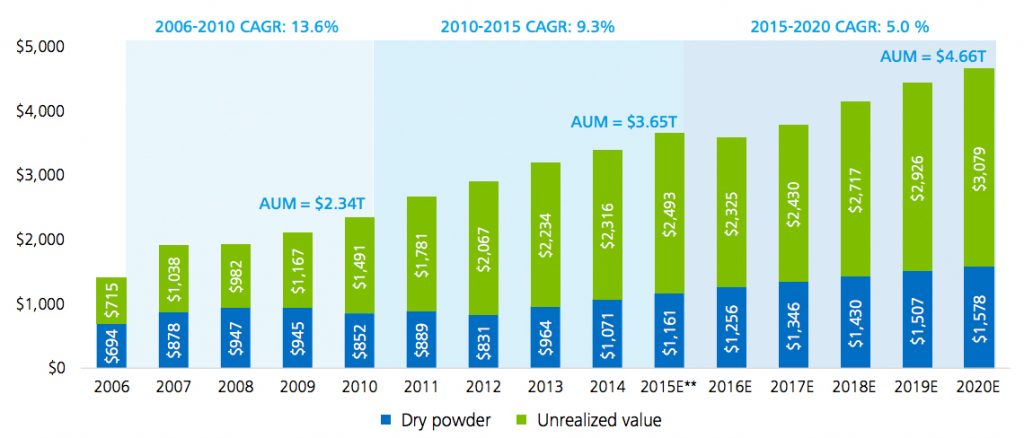

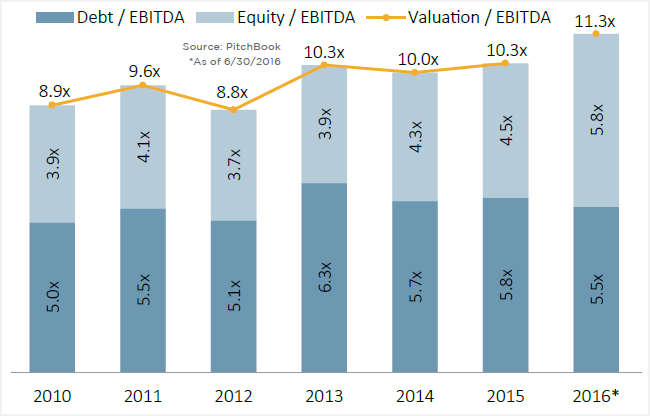

As we head closer toward the end 2017, timing elements for corporate mergers and acquisitions are beginning to weigh on the minds of individual business sellers. Is now the right time for selling my business? If I wait, will I miss the wave before another recession ensues?�The lack of a crystal ball often makes business�decisions difficult. And while no decision should ever be made on macro-factors alone, the overall market should play a key role in choosing the right time to�selling a business. We are currently in the caboose�stages of one of the�longest bull markets in history. The party cannot last forever. Hence, business owners need to weigh all the macro factors that may create the perfect storm for selling the business in the next 12 to 24 months. What follows are a few factors aiding the perfect storm for sell-side M&A.Historically Low Interest RatesDebt is almost always a portion of private equity and corporate acquisition deal structures. In fact, all-equity deals are a rare breed indeed. With interest rates at historic lows, strategic and financial buyers alike are able to obtain assets with a much lower cost of capital compared to historical trends. This makes M&A easier and less costly, giving private equity acquirers the ability to afford to pay higher multiples while still achieving benchmark returns for their limited partners and corporate shareholders.Interest rates continue to stay at historic lows. The Fed has postured at the idea of raising rates and "easing" up on all the quantitative easing, but many prognosticators feel the Fed is afraid to let up on the gas pedal. At some point this inexpensive capital may come to an end. And while owners cannot control what happens with interest rates and other macroeconomic factors, they do have some control over the timing of an ultimate business sale.Private Equity Dry PowderPrivate equity buyers�currently hold over $1.3T in�dry powder (un-invested funds). The PE fundraising machine continues continues to march on, further increasing the amount of capital that remains on the sidelines--all of it looking for quality, invest-able�deals. With a larger hoard of cash chasing fewer and fewer deals, there remains a high demand for quality middle-market opportunities among financial buyers. �With excessive capital�chasing �good / valuable� companies no wonder M&A spending and deal multiples are up.

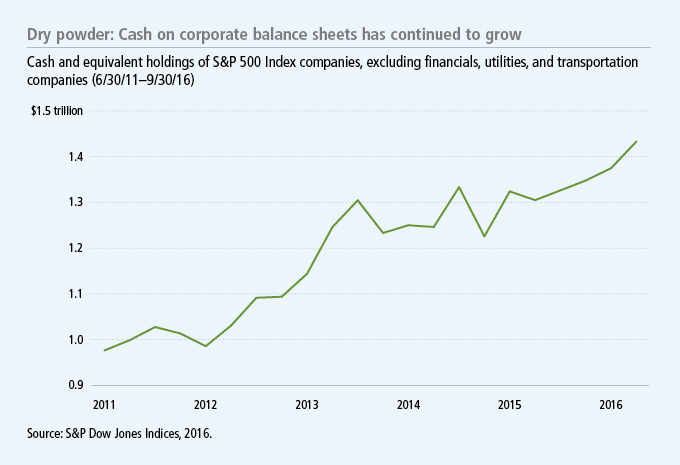

Strategic Cash ReservesAmerican corporations (often referred to as the �strategic buyers�) have never had more cash on their balance sheets. This is likely due in part to post-recession discipline and lack of opportunity to invest in systemic growth anemia. With "buy vs. build" alive and well, �strategic buyers are also competing for quality opportunities in nearly every market vertical.

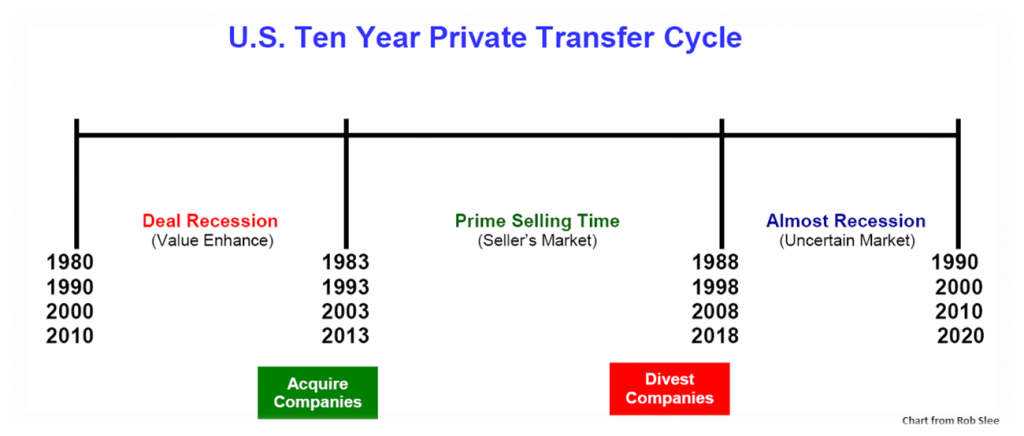

Ten Year Transfer CycleTransfer cycles in economics are often used as a means to gauge the best timing of buying, selling or holding strategic and financial assets. Such predictions usually hold true for everything from homes to stocks in privately-held businesses. Rob Slee et al, �Private Capital Markets��, one of the foremost in tracking transfer cycles, predicts the current divestiture cycle will crest 2018.

Baby Boomer RetirementIt is expected that a glut of companies will be flooding the market as�baby boomers look to retire. They are currently doing so at a rate of 10,000 per day--for about the next 15 years. The supply demand economics of this trend will be real. In 2016 the first wave of boomers turned�70 (born 1946 � Post WWII) followed by the next three waves. �Get ahead of the supply and demand curve. Again you can�t control this variable but can profit from knowledge of it.

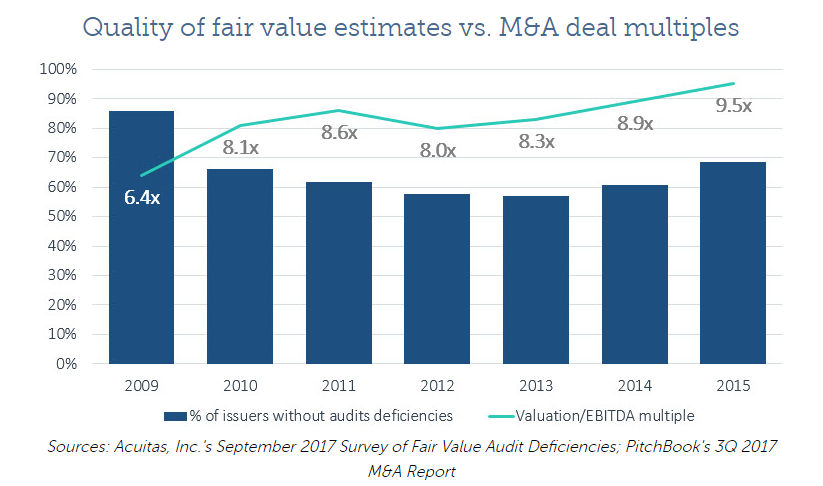

Market Multiples Are Way UpM&A sales multiples and overall private company values are up across the board. More capital is chasing fewer quality opportunities, particularly in the middle market. This continues to drive prices up. As a good friend in private equity put it the other day, "all the deals we have seen of late have been atrocious." We continue to see 7x to 12x EBITDA multiples in industries where historical turns have been in the 4x to 6x range. Valuations are up =�the time to sell is now.

Planning a proper exit of a private business is never an easy decision, macro-timing factors excluded. When you stack on internal corporate performance combined with personal readiness, the complexities of the decision tend to mount. Questions such as, "is the business ready and prepared to be sold?" "Am I ready and prepared to sell?" "Am I willing to put in another 18 to 24 months to pushing hard as an operator in order to get the highest possible multiple?" "How does my growth path stack against the macro conditions discussed above?"Market froth does not last forever. Selling on the way up is important from both an internal as well as an external perspective. That's where an investment banker can add excessive value in the transaction.

.png)

.png.png)