Hospitality and Entertainment: Industry Performance

This is the third in a multi-part series that will focus on the recent performance of the hospitality and entertainment industry.

Industry Performance

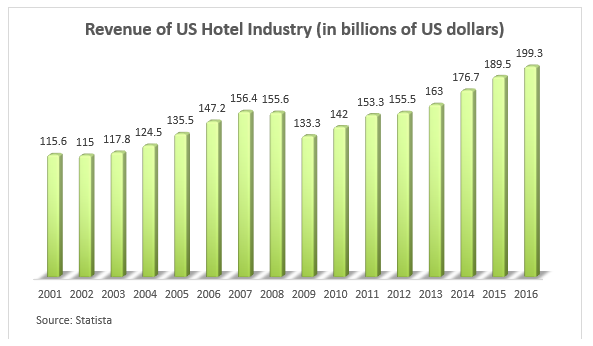

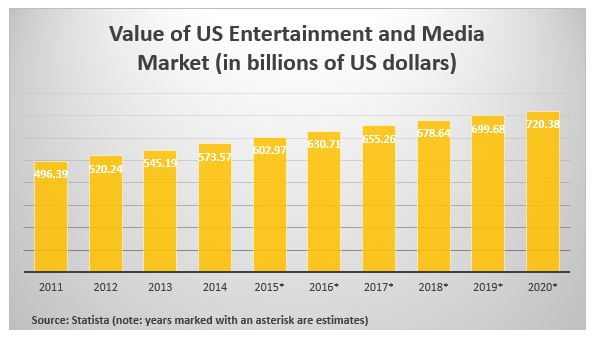

The value of the hospitality and entertainment industry has steadily increased throughout the past five years. In 2016, hotels generated $199.3 billion in revenue[1]. The value of the US entertainment industry in the same year is estimated to be $630.71 billion[2].

Key External Drivers

Economic Downturns

In the hospitality segment, consumer spending and tourism may drop because of adverse economic conditions[3]. At the moment in the United States, the real disposable income has been steadily rising[4]. However, domestic trips in the United States, a major indicator of the spending on hospitality, has been experiencing moderate increases in spending and is projected to have modest gains[5]. In recent years, the data appears to show that there have not been major economic downturns.

Legal Factors

Changes in the law can include regulations and tax laws. These may affect the profit that this industry is able to take in[6]. For instance, in recent tax law changes, the limitation of net operating losses claimed has been limited to 80 percent since after December 31, 2017 from 90 percent of taxable income previously. This may limit the risks that some investors or companies are willing to take[7]. The impact from the 2017 Tax Cuts and Jobs Act, which lowered the corporate tax rate from 35% to 21% and provides for a one-time 8% repatriation tax on overseas profits, will also impact the bottom line of the businesses in the industry.

Changes in Technology

The industry is often vulnerable to major changes in technology and will need to update their current infrastructure often to adapt to shifts[8]. The hospitality segment also faces disruption through services such as Airbnb, which enables a significant number of suppliers of lodging to undercut hotels[9]. Providers of entertainment must also contend with new technological changes. Advancements in augmented reality and virtual reality, for example, will provide a new means of entertainment. Businesses that fail to keep up with these new shifts may find themselves at a disadvantage to competitors who are open to adopting new technologies.

Political Conflict and Safety

Conflict between governments often restricts the ability for consumers to travel freely about the world. Beyond political issues, travelers may also fear disease or severe physical threats that may loom in a foreign country[9].

Hacking

The hospitality and entertainment industry is a very competitive landscape, so any company that faces cyberattacks on its digital assets such as an unauthorized takeover on social media networks can destroy millions of dollars of investment and trust[10].

Current Performance

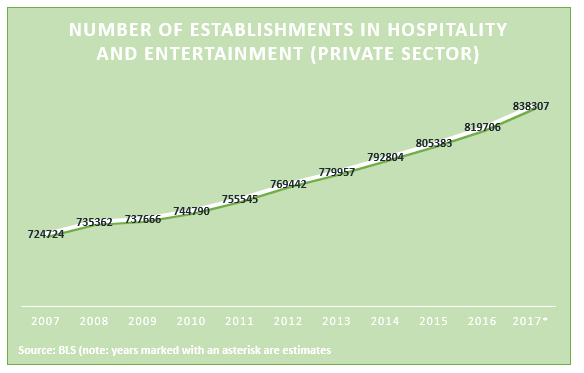

According to the Bureau of Labor Statistics, the number of establishments related to hospitality and entertainment have been steadily rising throughout the past decade. The most recent preliminary statistic is from the 4th quarter of 2017, which estimates 845,762 establishments in the private industry at the end of the year. This presentation of steady growth provides stable signs of economic advancement in this industry[11].

Industry Life Cycle

The hospitality and entertainment industry serves as an umbrella for diverse companies, and they individually fit on different of their respective life cycles. However, in aggregate, companies within this industry should expect annual growth that reflects maturity.

US hotels are expected to see modest growth as consumer spending grew by 3.8% in the fourth quarter of 2017. Additionally, large companies such as the Hyatt Hotels Corporation are positioning themselves to better serve millennials, focusing on concerns within this demographic. These include health and convenience[12].

The entertainment segment of the industry saw a CAGR of 3.6 percent from 2016 to 2017. The sector sees significant growth from video gaming and consuming data[13].

The hospitality and entertainment industry should expect to see modest growth in the future. Both segments are looking to position themselves to the evolving tastes of their consumers. From 2016-2021, PwC expects to see a CAGR of 4.2 percent in the entertainment segment[13]. The hospitality industry also expects significant growth in the number of hotels within the next year[14]. This exceeds the current growth rate of the GDP, which indicates significant growth for the next few years[15].

Adrian Lee contributed to this report.

Sources

[1] Revenue of the U.S. hotel industry 2016 | Statistic, Statista, https://www.statista.com/statistics/245841/total-revenue-of-the-us-hotel-industry/ (last visited Aug 20, 2018).

[2] U.S. entertainment and media industry 2011-2020 | Statistic, Statista, https://www.statista.com/statistics/237769/value-of-the-us-entertainment-and-media-market/ (last visited Aug 20, 2018).

[3] Jared Lewis, Uncontrollable Variables That Affect the Hospitality Industry Small Business – Chron.com (2016), https://smallbusiness.chron.com/uncontrollable-variables-affect-hospitality-industry-38795.html (last visited Aug 19, 2018).

[4] Real Disposable Personal Income, FRED(2018), https://fred.stlouisfed.org/series/DSPIC96#0 (last visited Sep 4, 2018).

[5] Number of business and leisure travelers U.S. 2008-2022 | Statistic, Statista, https://www.statista.com/statistics/207103/forecasted-number-of-domestic-trips-in-the-us/ (last visited Sep 4, 2018).

[6] Jared Lewis, Uncontrollable Variables That Affect the Hospitality Industry Small Business – Chron.com (2016), https://smallbusiness.chron.com/uncontrollable-variables-affect-hospitality-industry-38795.html (last visited Aug 19, 2018).

[7] Corporate Tax Reform – Summary of New Laws Taking Effect, BDO USA, https://www.bdo.com/insights/tax/federal-tax/corporate-tax-reform-summary-of-new-laws (last visited Sep 4, 2018).

[8] Jared Lewis, Uncontrollable Variables That Affect the Hospitality Industry Small Business – Chron.com (2016), https://smallbusiness.chron.com/uncontrollable-variables-affect-hospitality-industry-38795.html (last visited Aug 19, 2018).

[9] Mark Brandau, 4 Threats to Hotel Industry Growth Duetto Revenue Strategy Platform, https://www.duettocloud.com/library/4-threats-hotel-industry-growth (last visited Aug 19, 2018).

[10] ZeroFOX Team, Top 6 Threats to the Media & Entertainment Industry on Social Media ZeroFOX(2018), https://www.zerofox.com/blog/top-threats-media-entertainment/ (last visited Aug 19, 2018).

[11] Bureau of Labor Statistics Data, U.S. Bureau of Labor Statistics, https://data.bls.gov/timeseries/ENUUS0002051026?amp;data_tool=XGtable&output_view=data&include_graphs=true (last visited Aug 19, 2018).

[12] Zacks Equity Research, U.S. Hotel Industry to Sustain Modest Growth in 2018Zacks Investment Research(2018), https://www.zacks.com/commentary/150145/us-hotel-industry-to-sustain-modest-growth-in-2018 (last visited Aug 20, 2018).

[13] PwC’s Entertainment & Media Outlook Forecasts U.S. Industry Spending to Reach $759 Billion by 2021, PR Newswire: news distribution, targeting and monitoring, https://www.prnewswire.com/news-releases/pwcs-entertainment–media-outlook-forecasts-us-industry-spending-to-reach-759-billion-by-2021-300469724.html (last visited Aug 20, 2018).

[14] Lodging Econometrics, 2.5% Growth Rate Of New Hotel Openings Expected In 2018 & 2019Hospitality Net(2018), https://www.hospitalitynet.org/news/4086740.html (last visited Aug 20, 2018).

[15] Real Disposable Personal Income, FRED(2018), https://fred.stlouisfed.org/series/DSPIC96#0 (last visited Sep 4, 2018).

- Covid-19 Impact on US Private Capital Raising Activity in 2020 - May 27, 2021

- Healthcare 2021: Trends, M&A & Valuations - May 19, 2021

- 2021 Outlook on Media & Telecom M&A Transactions - May 12, 2021