Tracking Reverse Mergers in Crypto & Blockchain

What follows is NOT investment or financial advice and is merely for informational purposes only. Please seek professional assistance when making investment decisions.

We regularly track the inventory of available public shells as an ancillary service to our capital advisory business. The supply of available public vehicles is now hovering as low as it has in decades, thanks to the hype in blockchain and cryptocurrency. Many private blockchain companies have resorted to reverse mergers transactions as an alternative to transition to a public company status. Entrepreneurs, startups and some private companies participate in reverse merger deals to raise funds, become more visible to shareholders and future acquirers, and attract more customers. The article will present recent reverse merger deals in blockchain and cryptocurrency as well as the trends of reverse merger deals.

Recent Blockchain Reverse Merger Deals

In 2017, many private crypto companies entered into reverse merger deals with public shells. Here is a list of some of the most notable alternative public offerings that have taken place in crypto.

| Date | Acquiring Company | Shell Company | Loan Borrowing Methods | Blockchain Ecosystem |

| December 2017 | Riot Blockchain (Majority-owned, TessPay Inc.) | Cresval Capital Corp | Riot Blockchain secured 41.6 million shares and

TessPay received 80 million shares of Cresval Corp. Cresval will be issued 8.4 million TessPay shares and TessPay will complete a private placement of C$3.5 million. |

Access to traditional carpet markets and to expose its parent company, Riot Blockchain to other blockchain applications.

Opportunity to trade on Canada’s TSX Venture Exchange and to expand investments in the blockchain ecosystem. [1] |

| March 2015 | My Big Coin | Shots Spirit Corporation | My Big Coin Pay will own approximately 90% of the common stock. Shareholders of Shots Spirits will own 10% | Access to the micro-cap public market as well as to provide opportunities for investors to access the platform of My Big Coin for cryptocurrencies. [2] |

| January 2018 | FogChain, a private company and a decentralized software development suite

|

Mukuba Resources Limited | FogChain will own 63,000,000 common shares and security holders of Mukuba will own 2,678,570 common shares. | The merger developed shareholder value by supporting businesses to gain from blockchain applications without raising large capital. [3] |

| January 2018 | DMG Blockchain

|

Emerald Health Sciences and Emerald Health Therapeutics |

N/A[1] |

The venture will be named CannaChain Technologies and will create a blockchain-based supply chain organization structure. DMG Blockchain will use the venture as a platform to develop and implement a blockchain supply chain management solution to address the prospects and difficulties associated with the cannabis industry. [4] |

| November 2017 | CryptoGlobal, a private cryptocurrency mining company

|

Apolo Acquisition Corp | Shareholders of Apolo will own approximately 2.7% of the issued and outstanding shares of the resulting issuer. | Increased opportunities for CryptoGlobal to participate in the blockchain and crypto market. CryptoGlobal, is expected to invest half of its total earnings in blockchain research and development (R&D) as well as into cryptocurrency mining infrastructure. [5] CryptoGlobal started to trade on the TSX Venture Exchange on January 29, 2018 and has become the latest publicly traded blockchain technology companies. [6] |

| October 2017 | Cryptonex

|

ICO of the international blockchain | Cryptonex raised $18 million for the transaction. | CryptoNex will have the capabilities to develop a mobile app to support customers to use tokens and cryptocurrencies to purchase goods and services. [7] |

| January 2018 | ChargaCard, a P2P payment processing network | Westbay Ventures Corp. | ChargaCard will issue up to 3,351,000 employee stock options. Security holders of Westbay will own 7,006,669 shares and holders of ChargaCard will own 38,754,000. Westbay will also execute a private placement offering up to 7,500,000 shares at a price of $0.45 per subscription receipt for gross proceeds of up to $3,375,000 | The reverse merger will enable ChargaCard to develop a full-service blockchain and cryptocurrency solutions. [8] |

| November 2017 | Byzen Digital (EPSV), a newly formed Blockchain Technology company | Emergency Pest Services, Inc. | N/A[2] | Byzen Digital is expected to become a major player in the global blockchain technology market. The merger will give customers access to learn about blockchain products. Additionally, the reverse merger will enhance and speed up the development and delivery of a multi-solution platform in 2018, and offer customers fair prices. |

| January 2018 | BlockTech Ventures, a blockchain technology company | Cayenne Capital Corp | Cayenne proposes to purchase 25,474,333 common shares issued and outstanding in BlockTech. | The proposed transaction will enhance the different aspects of the business model including establishing the largest blockchain technology and having the largest co-working space on the West Coast. Additionally, the reverse merger will position BlockTech Ventures as a leader in the blockchain market. BlockTech will continue to expand blockchain transactions processing operations located in British Columbia. |

| January 2018 | BitFrontier Capital Investments | Purio Inc. | Purio Inc. acquired both the issued and outstanding shares, 12,400,263,104, of BitFrontier Capital Investments. However, 12,000,189,958 shares have not been registered under the Securities Act of 1933. Purio Inc. will change its certificate of incorporation to reduce its authorized capital to 17,550,000,000 shares. | BitFrontier Capital Investments will focus on investment opportunities in both public and private blockchain companies via joint ventures, strategic direct investments and convertible debentures. The company is positioned to maximize profitability and reduce the downtime associated with switching servers to other algorithms. [9] |

| October 2017 | Bitfarms, the commercial name for Backbone Hosting | Natural Resources | Natural Resource is expected to acquire more than half (75%) of the shares in Bitfarms in exchange for 75% of its own shares.[10] | The merger will enable Natural Resource to pivot into cryptocurrency and will also enable Bitfarms to build cryptocurrency mining facilities. Increased opportunities for Bitfarms to gain access to capital markets. Additionally, the merger has revived the public company’s stagnated shares. Natural Resource’s market cap valuation increased from NIS 133 million to NIS 346 million. [11] |

| December 2017 | Big Blockchain Intelligence Group | Acana Capital Corp | Prior to the transaction, Acana Capital Corp issued 37,939,483 common shares to Blockchain’s shareholders for all the issued and outstanding shares of Blockchain.

Upon completion of the transaction, Acana Capital Corp has 73,758,877 common shares issued and outstanding and the principals of the company collectively hold 25,781,130 common shares.[12] |

The transaction will expose Acana Capital to the cryptocurrency market. [13]

|

Trends in Reverse Merger Companies

Some of the private companies that participated in reverse merger transactions with shell companies have experienced various shifts in their stock performance. In many cases, a reverse merger announcement increases the share price of the public entity, but stock performance among cryptocurrency reverse mergers has varied greatly, especially since January’s cryptocurrency selloff.

| Big Blockchain Intelligence Group

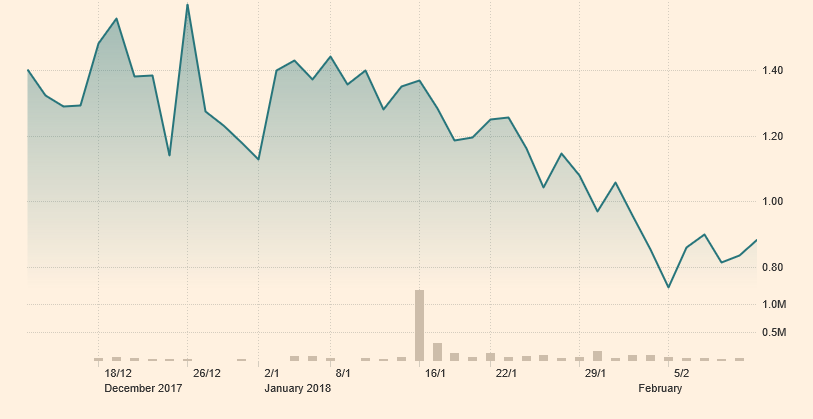

In December 2017, Big Blockchain Intelligence Group shares skyrocketed when the reverse merger deal with Acana Capital Corp was announced. However, since the announcement, the shares of Big Blockchain Intelligence Group have fluctuated. Compared to the share price in December, the share price in February has dipped by more than 40%.[14]

|

CryptoGlobal Corp

CryptoGlobal publicly traded for the first time on January 29, 2018, following a recent merger with Apolo Acquisition Corp. CryptoGlobal Corp’s stock price increased up by 26% from January 30 to January 31st, 2018. Investors also gained interest in the company following an announcement in January to have 8600 machines operational by March 2018. The share price has remained relatively stable since February 6, 2018. [15]

|

The share price of Riot Blockchain rose by 20% in December following the reverse merger announcement with Cresval Capital Corp. However, the biotech company’s investments in private companies makes it difficult for investors to value its holdings. [16] The share price of the company declined until February when Riot Blockchain announced to participate in Coinsquare Private Placement.[17]

|

|

|

In October 2017, the share price of Cryptonex trended upward and increased to $2.5 following an announcement to merge with ICO of the international blockchain. The share price dipped in November but has surged through February. |

Future of Public Companies

The future of public companies that participated in a reverse merger may include positive gains. Companies may trend upward in the future as investors gain interest in the stocks of new publicly traded companies. For example, the reverse merger with Bitfarms, influenced investors to trade Natural Resource stocks and placed the company as the tenth most traded company on Tel Aviv Stock exchange (TASE) by volume.[18]

Fraudulent activities associated with cryptocurrencies can impact the credibility of public companies in the future. Since its reverse merger, My Big Coin has had a slew of negative media reports claiming fraudulent activities. US regulators charged My Big Coin with misappropriation of funds worth $6 million from customers purchasing virtual currencies. The two employees who allegedly deceived customers claimed that the coin investment was traded on multiple exchanges, and advised customers to refrain from cashing their holdings.[19]

Public companies that engage in reverse mergers with private companies may experience challenges in the future due to risks associated with reverse mergers. Combine such risk with the risk associated with cryptocurrency and the near term does not necessarily bode well. There may also be uncertainty about whether shareholders will maintain stock ownership in the future.[20]

Public companies have the potential to face regulatory issues in the future due to less regulatory processes associated with reverse merger transactions. However, regulatory cost and securities issues can be avoided with increased due diligence.

Reverse Merger versus ICO

The trend to gain more access in the capital markets has influenced crypto startups and entrepreneurs to use reverse mergers or ICOs to raise capital. Some entrepreneurs select ICO as an alternative to reverse mergers to avoid the traditional startup capital raising process. For example, some venture capitalists have been attracted to ICOs due to a similar liquidity available to public stock. In addition, cryptocurrency investors have been known to make large returns from simple buy-low and sell-high strategies thanks to the lack of regulation in the cryptocurrency market.[21]

Blockchain companies may avoid giving away equity, inheriting the tax liabilities, lawsuits and unpaid notes of a public company and thereby select an ICO transaction to raise capital. In addition, a cryptocurrency company may opt-out of a reverse merger due to audits, increased regulations, the cost of a public shell and OTC market fees that are associated with reverse mergers.[22]

Many startup companies also prefer ICOs since they do not require a business valuation. ICOs enable startups to raise capital from users by selling tokens or coins to investors in exchange for utility and sometimes equity. Whether a company using an ICO or reverse merger or some combination of the two will be entirely dependent on the strategy of the business and the company’s potential capital needs in the future.

Conclusion

The capital raised in ICOs and the slate of recent reverse mergers in blockchain are evidence of the exuberance of the crypto market. Sadly, the regulatory issues surrounding both avenues for raising capital should not be overlooked. It will be interesting to track the success and failure of the various deals associated with reverse mergers and ICOs as this market continues to shift and mature.

Sources

[1] The details of the loan borrowing method for the reverse merger between DMG Blockchain and Emerald Health Sciences and Emerald Health were not disclosed.

[2] The details of the loan borrowing method for the reverse merger transaction between Byzen Digital Inc. and Emergency Pest Services, Inc were not disclosed.

[1] Elizabeth Balboa, Attention Riot Blockchain Investors: Here’s What You Need to Know About the TessPay Deal, (Dec 11, 2017), https://www.benzinga.com/news/17/12/10897351/attention-riot-blockchain-investors-heres-what-you-need-to-know-about-the-tesspa.

[2] My Big Company Pay, My Big Coin Pay, Inc. Announces Letter of Intent to Merge with Shot Spirits Corporation, (mar 3, 2015), http://www.marketwired.com/press-release/my-big-coin-pay-inc-announces-letter-intent-merge-with-shot-spirits-corporation-otc-pink-sspt-1997160.htm.

[3] GlobeNewswire, Mukuba Announcement of Letter of Intent with FogChain Inc., (Jan 23, 2014), https://globenewswire.com/news-release/2018/01/23/1299387/0/en/Mukuba-Announcement-of-Letter-of-Intent-With-FogChain-Inc.html.

[4] Econotimes, Emerald Health Therapeutics and DMG Blockchain Solutions Establish LOI to Create Cannabis Supply Chain Management System and E-Commerce Platform, (Jan 26, 2018), https://www.econotimes.com/Emerald-Health-Therapeutics-and-DMG-Blockchain-Solutions-Establish-LOI-to-Create-Cannabis-Supply-Chain-Management-System-and-E-Commerce-Platform-1118176.

[5] Market Wired, Apolo Acquisition Corp. Announces Proposed Qualifying Transaction, (Nov 7, 2017), http://www.marketwired.com/press-release/apolo-acquisition-corp-announces-proposed-qualifying-transaction-2239816.htm.

[6] PR Newswire, CryptoGlobal Starts Trading on the TSX Venture Exchange Under the Ticker Symbol “CPTO”, (Jan 29, 2018), http://markets.businessinsider.com/news/stocks/CryptoGlobal-Starts-Trading-on-the-TSX-Venture-Exchange-Under-the-Ticker-Symbol-CPTO-1014441795.

[7] The Merkle, The World’s First Blockchain Acquiring Cryptonex (CNX) is Preparing for Launch, (Oct 29, 2017), https://themerkle.com/the-worlds-first-blockchain-acquiring-cryptonex-cnx-is-preparing-for-launch/.

[8] Westbay Enters Blockchain Sector Letter of Intent Signed with ChargaCard, (Nov 29, 2017), https://www.fscwire.com/newsrelease/westbay-enters-blockchain-sector-letter-intent-signed-chargacard.

[9] GlobeNewswire, Purio, Inc. (PURO) Provides Corporate Update on Recent Restructuring and Closes on Merger, (Jan 3, 2018), https://globenewswire.com/news-release/2018/01/03/1281666/0/en/Purio-Inc-PURO-Provides-Corporate-Update-on-Recent-Restructuring-and-Closes-on-Merger.html.

[10] Roy Katsiri, Blockchain merger to make Natural Resource NIS 2b co, (Dec 7, 2017), http://www.globes.co.il/en/article-blockchain-merger-to-make-natural-resources-nis-2b-co-1001214878.

[11] Camila Russo, Bloomberg Technology, (Dec 4, 2017), https://www.bloomberg.com/news/articles/2017-12-04/israeli-firm-strikes-digital-gold-with-canadian-miner-purchase.

[12] Lance Morginn, Acana closes acquisition of Blockchain Technology Group, (Dec 12, 2017), https://www.stockwatch.com/News/Item.aspx?bid=Z-C:ACM-2541214&symbol=ACM®ion=C.

[13] Blockchain Intelligence Group. Acana Capital Corp. Executes Share Exchange Agreement with Blockchain Technology Group. Inc., (Sept 15, 2017), https://blockchaingroup.io/corporate/acana-capital-corp-executes-share-exchange-agreement-with-blockchain-technology-group-inc/.

[14] The Financial Times, Equities, (Feb 12, 2018), https://markets.ft.com/data/equities/tearsheet/summary?s=BBKCF:PKC.

[15] TMX Money, CryptoGlobal Starts Trading on the TSX Venture Exchange Under the Ticker Symbol “CPTO”, (Jan 29, 2018), https://web.tmxmoney.com/article.php?newsid=7879366282978901&qm_symbol=CPTO.

[16] The Motley Fool, Why Riot Blockchain Stock Is Surging Today, (Dec 26, 2017), https://www.fool.com/investing/2017/12/26/why-riot-blockchain-stock-is-surging-today.aspx

[17] ADVFN, Riot Blockchain, (RIOT), (Feb 8, 2018), https://uk.advfn.com/stock-market/NASDAQ/RIOT/chart/real-time.

[18] David Gosse, Gold Mining Company’s Shares Jump 1,300% After Switch to Bitcoin – Bitcoin News, (Dec 4, 2017), https://www.coinhash.co/gold-mining-companys-shares-jump-1300-after-switch-to-bitcoin-bitcoin-news?

[19] Venture Canvas, U.S. CFTC charges My Big Coin Pay operators on fraud and ponzi claims | #VentureCanvas, (Jan 27, 2017), http://www.venturecanvas.com/2018/01/27/u-s-cftc-charges-my-big-coin-pay-operators-on-fraud-and-ponzi-claims-venturecanvas/.

[20] Laura Anthony, Mergers And Acquisitions; Appraisal Rights, (Nov 10, 2015), http://www.reverse-merger.com/tag/merger-agreement/.

[21] Richard Kastelein, What Initial Coin Offerings Are, and Why VC Firms Care, (Mar 24, 2017), https://hbr.org/2017/03/what-initial-coin-offerings-are-and-why-vc-firms-care.

[22] Reverse Mergers and Blockchain Companies, (2018), https://bitcoin-lawyer.org/crypto_videos/reverse-mergers-blockchain-companies/.

Jenn Abban contributed to this report.

- Covid-19 Impact on US Private Capital Raising Activity in 2020 - May 27, 2021

- Healthcare 2021: Trends, M&A & Valuations - May 19, 2021

- 2021 Outlook on Media & Telecom M&A Transactions - May 12, 2021