Software Staffing & Consulting: Industry Performance

This research report is one in a series covering IT & software staffing, a subsector of software & technology investment banking.

The software and IT segment is the fastest growing subsector of professional staffing and consulting firm.[1] Revenues for this subsector continue to grow along with the entire staffing industry. This report will discuss the (a) key external drivers and (b) current performance for staffing firms in 2017.

Key External Drivers

IT Staffing firms, like other firms, are heavily influenced by external factors such as customers, the economy and competition.[2] The economy heavily affects IT staffing firms by influencing the (a) labor force participation rate, and (b) overall industry competition.[3]

Labor force participation. When the labor force participation is low, typically in a recession, companies have trouble finding the right candidates for a position. This makes it critical for businesses to look to staffing companies for recruiting and hiring top employees.[4]

When labor force participation is low, staffing agencies fill employment needs. Using staffing firms during these times will help a company productively fulfill demands without having to deal with full-time employees.[5]

Competition. As the economy rises, the competition goes along with it. During periods of healthy and improving economic growth, companies struggle to find and retain key employees. Companies can use staffing agencies to improve their pool of qualified candidates.[6]

Overall, the economy drives the fluctuation of staffing firms’ performance. Along with fluctuations in the economy, IT staffing firms are influenced by the current fluctuations of the technology market.

Current Performance

The following looks at both the quantitative and qualitative performance of staffing firms.

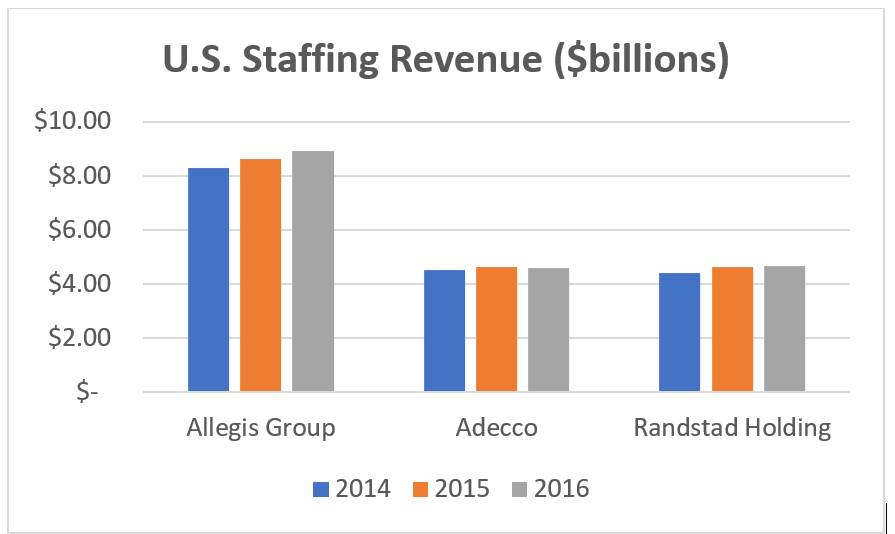

Quantitative performance. In 2016, the staffing industry generated about $137 billion of revenue.[7] The top-performing industry for the last three years, Allegis Group, has a 6.5% market share of the entire industry.[8] Figure 1 displays the revenue for top firms from 2014 to 2017.

Figure 1 Source: https://www2.staffingindustry.com/site/Editorial/Daily-News/Staffing-Industry-Analysts-lists-largest-US-staffing-firms-for-2017-42794

The graph portrays revenues healthily increasing year by year. The total US staffing market is predicted to “rise by 3% [each year].”[9]

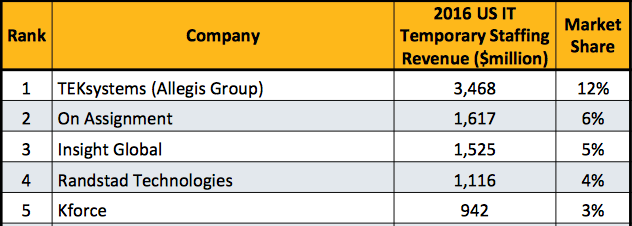

The top 43 IT software and staffing firms account for over $18 billion of revenue and 63% of market share.[10] The following chart (Figure 2) shows the top five IT staffing firms in the U.S.

Largest IT Staffing Firms in the United States

Figure 2 Source http://aictalent.acsicorp.com/aictalent/sites/all/themes/aic/images/Largest-IT-StaffingFirms.pdf

Allegis Group’s 12% market share equates to $28.9 billion of total market value for IT staffing firms. IT staffing firms are the fastest growing subsector of professional staffing and consulting firms.

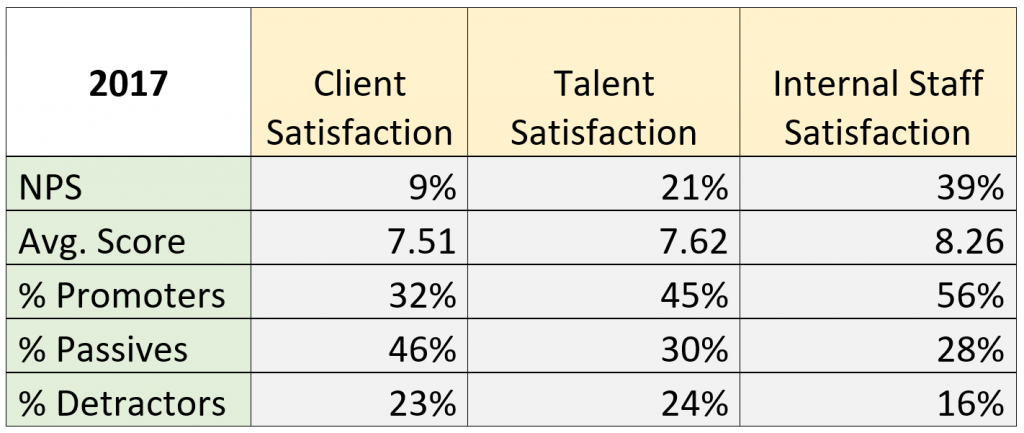

Qualitative data. Because staffing, in general, is an industry based on human capital and intangible key indicators, studies are done to rank staffing using net promoter scores (NPS). Net promoter scores “measure customer experience and [predict] business growth.”[11] The NPS is calculated by asking the question, “How likely is it that you would recommend [brand] to a friend or colleague?” The answer is given on a scale of 0 (not at all likely) to 10 (extremely likely).[12]

Those who score 9-10 are titled as “promotors,” those who score 7-8 are titled “passives,” and those who score 0-6 are titled “detractors.” The NPS is calculated by taking the percentage of promoters and subtracting the percentage of detractors.[13] Figure 3 shows the scale used for NPS calculation.

Figure 3 Source: https://www.netpromoter.com/know/

Studies and surveys were completed to calculate the NPS for the staffing industry. In the survey program promoted by Inavero, the study measured the NPS for three different categories: (1) client satisfaction, (2) talent satisfaction, and (3) internal staff satisfaction. Figure 4 shows the results of the study for 2017.

Figure 4 Source: https://www.inavero.com/category/staffing_recruiting/staffing-nps-benchmarks/

With an average scores between 7.5 and 8.3, staffing is perceived as neutral by consumers. According to the same survey done in previous years, last 7 years has yielded net promoter scores similar to the chart shown above.[14] Client satisfaction has fluctuated the most with an NPS of 33%, -3%, and 9% in 2010, 2015, and 2017, respectively.[15] Overall, current performance has remained fairly constant according to net promoter scores.

Conclusion

Revenue for staffing firms continue to increase year over year. The fluctuation of external factors (e.g. economy) heavily impact the current performance of these staffing firms. External factors impact the need for staffing firms but also affect the way individuals perceive staffing firms. Depending on the ups and downs of an economy, staffing firms perform differently.

[1] Duff&Phelps, 2017. “Staffing Industry M&A Landscape,” Retrieved from: https://www.slideshare.net/DuffandPhelps/staffing-industry-ma-landscape-winter-2018-87565633. Accessed March 6, 2018

[2] Chron, 2017. “What are Internal & External Environmental Factors That Affect Business?” Retrieved from: http://smallbusiness.chron.com/internal-external-environmental-factors-affect-business-69474.html. Accessed March 6, 2018.

[3] @Work, 2015. “What Impact Does the US Economy Have on Staffing?” Retrieved from: https://www.atwork.com/2015/11/06/what-impact-does-the-us-economy-have-on-staffing/. Accessed March 6, 2018.

[4] Ibid.

[5] Ibid.

[6] Ibid.

[7] Staffing Industry Analysts, 2017. Retrieved from: https://www2.staffingindustry.com/site/Editorial/Daily-News/Staffing-Industry-Analysts-lists-largest-US-staffing-firms-for-2017-42794. Accessed March 9, 2018.

[8] Ibid.

[9] Staffing Industry Analysts, 2017. Retrieved from: https://www2.staffingindustry.com/site/Editorial/Daily-News/US-staffing-market-to-increase-3-SIA-forecast-says-43471. Accessed March 9, 2018.

[10] Staffing Industry Analysts, 2017. Retrieved from: http://aictalent.acsicorp.com/aictalent/sites/all/themes/aic/images/Largest-IT-StaffingFirms.pdf. Accessed March 10, 2018.. Accessed March 9, 2018.

[11] Satmetrix, 2017. “What is Net Promoter?” Retrieved from: https://www.netpromoter.com/know/. Accessed March 6, 2018.

[12] Ibid.

[13] Ibid.

[14] Inavero, 2017. “Net Promoter Score (NPS) Benchmarks for Staffing.” Retrieved from: https://www.inavero.com/category/staffing_recruiting/staffing-nps-benchmarks/. Accessed March 6, 2018.

[15] Ibid.

Wesley Bosco contributed to this report.

- Covid-19 Impact on US Private Capital Raising Activity in 2020 - May 27, 2021

- Healthcare 2021: Trends, M&A & Valuations - May 19, 2021

- 2021 Outlook on Media & Telecom M&A Transactions - May 12, 2021