Industrial Real Estate: Transactions

This is the third in a multi-part series that will focus on the transactions and recent deals in the industrial real estate industry, a member of the commercial real estate sector.

Recent Transactions

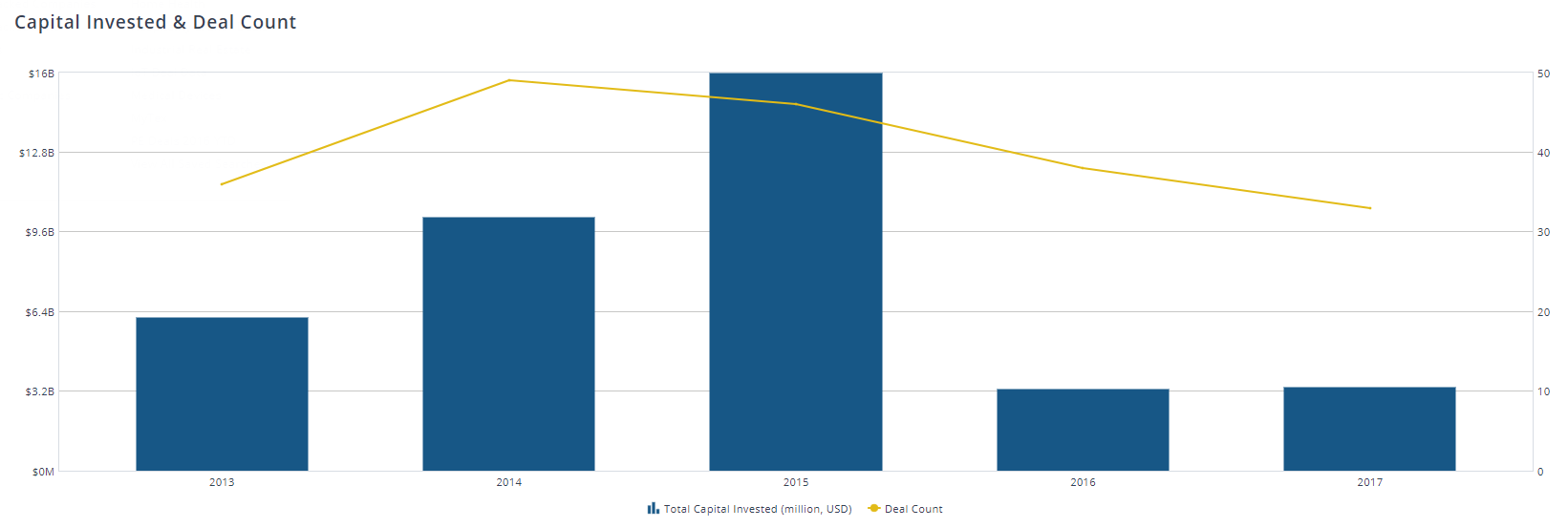

The industrial real estate industry has seen a decline in the number of deals completed and the capital invested since reaching a high of 46 deals receiving $16.0 billion in 2015.

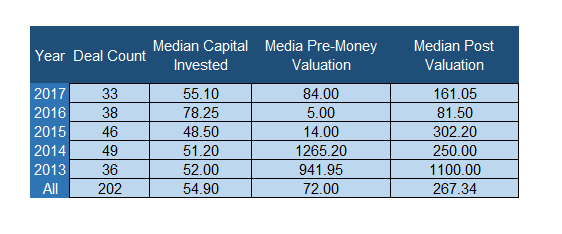

As we can see from the table below, median deal terms for industrial real estate have varied over the past few years.

It can be hard to see any trends from the data above, especially from the pre-money to post valuation median. Two things to notice from the data above are the deal counts. The number of deals hasn’t varied excessively, with an average of 40.4 deals every year over the past 5 years and an average of $57.01 million invested per deal. We can also tell that median deal values are on the rise after 2015 lows, even though the deal count is shrinking.

As for recent investments during the past five years, there have been some constant trends. First, finding a company that has been financed only through being publicly listed or via debt is very rare. A very small percentage of companies in the past five years have done so (about 2%)[1]. Out of all the deals that have occurred in the past 5 years, the two most common types of deals have been M&A and Private Equity (about 24% and 26% of deals, respectively). However, most deals have had a combination of financing in the past and vary according between Debt Financing, Private Equity, M&A and Venture Capital. One interesting point to note is the percentage of the company being offered in the transaction. In the period from 2013 thru 2017, the average percentage of a company being bought was around 91%, with 86% of the deals being full 100% buyouts of the business.

If we look at the type and style of deals over the past 5 years we will notice there is a good deal of variety. From buyouts to M&A to PE Growth, there has been a large variety of the types of deals with the two most popular being Buyout/LBO and Merger/Acquisition. Together these make up roughly half of all the deals.

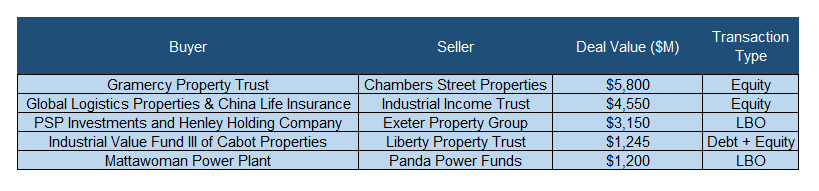

Top Deals Over the Past Five Years

Some notable deals over the past five years include Chambers Street Properties, which was acquired by Gramercy Property Trust for about $5.8 billion and is the largest deal in this sector over the past 5 years. The deal was structured as an equity deal with Gramercy Property Trust shareholders owning a 44% stake in the new entity and Chamber Street Properties shareholders owning the remaining 56%. Another very large deal that was completed recently was Industrial Income Trust’s acquisition by Global Logistic Properties and China Life Insurance for $4.55 billion on Q4 2015. GLP was the lead on this transaction, contributing 70% of the required capital.

Some interesting things to note is that while the median capital invested in this industry over the past five years has been around $55 million, the transactions vary greatly in size and consideration. We can clearly see that some deals go well over that median, creating various outliers in the data set. As far as where these deals are coming from, that varies greatly as well. Some deals are international, like the deal mentioned involving China Life Insurance. International transactions take place in this sector, but participants vary from deal to deal and can come from many geographic areas.

Baxter Gosch contributed to this report.

Sources

[1]PitchBook data found by searching the following keywords: “Industrial Real Estate” OR “United States”. Retrieved July 1st, 2018.

- Covid-19 Impact on US Private Capital Raising Activity in 2020 - May 27, 2021

- Healthcare 2021: Trends, M&A & Valuations - May 19, 2021

- 2021 Outlook on Media & Telecom M&A Transactions - May 12, 2021