eSports — VC & M&A Trends, Valuations and Investments

This is the second piece of a multi-part series covering the eSports and Gaming Video Content (GVC) industries.

As the eSports industry continues to grow to a market size of close to $1.5B by 2020, growing at a YoY rate of 41%, both deal flow and deal size are expected to grow with it.[1] This article will discuss the buyer profile, notable transactions, and valuation methodologies in the eSports and gaming industry.

Overview

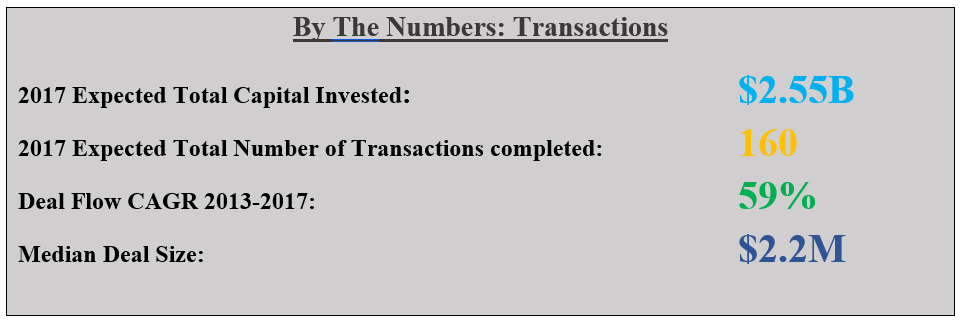

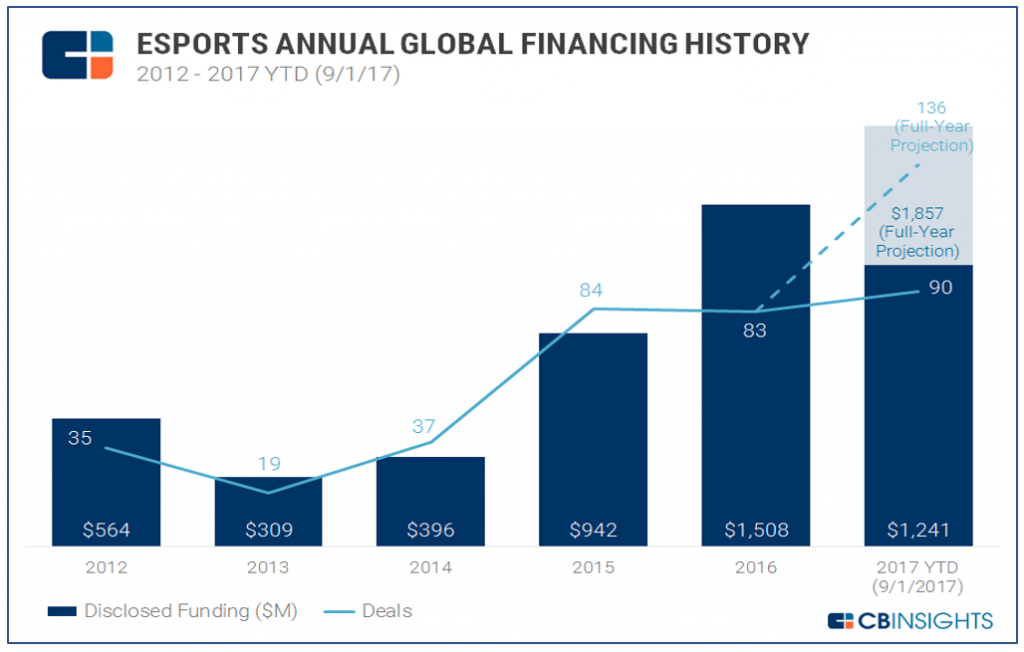

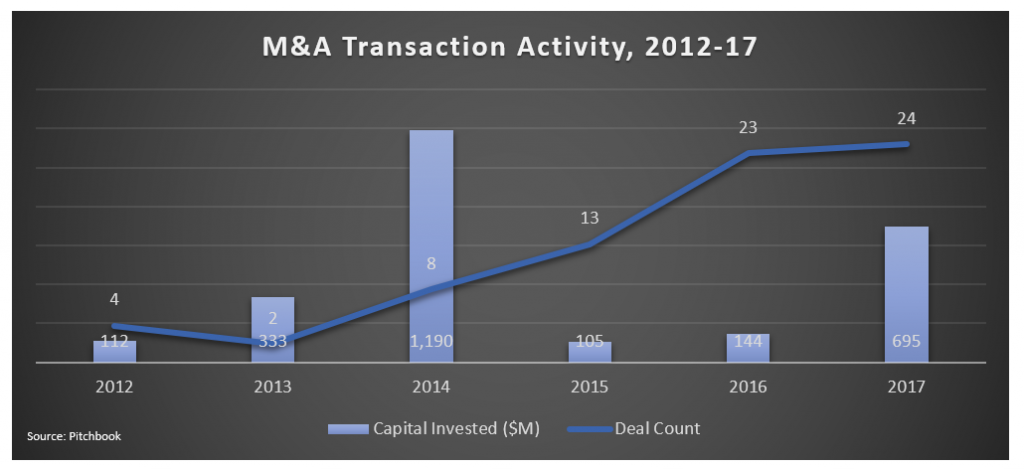

According to CrunchBase, total non-controlling equity investments in the eSports industry has already passed $1.2B YTD 2017, and is expected to top $1.8B from 136 deals by year end.[2] That would represent a YoY growth in capital raised of 23.3% over the $1.5B raised in 2016. eSports M&A activity is following a similar trend growing deal flow and capital invested. The large exception to the trend is the surge in capital invested in 2014 which was a result of Amazon’s $1.1B acquisition of Twitch – the leading live stream platform for eSports. Total deals completed in the space have grown at a 5yr CAGR of 59%, and that growth is expected to continue in the next five years.

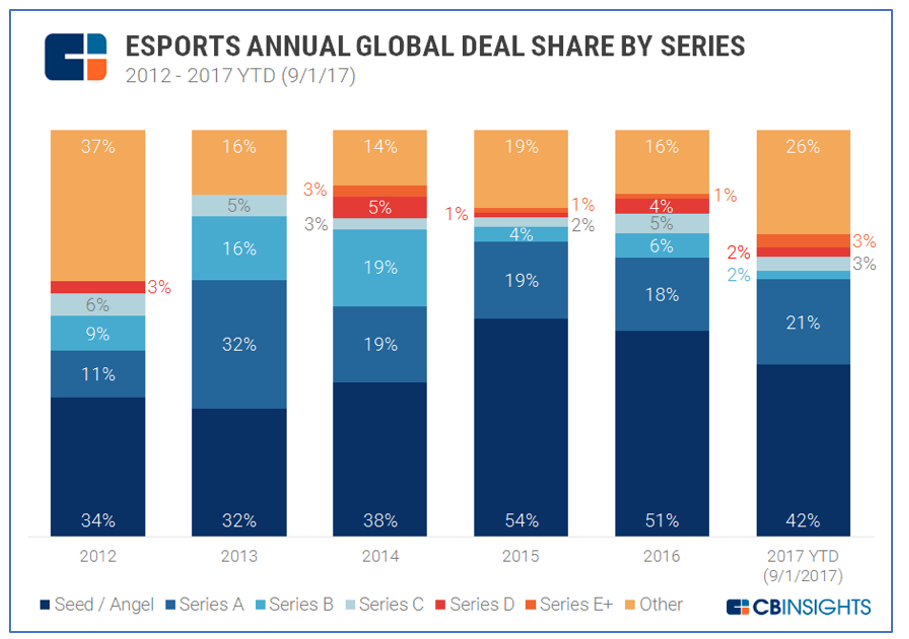

The division of equity financing based on timing illustrates the stage of the industry. The industry is young, but growing as invested capital continues to shift from early to later stage (late stage VC and PE). Early stage financing (Seed/Angel and Series A) has represented over 50% of total deal share since 2013, but has declined from 73% in 2015 to 63% in 2017 YTD.[3] Late stage financing (corporate minority, convertible notes, private equity, and growth equity rounds) has consistently been over 10% of all deals, increasing from 14% to 26% from 2014 to 2017 YTD.[4]

M&A activity has represented 15-20% of transactions by deal count over the past 3 years, and 8-27% of transactions by deal size. The key insight from M&A activity is that it has consistently tracked with overall financing, including its upward growth in deal count annually over the past 5 years. As overall financing flows into the eSports and gaming industry in the next five years, expect to see a continued shift from early stage to late stage investment and greater M&A activity.

Major Investors

- Traditional sports teams/figures

Professional sports clubs view eSports as an opportunity to diversify their revenue streams and capture those not previously interested in traditional sports. Many NBA and professional soccer clubs in Europe and South America have signed professional gamers to represent their respective club in eSports competitions of every kind. The race to sign competitive gamers is expected to intensify as corporate brands hope to tap into a new revenue stream.[5]

- PE/VC firms

Investment firms see the gaming industry as one of the fastest growing tech industries. With ever increasing amounts of sponsorship and advertising dollars and a global fan base that is becoming more engaged than traditional sports fans, eSports represents a young industry exploding with high growth. This is the ideal dynamic for most tech investors.

- Media groups

Another group that finds relevant synergies with eSports and gaming organizations are media groups that are looking to diversify their revenue streams. These groups, such as Modern Times Group, operate other digital entertainment mediums via the internet and recognize the trend of consumer entertainment shifting towards gaming video content and eSports. In an effort to gain market share in a nascent industry, these media groups are acquiring eSports teams, talent agencies, and related technology companies.

Notable Deals

eSports and gaming have seen several notable transactions take place in the past five years as mainstream power players have begun jockeying for positions of long term profitability. The largest deal by deal size and perhaps market dynamic is Amazon’s $1.1B acquisition of Twitch in 2014. This investment signaled to the world that eSports and gaming were becoming a long-term, profitable industry worth investing in. Since then, DouyuTV and Huya, Chinese equivalents of Twitch, have received minority investments of $226M and $75M, respectively. In 2015, Modern Times Group, the digital media conglomerate, bought a controlling interest in Turtle Entertainment for $87M. Turtle is the holding company for ESL, the world’s largest eSports company. Alibaba recently invested $150M in International eSports Federation – the global organization charged with promoting eSports as an official sport at competitions such as the Olympics. Additionally, many NBA and professional soccer clubs in Europe and South America have signed professional gamers to represent their respective club in eSports competitions of every kind.

Valuations and Multiples

As the growth in the eSports and gaming industry accelerates, the influx of capital and new investors accelerates as well. This growth is outpacing the development of valuation techniques for this relatively young industry. This makes it difficult for all investors to make investment decisions, but this is especially true for non-endemic brands trying to make sponsorship investment decisions. The usefulness of traditional financial performance-based valuation methods are limited by two market conditions: 1. The majority of eSports clubs are not yet generating profit or even revenue 2. The lack of accounting standards in the industry and the major absence of accessibility and organization of financial or other performance metrics.[6] As a result, eSports clubs are observing a large variation in investment for similar performance and are unable to demand a deserved high valuation. Likewise, non-endemic brands seeking to invest sponsorship money are unsure as to the ROI on their sponsorship and are thus hesitant to infuse large amounts of money. The ability of industry players to accurately approximate the worth of an eSports investment with more reliable metrics will lead to greater investment and growth in the industry and reduce the chances of an overvalued industry bubble popping in the next ten years.

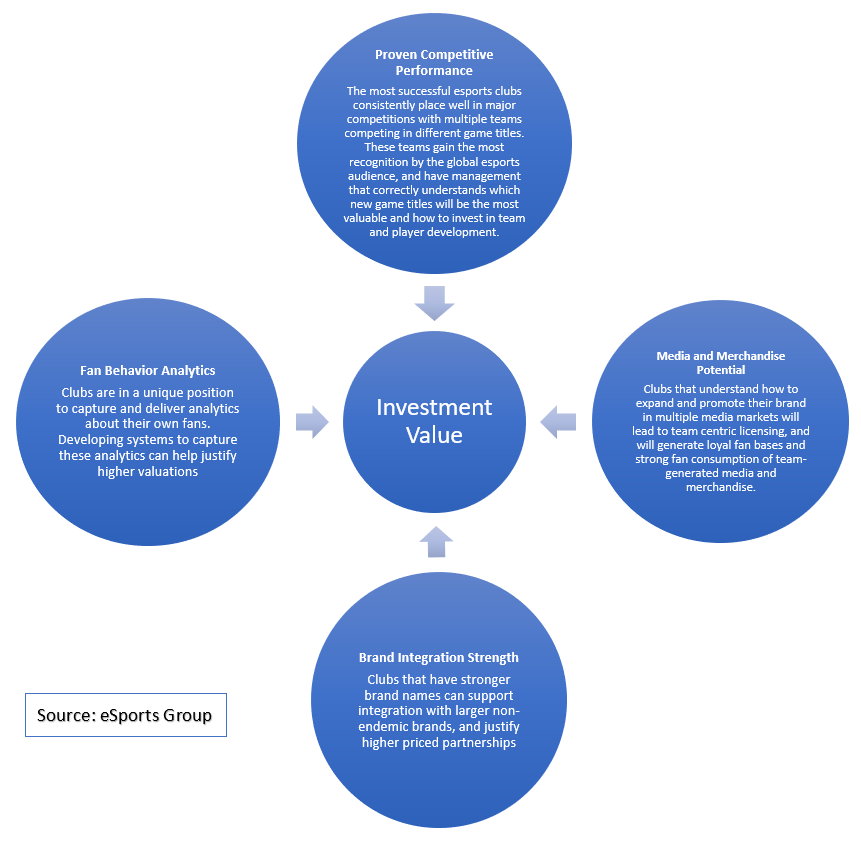

- Valuation Drivers

eSports teams represent a hybrid of media and sport. Financial success depends not only on winning, but on leveraging text, gaming content, video, and community into engaging experiences. Consequently, metrics defining successful performance and from which effective multiples may be created are varied.

Outlook

The eSports industry will continue to see large variation in the multiples of valuations due to the young age of the industry. As the industry develops, more transactions are completed, accounting standards are formalized, and revenue models are solidified, that variation will shrink. Team collectives like the WESA and PEA will promote standard report and metrics which will lead to more consistent valuations and smarter investments. Deal flow, median deal size, and total invested capital are all expected to continue to increase moving forward. As the industry matures, late stage financing is expected to grow in volume and deal share as a portion of overall equity investing signaling investors growing interest and trust in eSports’ viability.

Sources

[1] Carl Christensen, 13 Nov eSports & Gaming Video Content (GVC) — Industry Overview InvestmentBank.com (1970), https://investmentbank.com/esports-gaming-video-content/ (last visited Dec 13, 2017).

[2] Leveling Up: Deals To eSports Startups On Track For 4th Annual High, CB Insights Research (2017), https://www.cbinsights.com/research/esports-funding-trends/ (last visited Dec 13, 2017).

[3] Leveling Up: Deals To eSports Startups On Track For 4th Annual High, CB Insights Research (2017), https://www.cbinsights.com/research/esports-funding-trends/ (last visited Dec 13, 2017).

4Leveling Up: Deals To eSports Startups On Track For 4th Annual High, CB Insights Research (2017), https://www.cbinsights.com/research/esports-funding-trends/ (last visited Dec 13, 2017).

[5] Carl Christensen, 13 Nov eSports & Gaming Video Content (GVC) — Industry OverviewInvestmentBank.com (1970), https://investmentbank.com/esports-gaming-video-content/ (last visited Dec 13, 2017).

[6] Understanding Esports Team Valuations, eSports Group (2016), http://www.esportsgroup.net/2016/10/understanding-esports-team-valuations/ (last visited Dec 13, 2017).

William Montgomery contributed to this report.

- Covid-19 Impact on US Private Capital Raising Activity in 2020 - May 27, 2021

- Healthcare 2021: Trends, M&A & Valuations - May 19, 2021

- 2021 Outlook on Media & Telecom M&A Transactions - May 12, 2021