Software Staffing: An Investment Banking & M&A Industry Trends Overview

- What is the software & IT staffing industry? (Executive Summary)

- What are the M&A and VC transaction trends and business valuations?

- What is the historical and future expected performance for the software & IT staffing industry?

- What are the supply chains, products, services, and major market in the software & IT staffing space?

- Who are the major industry competitors and what is their market share?

- What are the industry operating conditions (key success factors, barriers to entry, industry globalization)?

Maximizing transaction value through expert advisory.

Our experienced software and IT staffing team provides world-class strategic investment banking advisory across the staffing ecosystem. With deep industry knowledge, expertise and execution experience in both staffing and surrounding services, our team provides an added layer to our client teams. In every client engagement, we provide partner-level support, shepherding transactions from start to finish.

With access to judgement, borne from transaction experience, we assist our clients in every step of the deal process from creating the deal offering documents, marketing, negotiating the terms, closing and everything in between.

Our senior bankers have long-standing relationships with some of the most active, key industry executives. With broad transaction experience, we help clients in providing a differentiated go-to-market strategy. Regardless of whether your business requires assistance on a corporate sale, recapitalization, acquisition or capital requisition project, our team has the expertise and tenacity to effectively deliver on our client objectives.

By partnering with some of the most innovative clients in the world, our staffing team boasts a high delivery rate of successful outcomes for our clients. Bolstering the standard of care and executing on a long-term strategic vision for your software and IT staffing business is what we are all about. Our team also includes numerous research analysts, covering both public and private buyers and sellers around the globe. We pride ourselves on giving our clients the expertise and focused effort required to navigate difficult transactions. Get in touch with one of our investment bankers today to discuss how we can help with your capital transaction goals.

Software & IT Staffing Industry Overview

An executive summary of software and IT staffing

The hiring process is critical for the long-term success of corporations. A study shows that on average, every corporate job opening attracts 250 resumes.[1] Staffing firms, including software staffing firms, were created to ease the high-stressed procedure. They help corporations find the right candidate marketplace, industry, and geographic area. The staffing firm “effectively evaluates candidates’ experiences and skills.”[2]

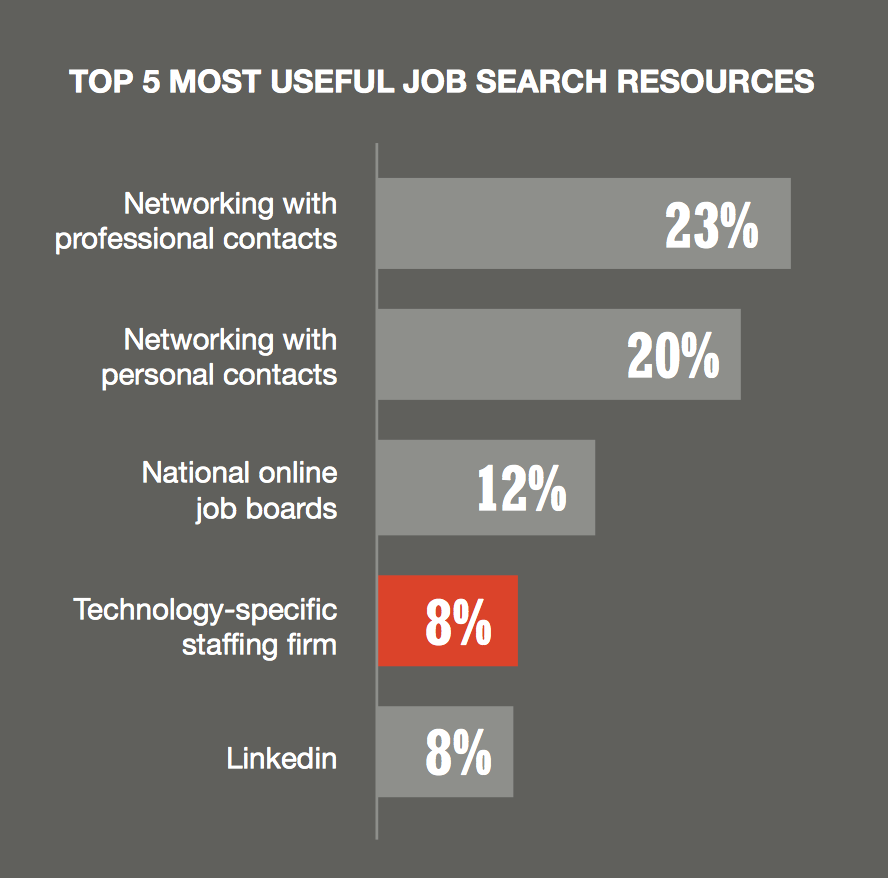

Software & Information technology (IT) staffing and consulting firms connect highly qualified, tech-skilled workers with companies that have that need. Figure 1 shows how the value of IT staffing agencies compare to other “useful job search resources.”[3]

Fig 2 Source: http://www.ibs.com/media/Infographics/IBS-Why-Work-For-an-IT-Staffing-Firm-F.pdf

This report is the first of a series that will describe the IT Staffing and Consulting Industry. Later reports will cover the following topics in the industry: transactions, industry performance, products and markets, competitive landscapes, major companies/activities, operating conditions, buy side agreements, and key statistics.

This first report will provide an executive summary by discussing (a) the overall purpose and (b) the main activities of an IT Staffing and Consulting firm. Then the report will discuss (c) similar industries that attempt to create the same value.

Overall Purpose

Pinnacle Group, an IT staffing and consulting firm, clearly states that it helps “enterprises meet their goals and objectives” by providing talent that improves “technology landscape, shortens the product realization lifecycle, and improves customer experience.”[4]

Because the need for highly skilled IT workers is at an all-time high, companies see great value in outsourcing their responsibilities of finding these employees to staffing agencies. Figure 2 shows how general staffing firms are widely used across organizations.

Fig 2 Source: http://www.ibs.com/media/Infographics/Key-Drivers-for-Buyers-of-IT-Staffing-Services-%20F.pdf

IT staffing and consulting firms also provide the value of human capital by offering consulting services to the firm. These firms use their highly valued human capital to help consult firms with IT problems. Their dual purpose enables them to bring highly trained individuals to solve projects for a short duration, and they provide companies with the opportunities to hire these individuals full time.[5]

Main Activities

The staffing agency screens and hires candidates for regular positions.[6] The agency goes through the detailed, hiring process so that the employer at the company can have full confidence in hiring that individual. The staffing service offers its IT talent to firms for a premium charge.

The individuals, which are hired on from the IT staffing and consulting, provide value by giving their clients, a corporation, insights about overall IT strategy.[7] For example, the IT consultant will advise clients concerning mobile security, process automation, data storage, etc.[8] An IT consultants is a domain expert about information technology who can satisfy corporations’ technological needs.[9]

Similar Industries

Staffing is a general business that can be practiced in every branch of a corporation. Finance and accounting, marketing, and public relations are all examples of staffing agencies. The staffing agency takes a skilled individual and then adds value by linking the individual to a company’s need. Figure 3 shows the breakdown of occupations by staffing employees.

Fig 3 Source: https://americanstaffing.net/staffing-research-data/fact-sheets-analysis-staffing-industry-trends/staffing-industry-statistics/

Conclusion

Overall, the IT Staffing and Consulting industry is a platform that provides value by connecting qualified, tech-skilled individuals with enterprises that need it. The industry adds value to the individual by promoting his or her skills and abilities. The industry also adds value to the enterprise by making the hiring process more efficient and effective. In return, the individuals’ human capital adds value to the enterprise.

Sources

[1] Peter Economy, “11 Interesting Hiring Statistics.” Retrieved from: https://www.inc.com/peter-economy/19-interesting-hiring-statistics-you-should-know.html. Accessed February 22, 2018.

[2] Robert Half, “How Do Staffing Agencies Work? 5 Tips for the Employer.” Retrieved from: https://www.roberthalf.com/blog/working-with-a-staffing-agency/how-do-staffing-agencies-work-5-tips-for-the-employer. Accessed February 22, 2018.

[3] IBS. Retrieved from: http://www.ibs.com/media/Infographics/IBS-Why-Work-For-an-IT-Staffing-Firm-F.pdf. Accessed February 24, 2018.

[4] Pinnacle Group. Retrieved from: https://www.pinnacle1.com/What-We-Do/IT-Staffing-and-Consulting. Accessed February 22, 2018.

[5] Randstad. Retrieved from: https://www.randstadusa.com/staffing-and-solutions/staffing/it-staffing-2017/. Accessed February 22, 2018.

[6] Amy White, “What is a Staffing Agency?” Retrieved from https://www.snagajob.com/resources/staffing-agency/. Accessed February 22, 2018.

[7] iCorps Technologies. Retrieved from: https://blog.icorps.com/what-are-the-differences-between-it-consulting-it-services-and-software-consulting. Accessed February 22, 2018.

[8] Ibid.

[9] Ibid.

Software & IT Staffing Transaction and Capital Trends

Software & IT Staffing Mergers, Acquisition & Venture Capital Investments

Staffing continues to be a hotspot for software M&A transactions because of the value that it creates for individuals and companies. In this report, the following items will be discussed about the transactions of an IT Staffing & Consulting firm: (a) historical transactions, (b) major buyers and buyer trends, (c) valuations and multiples, and (d) notable deals.

Historical Transactions

In 2017, there were 88 staffing firm transactions announced. Of those transactions, Healthcare and IT staffing firms were the most frequently targeted segments.[1] Staffing Industry Analysts’ Database Tool holds information about 847 transactions that occurred between January 2014 and December 2017.[2]

According to Duff & Phelps, the number of staffing deals in 2017 totaled to 139, ~14% increase from 2016. Figure 1 represents Duff & Phelps’ yearly staffing transaction volume from 2007 to 2017. Figure 2 shows the percentage of staffing transactions per industry.

Fig. 1 (left), Fig. 2 (right) Source: https://www.duffandphelps.com/-/media/assets/pdfs/publications/mergers-and-acquisitions/industry-inserts/staffing/staffing-industry-ma-landscape-winter-2018.ashx

Because the economy is in the middle of a recovery cycle, the current demand for temporary jobs has increased; therefore, M&A activity in the staffing industry has increased over the last few years.[3]

Major Buyer and Buyer Trends

Staffing companies are generally acquired by strategic buyers. From the 139 reported transactions in 2017 (see Fig. 1), 20% were obtained by financial buyers and 80% by strategic buyers.[4] Because financial and strategic buyers’ processes differ, each buyer valuates firms differently.[5] Figure 3 compares financial buyers to strategic buyers for staffing transactions for the last five years.

Fig 3 Source: https://www.duffandphelps.com/-/media/assets/pdfs/publications/mergers-and-acquisitions/industry-inserts/staffing/staffing-industry-ma-landscape-winter-2018.ashx

Financial buyers. Financial buyers include “private equity firms, venture capital firms, hedge funds, family investment offices, and ultra-high net worth individuals.”[6] These firms are looking for a return on invested capital. Generally, financial buyers acquire firms that can generate cash flow on their own.[7]

Strategic buyers. Strategic buyers are operating companies that acquire other firms to integrate the firm into its own operations to increase its primary revenue stream. Also, strategic buyers may acquire another company with unrelated operations to diversify revenue sources.

Valuations and Multiples

The following table (Fig. 4) represents public trading statistics for eight staffing companies. This chart includes stock prices, market capitalization, enterprise value, and other valuation ratios to represent multiples.

Fig. 4 Source: https://www.slideshare.net/DuffandPhelps/staffing-industry-ma-landscape-winter-2018-87565633

The data shows that the average EV/EBITDA multiple for these companies is 9.8x. According to Valuation Academy as of January 2014, the average EV/EBITDA multiple for industries such as computer services, information services, and telecom services are 9.51, 15.21, and 7.42, respectively.[8] A relatively high EV/EBITDA means that the company is overvalued; versus a low multiple, which means the company is undervalued.[9]

Notable Deals

In the fourth quarter of 2017, Vaco, a staffing firm, was acquired by Olympus Partners, a private equity firm. Vaco provides consulting and staffing in the accounting, finance, technology, healthcare, operations, and administrations sectors. The amount of the acquisition is not publicly known, however, Vaco’s revenue is projected to surpass $458 million in 2017.[10]

Accretive Solutions is a consulting, staffing, and outsourcing services firm that was acquired by Resources Connection Inc. in the fourth quarter of 2017. Resources connection paid “$19.4 million in cash plus 1.15 million shares of restricted common stock for the firm.”[11]

Conclusion

The Staffing Industry continues to grow with the economy. IT staffing and consulting represents the top sector of M&A transactions for staffing companies in the United States. Strategic buyers acquire staffing companies to improve their company’s margins and to create different revenue streams. IT staffing transactions are growing and expanding in the market.

Source

[1] Staffing Industry Analysts, 2017. “Staffing Mergers & Acquisitions: 2018 Update.” Retrieved from: https://www2.staffingindustry.com/site/Research/Research-Reports/Americas/Staffing-Mergers-Acquisitions-2018-Update. Accessed February 27, 2018.

[2] Ibid.

[3] Madison Street Caapital, 2017. “2017 Staffing Industry.” Retrieved from: http://madisonstreetcapital.com/blog/id/86. Accessed February 27, 2018.

[4] Duff & Phelps, 2017. “Staffing Industry M&A Landscape.”

[5] Boyte, Cody, 2014. “5 Differences Between Financial and Strategic Buyers.” Retrieved from: https://www.axial.net/forum/5-differences-financial-strategic-buyers/. Accessed February 27, 2018.

[6] Ibid.

[7] Ibid.

[8] Valuation Academy, 2014. “Industry Specific Multiples.” Retrieved from: http://valuationacademy.com/industry-specific-multiples/. Accessed March 1, 2018.

[9] Y Charts, 2017. “EV/EBITDA” Retrieved from: https://ycharts.com/glossary/terms/ev_ebitda. Accessed March 1, 2018.

[10] Duff & Phelps, 2017. “Staffing Industry M&A Landscape.”

[11] Ibid.

Software & IT Staffing Industry Performance

Historical and future expected macro performance in software and IT staffing

The software and IT segment is the fastest growing sub-sector of professional staffing and consulting firm.[1] Revenues for this sub-sector continue to grow along with the entire staffing industry. This report will discuss the (a) key external drivers and (b) current performance for staffing firms in 2017.

Key External Drivers

IT Staffing firms, like other firms, are heavily influenced by external factors such as customers, the economy and competition.[2] The economy heavily affects IT staffing firms by influencing the (a) labor force participation rate, and (b) overall industry competition.[3]

Labor force participation. When the labor force participation is low, typically in a recession, companies have trouble finding the right candidates for a position. This makes it critical for businesses to look to staffing companies for recruiting and hiring top employees.[4]

When labor force participation is low, staffing agencies fill employment needs. Using staffing firms during these times will help a company productively fulfill demands without having to deal with full-time employees.[5]

Competition. As the economy rises, the competition goes along with it. During periods of healthy and improving economic growth, companies struggle to find and retain key employees. Companies can use staffing agencies to improve their pool of qualified candidates.[6]

Overall, the economy drives the fluctuation of staffing firms’ performance. Along with fluctuations in the economy, IT staffing firms are influenced by the current fluctuations of the technology market.

Current Performance

The following looks at both the quantitative and qualitative performance of staffing firms.

Quantitative performance. In 2016, the staffing industry generated about $137 billion of revenue.[7] The top-performing industry for the last three years, Allegis Group, has a 6.5% market share of the entire industry.[8] Figure 1 displays the revenue for top firms from 2014 to 2017.

Figure 1 Source: https://www2.staffingindustry.com/site/Editorial/Daily-News/Staffing-Industry-Analysts-lists-largest-US-staffing-firms-for-2017-42794

The graph portrays revenues healthily increasing year by year. The total US staffing market is predicted to “rise by 3% [each year].”[9]

The top 43 IT software and staffing firms account for over $18 billion of revenue and 63% of market share.[10] The following chart (Figure 2) shows the top five IT staffing firms in the U.S.

Largest IT Staffing Firms in the United States

Figure 2 Source http://aictalent.acsicorp.com/aictalent/sites/all/themes/aic/images/Largest-IT-StaffingFirms.pdf

Allegis Group’s 12% market share equates to $28.9 billion of total market value for IT staffing firms. IT staffing firms are the fastest growing subsector of professional staffing and consulting firms.

Qualitative data. Because staffing, in general, is an industry based on human capital and intangible key indicators, studies are done to rank staffing using net promoter scores (NPS). Net promoter scores “measure customer experience and [predict] business growth.”[11] The NPS is calculated by asking the question, “How likely is it that you would recommend [brand] to a friend or colleague?” The answer is given on a scale of 0 (not at all likely) to 10 (extremely likely).[12]

Those who score 9-10 are titled as “promotors,” those who score 7-8 are titled “passives,” and those who score 0-6 are titled “detractors.” The NPS is calculated by taking the percentage of promoters and subtracting the percentage of detractors.[13] Figure 3 shows the scale used for NPS calculation.

Figure 3 Source: https://www.netpromoter.com/know/

Studies and surveys were completed to calculate the NPS for the staffing industry. In the survey program promoted by Inavero, the study measured the NPS for three different categories: (1) client satisfaction, (2) talent satisfaction, and (3) internal staff satisfaction. Figure 4 shows the results of the study for 2017.

Figure 4 Source: https://www.inavero.com/category/staffing_recruiting/staffing-nps-benchmarks/

With an average scores between 7.5 and 8.3, staffing is perceived as neutral by consumers. According to the same survey done in previous years, last 7 years has yielded net promoter scores similar to the chart shown above.[14] Client satisfaction has fluctuated the most with an NPS of 33%, -3%, and 9% in 2010, 2015, and 2017, respectively.[15] Overall, current performance has remained fairly constant according to net promoter scores.

Conclusion

Revenue for staffing firms continue to increase year over year. The fluctuation of external factors (e.g. economy) heavily impact the current performance of these staffing firms. External factors impact the need for staffing firms but also affect the way individuals perceive staffing firms. Depending on the ups and downs of an economy, staffing firms perform differently.

[1] Duff&Phelps, 2017. “Staffing Industry M&A Landscape,” Retrieved from: https://www.slideshare.net/DuffandPhelps/staffing-industry-ma-landscape-winter-2018-87565633. Accessed March 6, 2018

[2] Chron, 2017. “What are Internal & External Environmental Factors That Affect Business?” Retrieved from: http://smallbusiness.chron.com/internal-external-environmental-factors-affect-business-69474.html. Accessed March 6, 2018.

[3] @Work, 2015. “What Impact Does the US Economy Have on Staffing?” Retrieved from: https://www.atwork.com/2015/11/06/what-impact-does-the-us-economy-have-on-staffing/. Accessed March 6, 2018.

[4] Ibid.

[5] Ibid.

[6] Ibid.

[7] Staffing Industry Analysts, 2017. Retrieved from: https://www2.staffingindustry.com/site/Editorial/Daily-News/Staffing-Industry-Analysts-lists-largest-US-staffing-firms-for-2017-42794. Accessed March 9, 2018.

[8] Ibid.

[9] Staffing Industry Analysts, 2017. Retrieved from: https://www2.staffingindustry.com/site/Editorial/Daily-News/US-staffing-market-to-increase-3-SIA-forecast-says-43471. Accessed March 9, 2018.

[10] Staffing Industry Analysts, 2017. Retrieved from: http://aictalent.acsicorp.com/aictalent/sites/all/themes/aic/images/Largest-IT-StaffingFirms.pdf. Accessed March 10, 2018.. Accessed March 9, 2018.

[11] Satmetrix, 2017. “What is Net Promoter?” Retrieved from: https://www.netpromoter.com/know/. Accessed March 6, 2018.

[12] Ibid.

[13] Ibid.

[14] Inavero, 2017. “Net Promoter Score (NPS) Benchmarks for Staffing.” Retrieved from: https://www.inavero.com/category/staffing_recruiting/staffing-nps-benchmarks/. Accessed March 6, 2018.

[15] Ibid.

Software & IT Staffing Key Performance

Key Performance Indicators (KPIs) in software and IT staffing

Supply Chains

A supply chain is the set of links between various steps that allow a business to reach its end goal. For example, a manufacturing business typically has a supply chain consisting of suppliers, the manufacturer, wholesalers, and then a retailer. Staffing supply chains vary slightly in that they rely on an employee board, hiring managers, recruiters, agencies, and background check providers. The important components of any human capital supply chain are training, development, and retention.

Figure 1 Source: http://supplychainbigairo.blogspot.com/2016/12/zappos-supply-chain.html

With the proliferation of technology, the most effective staffing systems electronically link agencies, online sources, and referrals through one-click multi-posting, agency portals and electronic employee referral programs[1]. This enhanced process reduces the recruiting cycle time and increases efficiencies in staffing. This is also useful in recruiting top-notch Information Technology (IT) talent.

Products and Services

According to TEKsystems, the world’s highest revenue generating IT staffing company, the goal of these firms is to provide IT talent, solutions, and services that help organizations stay competitive and actualize ROI[2]. Their IT staffing solutions include IT application staffing, communications staffing, and network infrastructure staffing. Annually, TEKsystems deploys over 27,000 IT professionals with 74% of those being application staffing and 19% communications staffing. They also provide many other services apart from staffing. This is typical with the top organizations.

Figure 2 Data Source: https://www.teksystems.com/en

Demand Determinants

The demand determinants are the price of the staffing services, the price of competitors’ services, the price it costs for organizations to recruit top talent themselves, and the income of potential clients. Each of these will determine whether an organization utilizes the resources of an IT staffing firm. The holiday and tax seasons typically represent the busy season for staffing services.

Major Markets

Virtual staffing firms are gaining in popularity. 73% of working adults include flexibility as one of their most important factors when considering a new job[3]. The benefits include a happier workforce with better work/life balance, a larger talent pool, and decreased overhead costs. Virtual staffing is successful in the IT industry as well as the clerical, administrative, and creative industries.

The Staffing Industry Analysis (SIA) estimates that the staffing industry generated USD 429 billion in revenue worldwide with the largest markets being the US, Japan, and the UK. The top 15 countries combined for 88% of total global staffing[4]. The staffing market as a whole has been experiencing accelerated growth.

Sources

[1]Yves Lermusi. Retrieved from https://www.ere.net/the-staffing-supply-chain/

[2]Retrieved from https://www.teksystems.com/en

[3]Retrieved from http://tempay.com/2014/01/15/virtual-staffing-firm-consider/

[4]Jennifer Arcuni. Retrieved from https://www2.staffingindustry.com/site/About/Media-Center/Press-Releases/Global-Staffing-Market-Revenue-Growth-to-Accelerate-to-6

Major Markets & Demand Determinants

Major subsectors, products and demand determinants in software & IT staffing

Top 20 Companies Based on Revenue and Market Share in the US

The following chart is based on research conducted by Staffing Industry Analysts (SIA). The chart highlights the top 20 IT staffing firms in the United States. They are ranked by the estimated temporary IT staffing revenue generated in 2016. The overall US IT staffing marketing for 2016, as estimated by SIA, was $28.6 billion.[1].

According to the four-firm concentration ratio, the IT staffing industry in the US is not considered very competitive or concentrated. To be defined as competitive the top four firms would need to account for roughly 40% of the industry’s output. In this case, the top four firms represent approximately 27% of the market.

When analyzing the market share held by the largest firms the following chart from SIA[1] shows that the five largest firms have maintained roughly the same share since 2010. The 15 largest firms experienced a jump in share from 2008-2010 but have slowly lost ground over the years.

SIA further mentions that the consolidation that was seen in 2008 thru 2010 was largely in part due to the acquisition of COMSYS IT Partners by ManpowerGroup. The transaction took place through the merger of a wholly owned subsidiary of ManpowerGroup into COMSYS. Another notable transaction during this same time period was the acquisition of MPS Group by Adecco.

Recent Activity

The below pie chart compares the M&A activity within each segment of the staffing industry during 2015 in North America. As illustrated, M&A within IT staffing constituted 22% of all transactions. Compared to other staffing services, such as commercial staffing, IT continues to dominate. This is attributed to the healthy margins of firms and the positive growth prospects for the future[2]. During the year 15 firms that specialize in IT were acquired. The industry experienced a downswing in M&A activity from 2015 to 2016. Deals in North America fell from 92 in 2015 to 69 in 2016. Both figures well off the 126 deals announced in 2007 prior to the recession. This may have been due to subpar economic growth and heightened business uncertainty.

Figure 1: https://www2.staffingindustry.com/site/Editorial/IT-Staffing-Report/Feb.-2-2017/IT-staffing-remains-industry-s-most-active-segment-for-M-A

In 2017, IT staffing has proven itself to be the most active segment of the staffing industry for M&A with 41 transactions globally. These results are significantly higher than the other sectors within the staffing industry.

Figure 2: https://www.statista.com/statistics/789227/mergers-and-acquisitions-staffing-industry-worldwide-sector/

In recent deals Creative Circle, LLC was acquired by On Assignment on May 11, 2015 for $570 million with an additional $30 million in potential earn-out payments[3]. The purchase price, including tax savings with a net present value of ~$91 million, represents ~8.0x 2015 Adjusted EBITDA (excluding earn-out) and ~8.5x 2015 Adjusted EBITDA (including full achievement of earn-out). Revenues for Creative Circle were $226 million in 2014 prior to the acquisition.

In recent years ManpowerGroup has been in acquisition mode. In 2015 ManpowerGroup acquired 7S Group GmbH in Germany for a reported €136.5 million to expand their range of solutions in specialty sectors[4]. In 2016 they purchased the Norway division of Ciber, Inc. and announced in early 2017 that they would be acquiring the Spain division as well[5].

Sources

[1]Landhuis, Timothy, and Maxim Kupfer. “Largest IT Staffing Firms in the United States: 2017 Update.” Staffing Industry Analysts, 21 July 2017, aictalent.acsicorp.com/aictalent/sites/all/themes/aic/images/Largest-IT-StaffingFirms.pdf. Accessed 18 Apr. 2018.

[2]Staffing Industry Analysts, www2.staffingindustry.com/site/Editorial/IT-Staffing-Report/Feb.-2-2017/IT-staffing-remains-industry-s-most-active-segment-for-M-A. Accessed 18 Apr. 2018.

[3]Acquisition of Creative Circle, LLC, 2015. Retrieved from http://phx.corporate-ir.net/External.File?item=UGFyZW50SUQ9Mjg1Nzg1fENoaWxkSUQ9LTF8VHlwZT0z&t=1

[4]ManpowerGroup Inc. (2017). Form 10-K 2017. Retrieved from SEC EDGAR website https://www.sec.gov/edgar.shtml

[5]“ManpowerGroup In the News.” ManpowerGroup Announces Acquisition of Ciber Spain, www.manpowergroup.com/media-center/news-releases/ManpowerGroup Announces Acquisition of Ciber Spain. Accessed 18 Apr. 2018.

Staffing Industry Operating Conditions

Capital Intensity, Technology Systems & Revenue Volatility in Staffing

There are many different competitors within the IT Staffing and Consulting sphere. The focus of this report will be to identify how the market is concentrated, key success factors, cost structure benchmarks, the basis of competition, barriers to entry, and the industry’s globalization.

Market Concentration

Staffing Industry Analysts (SIA) creates a list each year of IT staffing firms with at least $100 million in revenue. The data is based on the year prior. The 2017 list, which was based on 2016 revenue, included 43 firms with a combined revenue of $18 billion.

Here are the top five IT staffing firms based on their 2016 revenue[1]:

These IT staffing firms are the largest and account for approximately 30% of the industry in the US. It is important to note that the higher rankings do not necessarily imply better service or greater value to each of the companies’ shareholders.

Key Success Factors

When identifying characteristics among successful firms the following tend to appear.

Successful firms provide various options that align with their unique clients’ needs. For example, On Assignment, the second largest revenue producing IT staffing firm, has a skill-focused recruiting methodology which allows them to quickly identify top local talent in 13 skill disciplines across the entire IT project life-cycle. By utilizing this methodology On Assignment is able to provide their clients with higher caliber candidates and a stronger applicant pool. Apex, On Assignment’s dedicated IT staffing and services company, offers many specialties including application development, technology support, systems administration, project management, business analysis, database development, data science, enterprise software, and quality assurance. Their 65 branch locations with over 3 million technical professionals across North America enable them to achieve this high standard[2].

The top IT staffing firms, like On Assignment, have a network that best matches the talent needs of their clients. These staffing agencies also have a timeline that matches the expectations and needs of their clients. On Assignment is able to quickly identify relevant candidates that match a client’s needs. Typically, a candidate can be found and placed with a client in a matter of weeks. The process may be even quicker if a candidate is currently between jobs.

Finally, the top IT staffing firms are transparent with their clients and provide the highest ROI[3].

Each of these key success factors are the basis for competition in this industry. The firms capable of providing these services the best will typically receive the most clients.

Cost Structure Benchmarks

For the Top Echelon Network recruiting firm, the average recruiting fee is $18,571, the average fee percentage is 22.1%, and the average starting salary is $86,907. For IT positions specifically they average a fee amount of $19,643, a fee percentage of 20%, and an average salary of $93,319[4]. The fees generated by the Top Echelon Network are standard for IT staffing firms. Fees generally vary depending on the position or title that is being filled and the industry in which the client operates. Fees are strategically negotiated based on the value provided to clients. Typically, they are percentage fees, but firms will occasionally accept a flat fee.

Barriers to Entry

Prior to the financial crisis, the staffing industry seemed to have low barriers to entry with low start-up costs and little governance or regulation[5]. Now, the industry is saturated with thousands of companies. This makes it more difficult to charge a premium for premium services. However, because of low barriers to entry, staffing companies do not have to provide formal training like other industries with many regulations. Companies that choose to go the extra mile set themselves apart more easily from their competitors.

Industry Globalization

“Global IT staffing generated $59 billion in revenue in 2016, based on SIA estimates, representing more than 15% of the total global temporary staffing market. About half of IT staffing is derived from the US.”[6]

IT staffing represents a significant percentage of the staffing industry. While IT staffing is still most common in the United States, its influence has spread globally, especially in Japan and the United Kingdom.

Figure 1: https://www.statista.com/statistics/495154/staffing-industry-market-share-country/

Austin Stradling, Wesley Bosco, Colin Cole, and Joseph Zhang contributed to this report.

Sources

[1] Timothy Landhuis, 2017. Retrieved from https://www2.staffingindustry.com/site/Editorial/Daily-News/SIA-ranks-largest-IT-staffing-firms-in-US-by-revenue-42915

[2]Retrieved from www.oalabsupport.com/divisions#technology

[3]Retrieved from https://www.adeccousa.com/employers/resources/selecting-a-staffing-provider/

[4]Matt Deutsch, 2017. Retrieved from https://www.topechelon.com/blog/placement-process/typical-placement-recruitment-fees-average/

[5]Ron Hore, 2015. Retrieved from http://blog.hhmc.com.au/2015/11/barriers-to-entry-likely-to-rise

[6]Timothy Landhuis, 2018 https://www2.staffingindustry.com/site/Editorial/IT-Staffing-Report/March-1-2018/Growth-assessment-provides-annual-update-on-the-global-state-of-the-IT-staffing-market/

- Covid-19 Impact on US Private Capital Raising Activity in 2020 - May 27, 2021

- Healthcare 2021: Trends, M&A & Valuations - May 19, 2021

- 2021 Outlook on Media & Telecom M&A Transactions - May 12, 2021