Recapitalizations – Guide to Corporate Financial Recapitalizations

Hundred of billions of dollars worth of recapitalizations (recaps) and restructurings are completed each and every single year around the globe – why?

The two primary reasons for recapitalizations are:

1. To make money

2. To save money

Contents

Private Equity Recapitalizations

Any business owner, whether young or old, has investigated a succession plan or at least wrestled with the idea of selling their business. Sometimes this can happen during a period where significant growth lies ahead, or in times when economics look bleak. What business owners often overlook is the alternative financial technique known as a private equity recapitalization (recap). A recap is where business owners can sell a portion of their business to Private Equity (PE) firm/partner. This gives them a cash reward, whilst still giving them the benefit of forecasted growth, or a turnaround in the economy.

More so, PE firms not only provide capital they can add value as a business partner. This additional benefit can come in the form of industry, operational and organizational expertise; all used to increase the value of your business.

How a PE recap works

It is hard to explain this with text, so let’s work through a simple fictional example. Sam founded Widget Co., a manufacturing company that specializes in widgets. Widget Co., like many companies in the manufactory industry, has weathered many storms over its years. However, during this recent downturn, Sam has realized that too much of net worth is tied up in Widget Co. Sam is now 60 and Widget Co. is his retirement fund. Sam believes the market will turn around, and growth lies ahead in foreseeable future. Sam is, therefore, reluctant to sell his company during its current downturn, but sees the need to de-risk himself in case he is wrong. He plans to de-risk in two ways; limit single person risk by reducing his involvement in daily operations, and to get some cash in return for equity. Sam is a micro-manager and Widget Co. has very little in the way of secondary management or future leaders in its ranks to offer ownership to.

Sam seeks advice from a sell-side advisor and they do some research into some possible options. After investigating a few options and reasons for performing a recapitalization, Sam decides to pursue a PE recap. Sam finds a PE firm that is willing to invest, and a management team willing to drive this change. Like many small businesses, Widget Co. is debt free and the negotiated enterprise value (EV) of Widget Co. is agreed upon by both parties to be US$10 million. The two agree on the structure of the acquisition, with the deal financed with 40% equity and 60% debt. Once the transaction is complete, Widget Co. will carry US$6 million in debt and Sam will continue to own 30% equity of the company.

The value of the equity after the recap will be as follows:

But the story is not over for Sam, and he will have another option to sell soon. After a period of time, generally five to seven years, the PE firm will execute a liquidity event for the business. Generally, this is through a sale to another larger PE firm, or through an IPO.

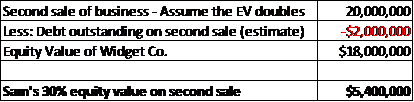

Below we show how Sam’s equity value changes in the second sale if, for example, they were able to double the enterprise value over this five to seven year timeline:

So, in this example, Sam walks away with US$14.2 million versus the US$10 million that he would have earned on the initial sale of 100% of his business. Use these tables as a benchmark and play around with the enterprise valuation multiple. In PE recaps it is not uncommon to see a two or three times increase, or alternatively less than a 100% increase. PE firms are known for aggressively growing their portfolio companies. This does mean you need to somewhat keep an eye on their practices, as growth at all costs can affect your customer relationships. Remember, not only did Sam profit from the growth, he was able to step back from the management team and diversify his personal investments.

But what are the risks of a recap?

The example above was meant to be very simplistic, with lots of fictional assumptions. This subject can and will be complicated, but we wanted to address it as a viable option for you to choose. Although our example illustrates the upside for this type of transaction, there are also downsides you must consider before you jump into this decision. In our example, Sam is no longer his own boss. As mentioned above, the PE firm will set up an advisory board with aims to invest in the new management team’s goal to drive the business to a new level. Most business owners, in particular, enthusiastic entrepreneurs, find it difficult to cede control.

Most small business owners avoid debt as this is generally the most prudent thing to do. After a recap, however, the company will carry a significant amount of debt on its books. As most small business owners are cautious about high debt levels, this may make them feel uncomfortable. Ceding control also means passing on the decision making. The value of the company on the second exit is not guaranteed, and bad decisions of the PE firm may result in a lower than expected value or a lack of one at all. Money and support can be good or bad. In order to try and avoid bad money, research the PE firm and their successes and track record. Do they own a competitor, as sometimes they might try and snowball you!

Investigate your recapitalization options, or seek advice

Every situation and company is different. A PE firm can be a great partner and a good solution for a business when the owner is optimistic about the future and not needing to sell the entire business urgently. More so, this option looks attractive if the owner simply wants to diversify his/her personal net worth but stay involved in their business. However, it is not all plain sailing and going down this road is as difficult, if not more difficult, than a sale. Like always, seeking out a sell-side advisor can help navigate the murky waters, and avoid a bold PE firm taking too much power. Investigating your main options with the help of an expert will allow you to put together the best possible deal when the time comes.

Dividend Recapitalizations

What if, as an investor, you didn’t want to wait for a return on your investment? What if you were looking for a short-term payday long before you ever sold your company? That practice is put into action quite regularly, and is known as dividend recapitalization.

If you’ve heard of dividend recapitalization, then chances are you’re familiar with the animosity that often surrounds it. But before you decide whether this strategy is good or bad, let’s dive deeper into what’s actually at play here.

During a dividend recapitalization, a private company will connect with a lender (private equity, bank or other institution) for another loan, based on the current worth of the company they own. Think of it as a second mortgage. The loan they receive doesn’t go back into the company; rather, the money is used as a payday for the shareholders and partners (also known as a dividend).

Then, when these entrepreneurs sell off the company, they’ll have to pack back the bank or PEG for this additional loan. The result will be a smaller payout for the company (and a larger repayment to the lender). While that may not seem in the favor of existing shareholders, in fact, this is a beneficial strategy for them as they’re reducing their overall risk with that early dividend payment.

Why do many people dislike dividend recapitalization?

One of the biggest issues with dividend recapitalization is in a scenario where the company takes a turn for the worse. Technically, what occurs during a corporate recapitalization is that companies incur additional debt on their balance sheets – all to pay one-time dividends to shareholders. In other words, the owners have added debt onto the company.

Notice the key phrase there: onto the company.

While existing owners reap the benefits of dividend recapitalization (in the form of an early payout), they are not responsible for that added debt if the company turns into a failed investment. The company is on the hook. In fact, the firm doesn’t have to pay back any of the loan (not the original nor top-up loan). It’s all tossed onto the company itself.

That’s why dividend recapitalization is often viewed so poorly; companies don’t seem to benefit from it, while their sponsors walk way quite happy. It’s also believed that this additional debt weighs down on companies, exposing them to volatile market conditions and, potentially, bankruptcy.

Dividend recapitalization: It may not be as hostile or bad as it seems

More often than not, only healthy companies are the ones who undergo dividend recaps. Sure, they’re assuming additional debt, but it’s matched by an increase in cash flow. This method has been used countless times successfully (and sometimes not) by many a private equity group.

While this surely may not always be the case, chances are if an owner opts for dividend recapitalization, they’re confident that the portfolio company can handle the added debt and still come out on top during a sale.

Examples of Recapitalizations

The types and effects of such capital structure repositionings are not all that simple as you may have guessed, but we will do our best to cover and simplify some of the more popular examples below.

Debt for Equity Plan

A business can obtain a loan against assets, inventory, receivables and use the cash received to buy back shares and/or issue dividends to shareholders, effectively “recapitalizing” the company by increasing the proportion of debt in the capital structure. Why leverage up?

Since interest payments are tax deductible, a business can decrease its tax bill and increase its return on capital all in one fell swoop.

Equity for Debt Plan

Just the same, short of an out-right sale many business owners have opted to sell minority or majority equity stakes in their respective businesses and use the capital infusion to retire debt. This has the effect of both saving and making money as it can help retain cash reserves as well as free up existing cash flow from operations for re-investment, instead of ever-onerous debt interest payments.

As a general rule unless one really likes to live on the edge of a fiscal cliff with both feet dangling over, recaps are only practical for businesses that possess stable existing cash flow from operations so as to be able to service debt through the ebb and flow of up and down market cycles.

This is more often than not found in more mature companies where a better return on invested capital can be generated by investing outside of the business as opposed to back into its organic growth.

In closing, though far less glamourous and receiving far less attention than mergers and acquisitions, recapitalizations are an all important mechanism for changing a business’s capital structure without consummating a full exit strategy.

Some special mentions which also deserve attention though technically they are reorganizations and not recapitalizations at all, although they have been used for the latter purpose in some more special cases:

Transfers

Commonly referred to as Type D & G transfers, these can include transfers of control by way of a majority sale as well as spin-offs and split-offs. As an example, Company A owns most of the assets of both Company A and Company B. Company B assets are liquidated or sold off and former Company B shareholders retain ownership of Company A.

Bankruptcy

Another type of transfer, involves the oft dreaded, but sometimes strategic “b” word – bankruptcy or Chapter 11 as reorganizations are referred to. This ordinarily involves a court approved plan to divest a failing company’s assets with the proceeds being used to reduce pre-existing obligations and debts while discharging others.

As anyone who has been through the process can attest, between the initial 120 day period to file a disclosure statement/plan of reorganization, receive court approval thereof, creditor’s committee consultations, the timeline can become rather lengthy and drawn out but nevertheless usually offers shareholders the best chance to preserve at least some capital in the end.

10 Reasons to Perform a Minority or Majority Recap

Corporate recapitalizations can be a beneficial tool used by business owners seeking capital. The structure, source and uses of the funds can be as unique and varied as the businesses themselves. Recapitalizations are typically funded using both debt and equity. Today’s liquid private markets include options for both majority and minority recapitalization. Businesses in various stages of growth have successfully used recapitalizations to achieve personal and business growth goals. What follows is a brief description of a few of the reasons business owners perform recapitalizations, including the benefits and risks associated with this unique financing arrangement.

Take some chips off the table

Perhaps the most undiversified group, from an investment perspective, is the middle-market business owner. Founders make large, but risk-mitigating bets on the businesses they build. They often achieve outsized returns in doing so, but such returns come with a higher dose of systemic risk.

Some debt financing companies, including those that work on equity majority, dividend and leveraged recapitalizations will do so with the expectations that a portion of the money will be for owners looking for diversification. Depending on the investor in the deal, issuers can receive favorable turns, terms and valuations on the debt including debt without the need for a personal guarantees.

Moving from systemic to systematic risk using a majority recapitalization can be a wise move. It works for owners both old and young. In fact, those that intend on a complete sell-side transaction in a few years can greatly benefit from such a restructure several years prior, especially if it includes the right estate planning, but I’m getting ahead of myself.

Acquisition financing

A recapitalization can be used as a simple financial tool for raising inorganic growth capital. Debt or private equity infusions can be a great way to source capital for the next wave of growth through mergers and acquisitions. Some of the most successful business owners have built their wealth through bolt-on or tuck-in acquisition opportunities.

Organic growth capital

Fast-growing companies are often burdened with capital constraints. Even companies that kick-out large amounts of cash flow can be hampered in their growth if the cash flow cannot track with the increased demand for working capital the business requires. These are good problems to have, especially for high-profit companies, but they are problems nonetheless.

A leveraged-based recapitalization of the business can help. A capital infusion here can be used to buy more inventory, hire more sales & support staff and/or beef-up systems and processes in an effort to create a better platform for sustained growth.

Estate planning + tax basis reset

Recapitalizations can take many forms. They are not always about levering the company with a large debt burden, but a recap could include ESOP or a stock exchange from common to preferred. This is frequently used when businesses owners are looking to transfer assets to children or grandchildren. If done properly, this form of recapitalization allows a reset of the tax basis, effectively freezing the majority owner’s stake in the business. Alternative options include various trusts, donor-advised options and gifting to family members and charity that are more favorable with an initial recapitalization and then a later sale.

Due to the opportunity to reset valuations at a lower, more tax-favorable rate, many lenders were peddling this as a service to entrepreneurs and business owners from 2008 to 2010 when valuations were extremely depressed. During that time, many owners took advantage of the opportunity to reset their tax basis by first having a professional business valuation followed by a corporate restructuring or recapitalization.

The full landscape and structure of recapitalizing using trusts, uni-trusts, and donor advised funds is well beyond the scope of a short blog post. However, the estate planning and tax sheltering options available cannot be understated, neither can the need to prepare for a business sale many years in advance. Also, macro trends do matter and year or two of depressed earnings can actually be a boon for longer-term tax savings.

Prepare for a later sale

Recapitalization financing can be used as a financing bridge shortly before a business is sold. The length of time between when a business is recapitalized and when a full sell-side engagement takes place depends on a number of factors, including the stability of the business, the cleanliness of the financials and other operational books, the age of the owner, growth factors (including those mentioned above) and the macroeconomic trends.

Recapitalization financing can certainly be used prior to an eventual sale, but the lenders’ warning bells will chime if an owner is looking to obtain recapitalization financing only a year or two before an eventual exit and that financing does not include a significant plan for growth. Any financier is going to want to see his/her investment in the company either grow or be protected by growth. It is best to recapitalize with an eye on growth and a time horizon that is at least three years or more.

Exit strategy

In some cases, a recap is—in and of itself—an exit strategy for an owner. Depending on the existing structure, the percentage of the debt and the relationship between buyer and seller, a recapitalization may include a business owner selling a minority or majority stake. The selling owner often intends to hold the remaining ownership shares indefinitely and subsequently walk into the sunset as a silent partner.

An ESOP, for instance, is nothing more than a fancily-structured recapitalization, used as an exit strategy for a retiring owner.

Retire old debt

There are several instances where a recapitalization makes sense simply for cost-of-capital maintenance and improvement. A decrease in interest rates or an improvement in the financial solvency of a company could impact its ability to source capital more cheaply.

Just like a homeowner refinancing his/her mortgage, a business owner may find a recapitalization as a prime method for saving some coin, even with origination and early termination fees factored-in.

Management Buyout

Leveraged, management buyouts remain one of the most prolific reasons for performing a majority recapitalization. Internal management—with a legitimate intent to acquire a majority stake from founders and other shareholders—may source capital from various sources to help fund the buyout.

The terms on this type of financing may be structured a bit differently and include some personal guarantees, but the ability to use both leverage and outside private equity in recapitalizing for the purpose of senior management acquiring the business

Tax Shield

It is unlikely obtaining a tax shield on debt would be the primary reason for a business owner to recapitalize the company, but it certainly remains a key benefit. Tax incentives can help with the cash flow bite taken when a leveraged recapitalization is placed on a business.

A tax shield is simply this: because the business is taxed after interest expense is incurred, there is a reduction in the tax liability the company will incur on an on-going basis. Again, it remains a secondary benefit, but a benefit nonetheless.

Maintain Culture & Control

True entrepreneurs are hard-driving, workaholics. They often have a difficult time completely unplugging from work and especially from the company they found and grew. By recapitalizing, a founder/owner will still maintain operational and cultural control of the business whilst taking some risk off the table. In addition, the optimistic owner may have bright prospects for the future of the business. Retaining some ownership and control over operations, while being able to share in at least some of the upside potential as the business grows is a win-win for most entrepreneurs. The second bite of the apple after yet another season of prolonged company growth is a real possibility for most quickly-growing companies.

Our Recapitalization Services

Business succession and liquidity issues are often resolved through a restructuring or recapitalization of a closely-held corporation. Restructuring or recapitalizing can improve cash flow, provide facility for more working capital and enhance the wealth of company founders and shareholders. An appropriate restructuring may also provide tax sheltering from future asset and equity appreciation within the business as future appreciation is often limited by restructuring.

Recapitalizations can also play a critical role for estate and financial planning purposes. The ultimate aim of a true company recapitalization is to transfer the associated value of certain stock within an organization away from the estate.

In instances of high growth in an organization, a shareholder’s investment within the corporation may grow beyond what is required for individual support. In such circumstances, a recapitalization of the business can provide a means of transferring future equity growth to posterity and charitable organizations in a more tax efficient manner.

Other benefits to recapitalization include sheltering certain assets from potential creditors and sheltering other liabilities where owners are citizens of countries without tax treaties with the United States.

Recapitalization and restructuring activities often take place in down markets when asset valuations are depressed and overall shareholder’s equity has fallen. In these instances, corporations may issue bonds to finance the recapitalization, maintaining the ownership of the shares for themselves or a party of their choosing at the lower basis. This form of restructuring is often referred to as a leveraged buyout and is often performed using mezzanine or unitranche debt financing.

Because of the unique nature of most recapitalizations, the business valuation remains a critical component to the structure, amount and timing of a corporate restructuring. Ensuring the proper value is transferred in the restructuring, a complete valuation of the company’s various forms of stock and debt is a necessary imperative.

Recapitalizations to avoid tax liabilities can be scrutinized by the IRS. The valuation of the business must therefore be unbiased, documented and fully supportable. Our professional team has extensive experience in valuing companies and sourcing the proper capital to perform expert recapitalizations and financial restructuring. Our team provides the right mix of legal, financial planning and investment banking advice to ensure your recapitalization is appropriately valued, structured and meets your long term wealth goals.

A recapitalization may address other goals that fit the overall trajectory of the organization including internal growth via bolstered working capital, mergers and acquisitions, distressed situations and debt re-financing. Restructuring and recapitalization can also be a means of attracting new capital with additional investors and stakeholders to optimize owners’ exposure to the risks of the business.

Conclusion

No two company recaps look the same. In fact, many recapitalizations will include a varied mix of the features and benefits outlined above. For instance, an owner who may be 8 to 10 years away from retiring with a business that produces $4mm a year in adjusted EBITDA. She believes she can take her business to over $8mm in EBITDA with the assistance of a few key hires, some systems improvements, increases in inventory and perhaps a couple of small acquisitions. The owner would also like to take some chips off the table as well. In sourcing recapitalization financing from various lenders a detailed sources & uses document outlines the various intended uses of the recapitalization financing.

As always, financing of this type is best obtained through a rigorous search, screen and vet process, typically achieved by a knowledgeable investment banker. Understanding both the benefits and risks associated with this type of transaction can be extremely helpful in achieving the best possible outcomes.