operators. [1]

Source: IBISWorld

Technology and Systems

The self-storage industry has a moderate level of technology change. Over the past five years, self-storage operators have experienced major technology changes by installing temperature and moisture control systems as well as security systems and motion-sensor lighting systems. As such systems have become more mainstream and ubiquitous, they have become expected features by many self-storage customers. In addition, apart from some of the aforementioned advances, there has been little growth in technology change within the sector.1 According to InsideSelfStorage, the industry has also had few technology changes due to the limited number of new equipment introduced in the industry. The few technology changes have been incremental and associated with the usefulness and reliability of existing products such as cameras, intercoms and videos.[2] For example, self-storage operators are currently investing in new technology such as surveillance and security systems to add value to their services and to replace older, antiquated solutions. In addition to security systems, self-storage operators are investing in other systems and software to enhance finance and operations, but such changes have been moderate.1

Revenue Volatility

Revenue volatility in the industry is low. The industry revenue remains consistent irrespective of economic conditions.[3] According to IBISWorld, the high demand for storage space has protected the industry from economic cycles. For example, the industry revenue increased to 10.9% in 2015 from 3.5% in 2012 despite economic fluctuations.1 Self-storage operators experience minimal volatility during economic recessions relative to other real estate.[4] During economic downturns, the demand for storage increases as households downsize creating opportunities for industry operators to benefit. Nonetheless, revenue volatility can also be caused by an increase in the size of housing. As individuals purchase larger homes, the demand for storage space decreases creating price competition among self-storage operators. The price competition subsequently results in a demand for space.

Regulation and Policy

The industry is subject to regulations and laws including rulings on taxation, rental contracts, harmful materials, chemical storage and disposal and development. For example, self-storage firms that are REITs are required to distribute a minimum of 90% of taxable income to shareholders. Self-storage firms must also abide to development stipulations including, but not limited to, landscaping conditions, vehicle parking, franchise and rental agreement laws and zoning laws. Under the umbrella of environmental laws, self-storage operators can store contaminants and hazardous materials. However, specific environmental laws forbid the storage of harmful items in small warehouses, and operators are also required to test the land and soil for dangerous material.1 The Self-Storage Association (SSA) expects operators to be subject to lien laws. Operators need to be versed in the laws pursuant to local city and state of jurisdictions governing rental contracts as such can affect default clauses which may trigger the auction of items when customers fail to pay.[5] Understanding the nuanced differences between local laws is important for self storage investors looking to scale operations in many varying jurisdictions.

Industry Assistance

The industry has a low level of industry assistance. According to IBISWorld, the industry does not obtain any form of government assistance, although, many large operators that are REITs offer depreciation and taxation allowances. The industry is supported by various associations including the Self-Storage Association (SSA), a non-profit organization that has over 20,000 members in the U.S. as well as the National Association of Real Estate Investment Trusts.1

Summary

The capital intensity of industry operators is high due to the cost of capital for buildings, properties and equipment. While few major technology changes have occurred in recent years, customers are demanding higher-tech implementations for temperature control, security monitory and online billing. However, it is not expected that major innovations will impact the industry in the near future. Regardless of economic conditions, industry revenue remains stable as demand for storage space maintains its consistency. While regulatory and legal oversight is less-stringent in self-storage than other real estate investment sectors (which explains some of the valuation and M&A trends in the self-storage sector), self-storage operators are still subject to regulatory standards and policies. However, in most cases, local operators are well aware of the law and play within the bounds of such restrictions.

Sources

[1] Marisa Lifschutz, Storing up: Low rental vacancies have paved the way for high demand for storage units, IBISWorld, (Nov 2017).

[2] Chester A. Gilliam, Advancements in Self-Storage Access-Control Technology, (July 17, 2017), http://www.insideselfstorage.com/articles/2017/07/advancements-in-selfstorage-accesscontrol-technology.aspx.

[3] Storage Authority, Industry Facts, (2015), http://www.storageauthorityfranchise.com/storage_facts.php.

[4] The Mele Group of Marcus & Millichap, A Self-Storage Buyer’s Guide to Understanding and Calculating Facility Value, (Dec 29, 2016), http://www.insideselfstorage.com/articles/2016/12/a-selfstorage-buyer-s-guide-to-understanding-and-calculating-facility-value.aspx.

[5] Self-Storage Association, An Introduction to Self-Storage, http://www.selfstorage.org/Portals/0/Public%20Library/Intro_to_SelfStorage.pdf?ver=2010-06-16-000000-000

Jenn Abban contributed to this report.

- Covid-19 Impact on US Private Capital Raising Activity in 2020 - May 27, 2021

- Healthcare 2021: Trends, M&A & Valuations - May 19, 2021

- 2021 Outlook on Media & Telecom M&A Transactions - May 12, 2021