Software Staffing & Consulting: M&A Transactions, History & Trends

This is one report in a series covering software mergers and acquisitions, including deals in staffing in information technology companies in the United States.

Staffing continues to be a hotspot for software M&A transactions because of the value that it creates for individuals and companies. In this report, the following items will be discussed about the transactions of an IT Staffing & Consulting firm: (a) historical transactions, (b) major buyers and buyer trends, (c) valuations and multiples, and (d) notable deals.

Historical Transactions

In 2017, there were 88 staffing firm transactions announced. Of those transactions, Healthcare and IT staffing firms were the most frequently targeted segments.[1] Staffing Industry Analysts’ Database Tool holds information about 847 transactions that occurred between January 2014 and December 2017.[2]

According to Duff & Phelps, the number of staffing deals in 2017 totaled to 139, ~14% increase from 2016. Figure 1 represents Duff & Phelps’ yearly staffing transaction volume from 2007 to 2017. Figure 2 shows the percentage of staffing transactions per industry.

Fig. 1 (left), Fig. 2 (right) Source: https://www.duffandphelps.com/-/media/assets/pdfs/publications/mergers-and-acquisitions/industry-inserts/staffing/staffing-industry-ma-landscape-winter-2018.ashx

Because the economy is in the middle of a recovery cycle, the current demand for temporary jobs has increased; therefore, M&A activity in the staffing industry has increased over the last few years.[3]

Major Buyer and Buyer Trends

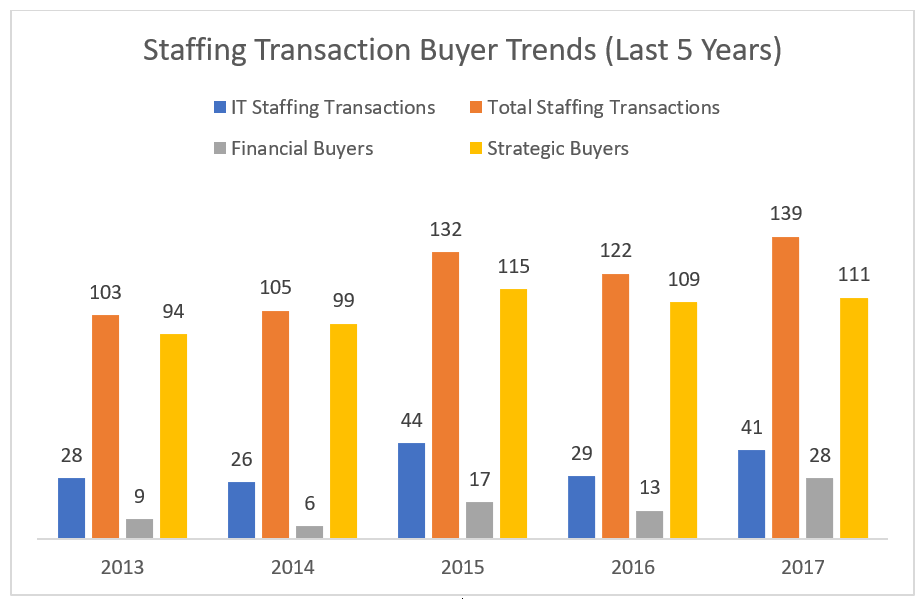

Staffing companies are generally acquired by strategic buyers. From the 139 reported transactions in 2017 (see Fig. 1), 20% were obtained by financial buyers and 80% by strategic buyers.[4] Because financial and strategic buyers’ processes differ, each buyer valuates firms differently.[5] Figure 3 compares financial buyers to strategic buyers for staffing transactions for the last five years.

Fig 3 Source: https://www.duffandphelps.com/-/media/assets/pdfs/publications/mergers-and-acquisitions/industry-inserts/staffing/staffing-industry-ma-landscape-winter-2018.ashx

Financial buyers. Financial buyers include “private equity firms, venture capital firms, hedge funds, family investment offices, and ultra-high net worth individuals.”[6] These firms are looking for a return on invested capital. Generally, financial buyers acquire firms that can generate cash flow on their own.[7]

Strategic buyers. Strategic buyers are operating companies that acquire other firms to integrate the firm into its own operations to increase its primary revenue stream. Also, strategic buyers may acquire another company with unrelated operations to diversify revenue sources.

Valuations and Multiples

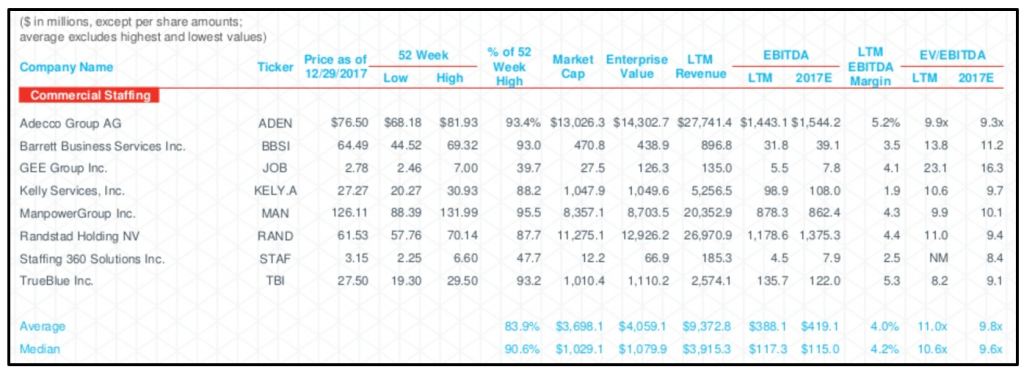

The following table (Fig. 4) represents public trading statistics for eight staffing companies. This chart includes stock prices, market capitalization, enterprise value, and other valuation ratios to represent multiples.

Fig. 4 Source: https://www.slideshare.net/DuffandPhelps/staffing-industry-ma-landscape-winter-2018-87565633

The data shows that the average EV/EBITDA multiple for these companies is 9.8x. According to Valuation Academy as of January 2014, the average EV/EBITDA multiple for industries such as computer services, information services, and telecom services are 9.51, 15.21, and 7.42, respectively.[8] A relatively high EV/EBITDA means that the company is overvalued; versus a low multiple, which means the company is undervalued.[9]

Notable Deals

In the fourth quarter of 2017, Vaco, a staffing firm, was acquired by Olympus Partners, a private equity firm. Vaco provides consulting and staffing in the accounting, finance, technology, healthcare, operations, and administrations sectors. The amount of the acquisition is not publicly known, however, Vaco’s revenue is projected to surpass $458 million in 2017.[10]

Accretive Solutions is a consulting, staffing, and outsourcing services firm that was acquired by Resources Connection Inc. in the fourth quarter of 2017. Resources connection paid “$19.4 million in cash plus 1.15 million shares of restricted common stock for the firm.”[11]

Conclusion

The Staffing Industry continues to grow with the economy. IT staffing and consulting represents the top sector of M&A transactions for staffing companies in the United States. Strategic buyers acquire staffing companies to improve their company’s margins and to create different revenue streams. IT staffing transactions are growing and expanding in the market.

[1] Staffing Industry Analysts, 2017. “Staffing Mergers & Acquisitions: 2018 Update.” Retrieved from: https://www2.staffingindustry.com/site/Research/Research-Reports/Americas/Staffing-Mergers-Acquisitions-2018-Update. Accessed February 27, 2018.

[2] Ibid.

[3] Madison Street Caapital, 2017. “2017 Staffing Industry.” Retrieved from: http://madisonstreetcapital.com/blog/id/86. Accessed February 27, 2018.

[4] Duff & Phelps, 2017. “Staffing Industry M&A Landscape.”

[5] Boyte, Cody, 2014. “5 Differences Between Financial and Strategic Buyers.” Retrieved from: https://www.axial.net/forum/5-differences-financial-strategic-buyers/. Accessed February 27, 2018.

[6] Ibid.

[7] Ibid.

[8] Valuation Academy, 2014. “Industry Specific Multiples.” Retrieved from: http://valuationacademy.com/industry-specific-multiples/. Accessed March 1, 2018.

[9] Y Charts, 2017. “EV/EBITDA” Retrieved from: https://ycharts.com/glossary/terms/ev_ebitda. Accessed March 1, 2018.

[10] Duff & Phelps, 2017. “Staffing Industry M&A Landscape.”

[11] Ibid.

Wesley Bosco, Austin Stradling, Colin Cole and Joseph Zhang contributed to this report.

- Covid-19 Impact on US Private Capital Raising Activity in 2020 - May 27, 2021

- Healthcare 2021: Trends, M&A & Valuations - May 19, 2021

- 2021 Outlook on Media & Telecom M&A Transactions - May 12, 2021