Media & Telecom: Investment Banking & M&A Trends

InvestmentBank.com – Quarterly M&A Beat: Media & Telcom

Media & Telcom | Q1 2019

A look at Q1 2019 M&A activity in the Media & Telcom industry

The M&A Beat Newsletter covers all sub-sectors (Advertising & Marketing, Telecommunications, Publishing, Film, Recreation & Leisure, Broadcasting, Music, and Video Games) of the Media and Telecommunications Industry with the latest transaction statistics and pertinent industry trends, in order to keep you enlightened and help make knowledgeable decisions regarding the future of your business.

U.S. Media and Telecommunications Deals Get Off to Slow Start in Q1

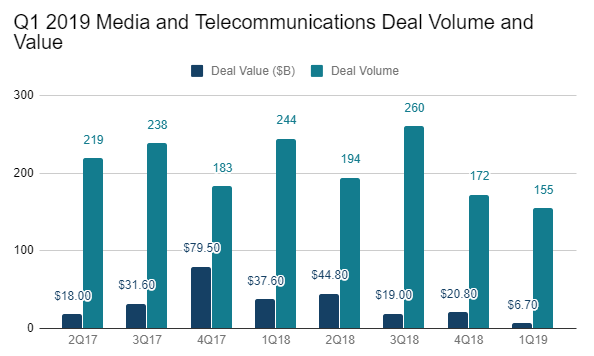

Coming off a strong year in 2018, the U.S. Media and Telecommunications industry experienced a lagging start to the new year. In Q1 2019, deal volume reached a two year low with 155 transactions, representing a 10% decrease from Q4 2018 (172 deals) and a 36% decrease from Q1 2018 (244 deals). Similarly, deal value also reached a two year low at $6.7 billion, compared to $20.8 billion in Q4 2018 (-68%) and $37.6 billion in Q1 2018 (-82%)1.

Deal Volume

Media and Telecommunications deal volume in Q1 2019 saw a total of 155 transactions. Total deal volume was lead by Internet and Information with 45 deals, followed by: Advertising & Marketing (40), Telecommunications (18), Publishing (14), Film (13), Recreation & Leisure (11), Broadcasting (8), Music (5), and Video Games (1)1.

Media and Telecommunications deal volume in Q1 2019 saw a total of 155 transactions. Total deal volume was lead by Internet and Information with 45 deals, followed by: Advertising & Marketing (40), Telecommunications (18), Publishing (14), Film (13), Recreation & Leisure (11), Broadcasting (8), Music (5), and Video Games (1)1.

Deal Value

U.S. Media and Telecommunications deal value in Q1 2019 resulted in a total of $6.7 billion in transactions. The noticeable drop in deal value can be credited to a lack of Megadeals (deals exceeding $5 billion) in the industry to start the year. The largest portion of deal value (48%) is represented by deals with announced value of $100 million or less. Deals valued between $101 million and $500 million account for 43% of total value, while deals valued between $500 million and $1 billion account for 9%1.

Trends

Investment Trends: Coming off a strong year of momentum in 2018 where it reached a 2 year high in Q4 2018, Private Equity investment volumes in the industry stayed relatively strong hovering around 27%. From a value standpoint, Private Equity deals accounted for 37% of the total value of the quarter’s deals. Industry Trends: The main driver in the significant drop in deal value in Q1 2019 was the lack of Megadeals in the industry. Behind Disney’s acquisition of 21st Century Fox and AT&T’s acquisition of Time Warner, the road has been cleared for a new group of mega conglomerates to control this vertical and kickstart its growth throughout the remainder of 20191. Sources [i] PricewaterhouseCoopers. (2019). Technology, Media and Telecommunications quarterly deals insights: Q1 2019. Retrieved May 10, 2019, from https://www.pwc.com/us/en/industries/tmt/library/quarterly-deals-insights.html (last visited May 10, 2019).

Media & Telecom | Q2 2019

A look at Q2 2019 M&A activity in the Media & Telecom industry

Introduction

Investmentbank.com’s M&A Beat is a quarterly report for founders, owners, and CEO’s of lower middle-market ($10MM-$100MM revenues) Media and Telecommunications businesses, highlighting relevant information on merger and acquisition deal value, volume, and trends in their respective industry and vertical.

The M&A Beat Newsletter covers all subsectors (Advertising & Marketing, Telecommunications, Publishing, Film, Recreation & Leisure, Broadcasting, Music, and Video Games) of the Media and Telecommunications Industry with the latest transaction statistics and pertinent industry trends, in order to keep you enlightened and help make knowledgeable decisions on the future of your business.

U.S. Media and Telecommunications Lags YoY but Bounces back from Weak Q1

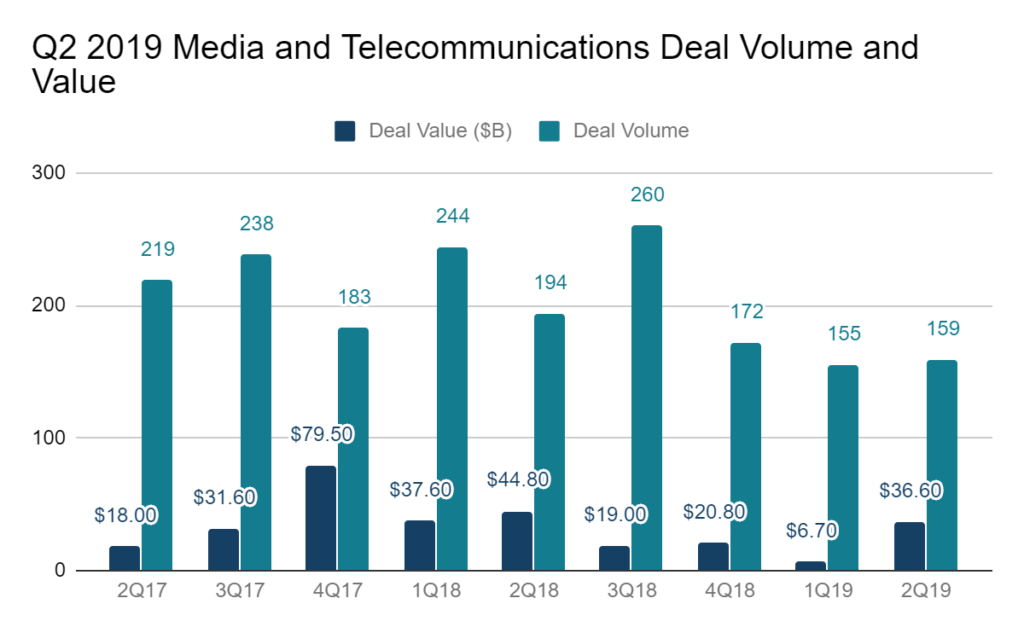

U.S. Media and Telecommunications deal value and volume showed growth following a slow start to the new year in Q1 2019. In Q2 2019, deal volume reached 159 transactions, compared to 194 deals in Q2 2018 and representing a 3% increase from Q1 2019 (155 deals). Deal value reached $36.6 billion, compared to $6.7 billion in Q1 2019 (+36%) and $44.6 billion in Q2 2018.

Deal Volume

Media and Telecommunications deal volume in Q2 2019 saw a total of 159 transactions. Total deal volume was led by Advertising and Marketing with 55 deals, followed by; Internet and Information (43), Telecommunications (19), Publishing (15), Recreation & Leisure (11), Broadcasting (9), Film (4), Cable (2), and Music (1).

Deal Value

U.S. Media and Telecommunications deal value in Q2 2019 resulted in a total of $36.6 billion in transactions. The noticeable jump in deal value can be credited to megadeals (exceeding $5B) taking place in the quarter. The largest portion of deal value (58%) is represented by deals with announced value of $500 million or more. Deals valued between $101 million and $500 million account for 22% of total value, while deals valued less than $100 million account for 20%.

Outlook

Investment Trends:

Continuing off the upward momentum experienced in 2018 where it reached a 2 year high in Q4 2018, Private Equity investment volumes in the industry continue to stay strong at 29% in Q2 2019. From a value standpoint, Private Equity deals accounted for 46% of the total value of the quarter’s deals.

Industry Trends:

The boost in deal value was due to two transformative deals taking place in the quarter. Sinclair Broadcasting Group’s acquisition of 21 Fox regional sports networks from Disney sent Sinclair shares flying with the deal totaling at $9.6B. The other key deal was the acquisition of Cheddar by Altice USA for $200 million, as Altice attempts to extend their news reach to OTT devices.

- Covid-19 Impact on US Private Capital Raising Activity in 2020 - May 27, 2021

- Healthcare 2021: Trends, M&A & Valuations - May 19, 2021

- 2021 Outlook on Media & Telecom M&A Transactions - May 12, 2021