When is the Best Age to Sell Your Business and Retire?

The question of when to retire isn’t always an easy one for people to answer and it’s all the more complex for business owners. Whereas most people can, health-permitting, choose a time frame for retirement, business owners will want to sell their business as part of the switch over, meaning it’s not their decision alone.

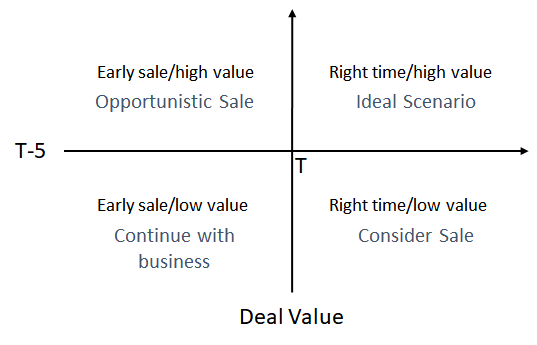

For this reason, the decision should be one that business owners begin making plans several years before it happens. The first step is to choose an age, or a predicted event in the future (the start of a pension, for example) and then subtract five years. Assuming you do this, your decision looks something like the four-square matrix below.

The four squares of the matrix represent different relationships between time and value from the business owner’s perspective, with the X-axis representing time and the Y-axis representing value. T represents a notional age at which the business owner has in mind for a sale, and the X-axis also dissects the Y-axis at a fair sales price.

When selling a business approaching the age of retirement, the relationship between time and value becomes more relevant than at a different stage of a business owner’s life. The four squares of the matrix are described in fuller detail below, outlining in simple terms how the sell and retire decision can be made.

Early Sale/High Value: Opportunistic Sale

Many business owners may be fortuitous enough to receive an attractive offer for their business over the course of their time at the helm. In an earlier phase of the life-cycle of the business, these are rarely high enough to be attractive: the business will be growing quickly and it suggests an exciting career ahead. Later on is different.

If an attractive offer is received in the 5-year period before an ideal time for retirement, business owners have to give it serious consideration. While it may be a little bit sooner than they were hoping to sell, by not accepting, the business owner runs the risk of not receiving a similarly attractive bid at the right time. An opportunistic sale is a good decision in this scenario.

Early Sale/Low Value: Continue With Business

The buyer that approaches with a deal that undervalues the business in the five years before retirement is likely to be a skillful one: Even if the proposed deal doesn’t reach what is deemed an acceptable value, by mere fact of the timing, maybe a part of the business owner is already considering a sale in earnest.

However, the advice here would be not to jump in – continue with the business. If it’s on a solid footing, and there are still aspects which can be improved, such as quality of earnings or ensuring that a succession plan is in place that allows the current owner to leave the company with little or no friction for the new owner when that time comes.

Right Time/Low Value: Consider Sale

Of all the squares, this is easily the most difficult one to negotiate. It may also be the most common: Entrepreneurs who have spent a lifetime building their business – and hopefully, taking a lot of value from that along the way – can’t bear the idea of seeing it go for less than what it’s worth to them, and unfortunately, that’s often not what it’s worth to someone else.

Hard questions need to be asked here, such as: “how long am I prepared (or physically able) to wait until the right offer comes along?”, “how likely is it that a better offer will arise in that timeframe?” and ultimately, “am I ready for an outcome which doesn’t involve selling this business?”

Right Time/High Value: Ideal Scenario

As the label says, achieving the right price at the right time is the ideal scenario for any business owner. How likely convergence of time and value is to happen depends on a combination of exogenous factors and thankfully, factors within the control of the business owner as well.

In a coming article, we discuss some of the steps that business owners can take before a sale in order to maximize the value of their company. As with any value maximizing steps, it can be a good idea to implement them whether a sale is being considered or not but when retirement is approaching, they become especially pertinent.

- Covid-19 Impact on US Private Capital Raising Activity in 2020 - May 27, 2021

- Healthcare 2021: Trends, M&A & Valuations - May 19, 2021

- 2021 Outlook on Media & Telecom M&A Transactions - May 12, 2021