Agtech — VC & M&A trends, valuations and investments

This is the second piece of a multi-part series covering the Agriculture technology (AgTech) industry. To view the first article, click here.

Within the United States Agribusiness grosses some $3.0 trillion in revenue per anum, but the industry has been steadily declining at -1.9% since 2012. Agtech, a sub-sector of overall Agribusiness aims to improve production, efficiency and overall growth within the the industry. Agtech deal flow remains at very healthy levels as entrepreneurs and VCs alike start to focus on this largely un-disrupted sector. This article will discuss VC and M&A trends, notable transactions, and valuation variation in the Agtech industry.

Overview

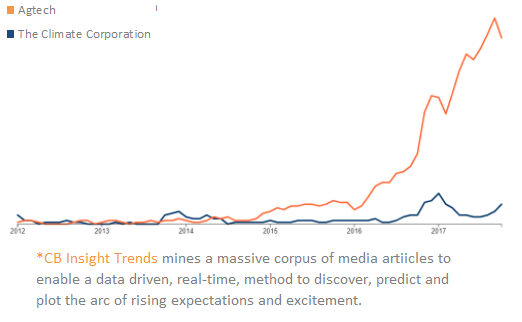

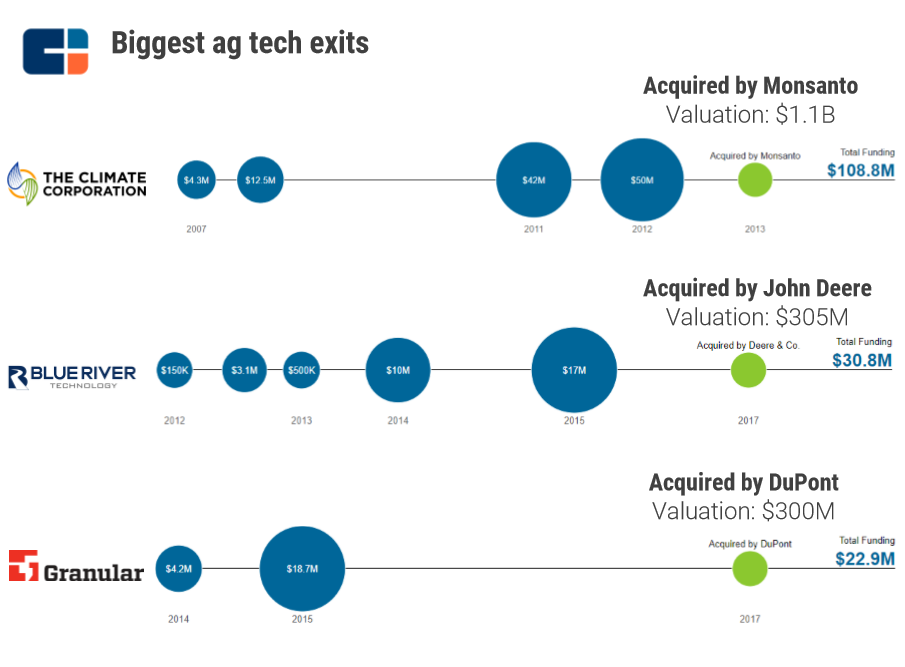

Attention for Agtech investment has been gaining attention as VC investing in the sector has steadily inclined from 2012-2015. A large contribution to early traction was Monsanto’s US$1B acquisition of The Climate Corporation (TCC) in 2013, a digital agriculture company that examines weather, soil and field data to help farmers determine potential yield-limiting factors in their fields [1].

Disclosed funding on the rise

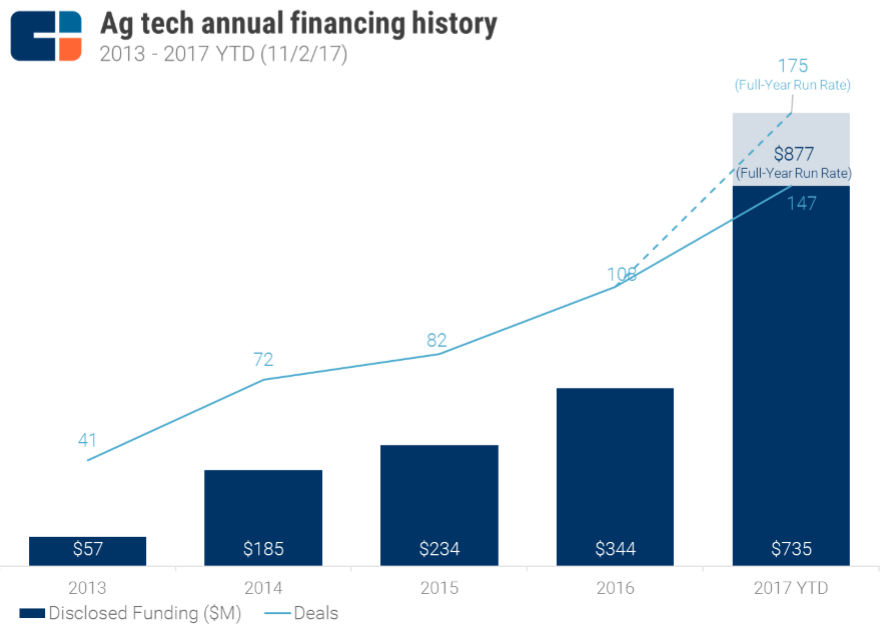

Investing activity in Agtech has increased steadily from 2013-2016, and we have seen another solid increase during 2017. As of November 2017, Agtech funding numbers had already more than doubled 2016 funding levels. CB Insights is forecasting a +65% increase in deal count. While the TCC deal drove a large share of the total investment in 2014, the 2017 increase is more substantial and relevant toward sustainable capital infusion into the industry [2].

Seed/Angel financing remains steady

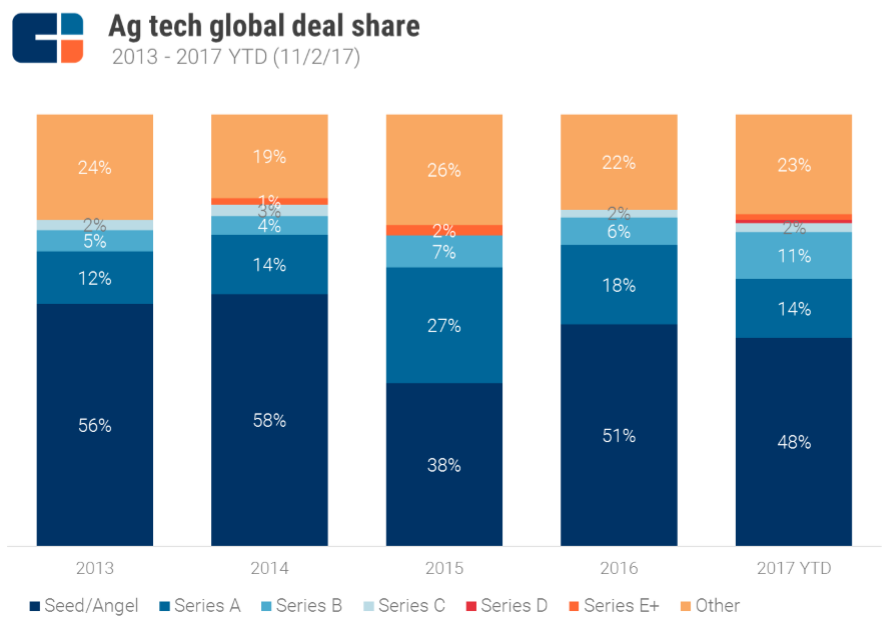

Although early-stage Seed/Angel financing remains at roughly 50% of the deal flow, its share has increased since 2015 where Series A increased as the greatest share of total financing. Agtech Series A and B financing seems to be maturing and during 2017 mid to later stage deals (Series C,D,E+) have emerged as growth has accelerated. Late stage financing (corporate minority, convertible notes, private equity, and growth equity rounds) has consistently been over 20% of all deals, averaging 23% of total financing since 2013.

M&A and deal count slightly down

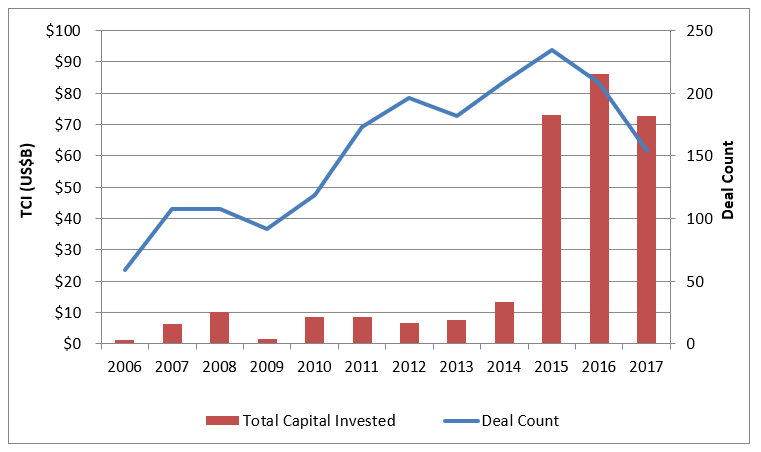

M&A activity (total capital invested) has seen three solid years, averaging at US$77B, despite the deal count dropping. This suggests less volume but greater overall deal size, an indication that industry leaders are emerging and maturing [3].

Source: Pitchbook Data, Inc.

Notable deals and exits

Although this list is not exhaustive, there have been five notable deals since 2013. Agriculture has shifted to sexy from a once boring sector.

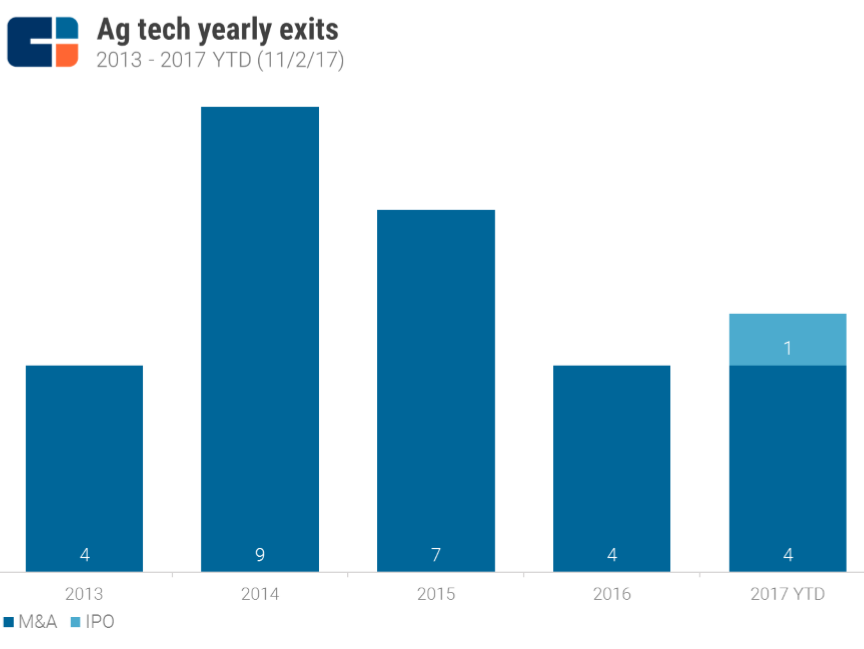

Agtech exits spiked after the TCC acquisition and we saw them pick up significantly in 2014. However, since then it has tapered with only four early exits in both 2016 and 2017. 2017 saw one Agtech IPO, of CropLogic. While small in overall company valuation at less than $10M, public market stocks like CropLogic it will start to help the overall reporting in the industry by providing valuation multiples and other relevant comparable metrics for future deals.

Recent agtech deals

Although TCC has been the largest exit in this space recently, we are starting to see John Deere and Dupont make small to midsize acquisitions, which is painting a positive picture in the near term as it suggests Agribusiness companies are looking into M&A. These exits are also relatively capital efficient, generating sizeable returns for investors and are more likely to encourage an increase of interest in the space.

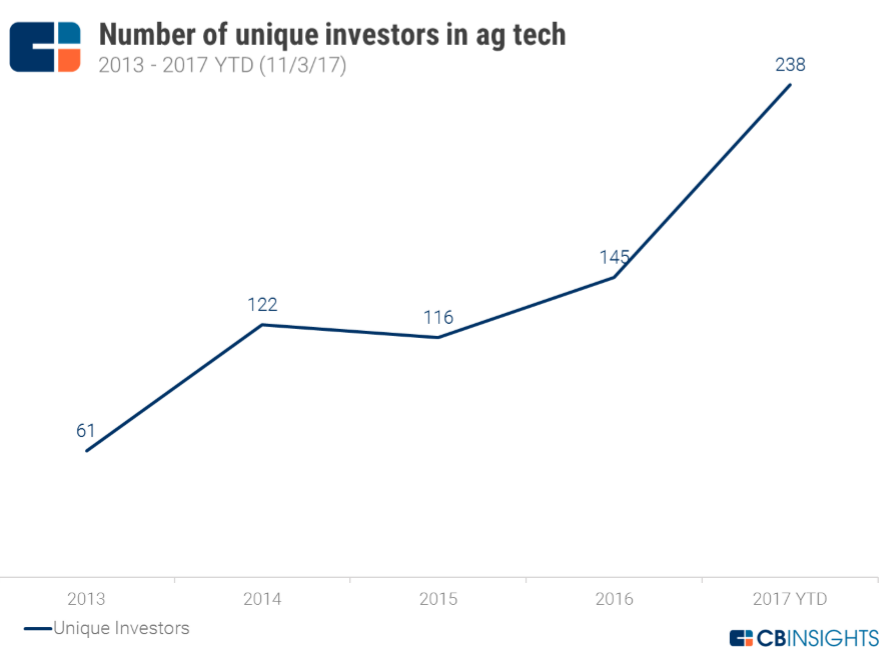

Increasing number of investors

Measuring unique investors is a common way to measure interest, as deal values can be misleading, and one large deal can skew numbers. The number of unique investors has been growing steadily since 2013 and increased +64% from 2016 to 2017. In fact, 2017 has seen the highest growth rate over this time frame.

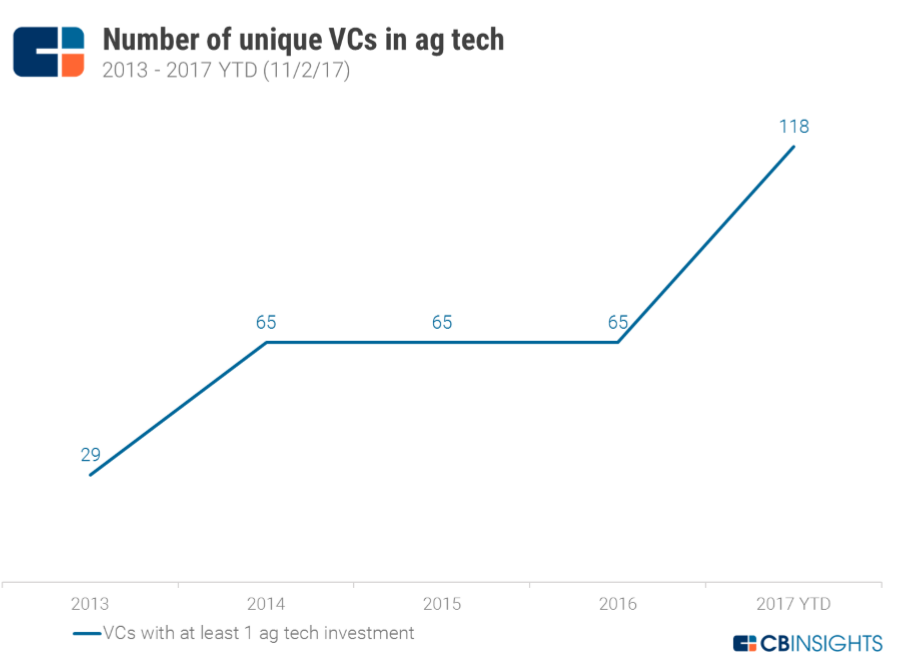

Although all investors are welcome, VC’s are a good indication of institutional interest. Venture capital helps with perception and capital growth. Although the number of unique VC’s in the Agtech space flat-lined from 2014-2016, remaining at 65, 2017 saw a solid jump in interest, with 118 VCs making at least one Agtech bet.

Valuation Methods – still finding their roots

As the growth in the Agtech industry accelerates the influx of capital, the number of new investors is likely to continue its climb. As with most new tech segments, the valuation of companies remains very much ‘finger in the air’. This makes it difficult for mainstream investors to make investment decisions, with VC and corporates leading the charge on big deals and exits. This is common, in most new tech segments, and as investment is funneled into research valuations will start to settle and multiples will become more relevant/usable. A company is worth what a buyer is willing to pay, and until a large data-set is formed, mainstream investors are more likely remain at bay.

Valuation – beauty is in the eye of the beholder

In general, Agtech is trying to improve the Agribusiness industry by way of efficiency gains and supply chain improvements. The majority of financing into this space supports companies that do just that. We are yet to see larger Uber-like ‘disruption’ in Agribusiness, however incremental improvements across the industry bode well for continued institutional investment in the sector. Efficiency gains, however incremental, will continue drive both corporate M&A and venture capital interest in the space as the industry continues to grow. However, it is more likely that business valuations will be more company specific until full maturation occurs, as what benefits one investor through synergies could actually not impact competitors. Consequently, comparable company multiples are likely to vary greatly.

Agtech Outlook

The Agtech industry will continue to see large variation in valuation multiples due to the nascent nature of the industry. More so, seed and angel stage investment as a total deal count has most recently been on the rise in the short run. As the number of later stage financing and exits increases as the industry matures, we are more likely to see number of and size of transactions increase and variation in M&A multiples shrink. IPOs and large private equity buyouts are likely to be more common over the next decade as VC’s look to the market for an exit. Listed companies will aid in more solid earnings multiple expectations. Deal flow, median deal size, and total invested capital are all expected to remain elevated in the near term.

Sources

[1] Alexia Tsotsis, Monsanto Buys Weather Big Data Company Climate Corporation For Around $1.1B TechCrunch (2013), https://techcrunch.com/2013/10/02/monsanto-acquires-weather-big-data-company-climate-corporation-for-930m/ (last visited Dec 21, 2017).

[2] Ag Tech Heats Up: 5 Trends Shaping The Future Of Farming & Agribusiness, CB Insights Research (2017), https://www.cbinsights.com/research/agtech-trends-shaping-the-future-of-farming-expert-intelligence/ (last visited Dec 21, 2017).

[3] Ag Tech Heats Up: 5 Trends Shaping The Future Of Farming & Agribusiness, CB Insights Research (2017), https://www.cbinsights.com/research/agtech-trends-shaping-the-future-of-farming-expert-intelligence/ (last visited Dec 21, 2017).

[4] Agtech to yield more M&A in coming year, PitchBook News, https://pitchbook.com/news/articles/agtech-to-yield-more-ma-in-coming-year (last visited Dec 21, 2017)

Sam Grice contributed to this report.

- Covid-19 Impact on US Private Capital Raising Activity in 2020 - May 27, 2021

- Healthcare 2021: Trends, M&A & Valuations - May 19, 2021

- 2021 Outlook on Media & Telecom M&A Transactions - May 12, 2021