Property and Casualty Insurance: Trends, Risks and Opportunities in Mergers and Acquisitions

Historically, the property and casualty (P&C) insurance industry has been characterized by stable demand and predictable cash flows, with high barriers of entry.

Current trends, such as autonomous vehicles and auto and home ownership rates, threaten the certainty of performance in the industry. P&C insurance companies, through M&A activity or entering other lines of business, are adapting and finding ways to increase profitability.

Economic growth and technological innovation are key drivers of future growth in the industry. New regulatory changes, such as rising interest rates, will increase investment income, which will help to mitigate underperforming underwriting results in the largest line of revenue for the P&C insurance industry—personal automobile insurance.

The P&C insurance industry has become an indispensable part of risk management in the U.S. economy. Adaptations to innovative technology and trends in consumers will help firms in this industry continue to generate stable and predictable cash flows.

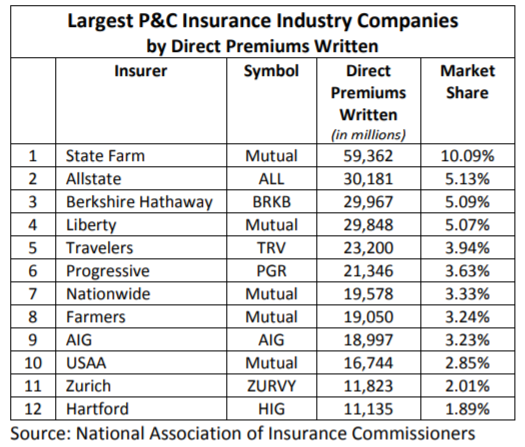

Industry Overview

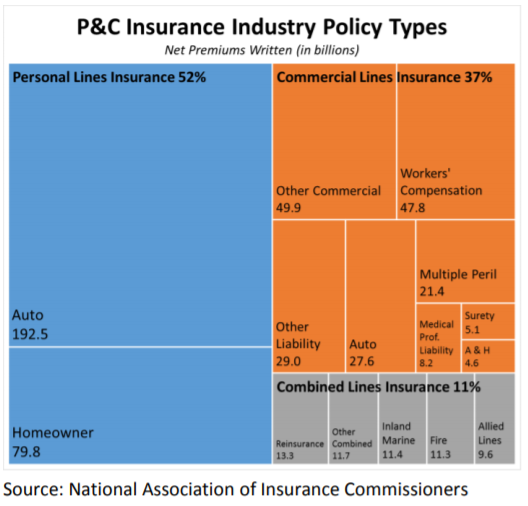

Property and casualty insurance companies are in the business of underwriting insurance policies for businesses and individuals to cover physical property and liabilities, such as homeowner insurance, automobile insurance, and workers’ compensation. P&C insurance companies generate revenue in two ways: underwriting and investment income. Underwriting insurance profit is measured by the difference between premium and fee income and the payments of policyholder claims. Investment income is generated by pooling policyholder premiums together and investing in liquid assets such as equity and fixed income securities. Property and casualty insurance firms share the risk of large groups of people. When policyholders experience a loss of property or need coverage for a liability, P&C insurers compensate the policyholders according to the terms of the policy.

Trends

Autonomous Vehicles

Technological advancements in the production of autonomous vehicles threatens the usually steady P&C insurance industry. Industry analysts expect the structure of auto insurance could potentially change, as the liability will transfer from the individual driver to automobile manufacturers or even municipalities. Additionally, automobile accidents caused by human error are estimated to dramatically reduce with the increasing use of autonomous cars. Currently, about 90% of all accidents are said to be caused by human error. Fewer accidents would save insurance companies money in dealing with claims; however, premiums would likely decrease. The implications of autonomous vehicles are still relatively unknown due to the uncertainty as to which entity, individuals or manufacturers, will bear the liability.

Motor Vehicles in the U.S.

In America, the average age of vehicles currently on the road is 11.6 years, and trending upward. Higher quality cars and more long-term financing options are speculated to be reasons behind this number. Consumers have also been trending towards keeping vehicles for longer. In 2015, consumer’s length of ownership increased to an average of 79.3 months, a 1.5 month increase from 2014. Generally, older vehicles offer lower premiums to policyholders, consequently less profitable for P&C insurers. With the average age of cars on the road increasing yearly, some consumers may elect to forgo full-coverage insurance on their vehicles.

In 2016, new car sales reached a high of 17.9 million. Rising interest rates in the economy and suppressed demand for new vehicles have contributed to the slight expected decrease in 2017, to 17.2 million.

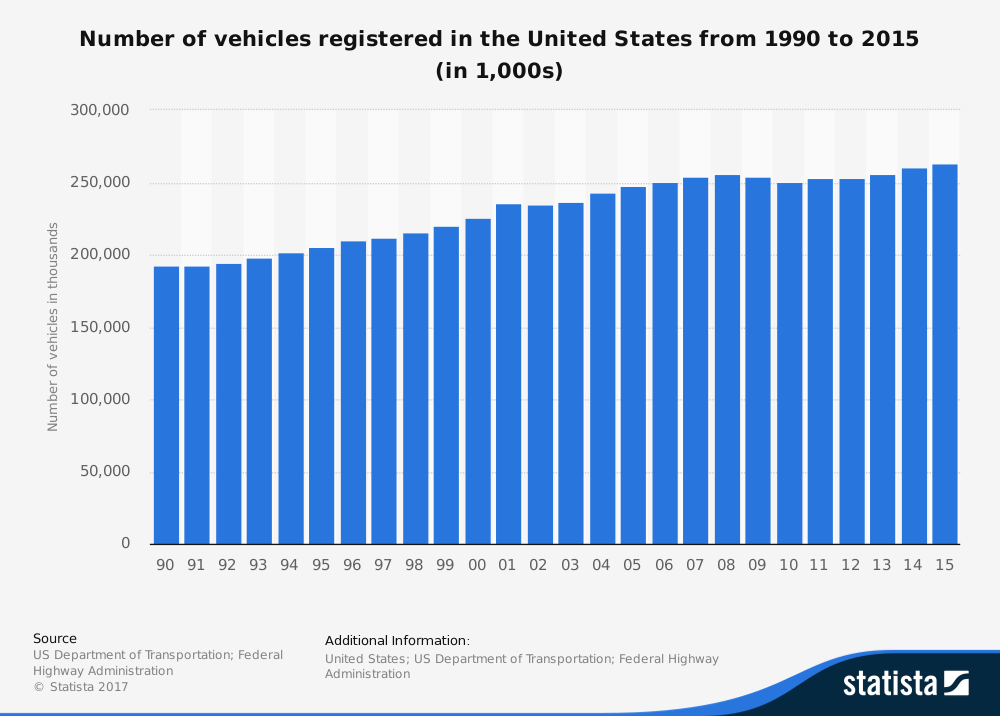

The number of registered motor vehicles is the dominant indicator of demand for auto insurance. The number of vehicle registrations has been steadily increasing from 1990. As shown, vehicle registrations in 2015 climbed over $250 million.

Although this number has been steadily increasing, expectations project new car sales to decline over the next five years to 2022. Private auto insurance is the largest line of business for the property and casualty insurance industry. Declining new car sales could potentially slow revenue growth for P&C insurance firms.

Technology

Recent technology has been slowly adopted by the P&C industry. Some firms have adopted telematic technology that allows a tracking device to be installed in vehicles to track information to estimate usage-based insurance. By 2023, estimates suggest that 142 million consumers will have policies written from usage-based insurance.

Homeowners in the United States

Homeowners’ insurance represents the second-largest revenue generator for P&C insurance companies. Found below is the breakdown of additional products and services that P&C insurers provide:

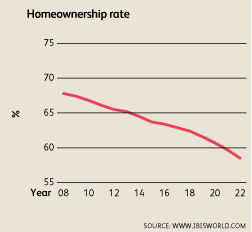

The homeownership rate has been a consistent negative trend for the industry. Since 2004, the United States homeownership rate has consistently decreased. As shown below, this trend is projected to continue through 2022:

Homeownership rates are not expected to increase, in part due to the higher cost of housing. Expectations for increased interest rates will also make mortgages more expensive. Younger people are renting longer instead of buying—a significant trend given that only 37% of renters elect for renter’s insurance, in contrast to 95% of homeowners electing for homeowner’s insurance.

Transactions

The property and casualty market is highly competitive. M&A in the P&C insurance industry is primarily driven by the inability to generate organic growth, searching for cost cutting synergies, and gaining access to new technology, such as InsurTech startups. In 2017, industry M&A trends showed that many P&C firms did just this—looking to buy smaller, specialized firms to uncover economies of scale. The acquisition of OneBeacon by Intact Financial, as shown in exhibit 1.4, is an example of this trend.

Source: Bloomberg

Industry sources expect M&A activity will continue to encompass small- to mid-sized targets. However, rising valuations in the current M&A market could potentially make these acquisitions become less attractive.

Opportunities

Regulatory Changes

Change in regulatory policies, including raising interest rates, could reduce insurer costs, while also contributing to increased investment returns. The Fed is expected to increase rates again in December. Due to P&C insurance company’s exposure into the equity and fixed income securities, P&C insurers face significant opportunities or risks with adjustments in the Fed Funds Rate. Higher interest rates will erode some value in the fixed income portfolio that P&C insurers hold; however, industry experts believe the decrease in the value of the fixed income portfolio would be offset by an increase in investment income. In the next five years until 2022, the P&C insurance industry’s investment income is expected to steadily increase due to the growth of the economy and slow interest rate rises. In addition to interest rate changes, proposed changes of Dodd-Frank could create potential compliance-saving opportunities for P&C insurers.

Cyber Security

Cyber security provides and area of growth for property and casualty insurance companies. Currently, only one-third of U.S. companies provide stand-alone cyber security insurance policies. P&C insurance companies will face difficulty in creating underwriting standards across the diverse landscape of cyber hacks. Analysts believe that P&C insurers who can adapt this technology quickly will be positioned well for future growth.

Risks

Autonomous Vehicles

As mentioned, the introduction of autonomous vehicles could provide risks for the P&C insurance industry. As the technology of autonomous vehicles improves and adoption of these vehicles emerges, the uncertainty as to which entity is responsible for the liability will unfold, and the market will be able to better predict the true influence autonomous vehicles will have on the property and casualty insurance industry.

Ownership Rates

Millennials have trended towards renting longer and delaying ownership of vehicles or homes. If this trend continues, P&C insurers will be heavily affected and will have to adapt to the unique environment.

Automobile Loss Claims

Higher employment in recent years has been one factor that has caused people to drive more and incur higher repair costs and claims. Collision claim frequency has increased in each of the past three years. Consumers are driving more, often driving more distracted due to the increased use of cellular and electronic devices in vehicles. Though premiums have risen 7-10% in 2017, higher claim frequency has driven down profitability in the industry.

Natural Disasters

Property and casualty insurers often offer coverage to businesses and households for catastrophic events. Insurers set aside capital reserves as precaution, hurting profitability. Hurricanes Irma and Harvey are examples of this risk.

Works Cited

Alex Buczynski, Alex Buczynskierieinsurance.com(2014), https://www.erieinsurance.com/blog/insuring-old-cars (last visited Nov 22, 2017).

Anthony Gambardella, Property, Casualty and Direct Insurance in the US, IBISWorld(2017), http://clients1.ibisworld.com.erl.lib.byu.edu/reports/us/industry/default.aspx?entid=1325 (last visited Nov 18, 2017).

Number of cars in U.S., Statista, https://www.statista.com/statistics/183505/number-of-vehicles-in-the-united-states-since-1990/ (last visited Nov 22, 2017).

Justin Svenson, Property & Casualty Insurancewww.biz.uiowa.edu(2017), https://www.biz.uiowa.edu/henry/download/research/PC_Insurance_2.pdf (last visited Nov 22, 2017).

The M&A Market for P&C Insurers: 2017, The M&A Market for P&C Insurers: 2017 | IRMI.com, https://www.irmi.com/articles/expert-commentary/MA-market-for-PC-insurers-2017/ (last visited Nov 22, 2017).

Jack Walsworth, Average age of vehicles on road hits 11.6 yearsAutomotive News, http://www.autonews.com/article/20161122/RETAIL05/161129973/average-age-of-vehicles-on-road-hits-11.6-years (last visited Nov 22, 2017).

Contributors to this report:

Brayden Willie

- Covid-19 Impact on US Private Capital Raising Activity in 2020 - May 27, 2021

- Healthcare 2021: Trends, M&A & Valuations - May 19, 2021

- 2021 Outlook on Media & Telecom M&A Transactions - May 12, 2021