Restaurant & Food Retail — Industry Overview

The Restaurant and Food Retail industry includes chain and franchised restaurants which encompasses all fast food, eateries and full-service locals, in addition to all retail supermarkets and grocery stores. The food retail industry contains any business that sells food to consumers for preparation and consumption. Key drivers for growth and activity in the Restaurant and Food Retail industry include an increase in consumer spending, healthy eating awareness, urban population and the price of agriculture. 1

In the United States, the Food Retail industry over the past five years have benefited from a strengthening domestic economy and rising disposable income level. This has enabled consumers to purchase more premium goods from grocers. Furthermore, a rising demand for all-natural and organic products has aided the industry. Consumers are eating healthier diets each day and are willing and able to pay extra money for high quality, all natural and organic foods.

The Restaurant industry has also benefited greatly from an increase in consumer disposable income. As a result, consumers are more willing to eat out instead of preparing meals at home. in 2017, industry sales are projected to extend to an estimated $799 billion. Full table-service restaurants are to remain the largest revenue driver, but the quick-service segment is projected to have a much larger sales growth rate. Over the past five years, the quick-service restaurants that exclude a sit-down table service but offer high quality food and atmosphere, have experienced particularly strong growth. This has taken market share away from full-service restaurant chains.

Current Trends

Grocery

The most rapid growth in the Food Retail industry has been in the limited assortment/smaller format stores. Consumers want a unique shopping experience where private labels and exclusive brands are found. Over the past five years and especially today, this exists in smaller format stores such as Trader Joes’s, Aldi’s (Midwest), Bfresh (Boston) and Green Zebra Grocery (Portland). Traditional supermarkets are being challenged continually in today’s food retail environment. In these smaller store, shoppers are able to choose between a select number of high quality products rather than shelves filled with different brand names. As market share grows for the limited assortment stores, the stores found with the large, traditional layout will struggle to compete.

The largest food retailers such as Kroger and Walmart are increasing their selections of natural and organic foods. This is an attempt to adapt to changing consumer preferences and take market share from the largest publically traded natural and organic supermarkets such as Whole Foods, Sprouts, and Fresh Market. Consumers now have the option to pay less for similar products that they find at the specialty grocers due to the supply chain capabilities of these mega-supermarkets.

Consumer Behavior

Today, consumers want food that makes their diet’s healthier, a minimal amount of processing, gluten-free, and a decrease in the number of ingredients. Consumers are desiring to live healthier lives through, organic, all-natural and non-genetically modified foods. Food retailers such as grocery stores and wholesalers, are now catering their products to be both health conscious and value driven to fit this need. Millennials (people born within 1980-2000) now take up roughly a quarter of the U.S. population and are believed to be driving the changes of the U.S eating behaviors. Millennials are a part of the age group which is the heaviest user of restaurants. This is due to their substantial growth in disposable income and willingness to spend more money for food.

Restaurant

The restaurant retail industry has experienced similar trends due to an increase in health awareness and per capita disposable income. For many restaurants, both chain and private, the health factor has become the focus of marketing strategies to attract a new niche. This is a result in society’s awareness of the many health risks correlated with diets which are high in fat, salt and sugar. Restaurants who are able to alter their menu to cater to this consumer, is likely succeed in efforts to maintain and increase customer base.

Transactions

Grocery

2017 is an increasing digital environment where consumers are spending more time shopping online versus in brick and mortar stores. The most notable acquisition of 2017 in the food retail industry that illustrates this was Amazon Inc.’s purchase of the Whole Foods grocery store chain for $13.7B. The acquisition price implies a 12-month price to earnings ratio for Whole Foods of 31x, versus a 14.4x average for the S&P 500 Food Retail Index. Whole Foods was also purchased for 10.4x EBITDA, which is a 30% premium to the 8.3x EBITDA multiple it was trading for at the time of the purchase. Amazon plans to provide an enhanced consumer experience to their stores through the introduction of years of technologic experiments. The purchase by Amazon gives Investment Banks a good idea of what market will have in store in terms of other large technology companies integrating with the Foot Retail industry. Looking ahead, the M&A environment looks strong due a continued demand for growth and the movement toward omni-channel retailing through advances in technology. Select transactions include:

Restaurant

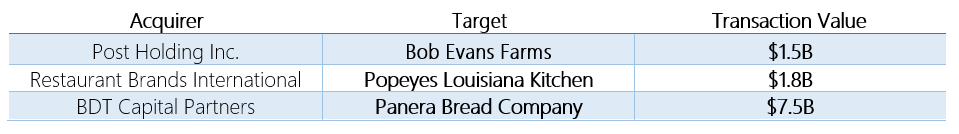

The Restaurant and Food Retail industries continue to change and businesses continue to grow and be introduced. The number of M&A deals in the Restaurant Retail industry in the U.S. has grown over 86% between the years of 2004-2016.2 The number of deals rose 17% from 2015 to 2016 with a total of 145. Some of the largest deals of 2017 include:

Restaurant Brand International’s acquisition of the restaurant chain of Popeye’s Chicken, was recorded of being the highest transaction multiple ever paid for a U.S. restaurant company at 21x EBITDA. Although the Restaurant Retail industry has a history of being unpredictable, current transaction multiples have been stable over the recent years. That stability was recorded in 2016 as restaurants involved in M&A transactions were purchased at an average of 9.6x EBITDA. As industry stability continues, a healthy M&A environment will prosper.

Opportunities

Grocery

In attempt to compete with these smaller stores, some national-level supermarket conglomerates, such as Whole Foods, have announced to be able to cater to the millennial trend, the construction of smaller, private labeled stores. Over the next five years, more supermarkets are expected to follow suit. In addition to the smaller stores, larger supermarkets have introduced and with implement new amenities involved with technology to costumers in current brink and mortar stores. These new amenities will include home grocery delivery services, movie rentals, in-store restaurants, beer and wine bars and ATMs.

Restaurant

Technology is changing the way restaurant owners run their businesses. Four out of five restaurant operators agree that technology helps increase sales, improves productivity and gives them a competitive edge above competitors. 3 Restaurants that have experienced significant growth can tie that to technological advancements in marketing and also the way they transact with customers. Some of these advancements come through mobile platforms such as applications that boast the restaurant’s menu, a takeout or on demand delivery service, incorporation of loyalty and rewards programs, meal nutrition breakdowns and reservation booking.

Risks

Grocery

A risk for both the restaurant and food retail industries is the rising growth of online competitors. E-commerce sales are expected to grow at a CAGR of 7.8% in the upcoming year. With corporations like Amazon and Walmart, that offer or will offer services such as automatic billing checkout in addition to same day grocery home delivery or pick up, traditional supermarket operators are having to continually adapt and innovate to stay competitive. Amazon recently announced the planned opening of 2,000 Amazon Fresh stores over the next decade that will operate without the need of checkout stands. Virtual shopping with its competitive pricing, is a major threat to standard grocery stores chains and also limited assortment/private chains if they don’t incorporate similar convenience services to customers.

Restaurant

It is projected that in 2017, Restaurants in the U.S. will employ about 1 in 10 working citizens.4 Rising labor costs and a complex regulatory landscape pressure the restaurant industry significantly to perform and increase the bottom line to be able to continue industry growth. Furthermore, as technologic advancements are being more frequently incorporated into full-service and fast food chains, there is an increased difficulty to recruit and retain top level weight staff. With a decrease of U.S. unemployment, competition for qualified employees rises to fill vacant restaurant positions. Largely, the restaurants that have difficulty recruiting a multi-skilled and flexible workforce, cannot adapt to new technology, and who cannot quickly and effectively adapt to regulatory changes will struggle to compete with those who can.

Sources

1. The Chain Restaurant Industry; Industry Performance; Key External Drivers, available at http://clients1.ibisworld.com.ezproxy.lib.utah.edu/reports/us/industry/currentperformance.aspx?entid=1677#KED

2. 2017 Restaurant Mergers and Acquisitions: An Update; found at http://aaronallen.com/blog/2017-restaurant-mergers-acquisitions

3. Restaurant Industry 2017 and Beyond; found at https://www.restaurant.org/Downloads/PDFs/Events-Groups/Fast-Casual-Show-State-of-Industry-Presentation-Ma.pdf

4. 2017 Restaurant Industry Outlook; found at https://www.restaurant.org/Downloads/PDFs/News-Research/2017_Restaurant_outlook_summary-FINAL.pdf

Matthew Winterholler contributed to this report.

- Covid-19 Impact on US Private Capital Raising Activity in 2020 - May 27, 2021

- Healthcare 2021: Trends, M&A & Valuations - May 19, 2021

- 2021 Outlook on Media & Telecom M&A Transactions - May 12, 2021