Industrial Real Estate: Industry Performance

This is the second in a multi-part series that will focus on the industry performance, outlook, and key external drivers in the industrial real estate industry, a member of the commercial real estate sector.

Industry Performance

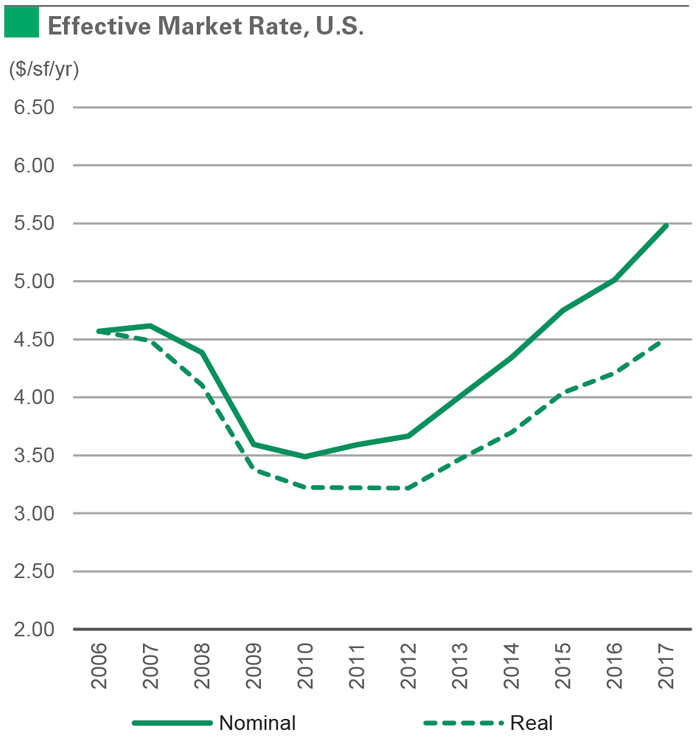

The global industrial real estate market has been steadily growing over the past few years. In 2017 global rental rates rose nearly 7%, surpassing the 4% growth in rental rates during 2016. Across all measured markets, the US led with a 9% growth rate[1]. One of the key factors driving the rate increase is low supply and healthy demand combined with low vacancy rates. The low vacancy rates and expectation of increasing rates throughout 2018 have increased the level of competition among customers in the industry as they try to secure the most attractive rates possible.

The low supply found in the market is due to a lack of land and labor. Naturally, as the supply dwindles, and consumers compete for prime locations the rental rates will continue to rise. In less desirable markets rates are also expected to increase as building owners must factor in replacement and upgrade costs for aging establishments.

E-commerce and the drive to overcome the “last mile” challenge also impacts the demand for prime locations for distribution centers and warehouses. With retail consumers growing increasingly accustomed to same day delivery it is imperative for e-commerce leaders to have strategic locations to meet this expectation. Five years ago, it was estimated that less than 5% of new leases for distribution centers was attributed to e-commerce companies. Today, that figure is closer to 20%[2].

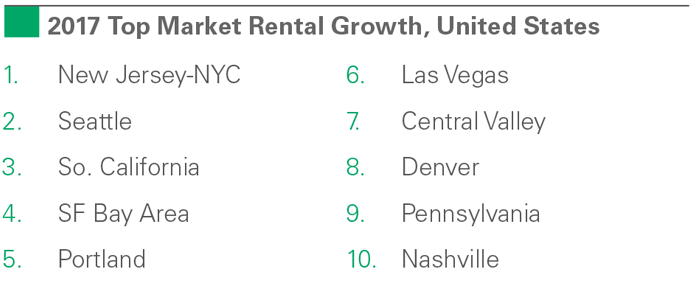

While the U.S. experienced a 9% growth rate, this was not evenly experienced in all markets. Large coastal markets experienced double-digit growth while markets with lower barriers to supply only experienced single-digit growth. Some of the most explosive growth is found on the West Coast where seven of the top-10 performing markets are located. These high-performing areas benefit from being gateways to global trade, having high barriers to supply, and healthy economic growth.

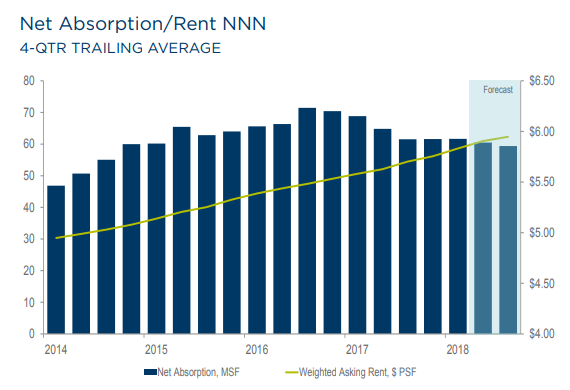

An important metric in the real estate industry is net absorption. The net absorption metric is used to gauge tenant demand and is calculated as total new square footage leased less the total square footage of tenants that no longer occupy their space. The calculation is usually made over a time period, such as a quarter or year. Net absorption is expected to increase over the following twelve months.

Globally, European markets show promise although growth isn’t predicted to be as strong as the U.S. In Asia conditions vary by market and sub-market and require extensive local knowledge to be able to predict future growth. The same goes for Latin America where barriers to supply and local economic conditions play a large factor in the rent growth.

The industry is currently in the mature phase of its life cycle. The products and services provided by the industry are accepted by the market and technological changes are generally moderate.

Industry Outlook

The industrial real estate industry is anticipated to experience continued growth throughout 2018. Low vacancy rates coupled with increased demand and increased interest from investors provide the industry with room to grow.

- E-commerce and Urban Logistics

- Renewed Investor Interest

As the e-commerce industry continues to expand, industrial real estate will feel the benefits. Companies in the e-commerce space are demanding warehouses and distribution centers closer to population clusters. E-commerce companies are changing their distribution model by moving away from a single large warehouse to a hub and spoke model. Obtaining real estate close to consumers and a supply of labor will be critical to success.

Institutional investors are showing renewed interest in industrial real estate properties. Sales volumes have been pushed higher due to increased industrial portfolio acquisitions. As of Q3 2017, YTD investment sales growth was 34.7%, representing $43.9B[4].

The industrial real estate industry will experience change as upgrades and renovations are required to accommodate robots and other automation tools. Warehouses today already have drones scanning bar codes and robots unloading trucks and moving inventory. Automation is a trend that is not likely to fade any time soon. Companies occupying existing facilities and developers who plan to build in the future will all need to factor in these changes.

Key External Drivers

Various external factors will impact the performance of the industry over the next few years.

Treasury Yields

Many construction projects in the industry are funded via debt and the rates charged are influenced by the yield on Treasury bonds. Lower rates are beneficial since the cost of borrowing is cheaper. However, rates have recently been increased and it is expected that the Fed will increase rates again in the future. High rates will increase the cost of borrowing and may pose a threat.

Private Investment

Private investment includes new developments, maintenance, and upgrades. Factors that influence private investments include the need for space by companies, lending standards, and property values. Due to the impact of e-commerce, private companies are competing to build distribution facilities and warehouses closer to areas with a high population. This could present an opportunity for the industry.

Corporate Profits

Corporate profits have been steadily increasing since mid-2017, and 5.9% to reach an all-time-high in Q1 2018[5]. An increase in corporate profits allows companies the option to hire more employees and expand locations. Following the same e-commerce explanation used in the private investment section, the increase in profits could pose an opportunity for the industry.

Baxter Gosch contributed to this report.

Sources

[1]Prologis. (2018, June 06). 2017: A Year of Accelerated Rent Growth. Retrieved June 27, 2018, from https://www.prologis.com/logistics-industry-research/2017-year-accelerated-rent-growth

[2]Thuermer, K. E. (2018, March 07). State of Industrial Real Estate: It’s crunch time. Retrieved June 27, 2018, from https://www.logisticsmgmt.com/article/state_of_industrial_real_estate_its_crunch_time

[3]Tolliver, J., & Salzer, C. (2018, March). PDF. Cushman & Wakefield. Retrieved June 27, 2018

[4]Coghlan, S., Kane, S., & Kroner, P. (2017). PDF. JLL. Retrieved June 27, 2018

[5]Trading Economics. (n.d.). United States Corporate Profits | 1950-2018 | Data | Chart | Calendar. Retrieved June 27, 2018, from https://tradingeconomics.com/united-states/corporate-profits

- Covid-19 Impact on US Private Capital Raising Activity in 2020 - May 27, 2021

- Healthcare 2021: Trends, M&A & Valuations - May 19, 2021

- 2021 Outlook on Media & Telecom M&A Transactions - May 12, 2021