How Much Is My Business Worth?

One of the most common questions asked by private business owners is “What is the value of my business?” It is human nature to wonder the cost of things, from your car to your house. Businesses are not exempt, but valuation is very complicated. You will see a common theme in my posts about seeking out an expert when you are going down this path. This is not because I am an ex-banker, more because I see deals go wrong constantly. Below I cover off a very quick and common way to value a business. We cover off some key terminology and a technique you will need to give you a rough guide.

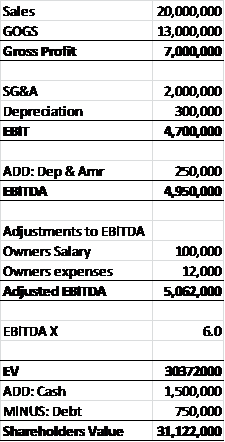

Enterprise Value

In short, Enterprise Value (EV) is a measure of a company’s total value. This differs slightly from Shareholder Value which is the sum of a company’s market value, including its debts but minus its cash and cash equivalents. Cash equivalents are items that are highly liquid and generally have a maturity of three months less. Common examples are; commercial paper, marketable securities, short-term government bonds, and treasury bills.

The methods for calculating EV varies but the most common include; DCF analysis, public company comparable or applying recent industry transactions. This blog will focus on the valuation approach commonly used by private equity and investment banking professionals as a sense check, and therefore easily applied before you seek out a professional, the EBITDA (Earnings before interest, taxes, depreciation, and amortization) multiple valuation methods. One of the benefits of this ratio is that you can make adjustments to allow investors to identify a comparable value.

What EBITDA Should I Use?

If you are in a rush, using financial year end EBITDA data values is acceptable but remember, no business sits still. A more common practice is to look at the trailing 12 months EBITDA. Another equally common approach is to use an average EBITDA of the last 2 or 3 years. This helps adjust for ‘pre-sale bloating’ if you are looking for companies that have sold or a way of adjusting for seasonality.

Yearly accounting impacts can also have an influence, so it is also common practice to normalize EBITDA. You would have seen this term as “Adjusted EBITDA.” These can be positive or negative adjustments, and the reasons include, but are not limited to, non-recurring revenues and expenses, non-business/personal-related expenses, facility rent and/or owner compensation above or below fair market value.

What EBITDA Multiple Should I use?

Calculating an EBITDA multiple means nothing without something to compare it too. This is where things get tricky, and where numbers like 5 and 10 are thrown around with little research. If you strip out everything you need to consider, most companies sell in the range of 5.0x and 8.0x EBITDA. But like any average, this is very misleading. The multiple you use is dependent on numerous critical factors affecting a buyer’s assessment of the risk-return profile.

The suitable EBITDA multiple for calculating a credible Enterprise Value is influenced by numerous factors. This includes, but is not limited to; company and industry growth rates, customer concentration levels, supplier concentration, competitive landscapes, profit margins, the size of the company and the depth of its management team. Such factors need to be assessed, measured and considered in entirety when determining the appropriate EBITDA multiple. The adjustments can be negative, for example, if there is a high level of customer concentration (e.g., single customer > 20%), or adjusted higher in markets where growth in both the company and industry is higher than comparable sales.

Enterprise Value vs. Shareholders Value

When you calculate your company’s value using an EBITDA multiple, this results in an estimate of Enterprise Value. This should not be confused with Shareholders Value. A company’s Shareholders Value depends on strategic decisions made by senior management, including the ability to make wise investments and generate a healthy return on invested capital. Since businesses generally transact on a cash-free, debt-free basis, Shareholders Value is calculated as the Enterprise Value (i.e., Multiple x Adjusted EBITDA) plus cash and cash equivalents minus third party debt. Below we show a worked example of this:

Downsides

The EBITDA multiple approach has certain disadvantages. The multiple eliminates some important variables such as taxes and depreciation and therefore fails to take account of the working capital. One of the biggest downsides is that EBITDA is eliminating taxes. The logic behind tax elimination, which is fairly sound, is that tax is out of the control of a business and it can change in any given year. As a theory this makes sense, however, most businesses have stable tax rates. Including taxes on the valuation of the company is important because it will show investors the cash flows that are available to investors. It allows investors to have a clear picture of the real cash flows of the business. The second elimination that EBITDA makes is the depreciation and amortization. Removing these two variables means we are not properly accounting for the cost of capital. In other words, the growth of the company is not considered.

EBITDA multiple – Final thoughts

The EBITDA multiple is a quick(ish), robust and commonly used method. However, like any other metric valuation, EBITDA has advantages and disadvantages. Most of the investment community uses several metrics when determining a valuation. The reason behind this is that using several metrics ensures that an investor deals with the weakness of other metric valuation. EBITDA multiple methods is a good measure when comparing different companies which are subjected to different accounting standards. Its main disadvantages are that it gets rid of important factors in a business such as taxes and depreciation. With that said, if you want to work out what your company is worth and attempt to increase the value of the company before M&A, it is a great starting point. It could result in a nice surprise, and result in you contacting an expert to get the exit-ball rolling.

- Covid-19 Impact on US Private Capital Raising Activity in 2020 - May 27, 2021

- Healthcare 2021: Trends, M&A & Valuations - May 19, 2021

- 2021 Outlook on Media & Telecom M&A Transactions - May 12, 2021