M&A Management Meetings: Key Considerations in Discussion & Negotiation

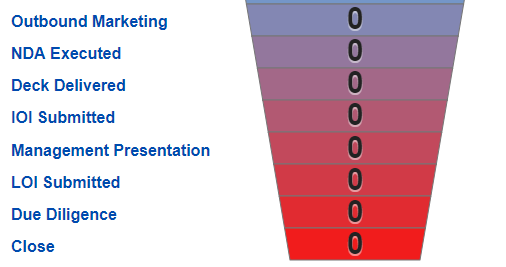

As your M&A deal gets closer to the Letter of Intent stage, your investment banker is likely to start scheduling Management Meetings with all the likely and interested suitors for your deal. Such Management Meetings are typically held on or off-site of the would be seller. On-site meetings are preferred as strategic and financial buyers likely will have a desire to see facilities and ask key questions related to operations. Off-site meetings may be desired by the seller so as not to disrupt operations or alert employees of a potential sale. The Management Meeting phase is a critical step in the business sale process.

In a disciplined and structured sell-side process, your investment banker is likely to scheduled back-to-back Management Meetings with multiple would-be acquirers during a very short window. If your deal represents a high-value target and the investment banker has done his/her job, you will likely have a large number of suitors with which to discuss the business in a face-to-face setting. It is not uncommon to schedule two separate buyer Management Meetings in a single day and have several days of such meetings back-to-back. Scheduling meetings in this way, does several things:

- It helps the buyers know they are not the only game in town. It helps to spike competition and demand for the business, which in investment banking vernacular = valuation boosting.

- It provides a setting for the seller to quickly gauge–in an apples-to-apples format–the various qualitative and quantitative aspects presented by various buyers and investors.

- It helps prevent the deal from getting stale, by keeping deal momentum–an oft overlooked component of good deal making.

- It can save travel and accommodation costs for the investment banker who may be flying out of town for the meetings and may stay for a week or more to be there to assist and advise his client while in the meetings.

Such meetings generally last several hours each and may be followed by meals and drinks. Most bankers are likely to structure the actual meeting time to last no more than four to five hours. This is long enough for a quick “speed date” for both sides to get to know one another and see if there is a general match among the parties. Items up for typical discussion during M&A Management Meetings could include the following:

- History of the company, including stories of the founders and a brief walk down memory lane.

- Quantitative and qualitative motives for a transaction.

- Key financial data metrics, including P&L and balance sheet details and questions.

- Operational questions and discussion surrounding the day-to-day of the business.

- Company strengths, weaknesses, opportunities and threats, including areas for improvement

- Potential areas for cost savings, including synergies between buyer and seller.

- Potential areas for revenue generating opportunities, including synergies between buyer and seller.

- Deal structure points, including anything from valuation to cash at close and everything in between.

While Management Meetings of this kind can get into the weeds, they are often no where near the level of detail the full proctological exam of complete due diligence requires, nor will they typically include “gotchas” unless a buyer is attempting to be disingenuous. In fact, to prevent many of the potential “gotchas” that could occur during Management Meetings, the most prepared investment bankers typically will ask the buyers for their own list of Management Meeting questions that are the most likely to be asked during the meeting. This not only helps the seller prepare for the meeting with confidence, but it also ensures the buyer that s/he is able to extract the detail out of the meeting that is most relevant to them without having to dig later for additional questions that may have been lost in translation.

While the meetings are organized to be as structured as possible, they can often veer down rabbit holes where superfluous and unnecessary detail requests may arise. These often occur naturally as buyers are looking to know as much as they can about the nuances and risks of the business. However, an investment banker can help steer the discussion back on track during such meetings, most often with statements like, “that’s a very deep dive question that can probably wait until due diligence.” Another key take away from being in dozens of such meetings is that Management Meetings are a chance to “bear the soul” of the business. That is, suitors should see the good, the bad and the ugly. While owners will want to paint the prettiest picture for the business, experienced buyers understand that no business is perfect. Candor is a preference to the cagey in a seller’s description of history. Buyers will ultimately be able to see through the facade-like attempts to paint too rosey of a picture. Genuineness and reality are your ally.

Lastly, and perhaps most importantly, Management Meetings are great places to get to know both sides of the transaction, but they are not necessarily the time to start in-depth negotiations for deal terms, especially if the investment banker is running a broad auction and five other buyer meetings are scheduled for the same week. Things like deal valuation and overall structure of the payouts should necessarily be discussed, but such terms should mostly be gleaned from the buyer, not the seller. At this juncture–and if the investment banker has performed his job well enough–the seller is simply assessing a single buyer among many options. In such M&A auction scenarios, it is best to first information gather and get into the details once a more holistic view of all potential and available options.

When it comes time for your business to be auctioned-off to the highest bidder, your investment banker will likely schedule Management Meetings within a window of one to two weeks, either on or off-site, near or at the physical location of your business. These meetings are a great way to break the ice between buyer and seller and provide both parties a chance to familiarize themselves with the opportunity. Buyers often require such personal meetings in order to get comfortable making a more definitive offer for the business. If you are a seller, your investment banker will work with you to create your own buyer question list, answer buyer questions and prepare for the overall experience of M&A Management Meetings.

- Covid-19 Impact on US Private Capital Raising Activity in 2020 - May 27, 2021

- Healthcare 2021: Trends, M&A & Valuations - May 19, 2021

- 2021 Outlook on Media & Telecom M&A Transactions - May 12, 2021