The Pros and Cons of Digital Dealflow

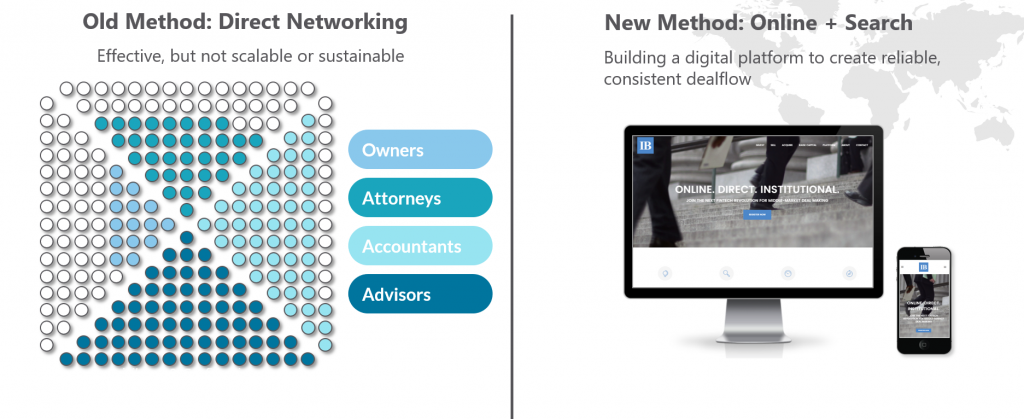

How do you source deals? Do you make 1,000 cold calls? Network with other professionals? Pay Google $12.50 a click? The methods and abilities to reach a desired audience have expanded greatly in recent years, thanks to tech.

The old method for sourcing quality middle-market deals is not dead. In fact, relationships are more important than ever, especially in investment banking where sellers contract with a banker on the most important transaction they will likely ever do.

In such a case, relationships become critical. In today’s selling vernacular, it’s the difference between relationship selling and transaction-based selling. People are less interested in the features and benefits and more interested in trusted advisory and quality relationships. However, digital has greatly expanded and enhanced the ability to source quality deals from new channels. We have witnessed it first hand. What follows is a discussion of the pros and cons of both methods and how they can be used in tandem for maximum benefit.

Traditional DealFlow

The traditional networking method of deal origination involves creating relationships and even mastermind networking groups among other, local industry professionals including accountants, attorneys, wealth managers, business owners and other trusted business advisors. The best networkers establish long-standing relationships with business owners directly–long before they are intent on transacting–slowly building rapport so as to become the “go to” advisor when a transaction is eventually imminent.

This remains one of the most solid means for sourcing some of the best deals. In fact, for the truly targeted industry experts–those who play in a single market sector with deep expertise–this is the true trump card method. It ensures the investment banker dominance in a given market and few distractions outside a focus area. But this also has its own flaws as well.

Scale & Sustainability

There are two major issues inherent with such limited strategy. First, outreach is not scalable. Even the largest boutique investment banking firms can struggle to maintain a large number of incoming new deals and opportunities with a networking-only strategy. It’s a very human and time capital-intensive proposition.

Second, the networking method is not sustainable. A boutique practice that relies exclusively on one or two heavy-hitting rainmakers, is destined to see a fall-off in the event of a transition or retirement. For the advisory shops whose practices rely on the outreach of just a couple Managing Directors, the risk can be acute, particularly if–after months of active sourcing–such a group is engaged with an active mandate.

Active deal-making means less active deal-sourcing and the pipeline goes dry.

Continuous digital deal sourcing, coupled with traditional targeted outreach ensures a good mix and a consistent pipeline. In the case of brand-building, it also means such a bank could become a sell-able entity at some point in the future.

Riff-Raff

The problem with scale is that it is scale. When you open up the funnel to everyone and anyone, there is a lot more riff raff that come through the door. Quality is sacrificed for quantity and sometimes dealmakers are tempted to substitute good deals and good sense for the potential of making a quick buck.

It’s the difference between a shotgun and rifle approach for sourcing new deals. Such a strategy ensures you see more startups and less-than-attractive capital raise opportunities than sell-side mandates. We solve this problem by using marketing automation and stringent deal questionnaires.

The Speed of Trust

Firm, solid and trusting business relationships can take months and years to develop and do not happen overnight. Digitally-connected relationships in business begin very transaction-focused and slowly move up the food chain as said relationships grow. But, absent of being face-to-face, the speed of getting to trust is much more difficult. What makes this process doubly-taxing is the fact that most digitally-sourced leads are ready to transact either now or in the very near future. Consequently, the speed to trust needs to happen and needs to happen now. Absent such speed, investment bankers end up spending more of their time in fruitless bake-offs and beauty contests than they would like. I have found the best solution here are tombstones and direct client references.

The newest and best methodologies combine organic and paid search strategy, social media (in particular, a good Linkedin strategy) WITH good old-fashioned calling and face-to-face networking.

Deals are not sourced in a vacuum.

Deal origination strategies also need not be mutually exclusive.

Combining all-of-the-above ensures dealmakers mitigate the natural risks while exploiting the differing benefits of respective strategies. That’s why we are building our software.

- Covid-19 Impact on US Private Capital Raising Activity in 2020 - May 27, 2021

- Healthcare 2021: Trends, M&A & Valuations - May 19, 2021

- 2021 Outlook on Media & Telecom M&A Transactions - May 12, 2021