1031 Tax-Deferred Real Estate Exchange

Section 1031 of the United States Internal Revenue Code (IRC) allows for capital gains tax liability to be deferred when a taxpayer exchanges real property of a like-kind. The property must be used in trade or business for either investment or productive use. Real property held primarily for sale is excluded. For those in the real estate sector, this would typically prevent “flippers” and private developers from using a 1031 exchange. “Like-kind” is a vague term that may cause confusion. Generally, “like-kind” refers to property that is exchangeable with another property and refers to the nature or character of the property and not its grade or quality[1].

Before continuing, it should be noted that 1031 exchanges can be used for other forms of real property; however, this post will focus solely on real estate.

Flavors of 1031 Exchanges

- Simultaneous Exchange

The investor exchanges the current property for a like-kind property in a single day. This style of exchange is not very common as it requires two parties to want the property currently held by the other. As can be imagined, this would be a rare occurrence indeed.

- Delayed Exchange

Of the four types of exchanges mentioned here, the delayed is the most popular. Investors have up to 180 days to select a replacement property after the sale of their original property.

- Reverse Exchange

The reverse exchange is tricky to execute. The investor will essentially be buying a property and paying later. The rub here is that the transaction must be all cash and banks typically don’t like to lend to investors conducting a reverse 1031 exchange.

- Construction or Improvement Exchange

If an investor happens to select a property that costs less than the property they just relinquished, then a construction or improvement exchange may be a suitable option. The investor would be allowed to build upon or improve the property using the balance of the funds from the exchange.

1031 Exchange Process

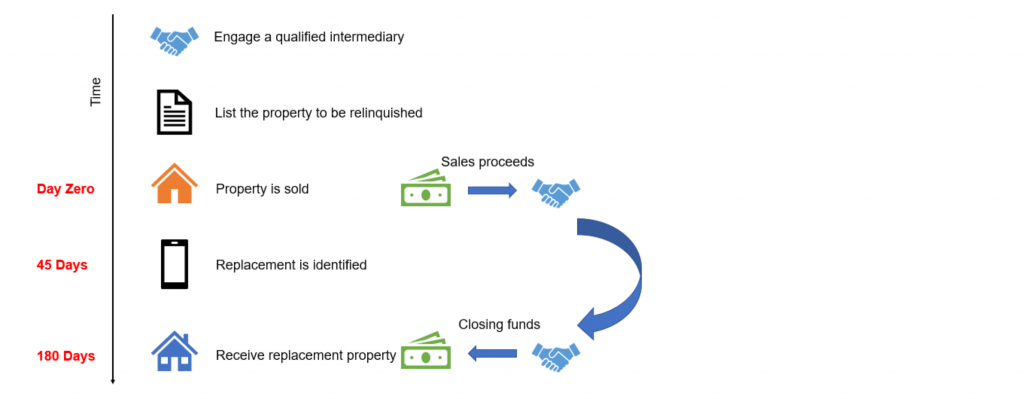

As is the case with many financial transactions a one-size-fits-all procedure does not exist for a 1031 exchange. The below represents the steps of a typical exchange. Investors should always consult a tax professional before engaging in an exchange and consider their individual situation.

First, identify a qualified exchange intermediary. The qualified intermediary will help ensure the proper execution of documents and may aid in the acquisition and transfer of the relinquished and acquired property[2].

Second, the property to be relinquished must be listed. It is important to work with both the potential buyer and a qualified intermediary to ensure that the purchase and sale agreement for the relinquished property contains 1031 specific language.

At this point the investor will enter into an exchange agreement[3] with the qualified intermediary. In a typical home sale, the seller would receive funds and can then decide to purchase a new property. This results in two separate transactions (the sell and the buy). A 1031 exchange will combine these two actions into one. The agreement will name the intermediary as the principal in the sale of the relinquished property as well as the principal in the purchase of the exchange property.

Once a seller is identified and the escrow on the relinquished property closes the qualified intermediary will receive the funds. The day that the escrow closes will be called Day Zero and the clock starts ticking to complete the exchange. The investor now has 45 days to identify a replacement property and 180 days to acquire the property. The investor can nominate more than one property, up to three, as a replacement and typically all that is required to meet the identification requirement is an address or description of the property.

Once the desired property has been selected the parties will enter into an agreement to purchase the replacement property. Similar to the sale of the relinquished property, the intermediary will be listed as the principal buyer.

Finally, once all the conditions have been met the intermediary will transfer the funds received from the relinquished property to an escrow account for the replacement property. The seller deeds the replacement property to the investor before receiving funds from the escrow account.

The investor will be required to file Form 8824[4] with the IRS in the tax year in which the exchange occurred. Other documents may be required by the investor’s state.

Timing Rules

It is critical to understand and stay within the time limits set forth by the IRS. Failure to do so could result in the entire gain being a taxable event[5]. The first deadline occurs 45 days after the sale of the relinquished property. The investor must identify the replacement property in writing, sign the document and deliver it to the qualified intermediary.

The next deadline takes place 180 days after Day Zero (not 180 days after the 45 day deadline). By the 180 day deadline the replacement property must be received and exchanged.

If executed correctly, a 1031 exchange can allow an investor to exchange like-kind property and defer capital-gains taxes. However, it is necessary to have a thorough understanding of the Internal Revenue Code or a knowledgeable intermediary when executing this strategy.

[1] 1031 Exchange Glossary | 1031 Tax Deferred Exchange Definitions | Terms for Section 1031 Tax Deferred Like Kind Exchanges | EXETER 1031 Exchange Services, LLC |, http://www.exeter1031.com/1031_exchange_glossary.aspx#top (last visited Mar 15, 2018).

[2]https://www.law.cornell.edu/cfr/text/26/1.1031%28k%29-1

[3]https://www.americanbar.org/newsletter/publications/law_trends_news_practice_area_e_newsletter_home/savetaxdollars.html

[4]https://www.irs.gov/pub/irs-access/f8824_accessible.pdf

[5]https://www.irs.gov/newsroom/like-kind-exchanges-under-irc-code-section-1031

- Covid-19 Impact on US Private Capital Raising Activity in 2020 - May 27, 2021

- Healthcare 2021: Trends, M&A & Valuations - May 19, 2021

- 2021 Outlook on Media & Telecom M&A Transactions - May 12, 2021