Hospitality and Entertainment: Industry Transactions

This is the second in a multi-part series that will focus on the major transactions in the hospitality and entertainment industry.

The hospitality and entertainment industry is a very broad service super-sector and has seen many notable transactions within recent years. With the use of relevant keywords regarding this sector, the mean deal size in 2013-2018 regarding transactions recorded by PitchBook is $78.65 million[1]. Of the over 2,500 relevant deals listed in PitchBook, 519 have financing from angel investors and 764 are financed by venture capital.

Notable Deals

There are many significant transactions in the hospitality and entertainment industry within the past five years.

21st Century Fox focuses on providing media to a general audience. The company presents an array of films and TV shows available on six continents[1]. The largest deal in 2013-2018 solely by dollar amount is Disney’s acquisition of components of this company. This major deal, if finalized, results in Disney acquiring 21st Century Fox for $71.3 billion. Shareholders voted to push it forward on July 27, 2018[2]. However, there are still several countries involved with the deal that must issue their own approvals for this transaction[3].

The Caesars Acquisition Company was an investment company that focused on developing a portfolio containing gaming and entertainment assets. These assets included three online gaming websites[4]. Caesars Entertainment acquired this company and was consequently removed from the NASDAQ stock exchange[1]. In the $2,457 billion deal in 2013, the company spun off from Caesars Entertainment to pursue acquisitions of new hotels along with their online gaming businesses[1].

First Avenue Entertainment is a holding company that owns the baseball team (Seattle Mariners) and a sports network (ROOT Sports)[5]. In a $1.4 billion deal, a group acquired this company from Nintendo of America in 2016[1].

In 2015, 2016, and 2017, there was a significant uptick in the number of deals made in the hospitality and entertainment industry. As of July 13, 2018, the current year has already delivered more deals than in 2013. The total capital invested is also heavily skewed by the recent $71.3 billion acquisition deal between Disney and 21st Century Fox.

Valuations and Multiples

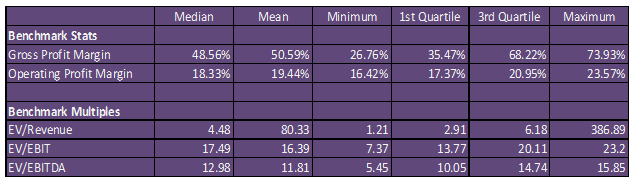

The chart below offers several benchmarks regarding the hospitality and entertainment industry. These statistics are based on ten companies, which had the highest post valuations on Pitchbook and excludes outliers[6].

Trends in the Hospitality Segment

The hospitality segment of the hospitality and entertainment industry is aided by the following[7]:

Consumer Spending

There are signs of continuing growth for consumer expenditures. Purchases in services have been steadily rising throughout the past year, reaching $9,116.079 billion in the second quarter of 2018[8].

The push for experiences over physical products

Spending on durable goods, such as cars and appliances, fell in the first quarter of 2018, from $1,445.717 billion to $1,434.474 billion. However, it should be noted that spending increased again in the following quarter[9]. This offers a potential implication that the spending has instead been allocated to services.

Trends in the Entertainment Segment

The entertainment segment stands to benefit from these valuation drivers[10]:

Virtual multichannel video programming distributors (vMVPDs)

vMVPDs are replacing traditional cable and satellite providers by giving access to television programs through an internet connection instead. These services include DirecTV Now, Sling TV, Youtube TV, and Hulu[11].

Cord-cutting

More consumers are continuing to end their cable and satellite subscriptions in favor of more straightforward offerings.

Targeted Advertising

Companies aim to further capitalize on client information from social media platforms to customize advertising experiences.

International Investment in the Hospitality Segment

In the hospitality segment of this industry, North America received approximately $4.4 billion in investments from several other countries in 2017. This exceeds the $2.6 billion invested by North America. The locations that received the most investment in North America are hubs such as New York. Investment in North America is exceeded by $0.1 billion by Europe[12].

International Investment in the Entertainment Segment

Internationally, the United States has the largest entertainment market, followed by China, which received revenues of $712 billion and $190 billion in 2016, respectively. These revenues are encouraged by significant investments into both countries. The US entertainment market accounts for approximately one-third of the entertainment sector[13].

Adrian Lee contributed to this report.

Sources

[1] PitchBook data found searching the following keywords: “Hospitality” or “Entertainment” or “Arts” or “Accommodation” or “Food Services” or “Performing Arts” or “Sports” or “Museums” or “Historical Sites” or “Amusement” or “Gambling” or “Accommodation” or “Drinking”

[2] Sarah Toy, Shareholders approve Disney’s $71 billion acquisition of Fox entertainment assetsMarketWatch(2018), https://www.marketwatch.com/story/disney-and-fox-shareholders-approve-71-billion-acquisition-of-fox-entertainment-assets-2018-07-27 (last visited Jul 29, 2018).

[3] Edmund Lee & Brooks Barnes, Disney and Fox Shareholders Approve Deal, Ending Corporate DuelThe New York Times(2018), https://www.nytimes.com/2018/07/27/business/media/disney-fox-merger-vote.html (last visited Jul 29, 2018).

[4] Company Overview of Caesars Acquisition Company, Bloomberg.com, https://www.bloomberg.com/research/stocks/private/snapshot.asp?privcapid=242741335 (last visited Jul 30, 2018).

[5] Company Overview of First Avenue Entertainment LLLP, Bloomberg.com, https://www.bloomberg.com/research/stocks/private/snapshot.asp?privcapId=332186350 (last visited Jul 30, 2018).

[6] Includes fuboTV, Hemisphere Media Group, Platform Specialty Products, Giphy, Fusion Media Group, First Avenue Entertainment, Emerald Expositions, STX Entertainment, Vici Properties, and 21st Century Fox

[7] Guy Langford & Guy, 2018 Travel and Hospitality Industry Outlook | Deloitte USDeloitte United States(2018), https://www2.deloitte.com/us/en/pages/consumer-business/articles/travel-hospitality-industry-outlook.html#1 (last visited Jul 30, 2018).

[8] Personal Consumption Expenditures: Services, FRED(2018), https://fred.stlouisfed.org/series/PCESV (last visited Jul 30, 2018).

[9] Personal Consumption Expenditures: Durable Goods, FRED(2018), https://fred.stlouisfed.org/series/PCDG (last visited Jul 30, 2018).

[10] Kevin Westcott & US Telecom, 2018 Media and Entertainment Industry Trends | Deloitte USDeloitte United States(2018), https://www2.deloitte.com/us/en/pages/technology-media-and-telecommunications/articles/media-and-entertainment-industry-outlook-trends.html (last visited Jul 30, 2018).

[11] Jordan Decker, The VMVPD: Cable’s Answer To Cord CuttingAdExchanger(2017), https://adexchanger.com/tv-and-video/vmvpd-cables-answer-cord-cutting/ (last visited Jul 30, 2018).

[12] JLL, Hotel Investment Outlook 2018 Hotel Investment Outlook 2018 , https://capitalmarkets.jll.com/report/hotel-investment-outlook-2018/ (last visited Aug 2, 2018).

[13] Top Market Series: Media and Entertainment, Trade.gov – State Reports – Index, https://www.trade.gov/topmarkets/media-and-entertainment.asp (last visited Aug 2, 2018).

- Covid-19 Impact on US Private Capital Raising Activity in 2020 - May 27, 2021

- Healthcare 2021: Trends, M&A & Valuations - May 19, 2021

- 2021 Outlook on Media & Telecom M&A Transactions - May 12, 2021