Why Real Estate Continues to be the Poster Child for Equity Crowdfunding

We are now several years into the introduction of accredited investor equity crowdfunding. The results, failures and successes of this new form of financing could be considered the ultimate “mixed bag.” Unfortunately, the stark differences between some of the nuanced structures of crowdfunding preclude anyone from making a blanket statement as to its ultimate success of failure. Variations between Titles II, III and IV crowdfunding are stark. Assuming a one-size-fits-all structure for equity crowdfunding would be foolhardy. Still, the success has not been the blockbuster many had predicted. In fact–and certainly for some deals–crowdfunding could be likened to the Hindenburg. For those deals that have had their day in the sun, there remains several key aspects that link the success of any deal.

First, successful deals always require quality deal marketing and distribution. Unlike traditional investment banking, the new order is less about who you know and more about access to quality data. In a world of competing mediums and channels, securing investor interest among a multitude of would-be financiers is difficult and expensive. Second, structure matters, but deals matter more. Unless a “fund” is using something like Regulation D 506(c) to raise capital to invest at its discretion, most smaller accredited investor raises are most likely specific to a single deal. That is, they do not involve the raising of money into a pool that is then disbursed and diversified among a multitude of deals. Instead, the typical equity crowdfunding deal further forces even greater discipline than is sometimes typical in private equity and venture capital broadly. Each deal must stand on its own when it is not part of a diversified fund (true, some equity crowdfunding portals out there are working to alleviate this problem by creating venture-like funds to invest across numerous deals). Real estate already has diversified funds. They’re called REITs. Consequently, when a business equity crowdfunding deal does not stand up to the rigors of preliminary due diligence, even among individual investors, it is less likely to obtain the eyes and ears of the broader crowd.

While deal distribution is a byproduct of quality marketing, advertising and list-building, deal structure is about sourcing quality opportunities. Distribution, while costly, improves over time and the various crowdfunding and institutional investment platforms out there will only get better as exposure improves. Improving our game on quality deal sourcing is another matter altogether. No other niche is seeing an industry-wide acceptance and success in equity crowdfunding like real estate. Here are a few reasons why.

Collateral

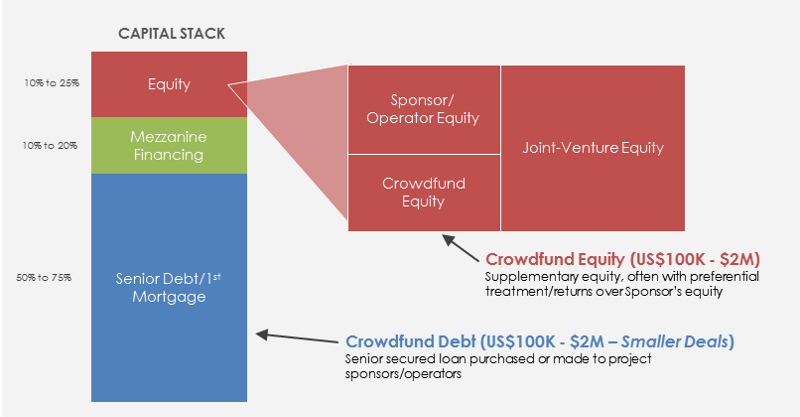

Even though most real estate equity crowdfunding deals involve only the equity slice of the capital stack–debt holders still remain first in line in the event of a liquidation–the possibility of receiving at least some of one’s investment returned is more likely in the event of a liquidation of an asset with existing tangible value. In contrast, the world of startups and venture capital are very different. When the only collateral is quite possibly software code at worst and perhaps a patent or two at best, the risk to capital is much more visceral and real.

A real life example could paint a healthy picture. Several years ago we were performing a sell-side M&A mandate on a lower middle-market IT consulting firm. The company had been in business for 15 years and had a notable list of some of the most well-recognized clients on the Fortune 500. It was a great business. The company also owned real estate. When we took the business to market for a potential liquidity event in a broad-based auction, the Indications of Interest which trickled-in included many initial valuations well below owner expectations. In fact, many of the initial values placed on the business were below the fair market value of the company-owned real estate. The owner was flummoxed: “how can my building which is simply a utility to me be worth more than the income-producing company housed inside of it?” My response included at least some of the following:

- It is significantly easier to manage real estate assets–particularly those that are on a triple net lease–than it is to manage and operate a business and its personnel.

- Company value is in the people and relationships, real estate value is in the land and location. I can more easily botch a relationship than I can the location of a commercial building.

- Collateral. When the only assets in a business are the relationships and those relationships are primarily owned by the founders, there is a significant discount to the overall business valuation.

In short, investors prefer collateral over potential.

Capital Returns vs. Capital Appreciation

To the conservative investor, capital returns are more important than capital appreciation. Receiving capital investment returns, rather than the potential equity appreciation of an investment is fairway shot, down-to-earth investment philosophy. At least one of the reasons the individual accredited investor crowd has been enamored by equity crowdfunding real estate deals is the potential for steady capital returns. Many such deals include not only the collateral of the underlying real estate but also a promise of X% to XX% capital returns per year for their investment.

Thanks to the mortgage crisis almost a decade ago, the capital appreciation in real estate (and most other assets) over the last decade has been unprecedented. From the lens of historical, long-term averages, real estate appreciates some 3% to 5% per year. However, most commercial and multi-family real estate ventures include Venture capital, on the other hand,

The Bonus of Leverage

Money is cheap these days. There is an oversupply of money–which has helped to drive down the cost of leverage over the last couple of decades. This has not only inflated asset values but it has also created a scenario where a little bit of equity can help borrowers to “lever-up” into their next big deal. Equity crowdfunding in real estate typically only includes raising the capital for the equity slice of the capital stack. In most cases, debt stands ready and waiting to finance the majority of the deal–depending on the expected Loan-to-Value (LTV) ratio. When properly structured, leverage allows the borrower (or, in the case of equity crowdfunding, a group of borrowers) to acquire a much larger asset without giving away the equity in the deal. This is where investors begin to measure things like cash-on-cash returns. The return on initial capital investment is much greater when leverage is in-play. Private equity operates under the same principal when they perform leveraged buyouts on behalf of their limited partners.

Money is cheap these days. There is an oversupply of money–which has helped to drive down the cost of leverage over the last couple of decades. This has not only inflated asset values but it has also created a scenario where a little bit of equity can help borrowers to “lever-up” into their next big deal. Equity crowdfunding in real estate typically only includes raising the capital for the equity slice of the capital stack. In most cases, debt stands ready and waiting to finance the majority of the deal–depending on the expected Loan-to-Value (LTV) ratio. When properly structured, leverage allows the borrower (or, in the case of equity crowdfunding, a group of borrowers) to acquire a much larger asset without giving away the equity in the deal. This is where investors begin to measure things like cash-on-cash returns. The return on initial capital investment is much greater when leverage is in-play. Private equity operates under the same principal when they perform leveraged buyouts on behalf of their limited partners.

In addition, leverage creates the literal “tax shield,” allowing borrowers to write-off interest expense for tax purposes. In this way, the government incentivizes more borrowing and the tax-holders subsidize the debt-based acquisition of assets. While this scenario is true for both business debt and real estate loans, it is much more prevalent in real estate where lenders themselves like to see collateral on their loan to prevent loss in the event of default and steady recurring payments from leases and sales.

While I do expect the market for equity crowdfunding for general business and startups to improve, it will likely be a combination of a number of different factors. First, deals still require a dealmaker. Deals still require typical “blocking and tackling.” Visit any crowdfunding site with any notoriety and investors are likely to experience what I would call “deal overload.” With too many options to chose from, it is helpful to have an investment banker or other intermediary to at least have a personalized introduction to the deals that make the most sense. It reverts back to “know your customer” (KYC) rather than just “general solicitation.” Second, truly scaled distribution among thousands of investors takes time to achieve. Most platforms have their own proprietary investor databases, which they keep very close to the chest. Getting a true unicorn to emerge is not likely to happen overnight without some acquisitions and consolidation. After all, most crowdfunding platforms are not innovating, they are competing with the same basic underlying technology in a red-ocean environment. Once the market is saturated there, the only way to grasp more market share is going to be through acquisitions. Third, diversification will be key. Most accredited investors that are Limited Partners in a venture fund still maintain some semblance of diversification: the fund invests across multiple deals. A truly diversified mix in venture investing is simply not going to be achieved as a single investor. More crowdfunding fund of funds need to emerge, offering the risk-mitigating diversified approach toward investment.

- Covid-19 Impact on US Private Capital Raising Activity in 2020 - May 27, 2021

- Healthcare 2021: Trends, M&A & Valuations - May 19, 2021

- 2021 Outlook on Media & Telecom M&A Transactions - May 12, 2021