Why Different Business Buyer Groups Matter

The pantheon of business buyers are as diverse as general populous. Understanding who these groups are and how each may view your business is an important aspect when considering a business sale. This is a continuation of a previous article where we discuss the difference between strategic and financial buyers.

Strategic Buyer

Most commonly this will be another company either within or outside your industry. Many larger, slower growing businesses actively pursue acquisitions as part of their core strategy since buying a faster growing business rather than re-investing profits back into their own can yield a better return.

Such a buyer will also be looking to eliminate redundancies between the two companies (such as accounting, admin, human resources) as cost-cutting measures. If you are an owner looking for a fair value or perhaps even a lucrative exit and the future direction of your business or staff is not the primary concern, then this route may be ideal.

Financial Buyer

This is a bit of a catch-all category which encompasses several different types of institutional buyers with varying characteristics. We will discuss this more in-depth in a moment.

Holding Company

Just as the name implies these businesses (or corporate structures) exist for the sole purpose of owning other businesses – think Russian doll but for operating companies.

Oftentimes these will be the poster child for “financial buyers” as hold co.’s typically look to purchase long standing, systematized businesses with existing management teams in place who are willing to stay on through a sale and beyond. Definitely a worthwhile avenue to pursue should you or family members wish to continue in the business after extracting equity in the form of a cash or combination of cash/equity sale.

Private Equity

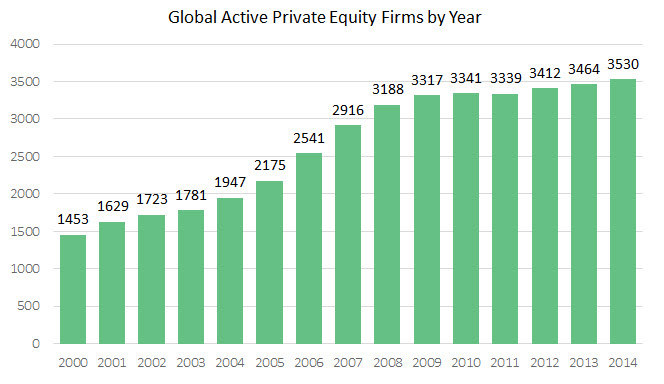

The number private equity (PE) firms has grown by over 140% since the year 2000.

Source: Pitchbook Data, Inc.

There is now a PE firm dedicated either exclusively or semi-exclusively to practically every large industry group and size of business. These firms bring with them financial resources and industry specific expertise making them a preferred option if seeking only a partial exit or a short/mid-term financial sponsor.

Family Office

Similar in structure to a private equity firm, but with the important distinction that instead of being backed predominantly by institutional investors (limited partners); these firms are the investment vehicle of a single wealthy family or high net-worth individual.

Since multi-generational wealth preservation is the primary focus as opposed to any one year’s returns, these investor’s longer time horizons makes them less involved in day to day operations and also more conservative in their capital allocation – most of the time. What does this mean for you as a seller?

A cash sale. Since such personal investment vehicles tend to shun debt and secondly, perhaps a lower valuation multiple offered than more aggressive counterparts such as strategic buyers and PE firms. However, family offices all behave very differently, so structure of a family office deal is much less predictable.

Operational Buyer

This will be an entity or individual(s) who will actually be actively involved in the day to day operations of the business after a sale is completed. These are typically buyers of smaller companies, coming from internal management or external acquisition. Their differing nomenclature is derived from both the source of capital as well as the origin of new ownership.

Search Fund

We are getting a bit esoteric now as search funds are relatively newer investment vehicles (first conceived in 1984). They consist of entrepreneur(s) who raise funds from investors who are seeking exposure to private investments in the first stage and then once funds have been raised and a target company identified, take operating roles at the acquired business in the second stage.

An adequately backed search fund is a great option for owners wishing to retire and sell their business to someone still in their youth that will take the torch and run with it over the long-term.

Employee Stock Option Plan (ESOP)

ESOPs represent one of the most sought after, but toughest to execute of all exit strategies. The familiarity, comfort, and confidence are there as you know and work alongside the people – after all whom better to takeover the business than someone who intimately understands it right?

Unfortunately, the cold, hard truth is that unless such a decision is made relatively early on in the company’s life and an employee stock option plan (ESOP) is put in place to gradually transfer the company’s equity over to long-time employees then the capital necessary for a sale likely will not be available.

The one exception to such a dilemma is the management buyout (MBO). Whereby a company’s existing managers or senior staff forms a legal entity to acquire all or part of a company from its existing owners. The catch here is that the financing required may be not insubstantial – depending upon the size of the business and it will oftentimes be a combination of equity/debt from the financiers, buyers, and perhaps even the sellers in the form of an earn-out or note. Of course, obtaining such financing from sponsors is easier said than done as you may have guessed since it is prevalent only among larger private and public companies but not so much for a middle-market business and basically non-existent for anything smaller.

Given the multitude of choices summarized above, one can see why exit planning and taking the time to consciously and deliberately think about the most suitable sales process long before you actually need to sell often turns out be a very profitable endeavor.

- Covid-19 Impact on US Private Capital Raising Activity in 2020 - May 27, 2021

- Healthcare 2021: Trends, M&A & Valuations - May 19, 2021

- 2021 Outlook on Media & Telecom M&A Transactions - May 12, 2021