Using an SBA Loan to Finance a Business Acquisition

When it comes to financing an acquisition, the capital obtained can come from a variety of sources. One common source is a Small Business Administration (the “SBA”) Loan. SBA loans are not made directly by the SBA. Rather, it provides guarantees to financial institution that are the lender. This is an important feature for borrowers. Since the financial institution is the one taking on the risk, each institution’s lending requirements may be different.

The SBA was founded in 1953 and is tasked with assisting small businesses in the United States. The organization provides assistance through four functions:

- Business Financing – The SBA provides small businesses with various financing options from microlending to debt and equity venture capital.

- Entrepreneurial Development – The SBA provides counseling for small businesses and new entrepreneurs throughout the U.S.

- Government Contracting – The SBA works with other government organizations to work towards meeting the goal of 23% in prime contract dollars going to small businesses.

- Advocacy for Small Businesses – The SBA reviews legislation and testifies on behalf of small businesses. The organization also conducts research on American small businesses.

Standard Loan Requirements

While each lending institution has the ability to set their own criteria, the following are common requirements across lenders:

Personal Credit

The borrower, or some of the borrowers if in a group, are required to have decent credit. Most lenders like to see credit above the 650-690 range.

Letter of Intent

The SBA likes to see a signed letter of intent between the buyer and seller before providing a loan term sheet. Many buyers may find this unsettling that they are entering into an LOI prior to funding approval. A simple fix is to contain language in the LOI that the offer is contingent on receiving acquisition financing.

Borrower Information Form

Found on Form 1919, this form is used to collect information on the principals and key individuals in the business.

Personal Financial Statements

Form 413 is used to provide financial information on the borrower, partners, and anyone with more than 20% equity.

Personal/Corporate Tax Returns (3 years)

The business tax returns are those of the target you are looking to acquire.

Business Financial Statements (3 years)

These include the standard financial statements: Profit & Loss, Balance Sheet, and Cash Flow Statement.

Debt Schedule

A schedule listing all of the debts and liabilities of the business.

Management Experience

Lenders want to see that the borrow has the ability to run the acquired business. Substantial business experience, preferably in the industry of the target, is required.

Debt Service Coverage Ratio

The ratio of cash that is available to service debt and interest payments. Lenders like to see figures above 1.15, and the higher, the better. The debt service coverage ratio can be calculated by dividing Net Operating Income by the Debt Service.

Down Payment

Lenders want to see that borrowers have skin in the game. Lenders typically like to see 20%, though the down payment can be as low as 10% in some cases.

Types of SBA Loans

SBA loans are advantageous for business owners because they typically carry lower interest rates and can have repayment terms of up to 25 years. As of this writing, the SBA offers six different types of loans.

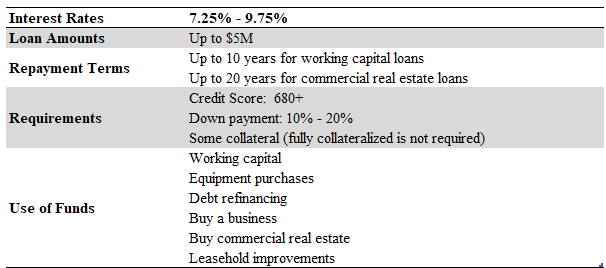

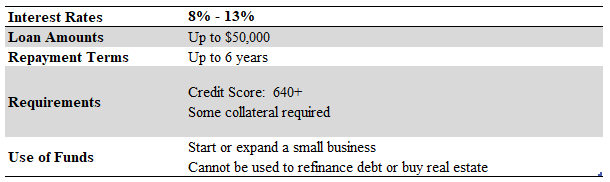

7a Loans

One of the most common types of SBA loans. These loans are ideal for small businesses that need to finance working capital needs. They are flexible and can be used for nearly any business purpose. The low interest rates and long repayment terms may be attractive to the right borrower.

SBA 7a interest rates will vary depending on the borrower’s credit score and the repayment term. Interest rates may be fixed or variable.

The 7a loan does have some fees that borrowers will pay. The SBA guarantee fee is typically 3%-3.5%, a referral fee, the packaging fees, which are usually $2,000 – $4,000, and closing costs. Origination fees in the range of 0.5% – 3.5% are also standard.

7a loans can be funded in 30 – 90 days or more, depending on the circumstances. Payments are made monthly and terms can be from 10 – 20 years. In addition to the criteria discussed here and presented in the table, the SBA will also look for recent bankruptcies, foreclosures, and tax liens.

Within the SBA 7a loan program, two other programs exist. The SBA Express Loan Program was designed to allow borrowers seeking $350,000 or less from select lenders an expedited process. The standard 7a loan application could take months to process. The Express Program guarantees a response to each application within 36 hours. This means that the SBA will notify the lender that you have been approved within this time period. The actual processing and funding of the loan may take longer. Another option is the Advantage Loan. This program is designed for businesses in underserved markets and who meet the eligibility criteria, but have low revenues, low collateral or other reasons that prevent them from qualifying for the full 7a loan. To reduce the risk to lenders, the SBA will guarantee up to 85% of loans up to $250,000 under the Advantage program.

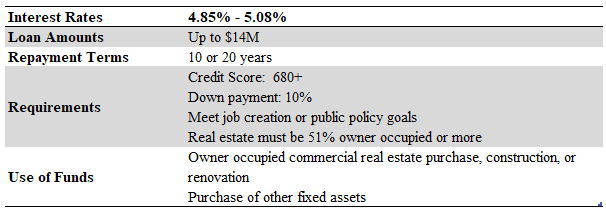

CDC/SBA 504 Loans

The SBA 504 loan is for businesses looking to buy or build owner occupied commercial real estate. Two lenders work together for this type of loan. The first is a bank or traditional lender who will lend up to 50%. The second party is a community development corporation (“CDC”) who will lend up to 40%. The 10% balance is required from the borrower. The borrower must occupy 51% of the commercial real estate and is free to rent out the remaining 49%.

The bank or traditional lender portion of the loan generally carries interest rates of 5% – 9.75% with a 5 – 10 year term. The CDC portion of the loan carries interest rates of around 4.85% for 10-year loans and 5.08% for 20-year loans. The CDC rates are fixed. Borrowers can take out multiple 504 loans for different projects at the same time.

In addition to the requirements shown in the above table, borrowers will also need:

- Tangible net worth < $15M

- Demonstrate the ability to repay the loan on time from the projected operating cash flows

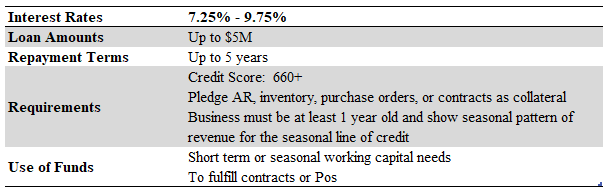

SBA CAPLines Program

The SBA CAPLines Program is designed for businesses that need a revolving line of credit to make recurring payments. These loans provide up to $5 million to small businesses. CAPLines are typically issued to borrowers along with the traditional 7a loan or the SBA 504/CDC loan. A stand-alone CAPLine, while possible, is not very common.

As a revolving line of credit, borrowers are allowed to draw on the CAPLine as needed and they are not required to draw on the if the capital isn’t needed. This provides business owners with a degree of flexibility to meet unexpected expenses and meet changing working capital needs.

Within the CAPLines program is the Small Short-Term Line of Credit which has lower servicing requirements, but limits the credit offered to $200,000.

The five credit products available from the SBA CAPLines program include:

- Seasonal Line of Credit: Up to $5 million for seasonal increases in AR, inventory, or labor.

- Contract Line of Credit: Up to $5 million for materials and labor associated with assignable contracts.

- Builders Line of Credit: Up to $5 million for contractors that build or renovate residential or commercial buildings.

- Standard Asset Based Line of Credit: Up to $5 million for converting short term assets into cash.

- Small Asset Based Line of Credit: Up to $200,000 for converting short term assets into cash. Stricter servicing requirements are waived due to the lower credit line.

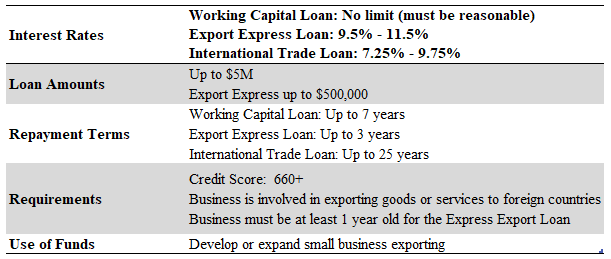

SBA Export Loans

The SBA Export Loans were designed to help small businesses expand their export activities. Origination fees on the loans range from 0.5 – 3.5%, loan packaging fees range from $2,000 to $4,000, and guarantee fees are 3% – 3.5%. While the Export Working Capital loan technically does not have an interest rate limit, they are usually in the 6% – 10% range. The SBA does review each working capital loan and they must see that the interest rate is reasonable. Repayments on the SBA export loans are monthly and time to funding can be 30 – 90 days, or more.

The SBA Export Loans come in three styles:

- Export Express Loan: Helps small businesses with export activities streamline funding, up to $500,000, for working capital.

- Export Working Capital Loan: For small businesses that have a purchase order from a foreign customer.

- International Trade Loan Program: For businesses negatively impacted by imports or businesses that export and need funding for working capital or fixed assets

SBA Microloan Program

The Microloan program was designed to provide loans to non-profit lenders who then loan the funds to non-profit child care centers and for-profit small businesses. The SBA does not guarantee loans made under the microloan program. The non-profit lenders can start by borrowing $750,000 from the SBA in their first year of business. After the first year, they can borrow up to $1.25 million.

The non-profit lender is allowed to set their own interest rates based on the creditworthiness of the borrower and the specific business details. Additionally, the lenders may require a personal guarantee. These loans take 30 – 90 days to fund, but it could be longer is some scenarios. Repayments are made monthly. These loans may require extensive documentation, adding to the approval time.

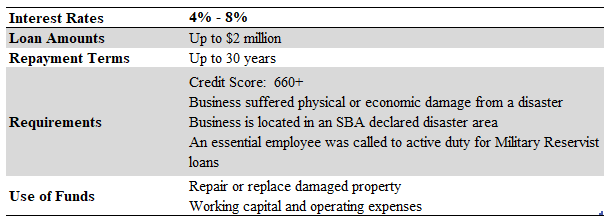

Disaster Loans

The SBA disaster loans can be used to recover from a physical or economic disaster. Borrowers can apply for various disaster loans at the same time.

Interest rates will vary depending on the type of disaster loan taken:

- Business Physical Disaster Loan: 4% – 8%

- Economic Injury Disaster Loan: < 4%

- Military Reservist Economic Injury Loan: 4%

Qualification for disaster loans will be based on the criteria in the above table as well as the specific injury suffered by the business. The physical disaster loans are intended for businesses that have been physically damaged in a disaster area. Economic injury loans are for businesses that have suffered an economic injury or cannot meet normal operating expenses due to a disaster. The military reservist economic loan is for businesses who lose an essential employee due to that employee being called to active duty. For businesses seeking a loan under the military reservist loan program, they should consider how the loan may impact insurance policies, such as key man insurance.

SBA Loans Conclusion

Small businesses may have a tough time finding the capital they need to support and grow their business. Traditional banks may be too risk averse and venture capitalists and private equity firms may not take an interest in smaller businesses. The SBA, by guaranteeing part of the repayment on loans, reduces the risk for lenders and enables them to lend to small businesses that would normally be passed over. For small business owners, an SBA loan presents an opportunity to source the capital needed to run their business at attractive rates and terms.

Sources

[1] Hanna, M. (2018, May 10). SBA Loans: Types, Rates & Requirements. Retrieved September 24, 2018, from https://fitsmallbusiness.com/types-of-sba-loans/

- Covid-19 Impact on US Private Capital Raising Activity in 2020 - May 27, 2021

- Healthcare 2021: Trends, M&A & Valuations - May 19, 2021

- 2021 Outlook on Media & Telecom M&A Transactions - May 12, 2021