When it comes to selling a business the numerous options and opportunities can confuse many would be sellers. Popular questions include "how to maximize the value of the sale?" and "should the transaction be structured as an asset sale or stock sale?". One possibility that sellers may not be aware of is the roll-up transaction. As with any other transaction, the roll-up has pros and cons that a seller should consider. If this is your first time around the block then enlisting the services of a seasoned investment banker may be a prudent move.

The Roll-Up Transaction

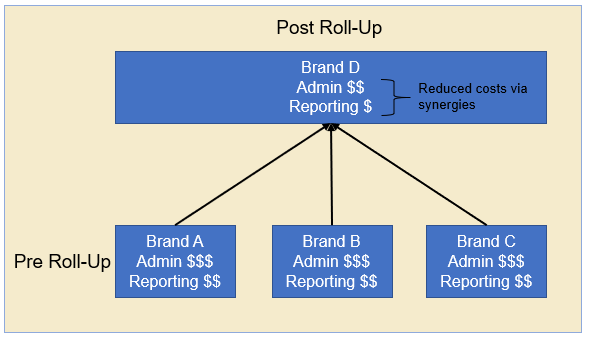

At a high level, a roll-up strategy is simple to understand. An industry is composed of multiple small firms and a buyer, typically a financial buyer, decides to purchase the smaller firms, thus consolidating the market. The smaller firms that are acquired usually provide common services or products in the given market. As the strategy is executed and new firms are acquired, they are brought under one brand and share the same administrative, reporting and other operational systems. By combining all of the small firms into one large entity the buyer hopes to create a firm that is able to command a larger part of the market and reduce expenses via synergies. If done correctly then the large entity will have a higher valuation when the buyer decides to exit.

Business owners contemplating selling into a roll-up strategy should take note of a few risks, especially if they will remain with the new entity post-sale. First and foremost, roll-ups can be difficult to execute. The buyer must be able to integrate companies with different cultures, practices, and people. While no integration is a cake walk, transactions involving multiple companies in a short period of time are more complex than those involving one company with ample time for post-deal integration.The speed with which the integration takes place will need to find the Goldilocks pace; neither too fast or too slow. Deals that are rushed and result in rapid change may cause core team members to leave. If the integration drags on too long, then the expected synergies of one large entity will be tough to capture. The result would be one large company with many small companies under its name.Another important factor will be the consideration used in the transaction. Remember, the buyer is focused on acquiring multiple companies to generate economies of scale and create one large entity. This requires a good deal of cash. When it comes time to negotiate the consideration for a deal the buyer may try to include shares in the new entity as one piece of the pie. For the buyer, this helps them reduce cash outflows. It also motivates the seller to remain with the new entity and continue to work hard towards growth as they are now partial owners.For some sellers this may be the perfect solution and for others it may be less than optimal. Business owners who have the following needs may want to think twice before selling into a roll-up strategy.

- A need for cash now: If the business owner requires a 100% cash exit then a roll-up may not be the best fit. As mentioned previously, the buyer will usually try and include shares in the new entity as part of the consideration. This may tie the seller to the new entity for several years before they are able to fully cash out.

- If control is required: While an owner may stay on after a sale it is not likely that they will be calling all of the shots. While they may retain a senior management position they will most likely still need approval from the buyer's management team for certain actions. For some business owners that have been their own boss for a number of years this may not sit well.

Creating Value in a Roll-Up Transaction

Roll-up transactions can be tricky to execute. For business owners who are selling as part of a roll-up strategy it is important that the proposed value is realized. This is especially true for owners who will receive part of the payout in shares of the new entity! The following factors should be considered when deciding if this transaction is the best style for a given situation. If the seller feels comfortable then they should explore next steps. Otherwise, it may be wise to pursue other exit opportunities.1. A Sound Investment Thesis - Growth for growth's sake is not the best strategy. Sellers should review the strategy with the buyer and determine if the process is truly strategic or not. This is very important for sellers who receive stock in the new entity. A future liquidity event could be delayed or even derailed if the roll-up is poorly executed and doesn't make sense to future buyers.2. The Management Team - The buyer will be conducting due diligence on you and everyone on your team in addition to the corporate entity. Be sure to return the favor. Does the buyer have the right people in the right position? A CEO may be great at a startup, but they may not make the best CEO for the new combined entity looking to present itself to a different class of investors.3. An Integration Plan - Deals don't end once cash changes hands. Once papers are signed the post-deal integration must begin. The buyer should have a good sense of how the newly purchased company will be integrated into the larger entity and a strategy for accomplishing this goal. Realizing the synergies that prompted the deal in the first place will be critical.Roll-up strategies come with challenges and require hard working teams to properly execute the plan. However, they can have exceptional results if done properly. Throughout the 1970s and 1980s Waste Management, Inc. became a major player in the US waste disposal business by acquiring nearly 133 small operators. Valeant Pharmaceuticals, a specialty pharmaceutical company, also executed a successful roll-up strategy. Since 2010 they have acquired nearly 100 businesses, helping them become the multinational company that they are today.

.png)

.png.png)