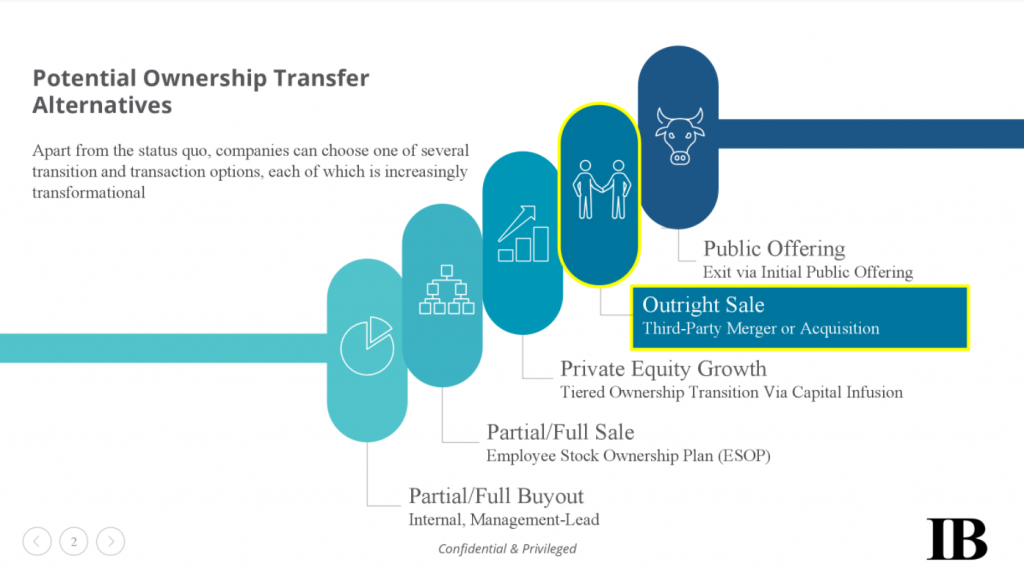

Deals are as unique as the companies themselves. No two structures are the same. Outcomes can sometimes drive deal structure, but all roads eventually lead to Rome. While exit strategies and structures are diverse, most fall into one of five general buckets, with nuances and details that expand out from there. In our assessment, the following graphic provides a good broad overview.

Partial/Full Buyout

Executing a partial or full management-led buyout (MBO) helps keep your company "within the family" so to speak. MBOs can involve direct relatives in a family-owned enterprise or management of an established business looking to transition an older, retiring owner away from the business into the hands of competent management. While MBO scenarios generally do keep things close to the chest, rarely does management or the family have the liquid cash to make the acquisition on their own. Additional equity and acquisition financing loans are helpful to bridge the gap for management/family as they look to buyout existing larger shareholders. The structure, cost, timing and options here are broad, but options abound for existing, successful companies looking to perform a management buyout of a closely-held business.

Partial/Full Sale

Shareholders can also keep it in the family by structuring a partial or full sale from employees through an Employee Stock Ownership Plan (ESOP). ESOPs have been criticized for their heavily leveraged structure which can be disingenuous to the business and its employees. However, if structured properly, ESOPs represent a legitimate form of currency and consideration in full and partial mergers and acquisitions from existing owners. In some cases, private equity groups have found ways to use them to provide premium pricing to selling owners through the tax savings inherent in such a plan. ESOPs are likely not a fit in most cases, but they remain an option for many transitioning companies.

Private Equity Growth

Private equity interest in a growing, profitable business can come at various stages in the company's growth cycle. Private equity funds will sometimes inject themselves at different intervals, infusing capital for minority or majority positions in a business. At each stage, a business owner is likely selling off his/her equity at a certain pre-determined valuation. Such a transition can happen over numerous years and with various differing individuals and groups. While most private equity groups prefer control positions, there are many that are fine with minority positions in private companies as long as they may have first rights to buy-in with a larger stake down the road. The multiple-bites-of-the-apple approach has its benefits for both the seller and the acquirer. Taking chips off the table helps to diversify idiosyncratic risk.

Outright Sale

While an outright sale sounds like the most simple in this list, it is far from such. Varying options for consideration, including cash, stock, notes and earnouts all include degrees of complexity. A veritable cacophony of options await successful sellers as they take their businesses to market. Strategic and financial buyers in both the public and private markets will vie for a seat at the feeding trough as they look to acquire yield from wherever they can get it. It's a great time to sell your business.

Public Offering

For some reason, taking companies public is treated as the crown jewel of investment banking. Unfortunately, most companies--especially middle-market companies--are not even close to being a fit for this type of exit strategy. And for most majority shareholders, Rule 144 will preclude them from quickly selling and diversifying their holdings anyway. Going public fits well for companies of a good size with high growth prospects, but is not typically a fit for most in the middle and lower-middle-market. Entire novels could be written around each of the aforementioned options for exiting a business. Some exits are best served in one glorious event. Others, by preference or necessity, are taken down one bite at a time. Each options has its own pros and cons. Which would fit your goals?

.png)

.png.png)