Blockchain’s Next Frontier: Cloud Computing?

Blockchain, in its more popular form, is a technology built using a peer to peer network. It is a decentralized operating system that anyone can join or leave as they wish. This technology can be utilized in a multitude of ways, ranging from cryptocurrencies, to media streaming, cloud storage and much more. It is run and operated by people who lend their computing power to the network and function as miners. Their computing power allows the network to function. The machines run by miners are in a constant race to solve a complex algorithm, SHA-256 if we were discussing Bitcoin’s blockchain, that facilitates the movement of data throughout the network. To solve these complex algorithms a massive amount of computing power is required. An estimated 27.2 million TH/s were performed on the Bitcoin network for May 13, 2018. As a reward for lending their computing power, miners receive a fee each time they successfully mine a block.

Blockchain has become synonymous with cryptocurrencies, but there is so much more in store for this technology. The first explosion was in cryptocurrency, but now there is expansion into other sectors. One of the most appealing features of blockchain technology is that it creates a decentralized ledger. This gives the network participants the opportunity to send and receive cryptocurrency without the need of a bank as a middleman. One of the highly touted benefits of this technology is that transactions are supposed to be completed quickly. Rather than waiting a few days for a payment to settle you only need an hour and sometimes even less. Individuals can also send cryptocurrency across the world and reduce transaction fees. However, depending on the cryptocurrency being used, the time it takes and fees will vary depending on the number miners in the network and the hashing power that they are providing. The more miners participating in the race to solve the algorithm, all else equal, the faster each transaction is completed.

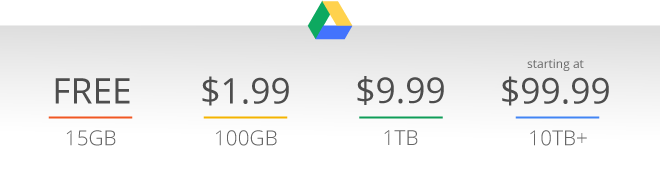

Blockchain technology has applications in many other places outside of the transfer of digital money. Cloud storage is another sector that blockchain can electrify and change. Traditionally, cloud storage companies allow users to purchase a certain amount of storage that is generally sold by the terabyte. This is profitable for these companies because they are taking advantage of the economies of scale. They are able to purchase vast amounts of servers for storage. Due to their bulk buying strategy, the storage fees are significantly cheaper, and the companies can resell the extra storage space to general consumers to generate additional revenue. The pricing system they have established is by terabyte or 100GB in the case of Google Drive. It would not be profitable for the company to charge for small amounts of storage. Due to the large supply of storage space, selling in smaller packages would require the addition of many more customers than would be required when selling by larger packages. This data storage method by the terabyte can potentially be good for small businesses with vast amounts of data that need to be stored. However, for the average consumer this is significantly more storage space then they need. Depending on the purpose of the data, blockchain technology can offer deals depending on the amount of storage space used that can be superior to traditional providers.

Blockchain technology provides users a means to store information on a peer to peer network. This is where cloud storage comes into play. A cloud storage platform could be run by the nodes that help facilitate transactions. The nodes would be giving up storage on their computers to the consumer. These owners of the nodes are giving up this storage space, but they are being compensated by the consumers for storing their data. This is the general concept of the overarching technology. There are different nuances to each sector.

Cloud Storage

Cloud storage is currently provided by companies such as Microsoft, Amazon and other large organizations. Cloud storage allows the user to store data and information online. This serves as a backup in case the data is lost and could be used to secure large amounts of data. One of the most exciting features is that the user can access their files from any computer or mobile device. They are no longer constrained to accessing files that are saved locally to the device. This is imperative in today’s society as we become increasingly dependent on digital files and straying away from physical and locally stored files.

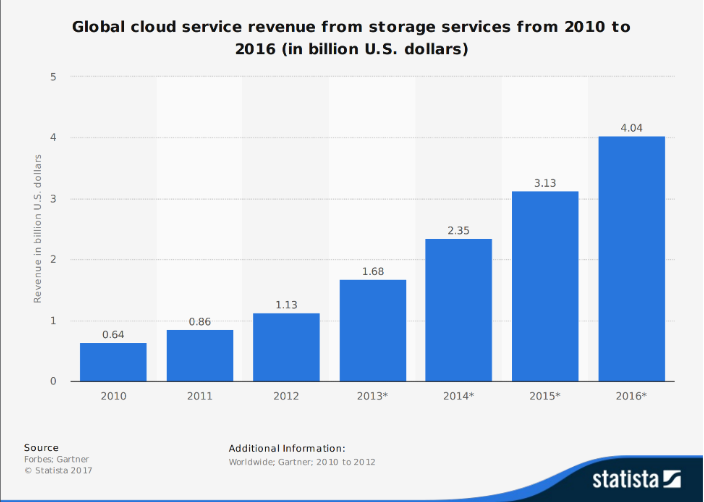

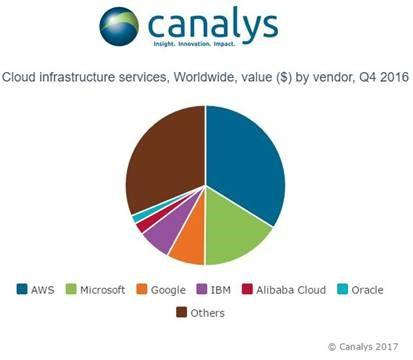

The graph illustrates that this market is growing at an exponential rate. As we can see in 2016 the market revenue grossed just over $4 billion. However, as discussed above, consumers currently have a very inefficient way of purchasing this storage. Blockchain is a potential solution to this problem. The leaders in the traditional industry can be seen in the graph below. Amazon is leading the cloud infrastructure services in dollar value. However, according to Forbes, Microsoft is the top cloud computing vendor because of “its deep involvement at all three layers of the cloud”[4]. This is referring to Information as a Service(IaaS), Platform as a Service(PaaS), and Software as a Service(SaaS). Amazon doesn’t hold up to the software standards of the other top 5 companies; however, their revenue from their web services is colossal. IBM and Google are significant players as well in the industry. Regarding worldwide cloud computing infrastructure, Amazon and Microsoft dominate the leader board taking up to 50% of the market share.

Blockchain Application in Cloud Storage

Blockchain in cloud storage? How does a decentralized method of sending coins all over the world work for data storage? The concept of blockchain is not an easy topic to grasp. Essentially, this peer to peer network that blockchain technology creates can be used for running algorithms along with storing data. Storing data is key for this sector.

Blockchain cloud storage solutions take a user’s data and break it up into tiny chunks of data. It then takes these chunks of data, encrypts them to add an extra layer of security and distributes them throughout the network. This is done by using blockchain features such as transaction ledgers, cryptographic hash functions, and public/private key encryption[1]. The data that is being stored throughout the blockchain ledger is split up and hashed a significant number of times. More importantly, the different chunks of hashed data are not stored on the same storage device. They are split randomly throughout the network. This ensures that even if one bad actor was able to decrypt a piece of data they would not have access to the entire file. The node would also not be able to identify who the data belongs to so that the true user remains anonymous. As a final safety precaution, when a user goes to take back their data those copied shreds are compared to make sure they are all identical before the host gets paid for their storage services. If something does get flagged indicating that a node attempted to manipulate or alter data, that user will be immediately removed. There are many nodes required to make a quick transaction.

Intuition would suggest that if a node goes down it may affect the network. Users may worry that should a node hosting their data be deactivated it would result in a loss of files. However, this is not accurate. Due to the vast number of nodes, when one goes down it is not very noticeable. Many storage services ensure that data is redundant. This means that more than one copy of the data is stored in multiple locations. Should one node fail or leave the network a user will still be able to access their files. Each node that is active on the network increases the speed of the transaction. The more nodes running the faster users are able to transfer data or complete a transaction.

Companies like Storj, Sia and Amazon are creating systems to pay hosts small amounts of money for letting renters store data on the extra space of their computer. When deciding to run a node, it is important to have the proper hardware to handle running this. Unfortunately, I cannot use my laptop to run these nodes due to the requirements and other factors such as the limited space on my computer and the required internet speeds and up-time requirements. This coupled with the safety risks make it illogical for someone without any knowledge of the blockchain sector to run nodes at this point.

If you have the necessary hardware and knowledge it is nice to know that you do get paid to be a node. Individuals that decide to serve as a miner must take into account the cost of the hardware and electricity as this will impact the profitability of the operation. Running multiple mining devices may increase the opportunity to turn a profit. Finland has been known for mining cryptocurrencies due to their cheaper electricity prices. The amount a miner gets paid depends on how many transactions they facilitate or approve. Therefore, the faster the computer, the more money they could generate from helping run the decentralized network. It should be noted that for more complex transactions that require high levels of hashing power a user will need an application specific integrated circuit (ASIC) and cannot mine on a home computer or laptop. In the case of storage, the users with the most storage space available will be able to generate more revenue.

Blockchain is a new and possibly cheaper way to perform cloud storage. Right now, it costs significantly more to use cloud storage for anything less than a terabyte. Based on Dropbox’s pricing model a user would have to pay a flat rate of $9.99 per month for a terabyte of data and there can also be set up fees coupled with that when a user first uses their system. Because you are using Dropbox’s space that they specifically designed for storage they are unable to provide a cheaper price for storing less information. Google drive is slightly more flexible in its pricing structure.

This is where blockchain storage stands out and solves a problem. Google Drive has the ability to pay for 100GB not just by the Terabyte(TB). Since blockchain is using extra space on other computers, bypassing the overhead costs that are associated with running a typical cloud storage company, pricing plans can be much more flexible. Blockchain allows you to purchase storage by the gigabyte to get the exact amount of storage you need.

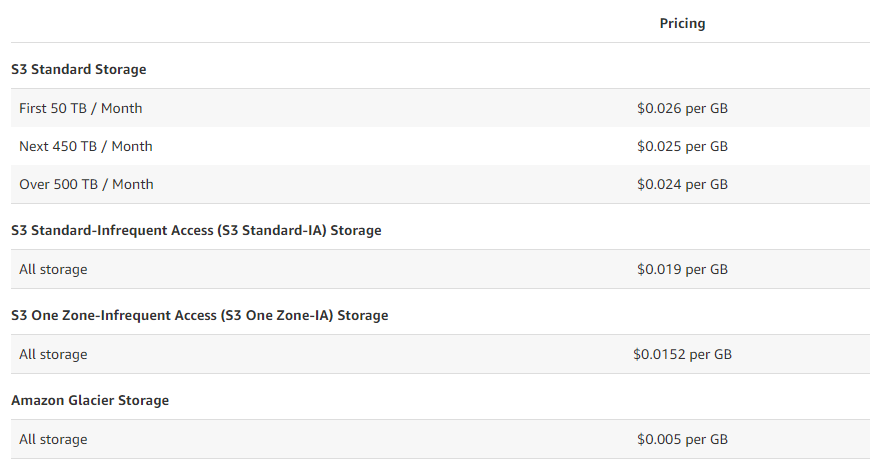

Comparing blockchain cloud storage to traditional storage solutions, the flexibility is the huge difference. As you can see by Amazon’s pricing structure, the more access you need to the data, the higher the price you pay. This is what blockchain emphasizes as the important factor. The nodes for blockchain storage get paid when someone accesses their storage and downloads it. Due to this, it makes sense that the more you access your storage the more you must pay. Even with this in mind if you want storage that isn’t an exact terabyte or other fixed amount, then the blockchain option is superior. At 500GB on the standard infrequent plan you save $3.75 per month. Even compared to Google Drive which offers the 100GB deal; if you use 50GB you save $0.84 monthly with the standard plan. With Amazon Glacier Storage you save $6 per terabyte. Depending on your preference, the blockchain storage solution allows many ways to save money as opposed to the rigid structure currently in cloud storage. Glacier Storage is long term storage. If you keep your access limited and are using cloud storage primarily for back up the blockchain solution provided by AWS is ideal.

Companies in the Sector

With the price discrepancy illustrated above, it is clear that this can be a lucrative market as long as the technology and awareness are there. The companies that have been on top of this are Amazon, Storj and Sia. Interestingly, they all are working on cryptocurrencies to help facilitate these functions and use for payment.

“Going forward, we are starting to see new models where protocols are where the value accrues”[5]. Amazon, due to its vast amount of resources and spearheaded by Jeff Bezos, sees an opportunity to undercut the current price of cloud storage and eradicate the middleman. The profit margins here compared to regular storage are significantly better because they have no overhead storage cost. They only need the software protocol.

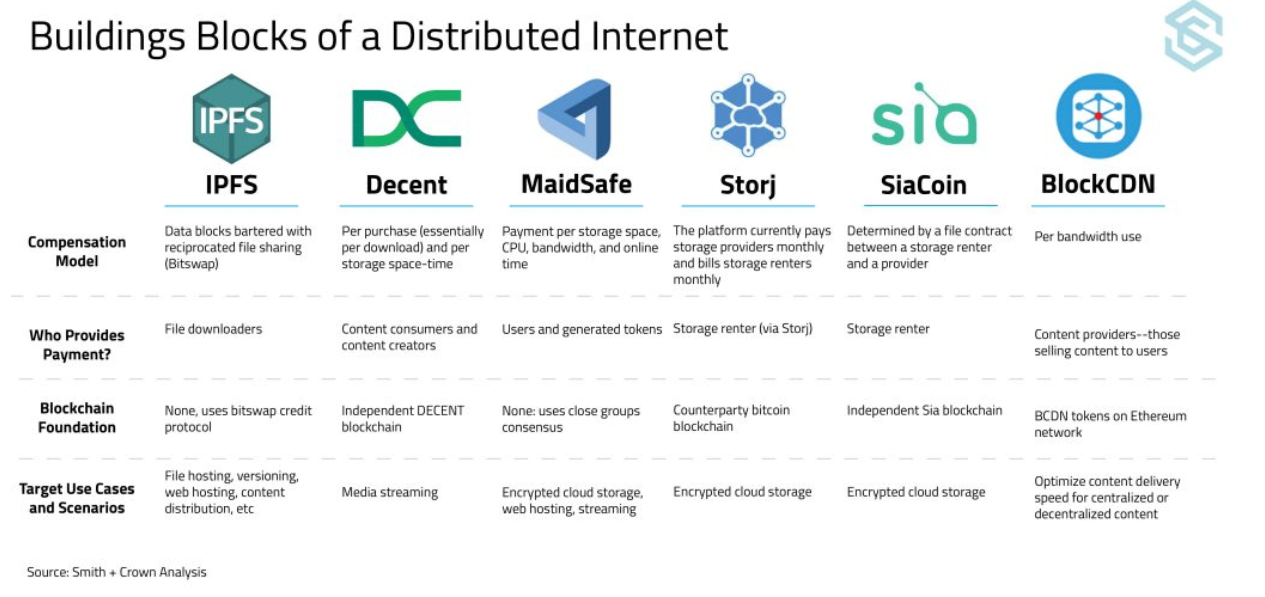

The graph above shows companies currently operating in the blockchain + cloud storage industry. The last three: MaidSafe, Storj, and SiaCoin are the main companies in this industry. As you can see, there are different models for payments and operation. MaidSafe is emphasizing the security and charges based on how much data a user is using along with storage space. Storj and SiaCoin have a payment plan. It differs for SiaCoin in the sense that there is a middleman creating an agreement between the provider and renter. Storj has monthly fees and then pays out the hosts providing storage.

Sia doesn’t have scalability issues because it only gives copies of the data out to 50 hosts. With blockchain technology, the information is spread out across the whole server for each piece of data. As the network grows in popularity, that means that the information would grow significantly faster than the method Sia has established. This unique approach allows the company to expand the network to more people when they run out of space. Regarding the price, SiaCoin pays the host a third of the renter’s price. Due to the use of triple redundancy to back up the data, the data is shared evenly between 3 hosts. Therefore, a host would receive approximately $0.66/TB/Month, equivalent to 31 SiaCoins at the current price of $0.02118.

Other companies need each host in the network to increase their storage. As they get more hosts or nodes, the more secure the network is. Conversely it also creates a cap on the number of customers they can have because there is a finite amount of storage space on the host’s computers. This is a much less feasible and scalable option. It will certainly be intriguing to see how these companies plan to tackle this problem in the future.

Connor Garnett contributed to this report.

[1]Joshi, Naveen. “Distributed Cloud Storage with Blockchain Technology.” Allerin, 21 June 2017,

www.allerin.com/blog/distributed-cloud-storage-with-blockchain-technology.

[2]Mearian, Lucas. “Blockchain and Cryptocurrency May Soon Underpin Cloud

Storage.”Computerworld, 26 Mar. 2018, www.computerworld.com/article/3250274/data-storage/blockchain-and-cryptocurrency-may-soon-underpin-cloud-storage.html.

[3]Sawers, Paul. “Amazon Cloud Drive Goes Unlimited.” VentureBeat, 26 Mar. 2015,

venturebeat.com/2015/03/26/amazon-launches-two-new-cloud-drive-unlimited-plans-11-99year-for-photos-and-59-99year-for-everything/.

[4]Evans, Bob. “The Top 5 Cloud-Computing Vendors: #1 Microsoft, #2 Amazon, #3 IBM, #4

Salesforce, #5 SAP.” Forbes, 7 Nov. 2017, www.forbes.com/sites/bobevans1/2017/11/07/the-top-5-cloud-computing-vendors-1-microsoft-2-amazon-3-ibm-4-salesforce-5-sap/#409863346f2e.

[5]Krug, Joey. “Why Amazon’s Margin Is Filecoin’s Opportunity.” Forbes, Forbes Magazine, 25 Aug.

2017, www.forbes.com/sites/joeykrug/2017/08/18/why-amazons-margin-is-filecoins-opportunity/#67164f1b24dd.

[6]Connell, Justin. “How Much Does It Cost to Run a Full Bitcoin Node?” Bitcoin News, 23 Feb.

2017, news.bitcoin.com/cost-full-bitcoin-node/.

[7]Scheidt, Zach. “Blockchain.” Daily Reckoning, 8 Jan. 2018, dailyreckoning.com/blockchain/.

[8]Burshteyn, Mike. “Coin Frenzy & Decentralized Data - What Are Implications for Fortune 500

Enterprise CIOs & CISOs?” CryptoMove Blog, 22 May 2017, blog.cryptomove.com/coin-frenzy-decentralized-data-what-are-implications-for-fortune-500-enterprise-cios-cisos-8b4de6cc201b.

[9]Lardinois, Frederic. “Google Drive Gets A Big Price Drop, 100GB Now Costs $1.99 A

Month.”TechCrunch, 17 Mar. 2014, techcrunch.com/2014/03/13/google-drive-gets-a-big-price-drop-100gb-now-costs-1-99-a-month/.

[10]“Cloud Services: Storage Services Revenue 2010-2016 | Statistic.” Statista,

www.statista.com/statistics/203474/global-forecast-of-cloud-computing-storage-services-revenue/.

[11]Patterson, Connor. “Distributed Content Delivery and Cloud Storage.” Smith + Crown, 26

Feb.2018, www.smithandcrown.com/distributed-content-delivery-cloud-storage/.

[12]Bishop, Todd. “Cloud Report Card: Amazon Web Services Is a $12B Juggernaut, but Microsoft

and Google Are Gaining.” GeekWire, 20 Feb. 2017, www.geekwire.com/2017/cloud-report-card-amazon-web-services-12b-juggernaut-microsoft-google-gaining/.

- Covid-19 Impact on US Private Capital Raising Activity in 2020 - May 27, 2021

- Healthcare 2021: Trends, M&A & Valuations - May 19, 2021

- 2021 Outlook on Media & Telecom M&A Transactions - May 12, 2021