Defining Synergies in Acquisition Targets

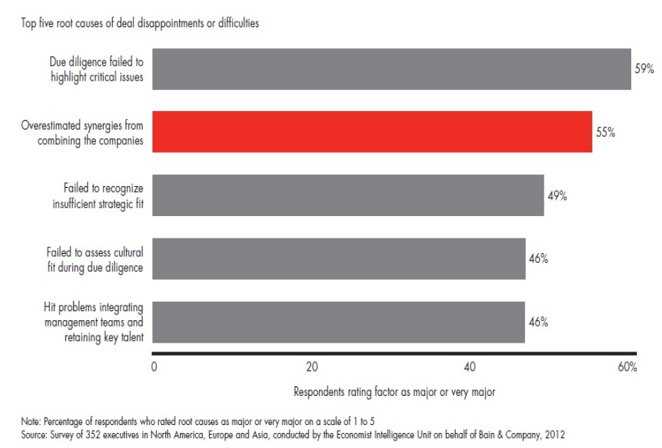

Synergies may be the most powerful way to create value within an acquisition and yet are still widely misunderstood. A 2012 survey of 352 executives in the United States, Europe and Asia by Bain & Co[1]. found that overestimating synergies was the second most common cause of deal disappointment or difficulty with 55% ranking it as a ‘major’ or ‘very major’ reason.

In the simplest terms, synergies refer to any element of a transaction whereby the new entity is greater than the sum of the individual parts: the ultimate goal of any transaction. But defining those synergies and estimating them accurately (as the company executives in the Bain survey will attest) is a significant challenge in itself.

The specifics of achievable synergies are unique to every transaction, which is one of the reasons why buyers would be well-advised to bring transaction specialists on board to guide them through the process. That said, broadly speaking, there are three categories in which companies can find these synergies: cost, capital and revenues.

Cost Synergies

Cost synergies are the quick wins: There are likely to be overlapping costs in transactions of any size. Examples of these duplicate costs include employees (particularly in the HR Department and at executive level), branch networks (retail branches from both companies in close proximity to one another), distribution and even R&D costs.

Cost synergies are often referred to as ‘run rate’ synergies, meaning that the savings they provide the new firm are recurring. So, to take one deal as an example, the $3.2bn cost synergies aimed for in the 2016 acquisition of SABMiller by AmBev[2] – if achieved – will affect its cost base every year, and not just in the period immediately following the deal.

Capital Synergies

Capital synergies include anything that allows the new entity to improve its balance sheet by reducing working capital and borrowing costs (and using the cash position of one firm against the debt position of the other, for example) and achieving a better return on capital from underutilized assets such as logistical operations.

Capital synergies, although in many cases, more difficult to pin down, can quickly feed into revenue synergies. When Amazon purchased Whole Foods Market Inc. in June 2017[3], it gained several hundred physical stores, which effectively doubled up as distribution channels for its existing online operations and in turn making the stores more productive than they had been.

Revenue Synergies

Revenue synergies, sometimes called ‘soft synergies,’ refer to anywhere the merged entity can enhance the combined revenues through cross selling of product lines, taking advantage of presence in new geographies, improved sales channels (for example, e-commerce) and even customer segments.

Companies in the airline industry are renowned for seeking out revenue synergies in acquisitions and the 2016 Alaska Airlines Group acquisition of Virgin America is a case in point. The newly acquired firm could offer more destinations, greater frequency of flights and increased sales distribution channels, giving it considerable cross-selling power.

Valuing the Combined Synergies

Synergies rarely happen without considerable work on the part of the acquiring firm. Even if achievable synergies can be identified before the deal, they’re unlikely to fall into place as soon as the deal closes – explaining at least some of the reason why their financial impact is so often overestimated.

Being realistic with the timeframe for achieving the goals is also crucial for valuing synergies. Timing is everything in integration, with faster integration leading to better savings, all things being equal. The sooner overlapping costs can be cut, the better the cash flow of the combined entity. As much as income statements suggest otherwise, costs aren’t quarterly – they’re daily.

Arriving at an accurate estimation of the achievable synergies in a deal will ultimately allow the acquirer to avoid overpaying for the target – the bane of most unsuccessful transactions. It also gives them the opportunity to be forthright with the target firm about their intentions for their management and their employees, ultimately making for a friendlier acquisition.

[1]Retrieved from https://www.valuewalk.com/2014/09/ma-synergy-overestimated/

[2]Retrieved from https://www.ft.com/content/d0191e84-ba25-11e7-8c12-5661783e5589

[3]Retrieved from https://www.bloomberg.com/news/articles/2017-06-16/amazon-to-acquire-whole-foods-in-13-7-billion-bet-on-groceries

Michael Minihan contributed to this report.

- Covid-19 Impact on US Private Capital Raising Activity in 2020 - May 27, 2021

- Healthcare 2021: Trends, M&A & Valuations - May 19, 2021

- 2021 Outlook on Media & Telecom M&A Transactions - May 12, 2021