Search Funds Services for Company Acquirers

Entrepreneurs come in all different shapes and sizes and from all over the world. One thing they have in common is that they are willing to risk everything on a new venture that has a high probability of failure. What about the individuals who want to run a business, but are more risk-adverse than those starting from scratch? The answer may lie in the search fund investment model.

Search Funds Explained

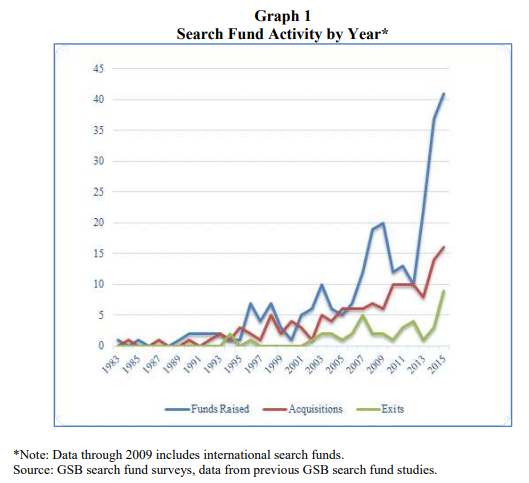

The search fund model was introduced in 1984 by H. Irving Grousbeck, the Director of the Center for Entrepreneurial Studies at Stanford Graduate School of Business. The objective of the search fund model is to provide young and capable individuals with the opportunity to acquire and grow a business, without having to start from square one. The would-be entrepreneur, called a “searcher”, has traditionally been someone with experience in private equity, investment banking, venture capital, and/or has a graduate business degree. When the model was first introduced it was not widely used. During the ’90s and 2000’s, however, the model gained in popularity.

Search Fund Stages

The search fund model is broken out into four stages.

Stage 1

The searcher will raise an initial amount of capital that is typically less than $400,000. The purpose of this initial funding is to allow the searcher to take a modest salary and have time to search for the proper company to acquire. The initial raise should be rather quick, taking less than 6 months. A majority of searchers tend to be individuals, with 72% of funds formed in 2014-2015 taking the solo model, while some form as partnerships.

For those new to the search fund model, raising capital shouldn’t be just about finding someone to give you a check. Strategically sourcing investors who have experience and connections in the business world is well worth the time and effort. Investors should be able to provide advice to the young entrepreneur, assist in identifying targets, and potentially serve on a Board.

Stage 2

In the second stage the searcher will begin hunting for a suitable target. This will be a tedious process and involve cold-calling, networking, and trying to find private, hidden gems with a willing seller. While many people get caught up in “shiny object syndrome” and focus on hot industries (blockchain and VR/AR, for example), search funds are looking for established businesses with cash flow. High-margin growth businesses make great targets, especially those with founders who are looking to exit.

The search phase can last nearly two years and additional time is required to close the deal. Once a target is found the searcher will conduct proper due diligence and acquire the entity. Acquisition capital will either come from the original group of investors or new investors. The searcher will need to ensure they have capital to complete the transaction once diligence is complete. Purchase prices tend to be a multiple equivalent of 4x-8x EBITDA, with a final price ranging from $5M – $20M[1]. Going forward, they will be the new CEO and will be tasked with growing the business to an eventual liquidity event.

If a searcher runs out of funds before finding a suitable target the fund is dissolved, and the investors do not receive a return on their capital.

Stage 3

The third stage is where the new CEO will create value and drive growth. Increasing value may come from growing revenues, expanding margins, acquisitions, or diversification (product lines, geography, etc.). As is typical with angel and VC backed companies, an exit can be an IPO, sale to a private equity group or strategic buyer, or a management buyout.

The growth stage can last anywhere from 4-7 years or more.

Stage 4

The exit is the final stage. The company is sold, and the searcher/CEO and the investors earn a return on their investment. For the unfortunate searchers that fail to find a target, a complete loss to the investors is recognized. Returns for those that successfully manage to find, acquire, grow, and exit a business can be very appealing. The pre-tax internal rate of return (IRR) for the asset class through 2015 is 36.7% with an aggregate pre-tax return on invested capital of 8.4x. Returns for funds have ranged from a less than desirable 1.0x of initial investor capital to a much-coveted 200x return on capital.

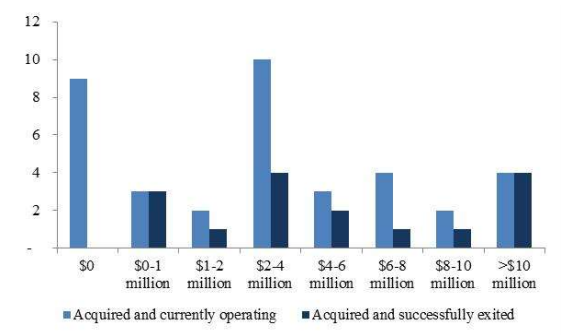

For the searcher returns can also be very rewarding. The below chart shows the distribution of returns to searchers who are operating or who have successfully excited from the acquired company.

The search fund model presents an exciting opportunity for talented individuals with a desire to run a business. While the industry is relatively young, resources do exist to help those who are considering launching a fund, are in the capital raising stage or in the search phase. One such resource for searches is InvestmentBank.com’s DealMachine platform. We list existing, profitable businesses who are seeking a sale and may provide a viable target for a searcher.

Search funds are typically started by individuals who come from a private equity, investment banking, or venture capital background. Many also have an advance degree, such as an MBA. Those who seek to raise a search fund are intrigued by the idea of running a company; however, they do not typically wish to build something from the ground up. Sometimes it is better to make the car go faster, rather than try and build a new car.

The pre-tax internal rate of return (IRR) for the asset class through 2015 is 36.7% with an aggregate pre-tax return on invested capital of 8.4x.

Returns to searchers upon exit after 5 – 7 years of operation have averaged $9M – $10M.

Our Search Fund Services

Our search fund team provides expert merger, acquisition, and capital advisory solutions for searchers at every stage of their journey. With years of market-specific industry experience our bankers can help identify viable acquisition targets and assist throughout the fund’s life cycle.

We link searchers with both the capital and connections to ensure our clients meet their capital and acquisition goals. Our platform, the DealMachine, features high-quality, vetted deals from a variety of industries and all with willing sellers. The best part: we don’t charge clients to view our sell-side inventory.

Our team has experience in the following industries:

• Media & Entertainment

• Real Estate

• eCommerce

• Aviation

• Medical Technology

• Oil & Gas Production

• Software / SaaS

• Distribution

• Automotive Parts

• Metals & Mining

• Consumer Products

Our expertise and services for search funds includes raising acquisition capital and identifying acceptable targets for the fund. Through our deal flow we are able to help searchers connect with active sellers in a wide variety of industries, both domestic and global. Many searchers can attest that the search for a company to acquire can be both time consuming and frustrating. By having a steady supply of active sell-side deals we can help reduce the time taken to find a quality company to acquire.

If you have questions about search funds or would like to discuss this model, feel free to contact our team of investment bankers. We have participated in capital raises and buy and sell-side deals in a variety of industries.

Any business venture comes with a healthy dose of risk. Search funds by nature seek to reduce some of the downside risk and focus on acquiring existing, profitable businesses. While some entrepreneurs are trying to create “the next big thing” from the ground up, search funds focus on businesses with a steady history of cash flows. The searcher will be tasked with finding an existing business that they believe can be scaled to create an acceptable return for all parties involved.

Sources

[1] Pohlmeyer, S., & Rosenthal, S. (2016, June 26). 2016 SEARCH FUND STUDY: SELECTED OBSERVATIONS [PDF]. Stanford Graduate School of Business. Retrieved July 20, 2018 from https://www.gsb.stanford.edu/faculty-research/case-studies/2016-search-fund-study-selected-observations

- Covid-19 Impact on US Private Capital Raising Activity in 2020 - May 27, 2021

- Healthcare 2021: Trends, M&A & Valuations - May 19, 2021

- 2021 Outlook on Media & Telecom M&A Transactions - May 12, 2021