What Creates Business Value? Kinetic Value vs. Potential Value

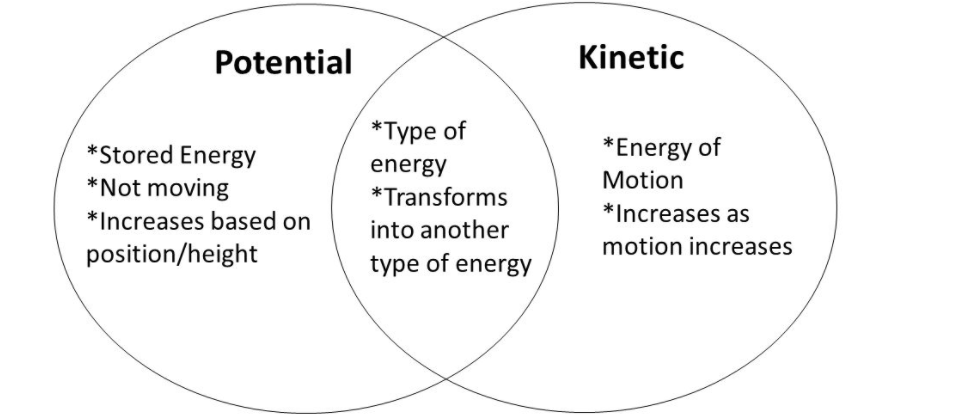

Some deals have actual value (cash flows, assets, etc.) and other deals have potential value (people, ideas, IP, etc.). What a buyer or investor is willing to pay for the latter vs. the former is entirely dependent on the strategic fit. What could be a huge boon for one group, may be a waste of time for another. The fact of the matter is that cash-flow will always be king. The valuation gap between business buyers and sellers is often caused by the difference between kinetic and potential value. Similar to energy in physics business value can be potential value or it can be kinetic. The following table (originally structured for energy) should prove helpful in understanding how the difference between kinetic and potential business value.

| Kinetic | Potential | |

| Definition | The value of a business or asset with respect to the cash flow produced by the asset or business. | Potential value is the stored value in an asset or entity because of its unique market position or configuration. |

| Relationship to Environment | Kinetic value of business is relative to other cash-flowing and non-income-producing assets and businesses in a similar sector. | Potential business value is not relative to the environment of an object. |

| Transferability | Kinetic value can be transferred from one cash-flowing business to another. | Potential value cannot be transferred. |

| Examples | Post-revenue and post-profitable companies. | People, Patents & Intellectual Property, ideas, rights, etc. |

| Unit of Measurement | Multiples of earnings, revenue or customers. | In the eye of the beholder. |

| Determining Factors | Total EBITDA, NWC, other balance sheet items. | TAM, SAM, assumed penetration. |

*EBITDA=Earnings Before Interest, Taxes, Depreciation, Amortization

*NWC=Net Working Capital

*TAM=Total Addressable Market

*SAM=Serviceable Available Market

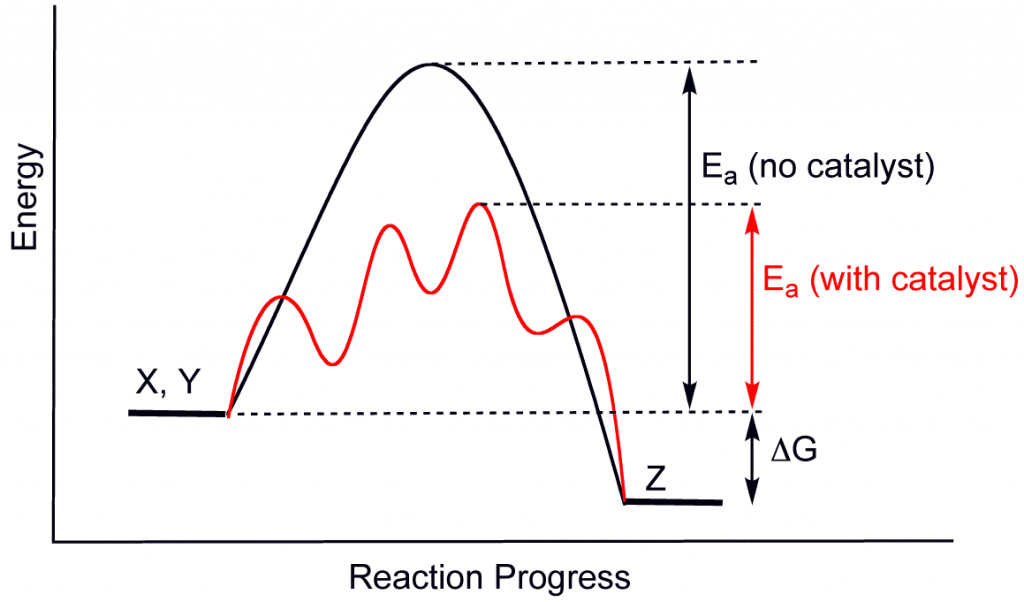

Unlocking potential energy with an asset requires the use of some type of catalyst. In physics and chemistry, a catalyst lowers the activation energy, allowing the reaction to proceed, thereby unlocking the potential energy and converting it to kinetic energy. The graphical example of this is as follows:

Here are some examples of chemical catalysts:

- Potassium permangante can be used to speed up the decomposition of hydrogen peroxide into water and oxygen gas. Each couplet of hydrogen peroxide decomposes into two molecules of water and one molecule of oxygen. When the potassium permanganate is added to the hydrogen peroxide heat energy is released and water vapor typically flows out.

- Platinum in the catalytic converter in automobiles is used as the catalyst which converts carbon monoxide into carbon dioxide.

Similarly, business assets that have potential value require a catalyst to help unlock the true potential of an idea, a patent or an inactive asset. Such catalysts typically include a combination of human and financial capital. Just as in energy, it is much more difficult to transfer value from potential value situations than it is from kinetic value situations. Kinetic value is often required in M&A. Private equity groups like to pay for kinetic value, venture capitalists often make calculated catalyst bets by infusing financial capital. In some cases, adding more value means creating new reactions by increasing sales through added salespeople or even growing the business inorganically through acquisition.

Buyers and investors do not want to pay for something unless they have to. That is, rarely will direct value be placed on potential unless there is confidence in the catalyst to take potential value and turn it into kinetic value. We see a great deal of opportunities from people who believe their idea or asset is “the next Facebook,” “a billion-dollar company” or “a no-brainer investment.” What is the catalyst that will convert the potential into kinetic value? For some, it is more intellectual capital. For others, financial capital is required. For others, a great deal of hustle and sweat equity.

The worst situations is where there is a great deal of perceived potential value in an idea. These are typically situations where an issuer is not self-aware, does not understand the product/market fit, or is your typical wantrepreneur.

For most entrepreneurs, the key is to:

- Understand and calculate the true potential value of the business.

- Find and exploit the catalysts required to move potential value into kinetic business value.

- Once kinetic value has been unlocked, transfer the kinetic value to someone else

Put differently:

- Plan, validate, launch

- Raise Seed, Series X, Growth, Debt OR hire the right talent

- Exit

We assist entrepreneurs throughout this sometimes difficult life cycle and process. What are some other catalysts you have seen? What are other ways to unlock more kinetic value from potential value?

- Covid-19 Impact on US Private Capital Raising Activity in 2020 - May 27, 2021

- Healthcare 2021: Trends, M&A & Valuations - May 19, 2021

- 2021 Outlook on Media & Telecom M&A Transactions - May 12, 2021