Medical Device Manufacturing: Capital Intensity

This is the seventh in a multi-part series that will focus on the capital intensity in the medical device manufacturing industry, a member of the manufacturing sector.

Capital Intensity

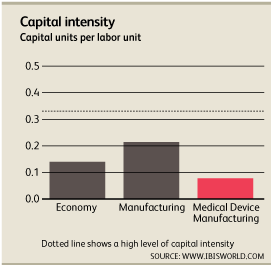

Roughly $0.08 is invested in capital improvements for every $1.00 the average medical device manufacturing company spends on labor[1]. Many specialized products require hands-on work and cannot be furnished through an automated assembly line. Highly paid skilled specialists research, assemble and create medical devices. Wages account for roughly 20.6% of revenue while depreciation accounts for 1.6%.

The level of technology change is high as companies seek to rapidly develop new products and adapt to technological changes. This can be attributed to the fact that 12% of market revenue is directed towards research and development. Industry players seek to incorporate non-industry technological advances into production processes. Technological advantages are protected fiercely by patents and can be acquired through mergers & acquisitions; especially by larger industry players.

Changes in technology outside of the medical device manufacturing industry can also be useful. Advances in technologies not directly linked to the industry, such as 3D printing, may someday provide a competitive advantage to industry players. However, as we discuss later, heavy regulation will require extensive testing before new technologies can be used on products used by humans.

The level of volatility is medium. The industry is not directly affected by the economic environment as doctors are unlikely to stop purchasing medical equipment necessary to improve patient health during an economic downturn. Exports count for roughly 30.1% of industry revenue making global economic conditions and trade barriers important factors.

Regulations

The already heavy regulation is increasing. The major regulatory bodies are:

- The Food and Drug Administration (FDA) is responsible for protecting the public health and for helping speed the innovation that make new medical devices safer.[2]

- The International Medical Device Regulators Forum (IMDRF) is the successor organization to the Global Harmonization Task Force (GHTF) and is composed of officials from regulatory organizations around the world. The IMDRF’s mission is to converge regulatory practices to ensure safety and quality of medical devices.[3]

Manufacturers are required to prove a quality system is in place through manufacturing process and must track devices during the distribution chain. Devices unapproved by the FDA may be exported outside the United States.

The 2.3% sales tax on medical device supplies imposed by the Patient Protection and Affordable Care Act could strain innovation in the US. Under the Act, goods produced domestically and imported are taxed equally. Devices that are produced in the US for export are exempt from the tax[4]. Opponents of the Act believe that it could motive some manufacturers of medical devices to take production offshore. Comparative Effectiveness Research (CER) is another provision that affects medical device manufacturers and creates uncertainty about the future of many products, stifling innovation.

There is a medium level of assistance in the industry which is expected to remain steady. Tariffs include a 0.4% tariff on computing tomography apparatus, a 0.8% tariff on electrocardiographs and 1.6% tariff on electro-surgical instruments.

Industry associations include the Association of Medical Diagnostics Manufacturers (AMDM), the Medical Device Manufacturers Association (MDMA), and the Advanced Medical Technology Association (AdvaMed). The AMDM links industry members with Regulatory Agencies. The MDMA acts as a watchdog against unreasonable regulation. AdvaMed is the largest medical technology association in the world and promotes fast product approvals by industry regulators worldwide, timely coverage and fair access to international markets.

Mohammed Siddiqui contributed to this report.

Sources

[1] Curran, J. (2018). Medical Device Manufacturing in the US (Industry Report 33451b). Retrieved August 20, 2018, from IBISWorld database

[2] U.S. Food & Drug Administration. (2018, March 28). What We Do. Retrieved August 20, 2018, from https://www.fda.gov/aboutfda/whatwedo/default.htm

[3] International Medial Device Regulators Forum. (n.d.). About IMDRF. Retrieved August 20, 2018, from http://imdrf.org/about/about.asp

[4] Daniel, G. W. (2016, July 28). 5 Questions About the Medical Device Tax, and Its Potential for Repeal. Retrieved August 20, 2018, from https://www.brookings.edu/opinions/5-questions-about-the-medical-device-tax-and-its-potential-for-repeal/

- Covid-19 Impact on US Private Capital Raising Activity in 2020 - May 27, 2021

- Healthcare 2021: Trends, M&A & Valuations - May 19, 2021

- 2021 Outlook on Media & Telecom M&A Transactions - May 12, 2021