eCommerce Industry: Overview of Mergers, Acquisitions and Venture Capital Trends & Investments

The internet has changed how the world operates in every aspect of our lives. Just as the Railroad revolutionized travel, and how the telephone revolutionized communication, the internet has revolutionized many things, one of them being the way people shop. eCommerce provides a way for online retailers to compete directly with Brick-and-mortar stores for customers, and in the recent years eCommerce has seen substantial growth. Experts at InvestmentBank.com explain: “In 2015 eCommerce sales increased nearly 15% to over $340B in 2015 according to the U.S. Census Bureau reports. While eCommerce still only accounts for less than 10% of overall commerce, it continues to massively outpace the growth of traditional brick-and-mortar sales.” [1].

There are a couple different trends worth noting in eCommerce that are contributing to the recent growth in the industry.

- Increased Mobile Connectivity

The use of Mobile devices like cell phones, tablets, iPads, etc. has made the ability to shop online increasingly easier and more accessible for a wide range of customers. While older generations may find using mobile electronic devices difficult, the younger generations are quite competent in completing any task on a mobile device. Big eCommerce companies, like Amazon, are catering more and more to the use of mobile applications and mobile-friendly websites in order to make online shopping easier for the younger generations. With mobile devices, customers can shop wile on-the-go. Instead of being constrained to shopping from a desktop computer, customers can shop while on the train, subway, in a taxi, or while out to eat. Lisa Tolliver at Capstone says, “During the five-year period to 2017, the number of mobile internet connections grew at an annualized rate of 14.0%, and growth is expected to remain high in the near future.” [2]

- Increased Market Entry

Before the internet, if you wanted to open a store, you would have to buy land, and build the actual store, or rent a property already constructed. The capital needed for these assets alone was a barrier to entry, especially for smaller mom-and-pop type stores. However, with Online Retail, it is a lot easier to set up a store, and the assets needed to run the online store are much easier to acquire. This ease of entering the eCommerce market has cause large market entry of new companies into the eCommerce sector, especially among smaller companies. These new entrants are direct competition for large Online Retailers like Amazon and Walmart. They also provide lots of opportunities for inorganic (acquisition) growth to larger Online Retailers. Another factor contributing to increased entry is the fact that eCommerce is the perfect platform to sell Niche products, because of the ability to reach worldwide customers. According to an eCommerce Industry Spotlight report done by Brigham Young University, “In 2016, eCommerce sales in the U.S. were at $322.17 billion. According to Statista, sales are projected to continue to increase by 50 percent over the next five years.” [3]

- New Technology

Large advancements in technology have given Online Retailers abilities to decrease costs and improve efficiency. The fact that the entire purchasing transaction is automated online eliminates the need for a human being to work the register, and even eliminates the need for the register itself. This is only one example of the cost reductions new technology provides. Providing links to customers during checkout like “Other Customers Also Bought.” or “Other Products You May Like” have increased sales. Other technologies like AI (Artificial Intelligence) and automated WMS (Warehouse Management Systems) increase efficiency and lower wages costs. “Warehouse Management Systems (WMS), for example, improve efficiency by determining the best routes for workers to take in picking products for warehouse operations.” [4]

Recent Transactions

Some of the biggest and most relevant transactions recently have been the Acquisitions Walmart has done in order to compete with eCommerce giant Amazon. Walmart has made 4 large acquisitions in 2017 worth noting.

- Bonobos, Inc. June 2017, for $310 Million.

Bonobos Inc. is a luxury men’s clothing company. The biggest competitor in Online Retailing in the apparel division is Amazon, so Walmart acquired Bonobos to compete directly for customers in the apparel division. Walmart previously acquired the company Jet.com for $3.3 billion, and will use Jet.com to help Bonobos expand its online presence. This move will help Walmart earn larger market share in online apparel. Marc Lore, President of Walmart eCommerce, said, “Adding innovators like Andy [Dunn, Founder & CEO of Bonobos] will continue to help us shape the future of Walmart, and the future of retail. I’m thrilled to welcome Andy and the entire Bonobos team. They’ve created an amazing product and customer experience, and that will not change. In fact, Andy will be a great influence on the company, especially in leading our collection of exclusive brands offered online.” [4]

- ModCloth Inc. March 2017 for an Undisclosed amount. (assumed $50-70 million).

Like I had mentioned earlier, Walmart is in a race to expand its online apparel section of business. The authors of morisonmenon.com have similar opinions, “In order to accomplish its goal of catching up with Amazon, Walmart has acquired the assets and operations of online apparel retailer ModCloth for an undisclosed sum, in Mar-2017.” [5] ModCloth Inc. sells unique clothing and accessory items for women. Now having acquired ModCloth and Bonobos, Walmart provides a lot larger range of apparel items online, expanding its presence and customer base in Online Retail.

- ShoeBuy, January 2017, for $70 Million.

“Walmart kicked off the year 2017 with the acquisition of an online shoe retailer ShoeBuy, through Walmart’s subsidiary Jet.com, for $70 million from IAC, thereby strengthening its online footwear business.”[5] ShoeBuy is a company that sells clothing and accessories, but focuses mainly in shoes, selling from more than 800 different brands. A company similar to ShoeBuy is Zappos, which was acquired by Amazon in 2009. This acquisition of ShoeBuy by Walmart is another move in order to become a direct competitor with Amazon.

- MooseJaw, February 2017, for $51 Million.

MooseJaw is a company that also sells clothing and apparel to men, women, and children. However, unlike typical brands in Walmarts stores, MooseJaw deals in higher quality and more luxury brands. “The acquisition of Moosejaw has improved Wal-Mart’s competitive standing in the U.S. eCommerce space against its rivals. Teaming with Moosejaw is expected to allow Walmart to sell a complete assortment of apparel, including brands like Patagonia, The North Face, Marmot, and others.” [5] A company like MooseJaw provides a strategic edge to Walmart’s online presence by dealing in luxury brands. Most brands like Patagonia or The North Face try to sell their brands in stores that only carry higher quality brands in order to target certain customer groups looking for more luxurious products. This acquisition allows for Walmart to cater towards luxury seeking customers as well as quality seeking customers.

Opportunities

With increasing growth and strong future expectations in the eCommerce world, there are many opportunities for Investment Banks in advising companies on Mergers & Acquisitions, or even Capital Raising for future organic or inorganic growth in eCommerce firms. Seeing how these big and small firms focus on their respected markets, they are not experts on Mergers & Acquisitions or Capital raising. This opens the doors for Investment Banks to provide quality services for thousands and thousands of eCommerce firms looking to grow. The majority of the smaller online retailers have strong numbers, making them very attractive acquisitions for bigger firms. Peakstone Group published a couple numbers on a sample of eCommerce firms: “For announced transactions (albeit a limited sample size), eCommerce multiples saw 9.7x EBITDA and 2.0x revenue in Year-to-Date 2016. eCommerce M&A continues to see strong activity. YTD 2016 transaction volume of 166 deals is on pace with 2015 levels. During 2015, there were 320 transactions.” [6] The data is a little dated, but still relevant. It is easy to see that there are a large number of deals taking place in the M&A field regarding to eCommerce companies. With numbers of transactions increasing from year to year, Investment Banks should assemble a team of Bankers who can address eCommerce specific deals in order to win these many deals that are coming from the Online Retailing sector.

With large expected growth and a huge amount of deals taking place in the eCommerce sector, it seems as if there would be no downside of taking on these M&A eCommerce deals as an Investment Bank. However, not every deal has gone as expected, and maybe the projected growth numbers are off. An article recently written by Nate Nead at InvestmentBank.com expresses how a M&A deal could go wrong: “Culture clashes, botched integration, tactics vs. strategy, lack of mission and acquihire buy-in can each play a critical role in the potential success of M&A in tech.” [7] Nate has a very good point. Although he was talking about Tech M&A deals, I think it applies just as much to eCommerce deals as well. These companies like MooseJaw Inc. or ModCloth Inc. are quite different in structure and management than Amazon is; it is one of the reasons they have been successful while previously competing against eCommerce giants like Amazon and Walmart. However, upon acquiring these companies, the management and structure of the acquired companies will need to adjust to fit Amazon’s plans. The Investment Banks that are hired to work on these deals need to make sure they take factors like Integration and Culture into account when working these deals, because if they fail to realize the importance of these factors, and the acquired companies end up hurting Amazon instead of helping, then the Investment Bank who was hired to work that M&A deal will not be hired again, which could be very costly for that specific Investment Bank. Amazon is sure to do many more M&A deals in the near future and being on their good side would be quite profitable.

Other risks include improper valuations and potential declining eCommerce growth. With respect to improper valuations, cbinsights.com shows us a couple deals that were drastically overvalued: “Gilt Groupe’s acquisition by Hudson’s Bay Company for just $250M in Q1’16 was significantly lower than the startup’s prior valuation of $1B in 2011… home goods eCommerce site One Kings Lane, which was acquired for only $11.8M in a down exit in Q2’16 by Bed Bath & Beyond, after previously being valued at over $900M.” [8] The Acquiring companies were sure to be happy that they payed a lot less for these companies, however there is a possibility that the acquired companies could have been acquired for their original valuations. If these companies had been acquired at their original valuations the Investment Bank responsible for these valuations would surely not be hired again. There are many reasons the value of these acquired firms dropped, however, it is easy to get caught up in “hype” around a certain sector in business, causing firms to be purchased for overvalued prices.

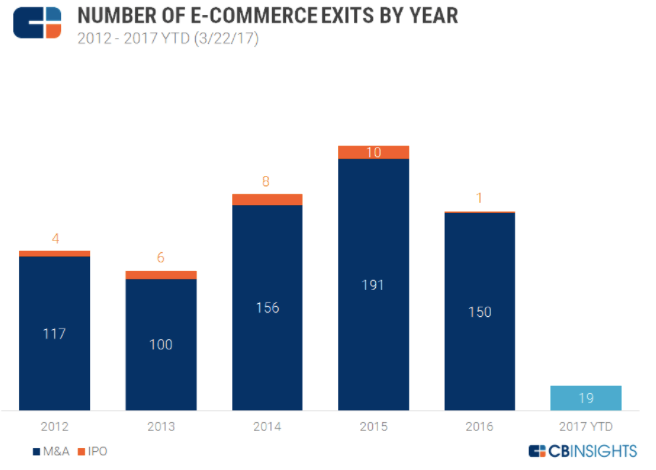

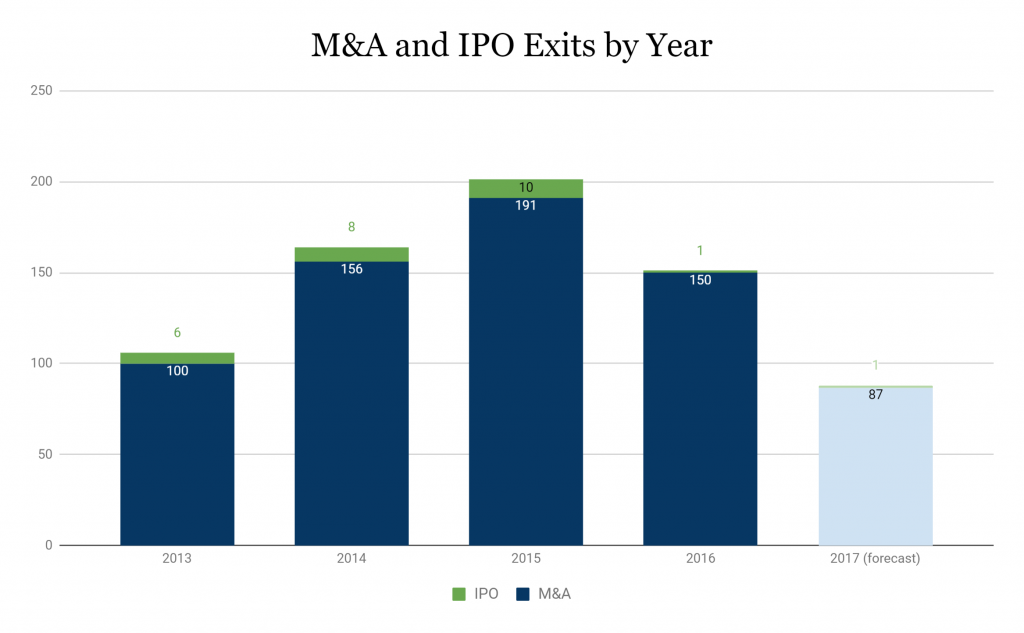

Graph 1 shows us that the expected growth in the eCommerce section has not exactly transferred directly to M&A deals for Investment Banks. While eCommerce growth has been projected to see anywhere from 30-50 percent growth annually, we can see in the graph that actual eCommerce exits, whether they be IPO’s or M&A deals, have declined in 2016 to lower levels than 2015 and 2014. While the data is only up to Q1 in 2017, even Q1 deals for 2017 are lower than Q1 deals in 2016. While the eCommerce sector is still growing, the opportunities for Investment Banks in this sector seem to be slowing down. Taking the time and money to put together an eCommerce deal team at an Investment Bank may bring in less money than expected.

Conclusion

The eCommerce sector is booming, and if anything, will continue to grow. Consumers are constantly looking for ways to improve their quality of life, and Online shopping is becoming increasingly popular. There is a lot of money to be made for Investment Banks in the eCommerce sector, especially when considering the amount of deals that eCommerce titans like Amazon and Walmart will be doing in the future. Investment Banks should create quality eCommerce teams and do all they can to win deals with these big companies. However, don’t over focus on the eCommerce sector because Exit deals seem to be slowing down compared to overall eCommerce growth.

References

[1]- Investment Bank (November 06, 2017) Expert Ecommerce Capital Advisory. https://investmentbank.com/ecommerce/

[2]-Tolliver, Lisa (June 30, 2017) eCommerce/Internet Retailing. http://www.capstonellc.com/sites/default/files/Capstone%20Ecommerce%2C%20Internet%20Retailing%20M%26A%20Coverage%20Report_Q3%202017.pdf

[3]- Johnson, Krista (2017) “eCommerce Industry Spotlight,” Marriott Student Review: Vol. 1 : Iss. 1 , Article 6. Available at: http://scholarsarchive.byu.edu/marriottstudentreview/vol1/iss1/6

[4]-Tolliver, Lisa (June 30, 2017) eCommerce/Internet Retailing. http://www.capstonellc.com/sites/default/files/Capstone%20Ecommerce%2C%20Internet%20Retailing%20M%26A%20Coverage%20Report_Q3%202017.pdf

[5]-Nimmi & Sathyavageeswaran (April 10, 2017) M&A Transactions in Global eCommerce Sector: Q1-2017. http://www.morisonmenon.com/blog/m-and-a-transactions-in-global-eCommerce-sector-q1-2017/

[6]- (June 30, 2016) eCommerce Industry M&A Update. http://peakstonegroup.com/wp-content/uploads/2014/08/Peakstone-eCommerce-Insights-June-2016.pdf

[7] – Nead, Nate (October 31, 2017) Why So Many Tech M&A Deals Fail. https://investmentbank.com/why-so-many-tech-ma-deals-fail/

[8] – CB Insights Research (June 08, 2017) Tough Sell: eCommerce Exits On a Continued Decline. https://www.cbinsights.com/research/eCommerce-merger-acquisition-ipo-trends/

Thane Pearson contributed to this report.

Mergers, Acquisitions and Venture Capital Trends and Investments

M&A in the e-commerce industry has generated substantial buzz lately, with 2017 again seeing the record broken for the largest e-commerce acquisition of all time. Most notably, Chewy.com, who was acquired by PetSmart for a whopping $3.35 billion, besting the prior record held by Jet.com when it was acquired by Walmart for $3.30 billion.1

However, not all e-commerce companies have seen the same level of success, making it crucial to understand industry trends. This article covers both general mergers and acquisition deal activity and VC investment trends occuring in the e-commerce sector.

Other Notable Deals

To fully understand the e-commerce space, it is important to be aware of some of the major transactions, which have had significant impact on the overall e-commerce environment:

- Petsmart/Chewy (April 2017) – As mentioned, this has been the largest ever e-commerce transaction to date ($3.35 billion).1 It signifies traditional retailers’ growing interest in the e-commerce model.

- Walmart/Bonobos, Modcloth, Moosejaw & ShoeBuy (2017) – Walmart acquired each of these in 2017 for over $50 million apiece as it looks to build its online brand presence. Walmart is hoping the strength of each of these brands will attract buyers to its online store.2

- Walmart/Jet.com (August 2016) – Walmart acquired Jet.com for $3.30 billion in order to have an online portal where it could sell its major brands.2 This was notable because it showed the pressure Amazon has put on Walmart to embrace the e-commerce model.

- Unilever/Dollar Shave Club (July 2016) – Unilever acquired Dollar Shave Club for $1 billion dollars in order to capture its loyal customers and its high-growth model. This transaction has been one of the first major subscription box models to see success.2

Major Buyers

Many buyers of e-commerce companies are large, established companies that are seeking to buy out competitors and growth opportunities in their space. These e-commerce buyers vary greatly in the types of products they sell and most have only made a limited number of acquisitions within their individual retail niches.

The one exception to this rule are Walmart, Amazon, and Alibaba. These companies have dominated the e-commerce space in terms of total acquisitions made because their strategy depends on being a place where consumers can buy nearly anything. Walmart alone has made four acquisitions greater than $50 million this year.2

Investor Trends

It can be helpful to break down the e-commerce deal market into different types of buyers and investors to gain a clearer picture of the market.

Angels and Seeds

Early-stage investment from angels and VCs have been shrinking in the e-commerce sector for the past several years. In 2013, seed and angel deals made up 54% of total deal share in the space. That amount has fallen to 38% in 2017. This decline suggests that the industry is coming to maturity.3

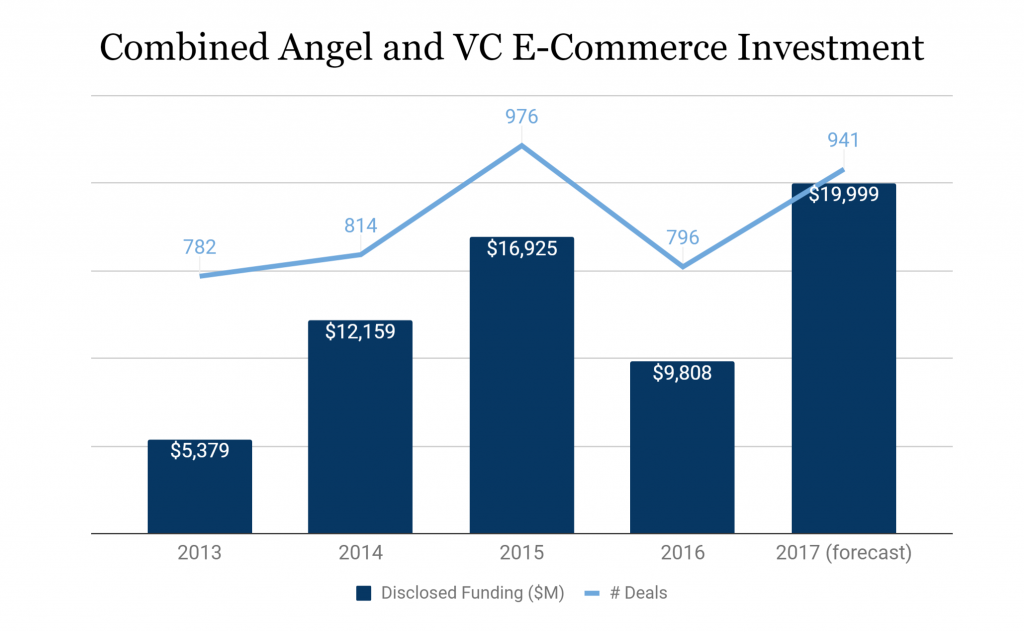

Venture Capital

Total VC investment has been strong in 2017. These have markedly been coming at later points in company’s lifecycle. In 2013, Series C investment and beyond comprised 23% of total deal share. In 2017, that amount has risen to 34%. In terms of the number of startup investment deals, 2017 is projected to see 941, which beats last year’s 796, and puts it close to 2015’s 976.3 The following graph illustrates this point.

Source: CBInsights

PE Funds

Private equity investment has been strong in terms of deal volume. As brick-and-mortar retailers continue to struggle, private equity funds have been attracted to the growth and streamlined approach of e-commerce companies. Pitchbook data as of a month ago shows that while total PE e-commerce deal count this year is slightly below 2015 and 2016, it is already more than 40% higher than in 2013.4

Source: Pitchbook

Strategic Buyers

Despite several recent high-profile exits, acquisitions by strategic buyers seem to be slowing down. The industry is also seeing more consolidation occurring prior to exiting.5 While 2016 saw 150 M&A exits, 2017 may end up with less than 90.6 Difficulty exiting has led some well-funded e-commerce companies to experience down valuations (such as Souq.com and Flipkart).5

Source: CBInsights

Valuation Metrics

Some of the most important metrics to know when finding the value of an e-commerce business are as follows:

- Price/Sales – This metric is important for valuing e-commerce companies because many of them reinvest most of their earnings. This means that an EBITDA or net income multiple would not be very useful.7

- Revenue Growth Rate – Faster-growing companies tend to be worth more. Looking at the growth rate over time can be helpful to see how quickly a company is maturing.

- Number of Customers – This is the biggest driver of sales and is key to understanding the scope of a company’s business.7

- Customer Retention Rate – Look for this rate to either be flat or decreasing in the best e-commerce companies.7

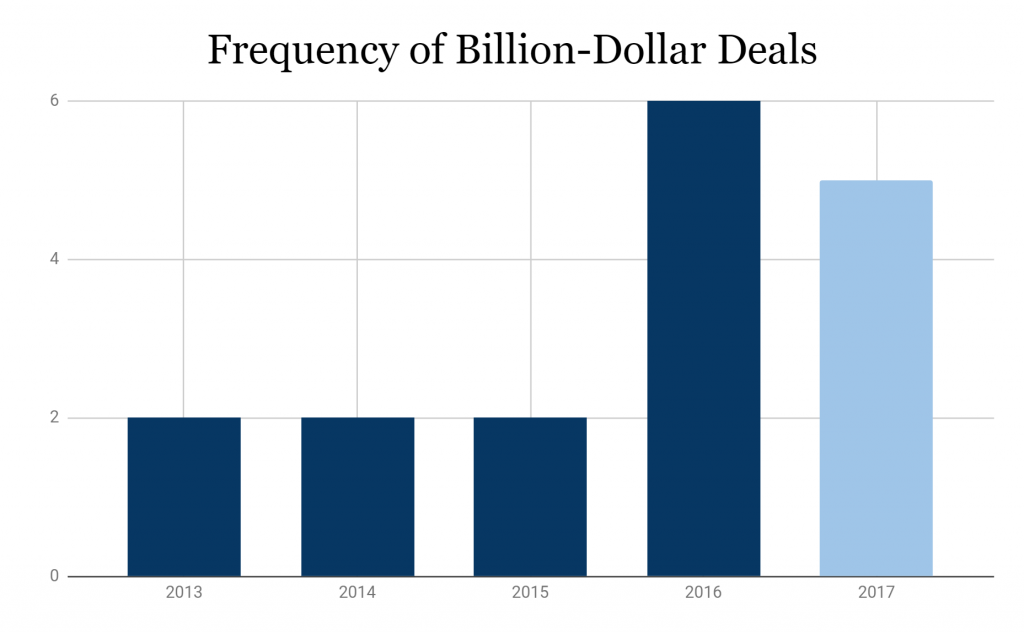

Larger Deal Sizes

Deal sizes tend to be trending larger as the industry matures. From 2013 to 2015, there were only two e-commerce deals per year that surpassed billion-dollar mark. That number jumped to 6 in 2016, and 2017 is close to repeating that.4

Source: Pitchbook

International E-Commerce Companies

China and India are the leaders in terms of the number of e-commerce companies that have raised over $100 million in funding. The United States comes in third, with other countries spaced much farther behind.5

Source: CBInsights

It will be exciting to see how e-commerce deals continue to evolve in the coming years. We’d love to hear what you think about the industry in the comments below.

Sources

- Rani Molla, These are the biggest e-commerce acquisitions of all time Recode (2017), https://www.recode.net/2017/4/21/15346630/top-ecommerce-deals-acquisitions-chart (last visited Dec 15, 2017).

- Lisa Tolliver, Ted Polk & Parker Dwyer, Capstone Partners (2017), http://www.capstonellc.com/sites/default/files/Capstone%20Ecommerce%2C%20Internet%20Retailing%20M%26A%20Coverage%20Report_Q3%202017.pdf (last visited Dec 15, 2017).

- Is The E-Commerce Slump Finally Over?, CB Insights Research (2017), https://www.cbinsights.com/research/ecommerce-startups-deals-funding-stage/ (last visited Dec 14, 2017).

- Kevin Dowd, Amid retail apocalypse, PE pushes into ecommerce PitchBook News (2017), https://pitchbook.com/news/articles/amid-retail-apocalypse-pe-pushes-into-ecommerce (last visited Dec 15, 2017).

- E-Commerce Planet: The Most Well-Funded Private E-Commerce Companies In One Map, CB Insights Research (2017), https://www.cbinsights.com/research/top-ecommerce-startups-global-map/ (last visited Dec 14, 2017).

- Tough Sell: E-Commerce Exits On A Continued Decline, CB Insights Research (2017), https://www.cbinsights.com/research/e-commerce-merger-acquisition-ipo-trends/ (last visited Dec 14, 2017).

- Is Stitch Fix’s IPO The Latest E-Commerce Dud Or Is Its Styling Algorithm A Game-Changer?, CB Insights Research (2017), https://www.cbinsights.com/research/stitchfix-valuation/ (last visited Dec 15, 2017).

Trevor Armstrong contributed to this report.

- Covid-19 Impact on US Private Capital Raising Activity in 2020 - May 27, 2021

- Healthcare 2021: Trends, M&A & Valuations - May 19, 2021

- 2021 Outlook on Media & Telecom M&A Transactions - May 12, 2021