IT Staffing and Consulting: Competitive Landscape

The following is one in a series of reports covering IT staffing and software, a sub-sector for software investment banking.

There are many different competitors within the IT Staffing and Consulting sphere. The focus of this report will be to identify how the market is concentrated, key success factors, cost structure benchmarks, the basis of competition, barriers to entry, and the industry’s globalization.

Market Concentration

Staffing Industry Analysts (SIA) creates a list each year of IT staffing firms with at least $100 million in revenue. The data is based on the year prior. The 2017 list, which was based on 2016 revenue, included 43 firms with a combined revenue of $18 billion.

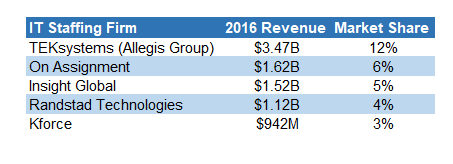

Here are the top five IT staffing firms based on their 2016 revenue[1]:

These IT staffing firms are the largest and account for approximately 30% of the industry in the US. It is important to note that the higher rankings do not necessarily imply better service or greater value to each of the companies’ shareholders.

Key Success Factors

When identifying characteristics among successful firms the following tend to appear.

Successful firms provide various options that align with their unique clients’ needs. For example, On Assignment, the second largest revenue producing IT staffing firm, has a skill-focused recruiting methodology which allows them to quickly identify top local talent in 13 skill disciplines across the entire IT project life-cycle. By utilizing this methodology On Assignment is able to provide their clients with higher caliber candidates and a stronger applicant pool. Apex, On Assignment’s dedicated IT staffing and services company, offers many specialties including application development, technology support, systems administration, project management, business analysis, database development, data science, enterprise software, and quality assurance. Their 65 branch locations with over 3 million technical professionals across North America enable them to achieve this high standard[2].

The top IT staffing firms, like On Assignment, have a network that best matches the talent needs of their clients. These staffing agencies also have a timeline that matches the expectations and needs of their clients. On Assignment is able to quickly identify relevant candidates that match a client’s needs. Typically, a candidate can be found and placed with a client in a matter of weeks. The process may be even quicker if a candidate is currently between jobs.

Finally, the top IT staffing firms are transparent with their clients and provide the highest ROI[3].

Each of these key success factors are the basis for competition in this industry. The firms capable of providing these services the best will typically receive the most clients.

Cost Structure Benchmarks

For the Top Echelon Network recruiting firm, the average recruiting fee is $18,571, the average fee percentage is 22.1%, and the average starting salary is $86,907. For IT positions specifically they average a fee amount of $19,643, a fee percentage of 20%, and an average salary of $93,319[4]. The fees generated by the Top Echelon Network are standard for IT staffing firms. Fees generally vary depending on the position or title that is being filled and the industry in which the client operates. Fees are strategically negotiated based on the value provided to clients. Typically, they are percentage fees, but firms will occasionally accept a flat fee.

Barriers to Entry

Prior to the financial crisis, the staffing industry seemed to have low barriers to entry with low start-up costs and little governance or regulation[5]. Now, the industry is saturated with thousands of companies. This makes it more difficult to charge a premium for premium services. However, because of low barriers to entry, staffing companies do not have to provide formal training like other industries with many regulations. Companies that choose to go the extra mile set themselves apart more easily from their competitors.

Industry Globalization

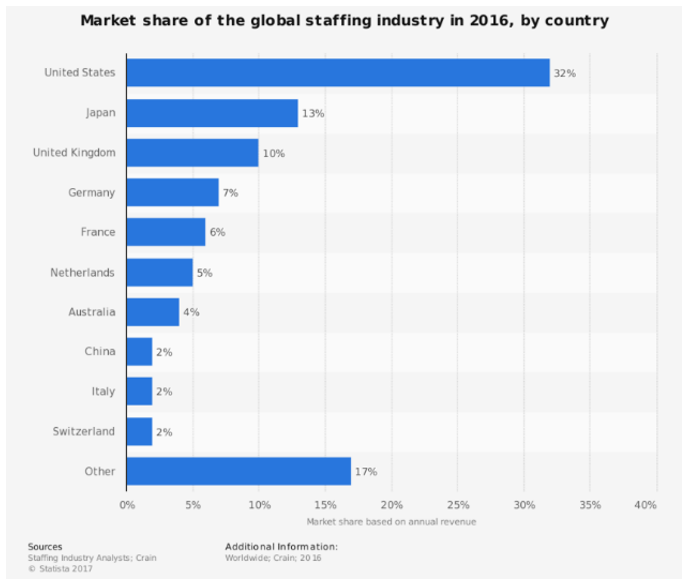

“Global IT staffing generated $59 billion in revenue in 2016, based on SIA estimates, representing more than 15% of the total global temporary staffing market. About half of IT staffing is derived from the US.”[6]

IT staffing represents a significant percentage of the staffing industry. While IT staffing is still most common in the United States, its influence has spread globally, especially in Japan and the United Kingdom.

Figure 1: https://www.statista.com/statistics/495154/staffing-industry-market-share-country/

[1] Timothy Landhuis, 2017. Retrieved from https://www2.staffingindustry.com/site/Editorial/Daily-News/SIA-ranks-largest-IT-staffing-firms-in-US-by-revenue-42915

[2]Retrieved from www.oalabsupport.com/divisions#technology

[3]Retrieved from https://www.adeccousa.com/employers/resources/selecting-a-staffing-provider/

[4]Matt Deutsch, 2017. Retrieved from https://www.topechelon.com/blog/placement-process/typical-placement-recruitment-fees-average/

[5]Ron Hore, 2015. Retrieved from http://blog.hhmc.com.au/2015/11/barriers-to-entry-likely-to-rise

[6]Timothy Landhuis, 2018 https://www2.staffingindustry.com/site/Editorial/IT-Staffing-Report/March-1-2018/Growth-assessment-provides-annual-update-on-the-global-state-of-the-IT-staffing-market/

Austin Stradling contributed to this report.

- Covid-19 Impact on US Private Capital Raising Activity in 2020 - May 27, 2021

- Healthcare 2021: Trends, M&A & Valuations - May 19, 2021

- 2021 Outlook on Media & Telecom M&A Transactions - May 12, 2021